Altcoins ‘Starting To Run’ After Reclaiming This Key Level, Altseason Around The Corner?

November 27 2024 - 1:30AM

NEWSBTC

As Bitcoin continues to move above the $90,000 mark, Altcoins began

to reach new highs. The sector has recently reclaimed a key

two-year level that could set the stage for a retest of 2021’s

highs. Some analysts consider that Altcoins’ recent performance

could kickstart the long-awaited Altseason. Related Reading: How

High Can XRP Price Realistically Go After Gensler’s Resignation?

Altcoins Market Cap Reclaims 2022 Levels The total crypto market

has seen a remarkable performance for the past 21 days, jumping to

a market capitalization of $3.36 trillion. This surge, fueled by

the US elections on November 5, has led Bitcoin’s price to a 40%

increase to its latest all-time high (ATH) of $99,645. Similarly,

Altcoins have started to record their best performance in years,

with tokens like Cardano (ADA) and XRP (XRP) surpassing the

long-awaited $1 mark. Meanwhile, cryptocurrencies like Solana (SOL)

and SUI (SUI) hit new ATHs recently, igniting investors’

bullishness for the cycle’s second leg up. The community has also

expressed optimism for the ‘King of Altcoins’ recent performance

after Ethereum (ETH) recovered the key $3,300 support zone last

week. The crypto market’s performance has led the Altcoins’ market

capitalization to hit a two-year high and reclaim key levels.

Notably, the total cryptocurrency market cap, excluding Bitcoin and

Ethereum, surpassed the Q1 2024 high of $788 billion as BTC soared

past the $90,000 resistance. The momentum led the Altcoins market

cap to break above the $840 billion mark last week, a level not

seen since April 2022. Since then, Alts have held above this range

despite the market retraces, turning this horizontal level into

support. Additionally, it neared May 2021’s high of $984 billion, a

crucial resistance level ahead of the Altcoins market cap ATH of

$1.13 trillion. Altseason To Start Soon? According to Bitfinex’s

Alpha report, this marks Altcoins’ “largest through-to-peak move”

since April 2021. The 23.2% increase hints at an increasing

investor appetite, leaving behind the previous “start of the bear

market” levels. This movement “indicates a rotation of speculative

capital and interest from Bitcoin into Altcoins as retail market

participation increases,” the Bitfinex analysts explained, which

tends to mark “the onset of the final stage of the bull market

where altcoins begin to outperform Bitcoin on an aggregate basis.”

Crypto analyst MikyBull pointed out that Alts dominance “just

climbed above the trend ribbon” on Tuesday. The analyst’s chart,

which excludes the top 10 cryptocurrencies by market cap, displayed

Altcoin’s dominance at 10.37%, breaking above the multi-month

downtrend line. Per the post, this has indicated before that “Alts

are about to outperform in the next coming weeks.” Similarly, he

highlighted a breakout from a multi-year cup and handle pattern in

the Altcoins’ chart. To him, the Alts have started running after

breaking out from the pattern’s neckline, and investors will see

the “full potential of the Altseason” from December to March 2025.

Related Reading: Polygon: Analyst Sets ‘Wild’ Price Target Amid

POL’s 38.2% Weekly Surge Meanwhile, Bitfinex forecasted that “lower

timeframe upside seems to be limited for altcoins” due to its

resistance at May 2021 levels. Nonetheless, the report noted that

breaking above the $984 billion resistance would signal a

continuation of altcoins ascend. Ultimately, Bitfinex’s analysts

consider that a larger Bitcoin correction could have a “magnified”

effect on altcoins, and they expect, “at minimum, a period of

ranging after a week full of consistently high liquidation numbers

for both longs as well as shorts for altcoins.” Featured Image from

Unsplash.com, Chart from TradingView.com

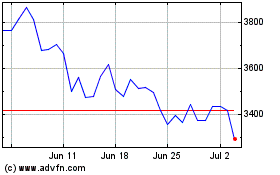

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024