TIDMAPOL

RNS Number : 8963Q

Apollon Formularies plc

30 June 2022

30 June 2022

Apollon Formularies Plc

Final Results for the Year Ended 31 December 2021

Apollon Formularies plc (AQSE: APOL, "Apollon" or the "Company")

, a UK based international pharmaceutical company trading on the

Aquis Stock Exchange, is pleased to announce its Final Results for

the year ended 31 December 2021 (the 'Period').

Period Highlights:

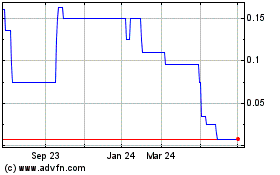

-- Listed on London's Aquis Growth market in April 2021

-- Raised GBP2.5 million through an oversubscribed fundraise

-- Third-party testing of Apollon's medical cannabis

formulations demonstrated the successful killing of nearly 100% of

triple negative and HER2+ breast cancer cells in 3D cell cultures.

Further testing showed the formulations to also be successful in

killing nearly 100% of prostate cancer cells in 3D cell

cultures

-- Expansion of Apollon's production facility in Negril,

Jamaica, to increase high-quality cannabis oil production capacity

to over 50 times the current production level

-- In preparation for global expansion, appointment of Stephen

Barnhill Jr. as Chief Operating Officer of Jamaican, Caribbean, and

North American Operations, and Stene Jacobs as Chief Operating

Officer of European and African Operations

-- Appointment of Dr. Dingle Spence as the Medical Director of

Apollon's International Cancer and Chronic Pain Institute

-- First patients treated at International Cancer and Chronic Pain Institute in December 2021

Post Period Highlights:

-- Joint Venture with Tri-Medi Canna, South Africa to start

servicing the South Africa Development community (SADC) comprising

of 16 member states encompassing a population of circa

350million

-- Acquired patents from Aion Therapeutic which includes all

associated supporting data including pre-clinical testing results

from BIOENSIS:

o Composition and Methods for Treatment of Cancers ;

o Composition and Methods for Treatment of Inflammation ;

o Methods for Treatment of Human Cancers using Mushroom

Combinations; and

o Methods for Treatment of Human Cancers using Cannabis Compos

itions.

-- Appointment of Dr. Archibald McDonald, Professor Emeritus as

Director of Clinical Trials and Dr. Herbert Fritsche to the Board

of Directors

-- Renewal of CLA-licenses for Processing and Retail

(Therapeutic) until January 2025. Apollon's Research and

Development license is current and does not need to be renewed

until September 2022

Chairman's Report

I am pleased to provide shareholders with Apollon's ("Apollon"

or the "Company") financial results for the full year ended 31

December 2021 and an update on the progress that the Company has

made, and continues to make, as it takes steps to transition

towards serving a wider global export market.

In April 2021, Apollon completed a reverse takeover and

commenced trading on the Aquis Growth Market. This public listing

was notable as Apollon was among the first medical cannabis

companies legally licenced to work with full-spectrum high THC

medical cannabis products allowed to be publicly listed in London.

As part of this, Apollon secured GBP2.5 million through an

oversubscribed fundraise at 5p.

As announced in June 2021, third-party independent lab testing

carried out by BIOENSIS demonstrated that Apollon's proprietary

medical cannabis formulations were successful in killing nearly

100% of triple negative and HER2+ breast cancer cells in 3D cell

cultures. Further testing carried out by BIOENSIS, announced in

July 2021, showed the formulations to be successful in killing both

hormone-resistant and hormone-sensitive prostate cancer cells in 3D

cell cultures.

As part of the Company's strategy to reach global markets,

Apollon expanded its production facility in Negril, Jamaica. A key

part of the upgrade consisted of Apollon purchasing a new imported

distiller from the US which will significantly increase our

high-quality cannabis oil production capacity by over 50 times the

current level, to more than 20 litres of distilled medical cannabis

oil per day. This allows Apollon to greatly increase its inventory

ahead of global exportation to countries where legal import is

allowed.

During the Period, we made a number of appointments to

strengthen our medical team and Board in preparation for global

expansion. In July 2021 we appointed Dr. Dingle Spence, MBBS, Dip

Pall. Med, FRCR, as the Medical Director of its new facility, the

Apollon International Cancer and Chronic Pain Institute, in

Kingston, Jamaica. In addition, Stephen Barnhill Jr. and Stene

Jacobs were appointed as joint Chief Operating Officers, with

Stephen Barnhill Jr. focusing on Jamaica, the Caribbean and North

America, whilst Stene Jacobs has been focusing on Apollon's

expansion into Europe and Africa.

