XRP Trades Near Crucial Support Of $0.46, Will This Level Hold?

April 26 2023 - 10:00AM

NEWSBTC

During the past week, the price of XRP has suffered significant

losses due to a powerful selling wave. While the one-day chart

reflects a 3% increase, the weekly chart shows a decline of over

12%. Buyers have faced resistance in the $0.45-$0.46 range and the

technical outlook for XRP indicates a selling trend. The demand for

this altcoin has also dropped, leading to a decrease in

accumulation. Unless buyers return to the market and stabilize the

price, XRP is likely to continue losing value. Meanwhile, Bitcoin’s

price has remained uncertain over the past week, and its recent

climb above $28,000 may inspire other altcoins to follow suit.

Related Reading: 37 Billion Dogecoin Holdings In Jeopardy: Price

Level Investors Should Watch For XRP to see upward momentum,

Bitcoin must maintain a price above $27,000. Furthermore, XRP must

surpass the immediate resistance level to preserve its current

support level. The decline in XRP’s market capitalization suggests

that sellers are currently in control of the market. XRP Price

Analysis: One-Day Chart At the time of writing, the altcoin’s

trading price is $0.47, and it currently stands above its critical

support level of $0.46. Despite attempting to recover significantly

over the past few weeks, XRP experienced considerable selling

pressure in the past week. The coin faces overhead resistance at

$0.48, and breaching that level could drive the price up to $0.50.

Conversely, if XRP fails to remain above $0.46, the coin may

decline to around $0.42 and possibly $0.40. The amount of XRP

traded in the last session was negative, indicating a decrease in

demand. Technical Analysis Despite the daily chart indicating a

recovery, buyers seemed hesitant to make a move. The Relative

Strength Index (RSI) was below 50, implying that sellers currently

outnumber buyers. Although there was an uptick in the RSI, buying

strength remained fragile unless XRP surpasses the immediate

resistance level. Furthermore, the altcoin was below the 20-Simple

Moving Average (SMA) line, indicating that sellers were driving the

price momentum in the market. Aligned with other technical

indicators, the altcoin began to exhibit sell signals on the

one-day chart. The Moving Average Convergence Divergence (MACD)

displays price momentum and trend reversals. Red histograms formed

under the half-line, indicating a sell signal for the altcoin and a

bearish price. The Bollinger Bands measure price volatility and

potential price fluctuations of the asset. The bands diverged in

anticipation of incoming price volatility, with the upper band

serving as a vital resistance level for the altcoin. Related

Reading: MATIC Price Prediction: Polygon Recovery Faces Many

Hurdles A move above the immediate price ceiling would aid XRP’s

recovery and reduce the likelihood of heavy price fluctuation.

Broader market strength will also be important for XRP to start its

recovery. Featured Image From UnSplash, Charts From TradingView.com

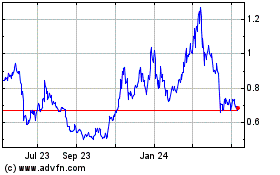

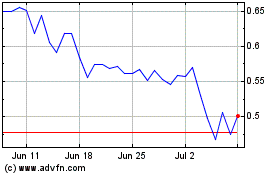

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024