Bitcoin Sell-Side Pressure Dominated By New Holders, Research Shows

November 28 2024 - 2:00AM

NEWSBTC

Bitcoin (BTC) remains resilient, trading close to the $100,000 mark

despite a recent correction that led to over $500 million in

liquidations, predominantly from long positions. A recent report by

Glassnode analyzes the cohorts driving the sell-side pressure

during this ongoing bull run. Majority Of Sell-Side Pressure Coming

From New Market Entrants According to Glassnode’s report titled

“The Week Onchain,” while some long-term Bitcoin holders

realize substantial profits – amounting to over $2 billion in a

single day – not all are willing to part with their holdings.

Related Reading: Bitcoin Price Closes Above Bull Channel, Crypto

Analyst Reveals What’s Next The report highlights that the

Long-Term Holder (LTH) cohort is capitalizing on the inflow of

liquidity and strong demand to sell BTC near all-time high (ATH)

price levels. Glassnode notes: Since the peak in LTH supply set in

September, this cohort has now distributed a non-trivial 507k BTC.

This is a sizeable volume; however, it is smaller in scale relative

to the 934k BTC spent during the rally into the March 2024 ATH. The

report breaks the LTH cohort into sub-cohorts based on realized

profit metrics to understand the sell-side dynamics better. It

reveals that holders who acquired BTC 6 months to 1 year ago

contribute the most to sell-side pressure, realizing $12.6 billion

in profits, accounting for 35.3% of all realized gains. Other

sub-cohorts have realized comparatively smaller profits, including

$7.2 billion by those holding BTC for 1 to 2 years, $4.8 billion by

those with 2 to 3 years of holdings, $6.3 billion by 3 to 5-year

holders, and $4.8 billion by investors holding for more than 5

years. The report adds: The dominance of coins aged 6m-1y

highlights that the majority of spending has originated from coins

acquired relatively recently, highlighting that more tenured

investors are remaining measured and potentially waiting patiently

for higher prices. This pattern suggests that heightened

profit-taking among holders in the 6-month to 1-year range

indicates the cohort is dominated by newer investors, many of whom

likely entered the market following the launch of Bitcoin

exchange-traded funds (ETF). Their strategy appears to involve

short-term gains, riding the wave of the current market surge.

Bitcoin Adoption Continues To Grow Around The Globe While the

recent price pullback may have cautioned some investors, others

opine that it was a healthy correction that gives the leading

cryptocurrency some time for consolidation before the next leg up.

Related Reading: Metaplanet To Expand Bitcoin Holdings With $11.3

Million Bond Sale Bitcoin’s unprecedented price has created a

shared urgency among corporations and nations worldwide. Following

MicroStrategy’s tactics, Canadian company Rumble recently announced

it would use a portion of excess cash reserves to buy BTC. Most

recently, CEO of Marathon Digital Holdings, Fred Thiel, said

institutional interest in BTC has increased significantly since

Donald Trump’s victory in the 2024 elections. BTC trades at $95,462

at press time, up 2% in the past 24 hours. Featured image from

Unsplash, charts from Glassnode and Tradingview.com

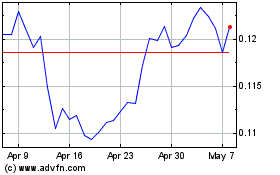

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024