At the beginning of December 2021, we announced that the

International Cancer and Chronic Pain Institute was open and had

begun treating its first cancer patients with Apollon's medical

cannabis products. This important step rounds off a successful year

which has seen significant growth and development of the Company,

as it strives to increase shareholder value.

Post-Period

Following the opening of the International Cancer and Chronic

Pain Institute, Apollon has had continued demand from international

patients for treatment and consultations at the Institute, as well

as at the Wellness Centre in Negril and we have made some exciting

steps in the first half of 2022 as we build on the success of

2021.

In March 2022, Apollon announced the formation of a joint

venture partnership with Tri-Medi Canna to establish a vertically

operated business, Apollon SA Pty. This joint venture represents

our first international expansion and is a significant development

for the Company as it provides access, under license, to the South

Africa Development Community (SADC), comprising of 16 member states

with the potential to reach over 350 million people. According to

Prohibition Partners, Africa Cannabis Report, March 2019, Africa's

medical cannabis sector is forecast to be worth up to $7.1 billion

by 2023, which provides an excellent potential for Apollon to

establish a commercial footprint.

We have also acquired four international patents from Aion

Therapeutics. These patents are filed through the Patent

Cooperation Treaty covering 156 countries and contracting states,

as well as being filed in Jamaica. This acquisition includes all

associated supporting data including the pre-clinical testing

results from BIOENSIS. The patent Titles are:

1. Composition and Methods for Treatment of Cancers.

2. Composition and Methods for Treatment of Inflammation.

3. Methods for Treatment of Human Cancers using Mushroom Combinations and

4. Methods for Treatment of Human Cancers using Cannabis Compositions.

Apollon currently provides these medical cannabis and medicinal

mushroom products by physician prescription at the International

Cancer and Chronic Pain Institute in Kingston, Jamaica, and at the

Cannabis Licensing Authority ("CLA") licensed dispensary in Negril,

Jamaica. Apollon will, and in the near term, provide them through

medically supervised patient trials to validate the successful

results seen in pre-clinical testing.

In January 2022, it was announced that Dr. Archibald McDonald,

Professor Emeritus, and Former University Dean, Faculty of Medical

Sciences and Pro-Vice Chancellor, University of the West Indies,

was appointed as Director of

Clinical Trials at Apollon. Dr. McDonald is currently the

Chairman of the Ethics Committee of the Ministry of Health in

Jamaica and is now working with the Company on medically supervised

patient trials. Further to this appointment, we were delighted to

welcome Dr. Herbert Fritsche to the Board of Directors. Dr Herbert

Fritsche is former Professor of Laboratory Medicine and Chief of

the Clinical Chemistry Section at The University of Texas, M.D.

Anderson Cancer Center in Houston, Texas and world-renowned

Clinical Chemist recognized internationally as an expert in the

field of clinical chemistry, cancer diagnostics and laboratory

medicine.

Furthermore, in January 2022, the CLA approved Apollon's request

for the renewal of two medical cannabis licenses: Processing, and

Retail (Therapeutic) for an additional three years. The Company has

a current CLA approved Research and Development (Experimental)

License, and we are currently one of the very few companies in

Jamaica with all three of these vertically integrated CLA approved

licenses.

The combination of these licenses allows the us to successfully

implement our business plan and achieve the goal of developing,

processing, and manufacturing our proprietary formulations, selling

Apollon's cannabis derived pharmaceutical and nutraceutical

products, treating patients, performing clinical trials, and

legally exporting our scientifically validated medical cannabis

products globally.

Outlook

As we look ahead through the second half of 2022 into 2023 and

beyond, there are several key developments that the Company intends

to make. A major priority for Apollon is exporting its first line

of products to South Africa for continued academic research with

its academic affiliates in the region, and for patients to access

through prescription under S21 guidelines in South Africa. Apollon

will continue engagement with the South African Health Products

Regulatory Authority to start the licensed medication process in

the region.

