$120 Million Of Aave Funds Stuck In Polygon, Good For Bears?

May 22 2023 - 7:00AM

NEWSBTC

Following a recent update, over $120 million of Aave v2, a

decentralized finance (DeFi) protocol for lending and borrowing

tokens, user assets are “stuck” on Polygon. Bug On Aave v2 On

Polygon The bug affecting withdrawals from Aave v2 deployed on

Polygon, an Ethereum side-chain, has been pinned to the recent

implementation of “proposal 224”. Proposal 224 sought to make

parameter changes “for the benefit of the protocol” in light of

“shifts in the crypto market .” The adjustment received majority

support and was implemented. However, after the execution,

the DeFi protocol was notified of several issues affecting the

interest rate strategy contracts applied to the wrapped versions of

Bitcoin, Ethereum, MATIC—the native currency of Polygon, and

USDT—the world’s most liquid stablecoin. Related Reading: Gas

Crisis Averted: NFT Marketplaces Witness Dramatic Reduction in

Ethereum Fees The development team has said the root cause was

because the updated version, especially relating to the

“LendingPool to call the rate strategy of an asset” applied on

Polygon, was slightly different from that integrated with Ethereum.

While users can’t withdraw assets, the DeFi protocol emphasizes

that all funds are safe. Beyond the explainer released by Aave,

analysts pin the specific problem on the incompatibility

issue between the ReserveInterestRateStrategy contract and the

underlying Polygon network. Since the contract was designed

to work specifically on Ethereum, as Aave mentioned, it couldn’t

work on Polygon, causing it to fail. Subsequently, users couldn’t

withdraw their tokens. Compatibility Problems The

ReserveInterestRateStrategy contract is a core contract in Aave

that helps calculate and apply interest rates to borrowed

loans. To correctly function, the autonomous contract factors

in several things, including prevailing market forces, the risk of

user defaulting, and the collateralization ratio. In Aave,

all loans are overcollateralized, meaning a borrower must commit

more collateral than the amount they wish to borrow. Related

Reading: Ethereum Price Remains Range Bound As Bulls Await The Next

Major Move The Aave team plans to fix the bug, subject to the

result of the ongoing vote. Though the community wants the

problem to be fixed, affected users will only begin withdrawing

assets from Aave v2 later this week. Considering governance times,

if approved, the fix will be applied in approximately seven days

from now: 1 day of delay to start voting, three days of voting, one

day of time lock on Ethereum, and two extra days of time lock on

Polygon. Despite the flaw, AAVE prices are stable. However, since

the problem was first brought to light on May 19, the token has

been lower but inside the bull bar of May 17. It is yet to be seen

how prices will react in the course of the week. Presently, the

token is down 25% from April 2023 and remains in a bearish

formation. Feature Image From Canva, Chart From TradingView

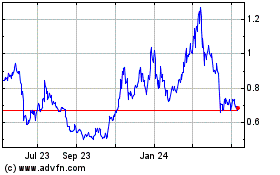

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

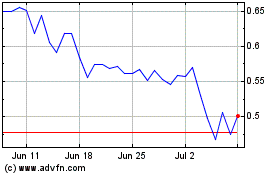

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024