UPDATE: Amcor In Talks With Rio Tinto To Buy Part Of Alcan

February 06 2009 - 2:29AM

Dow Jones News

Amcor Ltd. (AMC.AU), the world's largest maker of plastic soft

drink bottles, said Friday it is in talks about the potential

acquisition of part of Rio Tinto Ltd.'s (RTP) Alcan packaging

business.

In answer to a share price query from the Australian Securities

Exchange, Amcor said the confidential and incomplete discussions

cover the "acquisition of part but not all" of the business, and it

may consider an equity raising if it proceeds with any deal.

Rio Tinto, the world's third-largest miner, plans to cut debt by

A$10 billion in 2009 through asset sales and cost cutting programs

after its US$38 billion acquisition of Canadian aluminum producer

Alcan to lighten its burden. Analysts have estimated the value of

the Alcan packaging assets, which include flexible, pharmaceutical

and tobacco packaging generating annual sales of about US$6

billion, at more than US$5 billion.

The share price query related to Amcor stock falling from A$5.35

at the close of trading Monday to its Friday low of A$4.57. Its

stock ended Friday down 6.6% at A$4.69.

"Amcor believes that it is possible that the market has been

speculating that Amcor is considering an equity raising in the near

future," it said.

"Amcor is not currently considering an equity raising" except in

relation to a possible Alcan transaction, the company said.

-By Andrew Harrison, Dow Jones Newswires; 61-3-9671-4323; andrew.harrison@dowjones.com

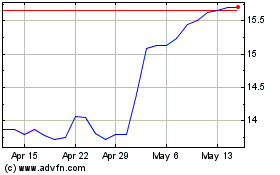

Amcor (ASX:AMC)

Historical Stock Chart

From Aug 2024 to Sep 2024

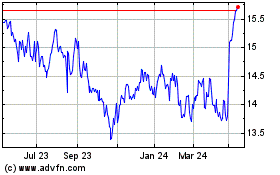

Amcor (ASX:AMC)

Historical Stock Chart

From Sep 2023 to Sep 2024