In Jamaica, Apollon is working to gain regulatory authority from

the Ministry of Health and Wellness to supply the entire Jamaican

dispensary and pharmacy network, which is currently 750 strong.

We are focused on investigating ways to upgrade our current

capabilities to a larger GMP/EU-GMP facility, which would give us

the access to the wider global export market in supportive

jurisdictions where medical cannabis is legal.

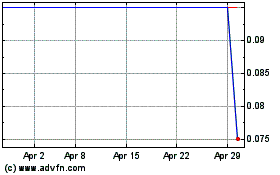

We note the recent extreme volatility in the global financial

markets as central banks struggle to contain inflationary pressures

after more than a decade of loose fiscal policy. This volatility

has disproportionately impacted growth-orientated companies such as

Apollon and has the potential to create challenging periods to

raise continued financing. Due to its relatively low overheads and

nimble decision making capabilities, the Company seeks to retain

financial and operational flexibility in the uncertain times ahead

while remaining committed to created shareholder value in the

longer term.

I am excited for what the future holds for Apollon and would

like to thank our shareholders for their support and continued

investment as we execute our strategy to become the premier global

medical cannabis company in Oncology and Chronic Pain. We have

achieved several key milestones during the year ended 31 December

2021 and we are well positioned to continue our growth both locally

and globally. I look forward to keeping investors updated with

future developments.

Stephen D Barnhill M.D

Chairman

30 June 2022

A copy of the annual report and financial statements will be

available on the Company's website at

https://www.apollon.org.uk/investor-relations/presentations-and-reports/

The Directors of the Company accept responsibility for the

contents of this announcement.

For more information contact:

Apollon Formularies

Tel: +44 771 198 0221

Stene Jacobs stene@apollon.org.uk

Peterhouse Capital Limited (Corporate Adviser)

Tel: +44 207 220 9795

Guy Miller gm@peterhousecapital.com

BlytheRay (Financial PR/IR-London)

Tel: +44 207 138 3204

Tim Blythe/Alice McLaren apollon@blytheray.com

Consolidated statement of comprehensive income for the year

ended 31 December 2021

For the For the

year ended year ended

31 December 31 December

2021 2020

Continued operations Note GBP GBP

--------------------------------------- ---- ------------ ------------

Revenue 6 197,671 -

Cost of sales - -

Gross profit 197,671 -

------------ ------------

Administrative expenses 7 (959,412) (56,145)

Share on loss of an associate 25 (197,931) (235,744)

Foreign exchange 6,723 (202,623)

Other net gains/(losses) 8 (241,344) -

Operating (loss) (1,194,293) (494,512)

------------ ------------

Impairment 24 (1,332,464) -

Finance costs 9 (3,799) (2,427)

Loss before tax (2,530,556) (496,939)

------------ ------------

Tax credit/(expense) - -

Loss for the year (2,530,556) (496,939)

============ ============

Other comprehensive income:

Items that will or may be reclassified

to profit or loss - -

Total comprehensive loss for the year

attributable to the equity owners (2,530,556) (496,939)

Basic and diluted - pence 19 (0.462) (0.287)

------------ ------------

Weighted average number of ordinary

shares parent

Basic and diluted 19 548,102,705 173,166,503

============ ============

Statement of Financial Position as at 31 December 2021

Group Company

-------------------------- ---------------------------

As at 31 As at As at 31 As at 31

December 31 December December December

2021 2020 2021 2020

Note GBP GBP GBP GBP

---------------------------- ---- ------------ ------------ ---------- ---------------

Non-current assets

Investment in Associate 25 2,379,981 2,157,310 402,189 -

Investment in Subsidiaries 23 - - 41,362,023 1,160,000

2,379,981 2,157,310 41,764,212 1,160,000

------------ ------------ ---------- ---------------

Current assets

Trade and other receivables 13 360,657 240,857 336,460 9,004

Cash and cash equivalents 14 304,986 2,369 202,133 12,162

------------

665,643 243,226 538,593 21,166

------------ ------------ ---------- ---------------

Total assets 3,045,624 2,400,536 42,302,805 1,181,166

------------ ------------ ---------- ---------------

Current liabilities

Trade and other payables 15 83,016 85,222 82,985 96,654

83,016 85,222 82,985 96,654

------------ ------------ ---------- ---------------

Total liabilities 83,016 85,222 82,985 96,654

------------ ------------ ---------- ---------------

Net assets 2,962,608 2,315,314 42,219,820 1,084,512

------------ ------------ ---------- ---------------

Equity

Share capital 17 - 17,344 - -

Share premium 17 54,050,764 3,910,557 54,050,764 11,704,388

Share option reserve 17 85,363 - 85,363 -

Reverse acquisition reserve 24 (47,030,385) - - -

Retained earnings (4,143,134) (1,612,587) (11,916,307) (10,619,876)

