Sims Metal Management Announces On–Market Share Buy–Back

October 07 2011 - 1:49AM

Business Wire

Sims Metal Management (the “Company”) announced today that it

will establish an on–market share buy–back as part of its capital

management strategy.

The Board considers it appropriate to establish the buy–back

program to provide the Company flexibility to repurchase shares,

particularly during times of share market turmoil and share price

volatility.

In announcing the buy-back program, Sims Metal Management Group

CEO Daniel W. Dienst stated, “The Company remains committed to its

growth strategy and will continue to execute on its organic and

external growth opportunities. Effecting a repurchase of shares on

the open market and perpetuating our growth objectives are not

mutually exclusive propositions. We have maintained discipline with

respect to our balance sheet so as to be positioned to

opportunistically pursue accretive deployment of our shareholders’

precious capital. The current share price, impacted by global

macroeconomic concerns, provides one such opportunity.”

Mr. Dienst continued, “In the last 12 months the Company

completed a number of strategically important acquisitions

including S3 Interactive Limited, Dunn Brothers, Device and

ergoTrade, Metrade and Commercial Metal Recycling Services. These

acquisitions were accomplished via free cash flow. As at 30 June

2011, the Company had net debt of 4 percent of total capital,

providing significant balance sheet flexibility to fund growth

initiatives, internal investment and in buying back shares under

this capital management initiative.”

The program will allow the Company to buy back a maximum of 10%

of its issued capital (20,603,871 shares) over a 12-month period on

the Australian Securities Exchange. The timing and actual number of

shares to be purchased will depend on market conditions and other

considerations. There is no guarantee that the Company will

repurchase the full 20,603,871 shares. The earliest the buy–back

can commence is 24 October 2011.

Cautionary Statements Regarding Forward-Looking

Information

This release may contain forward-looking statements, including

statements about Sims Metal Management’s financial condition,

results of operations, earnings outlook and prospects. Forward

looking statements are typically identified by words such as

“plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,”

“estimate,” “forecast,” “project” and other similar words and

expressions.

These forward-looking statements involve certain risks and

uncertainties. Our ability to predict results or the actual effects

of our plans and strategies is subject to inherent uncertainty.

Factors that may cause actual results or earnings to differ

materially from these forward-looking statements include those

discussed and identified in filings we make with the Australian

Securities Exchange and the United States Securities and Exchange

Commission (“SEC”), including the risk factors described in the

Company’s Annual Report on Form 20-F, which we filed with the SEC

on 6 December 2010.

Because these forward-looking statements are subject to

assumptions and uncertainties, actual results may differ materially

from those expressed or implied by these forward-looking

statements.

You are cautioned not to place undue reliance on these

statements, which speak only as of the date of this release.

All subsequent written and oral forward-looking statements

concerning the matters addressed in this release and attributable

to us or any person acting on our behalf are expressly qualified in

their entirety by the cautionary statements contained or referred

to in this release. Except to the extent required by applicable law

or regulation, we undertake no obligation to update these

forward-looking statements to reflect events or circumstances after

the date of this release.

All references to currencies, unless otherwise stated, reflect

measures in Australian dollars.

About Sims Metal Management

Sims Metal Management is the world’s largest listed metal

recycler with approximately 260 facilities and 6,300 employees

globally. Sims’ core businesses are metal recycling and recycling

solutions. Sims Metal Management generated approximately 85 percent

of its revenue from operations in North America, the United

Kingdom, Continental Europe, New Zealand and Asia in Fiscal 2011.

The Company’s ordinary shares are listed on the Australian

Securities Exchange (ASX: SGM) and its ADRs are listed on the New

York Stock Exchange (NYSE: SMS). Please visit our website

(www.simsmm.com) for more information on the Company and recent

developments.

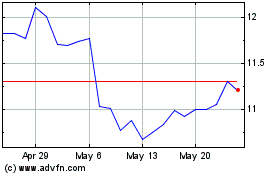

Sims (ASX:SGM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sims (ASX:SGM)

Historical Stock Chart

From Nov 2023 to Nov 2024