ANZ Bank CEO: Confident On RBS Asia Assets Bid

May 28 2009 - 1:07AM

Dow Jones News

Australia & New Zealand Banking Corp. (ANZ) chief executive

Mike Smith said Thursday he is confident of the bank's bid for some

of Royal Bank of Scotland Group PLC's (RBS) Asian assets but if the

bank isn't successful he sees significant alternatives in Asia and

Australia.

Speaking to journalists after an Australia-Israel Chamber of

Commerce lunch in Melbourne, Smith said he had seen reports that

HSBC Holdings PLC (HBC) and Standard Chartered PLC (2888.HK) hadn't

submitted bids for RBS' assets but he had no confirmation of

that.

ANZ Wednesday raised A$2.5 billion to help fund potential

acquisitions.

"I'm very confident there will be a few opportunities and we

need to be prepared," Smith said.

"There are quite significant (acquisition opportunites) coming

up in Asia but I also think there are opportunities in

Australia."

Smith declined to say which assets ANZ is interested in or has

bid for, but he said if successful the bank expects a deal would be

earnings per share accretive in around three years.

Smith declined to rule out another tilt at the banking arm of

Australian financial services company Suncorp-Metway Ltd.

(SUN.AU).

"I've said we're always interested in opportunities but that

depends how they feel," he said.

He also said he expects ANZ will receive a banking license to

operate in India soon.

-By Lyndal McFarland, Dow Jones Newswires;

61-3-9292-2093; lyndal.mcfarland@dowjones.com

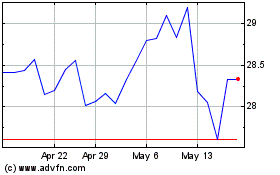

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Aug 2024 to Sep 2024

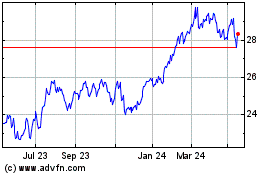

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Sep 2023 to Sep 2024