------------ ------------

Total equity 2,962,608 2,315,314 42,219,820 1,084,512

------------ ------------ ---------- ---------------

The Company has elected to take the exemption under section 408

of the Companies Act 2006 not to present the Parent Company

Statement of Comprehensive Income. The loss for the Parent Company

for the year was GBP1,296,431 (31 December 2020: loss of GBP

330,942 ).

The Financial Statements were approved and authorised for issue

by the Board on 30 June 2022 and were signed on its behalf by:

Stephen D Barnhill M.D

Executive Chairman

Consolidated statement of changes in equity for the year ended

31 December 2021

Share Share premium Reserve Retained Total

capital Share option acquisition earnings

reserve reserve

GBP GBP GBP GBP GBP

------------------------- -------- ------------- ------------ ------------ ----------- ---------

Balance as at

1 January 2020 17,309 3,861,592 - - (1,115,648) 2,763,253

-------- ------------- ------------ ------------ ----------- ---------

(Loss) for the

period - - - - (496,939) (496,939)

Total comprehensive

(Loss) for the

period - - - - (496,939) (496,939)

-------- ------------- ------------ ------------ ----------- ---------

Issue of shares 35 48,965 - - - 49,000

Total transactions

with owners, recognised

directly in equity 35 48,965 - - - 49,000

-------- ------------- ------------ ------------ ----------- ---------

Balance as at

31 December 2020 17,344 3,910,557 - - (1,612,587) 2,315,314

======== ============= ============ ============ =========== =========

Reverse

Share Share Share option acquisition Retained

capital premium reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP

------------------------- -------- ----------- ------------ ------------ ----------- ------------

Balance as at

1 January 2021 17,344 3,910,557 - - (1,612,587) 2,315,314

-------- ----------- ------------ ------------ ----------- ------------

(Loss) for the

period - - - - (2,530,556) (2,530,556)

-------- ----------- ------------ ------------ ----------- ------------

Total comprehensive

loss for the period - - - - (2,530,556) (2,530,556)

-------- ----------- ------------ ------------ ----------- ------------

Transfer to reverse

acquisition reserve (17,344) (3,910,557) - (47,030,385) - (50,958,286)

-------- ----------- ------------ ------------ ----------- ------------

Recognition of

AfriAg plc equity

at acquisition

date - 11,704,388 - - - 11,704,388

-------- ----------- ------------ ------------ ----------- ------------

Share issue for

acquisition - 40,000,000 - - - 40,000,000

-------- ----------- ------------ ------------ ----------- ------------

Share issue for

cash - 2,500,000 - - 2,500,000

Share issue costs - (153,624) - - (153,624)

Warrants issued - - 85,363 - - 85,363

-------- ----------- ------------ ------------ ----------- ------------

Total transactions

with owners, recognised

directly in equity (17,344) 50,140,207 85,363 (47,030,385) - 3,177,841

-------- ----------- ------------ ------------ ----------- ------------

Balance as at

31 December 2021 - 54,050,764 85,363 (47,030,385) (4,143,134) 2,962,608

======== =========== ============ ============ =========== ============

Company statement of changes in equity for the year ended 31

December 2021

Share Share premium Share option Retained Total

capital reserve earnings

GBP GBP GBP GBP GBP

------------------------- ----------- --------------- -------------- -------------- -----------

Balance as at 1 January

2020 - 11,705,388 127,828 (11,078,646) 754,570

----------- --------------- -------------- -------------- -----------

(Loss) for the period - - - 330,942 330,942

Total comprehensive

(loss) for the period - - - 330,942 330,942

----------- --------------- -------------- -------------- -----------

Share issues costs - (1,000) - - (1,000)

Transfer with equity - (127,828) 127,828 -

Total transactions

with owners, recognised

directly in equity - (1,000) (127,828) 127,828 (1,000)

