U.K. Treasury Says EU Exit Could Cause Recession

May 22 2016 - 10:00PM

Dow Jones News

LONDON—The U.K. economy could fall into recession if the country

votes to leave the European Union in a referendum next month,

according to a U.K. Treasury analysis due to be published

Monday.

The analysis will say that a vote in favor of a British exit

from the EU, or Brexit, in a referendum scheduled for June 23 could

trigger "an immediate and profound economic shock," according to

excerpts released by the Treasury in advance.

Britain's economy has become a key battleground in a fierce

debate over the country's membership of the EU. The Treasury's

latest analysis adds to warnings over the potential cost of Brexit

from the Bank of England, the International Monetary Fund and the

Organization for Economic Cooperation and Development.

Proponents of quitting the bloc dispute such claims, saying that

any disruption following a vote to leave will be short-lived and

that the U.K. will ultimately be better off outside the EU, where

it will be free of burdensome EU regulation and can pursue its own

trade deals with faster-growing parts of the world.

Prime Minister David Cameron and Treasury chief George Osborne

are due to present the findings of the Treasury analysis at an

event later Monday. Mr. Cameron in a statement Sunday said leaving

the EU represents "a leap in the dark that would risk prosperity

and security."

Mr. Osborne intends to say on Monday that British people must

ask themselves whether they can "knowingly vote for a recession,"

according to extracts of his planned remarks. Choosing to remain in

the EU represents "the brighter future on offer," Mr. Osborne will

say.

The Treasury's new analysis, which focuses on the possible

short-term costs of Brexit, follows a report in April into the

potential long-term costs of leaving the EU.

The new analysis will say the economy could suffer a year-long

recession after a vote to leave, defined as two or more consecutive

quarters of falling output.

The Treasury will say the hit to the economy would likely come

as uncertainty about the economy's future prospects delays spending

and investment, and financial-market volatility squeezes the supply

of credit for households and businesses. It also anticipates a

surge in inflation fueled by a falling pound and a decline in house

prices of around 10%—claims dismissed by pro-Brexit

campaigners.

"Sterling will not fall if we vote Leave, so claims of prices

rises are wrong," said Robert Oxley, spokesman for campaign group

Vote Leave, in an emailed statement.

The Treasury will say that the economy could be as much as 3.6%

smaller after two years if Britons vote to leave than if they vote

to stay in. The analysis will also say that the potential cost

could be almost twice as large if the U.K. immediately leaves

Europe's single market and chooses to trade with its neighbors

under World Trade Organization rules, which some in the pro-Brexit

camp have advocated.

The Treasury's intervention came after Turkey's place in Europe

on Sunday became the latest battle line to be drawn between Mr.

Cameron and campaigners pushing for the U.K. to leave the EU.

Mr. Cameron on Sunday responded to claims by Vote Leave that

Turkey would soon be allowed to join the EU, giving millions of

citizens from the Muslim-majority nation the right to live and work

in Britain.

On Sunday, Mr. Cameron locked horns with Penny Mordaunt, a

pro-Leave proponent who is also a minister in Mr. Cameron's

government. Ms. Mordaunt said in an interview with the British

Broadcasting Corp. that Britain wouldn't be able to stop Turkey

joining the EU, but Mr. Cameron dismissed Ms. Mordaunt's claims in

an interview with rival broadcaster ITV PLC, saying "it is not

remotely on the cards that Turkey is going to join the EU any time

soon."

The sparring underscores how advocates on both side of the

debate are zeroing in on their strongest arguments, with Leave

campaigners highlighting the risks of immigration in the face of

warnings by the government-backed Remain camp that the economy will

be seriously damaged if the U.K. pulls out of the EU.

Write to Jason Douglas at jason.douglas@wsj.com and Alexis Flynn

at alexis.flynn@wsj.com

(END) Dow Jones Newswires

May 22, 2016 21:45 ET (01:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

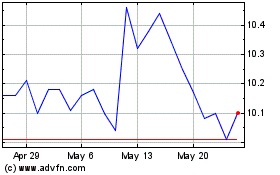

Pacific Current (ASX:PAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pacific Current (ASX:PAC)

Historical Stock Chart

From Nov 2023 to Nov 2024