Sims Metal Management Limited, the world's largest listed metal

and electronic recycling company (SimsMM), today announced that it

has made a significant minority investment in Chiho-Tiande Group

Limited (CTG) (HKG:976), a Hong Kong listed and fast growing metals

and electronics recycler with operations in the People's Republic

of China and Hong Kong.

With main processing facilities in Taizhou and Ningbo, CTG is

the largest mixed scrap metals importer in China and operates three

core businesses: a metal recycling business, foundry business and

wholesale scrap metal brokerage business. CTG has expanded into

domestic ferrous and non-ferrous scrap metal recycling in Shanghai

and recently announced further expansion plans to Yantai on the

Bohai Coast and Hong Kong with new metals and electronics recycling

facilities.

SimsMM has acquired 16 percent of the existing shares of CTG

from founder Chairman Ankong Fang and Delco Participation B.V.

(Delco), a Netherlands-based scrap metal company. Delco has granted

an option to SimsMM to acquire a further 2 percent of CTG. In

addition, subject to approval by CTG’s independent shareholders,

SimsMM will subscribe for a convertible bond and be issued

warrants. After all instruments are exercised or converted, SimsMM

expects to hold 20 percent of the fully diluted issued capital of

CTG. In order to support the continued growth plans of the company,

Chairman Fang and Delco will re-invest two-thirds of the proceeds

received from SimsMM into convertible bonds issued by CTG on the

same terms as SimsMM.

Daniel W. Dienst, Group Chief Executive Officer stated, “After

several years of earnest evaluation of opportunities to enter the

physical recycling arena on Mainland China and in Hong Kong, we

have identified CTG as among the most exciting and attractive

companies that will define and shape the nascent Chinese recycling

landscape. Through our investment and partnership, we are

validating not only CTG's extraordinary growth prospects under the

vision of Chairman Fang and his leadership team but, as

importantly, the shared cultures of our two companies manifested in

unwavering commitments to creation of long-term shareholder wealth,

the safety of our valued employees and the health of the

environment and communities in which we operate and locate. CTG, as

a long-standing trusted and honorable trading partner of SimsMM,

made this investment decision that much more compelling."

Ankong Fang, Chairman of CTG stated, “As the largest mixed metal

scrap importer and processor in China, we are always exploring

opportunities to grow, both within China and worldwide. SimsMM has

been one of our major suppliers for a number of years and, given

SimsMM’s global reach and customer network, advanced technologies

and solutions in the metals and electronics recycling industry, the

proposed strategic collaboration with SimsMM will add significant

value and expertise and complements our Group.”

Chairman Fang continued, “I believe that SimsMM, the industry

leader, becoming a significant minority shareholder shows a strong

recognition of our Group’s competitiveness and achievements. I look

forward to continuing to lead our company and the opportunity to

work with a world-class management team under the leadership of Mr

Daniel Dienst and particularly Mr Michael Lion, who will become a

member of our Board upon the successful completion of the

transaction.”

Michael Lion, Chairman Sims Metal Management Asia Limited, and

SimsMM’s nominee to the CTG Board, concluded by saying, “The

complementary expertise of SimsMM’s global trading reach, material

recovery technology and rigorous controls married to CTG’s

exceptional leadership and fast-growing presence in the China and

Hong Kong recycling space provides a transformational platform for

our partnership. As the domestically generated volumes of

recyclable non-ferrous and ferrous metals and electronics continues

to grow, SimsMM's and CTG's shared vision of building a leading

best practices position in China together is an extraordinary and

exciting opportunity. I am honored to be designated to serve.”

Transaction details

SimsMM, through its Hong Kong subsidiary, has entered into a

sale and purchase agreement (SPA) with HWH Holdings Limited, an

affiliate of Chairman Fang, and Delco with respect to 18 percent of

the existing share capital of CTG. Pursuant to the SPA, SimsMM has

completed the initial purchase of 167 million CTG ordinary shares

(representing 16 percent of the current issued share capital of

CTG) at HK$4.50 per share from Chairman Fang and Delco. In

addition, Delco has granted SimsMM an option (for nominal

consideration) to acquire up to an additional 21 million shares

(representing 2 percent of the current issued share capital of

CTG), exercisable between two and three years from the date of

completion of the SPA, at an exercise price of HK$6.00 per

option.

SimsMM will subscribe for a three-year warrant (for nominal

consideration) over 13 million new CTG shares at an exercise price

of HK$6.00 per warrant as well as a three-year HK$316 million

convertible bond, which has a 4 percent per annum coupon and is

convertible into 53 million CTG shares at a conversion price of

HK$6.00 per share. Both the warrant and convertible bond issues are

subject to CTG independent shareholder approval. Chairman Fang and

Delco have also agreed to subscribe for a convertible bond on

equivalent terms.

The upfront investment by SimsMM will be approximately US$137

million and should all options, warrants and convertible bonds be

exercised or converted, SimsMM expects to have a fully-diluted 20

percent shareholding in CTG. Provided SimsMM retains a 10 percent

shareholding in CTG, it will have the right to nominate one

director to the CTG Board of Directors.

Based on SimsMM initially accounting for the investment as a

financial asset (as opposed to the equity method of accounting),

the transaction is expected to be EPS neutral to SimsMM in the near

term.

Cautionary Statements Regarding Forward-Looking

Information

This release may contain forward-looking statements, including

statements about Sims Metal Management’s financial condition,

results of operations, earnings outlook and prospects.

Forward-looking statements are typically identified by words such

as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,”

“estimate,” “forecast,” “project” and other similar words and

expressions.

These forward-looking statements involve certain risks and

uncertainties. Our ability to predict results or the actual effects

of our plans and strategies is subject to inherent uncertainty.

Factors that may cause actual results or earnings to differ

materially from these forward-looking statements include those

discussed and identified in filings we make with the Australian

Securities Exchange and the United States Securities and Exchange

Commission (“SEC”), including the risk factors described in the

Company’s Annual Report on Form 20-F, which we filed with the SEC

on 14 October 2011.

Because these forward-looking statements are subject to

assumptions and uncertainties, actual results may differ materially

from those expressed or implied by these forward-looking

statements. You are cautioned not to place undue reliance on these

statements, which speak only as of the date of this release.

All subsequent written and oral forward-looking statements

concerning the matters addressed in this release and attributable

to us or any person acting on our behalf are expressly qualified in

their entirety by the cautionary statements contained or referred

to in this release. Except to the extent required by applicable law

or regulation, we undertake no obligation to update these

forward-looking statements to reflect events or circumstances after

the date of this release.

All references to currencies, unless otherwise stated, reflect

measures in Australian dollars.

About Sims Metal Management

Sims Metal Management is the world’s largest listed metal

recycler with approximately 260 facilities and 6,500 employees

globally. Sims’ core businesses are metal recycling and recycling

solutions. Sims Metal Management generated approximately 85 percent

of its revenue from operations in North America, the United

Kingdom, Continental Europe, New Zealand and Asia in Fiscal 2011.

The Company’s ordinary shares are listed on the Australian

Securities Exchange (ASX: SGM) and its ADRs are listed on the New

York Stock Exchange (NYSE: SMS). Please visit our website

(www.simsmm.com) for more information on the Company and recent

developments.

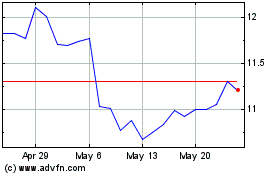

Sims (ASX:SGM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sims (ASX:SGM)

Historical Stock Chart

From Nov 2023 to Nov 2024