----------- --------------- -------------- -------------- -----------

Balance as at 31

December 2020 - 11,704,388 - (10,619,876) 1,084,512

=========== =============== ============== ============== ===========

Share Share premium Share option Retained Total

capital reserve earnings

GBP GBP GBP GBP GBP

---------------------------- -------- ------------- ------------ ------------ -----------

Balance as at 1 January

2021 - 11,704,388 - (10,619,876) 1,084,512

-------- ------------- ------------ ------------ -----------

(Loss) for the period - - - (1,296,431) (1,296,431)

-------- ------------- ------------ ------------ -----------

Total comprehensive

loss for the period - - - (1,296,431 (1,296,431)

-------- ------------- ------------ ------------ -----------

Share issue for acquisition - 40,000,000 - - 40,000,000

-------- ------------- ------------ ------------ -----------

Share issue for cash - 2,500,000 - - 2,500,000

Share issue costs - (153,624) - - (153,624)

Warrants issued - - 85,363 - 85,363

Total transactions

with owners, recognised

directly in equity - 42,346,376 85,363 - 42,431,739

-------- ------------- ------------ ------------ -----------

Balance as at 31

December 2021 - 54,050,764 85,363 (11,916,307) 42,219,820

======== ============= ============ ============ ===========

Consolidated cash flow statement for the year ended 31 December

2021

For the For the

year ended year ended

31 December 31 December

2021 2020

Note GBP GBP

------------------------------------------ ---- ------------ ------------

Cash flows from operating activities

Net (loss) for the year (2,530,556) (496,939)

Adjustments for:

Interest expense - 2,426

Shares issued for services - 49,000

Share based payments 18 85,363 -

(Increase)/decrease in trade and other

receivables (24,768) 256,092

(Decrease)/increase in trade and other

payables (617,215) (581)

Foreign exchange (gain)/loss (18,406) 202,753

Net cash flows from operating activities (3,105,582) 12,751

------------ ------------

Investing activities

Acquisition of Apollon Formularies

PLC, net of cash acquired 24 1,332,464 -

Cash acquired upon acquisition of Apollon

Formularies Ltd 24 17,542 -

Loans granted to associate 25 (402,189) (291,288)

Loss from associate 25 197,931 235,745

Net cash inflow/(outflow) in investing

activities 1,145,748 (55,543)

------------ ------------

Financing activities

Proceeds from share issue 17 2,500,000 -

Cost of share issue 17 (153,624) -

Loan repayments (83,925) (30,000)

Proceeds from borrowings - 71,500

Net cash inflow/(outflow) in financing

activities 2,262,451 41,500

------------ ------------

Net increase/(decrease) in cash and

cash equivalents 302,617 (1,292)

Cash and cash equivalents at beginning

of period 2,369 3,661

Cash and cash equivalents and end

of period 304,986 2,369

------------ ------------

Major non-cash transactions

On 13 April 2021, the proposed reverse takeover of Apollon

Formularies Limited had completed. The Company acquired the full

share capital of Apollon Formularies Limited via the issuance of

666,666,666 shares based on 3.95 consideration shares being issued

for every 1 ordinary share in Apollon Formularies Limited. The

acquisition constitutes a reverse acquisition as the shareholders

of Apollon Formularies Limited will acquire control of Apollon

Formularies Plc (formerly AfriAg Global plc).

Company cash flow statement for the year ended 31 December

2021

For the For the

year ended year ended

31 December 31 December

2021 2020

Note GBP GBP

----------------------------------------- ---- ------------ ------------

Cash flows from operating activities

Net profit/(loss) for the year (1,296,431) 330,942

Adjustments for:

Share based payments 18 85,363 -

(Increase)/decrease in trade and other

receivables (230,977) 4,242

(Decrease)/increase in trade and other

payables (109,986) (427,621)

Net cash flows from operating activities (1,552,031) (92,437)

------------ ------------

Investing activities

Loans granted to associate 25 (402,189) -

Loans granted to subsidiary 23 (202,023) -

Receipts on sale of investments - 7,130

Net cash inflow/(outflow) in investing

activities (604,212) 7,130

------------ ------------

Financing activities

Proceeds from share issue 17 2,500,000 -

Cost of share issue 17 (153,624) (1,000)

Net cash inflow/(outflow) in financing

activities 2,346,376 (1,000)

------------ ------------

Net increase/(decrease) in cash and

cash equivalents 190,133 12,162

Cash and cash equivalents at beginning

of period 12,000 86,307

Cash and cash equivalents and end

of period 202,133 98,469

------------ ------------

Major non-cash transactions

On 13 April 2021, the proposed reverse takeover of Apollon

Formularies Limited had completed. The Company acquired the full

share capital of Apollon Formularies Limited via the issuance of

666,666,666 shares based on 3.95 consideration shares being issued

for every 1 ordinary share in Apollon Formularies Limited. The

acquisition constitutes a reverse acquisition as the shareholders

of Apollon Formularies Limited will acquire control of Apollon

Formularies Plc (formerly AfriAg Global plc).

Notes to the financial statements

1. General information

Apollon Formularies Plc is a medicinal cannabis pharmaceutical

company incorporated and registered in the Isle of Man. The

Company's registered office is 34 North Quay, Douglas, Isle of Man,

IM1 4LB. The Company's ordinary shares are traded on the AQSE

Exchange Growth Market as operated by Aquis Stock Exchange Ltd

("AQSE").

Information on the Group's structure is provided in Note 23.

Information on other related party relationships of the Group is

provided in Note 22.

2. Accounting policies

The principal accounting policies applied in the preparation of

these Financial Statements are set out below (Accounting Policies

or Policies). These Policies have been consistently applied to all

the periods presented, unless otherwise stated.

2.1. Basis of preparing the Financial Statements

The consolidated Financial Statements have been prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006. The Financial

Statements have also been prepared under the historical cost

convention, except as modified for assets and liabilities

recognised at fair value under business combinations and for

derivatives.

The Financial Statements are presented in Pounds Sterling

rounded to the nearest pound.

The preparation of Financial Statements in conformity with

UK-adopted international accounting standards requires the use of

certain critical accounting estimates. It also requires management

to exercise its judgement in the process of applying the Group's

Accounting Policies. The areas involving a higher degree of

judgement or complexity, or areas where assumptions and estimates

are significant to the Financial Information are disclosed in Note

4.

a) Changes in Accounting Policies

i) New and amended standards adopted by the Group

As of 1 January 2021, the Company adopted IAS 1, IFRS 7, IFRS 9,

IAS 8 (amendments) definition of material, IFRS 3 (amendments)

business combinations and Amendments to References to the

Conceptual Framework in IFRS Standards, as well as Amendments to

Interest Rate Benchmark Reform in IFS Standards. The adoption of

these standards did not have a material impact on the financial

statements.

ii) New IFRS Standards and Interpretations not yet adopted

At the date on which these Financial Statements were authorised,

there were no Standards, Interpretations and Amendments which had

been issued but were not effective for the period ended 31 December

2021 that are expected to materially impact the Group's Financial

Statements.

iii) New standards, amendments and interpretations in issue but

not yet effective or not yet endorsed and not early adopted

Standards, amendments and interpretations that are not yet

effective and have not been early adopted are as follows:

Standard Impact on initial application Effective date

IAS 16 (amendments) Property, Plant and Equipment: 1 January 2022

Proceeds before Intended Use

---------------------------------- ---------------

IFRS 3 Reference to Conceptual Framework 1 January 2022

---------------------------------- ---------------

IAS 37 Onerous contracts 1 January 2022

---------------------------------- ---------------

IFRS Standards 2018-2020 annual improvement 1 January 2022

(amendments) cycle

---------------------------------- ---------------

IAS 8 Accounting estimates 1 January 2023

---------------------------------- ---------------

IAS 1 Classification of Liabilities 1 January 2023

as Current or Non-Current.

---------------------------------- ---------------

IFRS 17 Insurance Contracts 1 January 2023

---------------------------------- ---------------

The Group is evaluating the impact of the new and amended

standards above which are not expected to have a material impact on

the Group's results or shareholders' funds.

2.2. Basis of consolidation

The Consolidated Financial Statements consolidate the Financial

Statements of the Company and the accounts of all of its subsidiary

undertakings for all periods presented.

Subsidiaries are entities over which the Group has control. The

Group controls an entity when the Group is exposed to, or has

rights to, variable returns from its involvement with the entity

and has the ability to affect those returns through its power over

the entity. Subsidiaries are fully consolidated from the date on

which control is transferred to the Group. They are deconsolidated

from the date that control ceases.

Any contingent consideration to be transferred by the Group is

recognised at fair value at the acquisition date. Subsequent

changes to the fair value of the contingent consideration that is

deemed to be an asset or liability is recognised in accordance with

IAS 39 either in profit or loss or as a change to other

comprehensive income. Contingent consideration that is classified

as equity is not re-measured, and its subsequent settlement is

accounted for within equity.

Investments in subsidiaries are accounted for at cost less

impairment.

Where considered appropriate, adjustments are made to the

financial information of subsidiaries to bring the accounting

policies used into line with those used by other members of the

Group. All intercompany transactions and balances between Group

enterprises are eliminated on consolidation.

2.3. Going concern

The consolidated Financial Statements have been prepared on a

going concern basis with a material uncertainty. The Directors

believe funds can continue to be raised from the capital markets to

support any working capital shortfalls. The Directors have a

reasonable expectation that the Group and Company will continue to

be able to raise finance as required and to continue in operational

existence for the foreseeable future. Thus, they continue to adopt

the going concern basis of accounting in preparing the Financial

Statements.

2.4. Foreign currencies

a) Functional and presentation currency

Items included in the Financial Statements are measured using

the currency of the primary economic environment in which the

entity operates (the functional currency). The Financial Statements

are presented in Pounds Sterling, rounded to the nearest pound,

which is the parent company's functional currency. For each entity,

the Group determines the functional currency and items included in

the financial statements of each entity are measured using that

functional currency. The Group uses the direct method of

consolidation and on disposal of a foreign operation, the gain or

loss that is reclassified to profit or loss reflects the amount

that arises from using this method.

b) Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where such items are re-measured. Foreign

exchange gains and losses resulting from the settlement of such

transactions and from the translation at year-end exchange rates of

monetary assets and liabilities denominated in foreign currencies

are recognised in the Income Statement. Foreign exchange gains and

losses that relate to borrowings and cash and cash equivalents are

presented in the Income Statement within 'finance income or costs.

All other foreign exchange gains and losses are presented in the

Income Statement within 'Other net gains/(losses)'.

Translation differences on non-monetary financial assets and

liabilities such as equities held at fair value through profit or

loss are recognised in profit or loss as part of the fair value

gain or loss. Translation differences on non-monetary financial

assets measured at fair value, such as equities classified as

available for sale, are included in other comprehensive income.

2.5. Investments in subsidiaries

Investments in Group undertakings are stated at cost, which is

the fair value of the consideration paid, less any impairment

provision. The financial statements of the subsidiary are prepared

for the same reporting period as the Group. When necessary,

adjustments are made to bring the accounting policies in line with

those of the Group.

2.6. Investments in associates

An associate is an entity over which the Group has significant

influence. Significant influence is the power to

participate in the financial and operating policy decisions of

the investee, but is not control or joint control

over those policies.

The considerations made in determining significant influence or

joint control are similar to those necessary to determine control

over subsidiaries. The Group's investment in its associate are

accounted for using the equity method.

Under the equity method, the investment in an associate is

initially recognised at cost. The carrying amount of the investment

is adjusted to recognise changes in the Group's share of net assets

of the associate since the acquisition date.

The statement of profit or loss reflects the Group's share of

the results of operations of the associate. Any change in OCI of

those investees is presented as part of the Group's OCI. In

addition, when there has been a change recognised directly in the

equity of the associate, the Group recognises its share of any

changes, when applicable, in the statement of changes in equity.

Unrealised gains and losses resulting from transactions between the

Group and the associate are eliminated to the extent of the

interest in the associate.

The financial statements of the associate are prepared for the

same reporting period as the Group. When necessary, adjustments are

made to bring the accounting policies in line with those of the

Group.

After application of the equity method, the Group determines

whether it is necessary to recognise an impairment loss on its

investment in its associate. At each reporting date, the Group

determines whether there is objective evidence that the investment

in the associate is impaired. If there is such evidence, the Group

calculates the amount of impairment as the difference between the

recoverable amount of the associate and its carrying value, and

then recognises the loss within 'Share of profit of an associate'

in the statement of profit or loss.

Upon loss of significant influence over the associate or joint

control over the joint venture, the Group measures and recognises

any retained investment at its fair value. Any difference between

the carrying amount of the associate upon loss of significant

influence or joint control and the fair value of the retained

investment and proceeds from disposal is recognised in profit or

loss.

2.7. Property, plant and equipment

Property, plant and equipment is stated at cost, less

accumulated depreciation and any accumulated impairment losses.

Subsequent costs are included in the asset's carrying amount or

recognised as a separate asset, as appropriate, only when it is

probable that future economic benefits associated with the item

will flow to the Group and the cost of the item can be measured

reliably. The carrying amount of the replaced part is derecognised.

All other repairs and maintenance are charged to the Income

Statement during the financial period in which they are

incurred.

Depreciation is provided on all property, plant and equipment to

write off the cost less estimated residual value of each asset over

its expected useful economic life on a declining balance basis at

the following annual rates:

Leasehold improvements 20%

Production equipment 15%

Office equipment 15%

The assets' residual values and useful lives are reviewed, and

adjusted if appropriate, at the end of each reporting period.

An asset's carrying amount is written down immediately to its

recoverable amount if the asset's carrying amount is greater than

its estimated recoverable amount.

Gains and losses on disposal are determined by comparing the

proceeds with the carrying amount and are recognised within 'Other

net gains/(losses)' in the Income Statement.

2.8. Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand and

are subject to an insignificant risk of changes in value.

2.9. Share capital

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new shares or options are

shown in equity as a deduction, net of tax, from the proceeds.

2.10. Reserves

Share Premium - the reserve for shares issued above the nominal

value. This also includes the cost of share issues that occurred

during the year.

Retained Earnings - the retained earnings reserve includes all

current and prior periods retained profit and losses.

Share option reserve - the reserve for share options which have

been granted by the Company.

Reserve acquisition reserve - represents a non-distributable

reserve arising on the acquisition of Apollon Formularies

Limited;

2.11. Trade payables

Trade payables are obligations to pay for goods or services that

have been acquired in the ordinary course of business from

suppliers. Accounts payable are classified as current liabilities

if payment is due within one year or less. If not, they are

presented as non-current liabilities.

Trade payables are recognised initially at fair value, and

subsequently measured at amortised cost using the effective

interest method

2.12. Borrowings

Bank and other borrowings

Interest-bearing bank loans and overdrafts and other loans are

recognised initially at fair value less attributable transaction

costs. All borrowings are subsequently stated at amortised cost

with the difference between initial net proceeds and redemption

value recognised in the Income Statement over the period to

redemption on an effective interest basis.

2.13. Taxation

No current tax is yet payable in view of the losses to date.

Deferred tax is recognised for using the liability method in

respect of temporary differences arising from differences between

the carrying amount of assets and liabilities in the Group

Financial Statements and the corresponding tax bases used in the

computation of taxable profit. However, deferred tax liabilities

are not recognised if they arise from the initial recognition of

goodwill; deferred tax is not accounted for if it arises from

initial recognition of an asset or liability in a transaction other

than a business combination that at the time of the transaction

affects neither accounting nor taxable profit or loss.

In principal, deferred tax liabilities are recognised for all

taxable temporary differences and deferred tax assets (including

those arising from investments in subsidiaries), are recognised to

the extent that it is probable that taxable profits will be

available against which deductible temporary differences can be

utilised.

Deferred income tax assets are recognised on deductible

temporary differences arising from investments in subsidiaries only

to the extent that it is probable the temporary difference will

reverse in the future and there is sufficient taxable profit

available against which the temporary difference can be used.

Deferred tax liabilities are recognised for taxable temporary

differences arising on investments in except where the Group is

able to control the reversal of the temporary difference and it is

probable that the temporary difference will not reverse in the

foreseeable future.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to offset current tax assets against

current tax liabilities and when the deferred tax assets and

liabilities relate to income taxes levied by the same taxation

authority on either the same taxable entity or different taxable

entities where there is an intention to settle the balances on a

net basis.

Deferred tax is calculated at the tax rates (and laws) that have

been enacted or substantively enacted by the statement of financial

position date and are expected to apply to the period when the

deferred tax asset is realised or the deferred tax liability is

settled.

Deferred tax assets and liabilities are not discounted.

2.14. Revenue recognition

Revenue is measured at the fair value of the consideration

received or receivable and represents amounts receivable for goods

or services supplied in course of ordinary business, stated net of

discounts, returns and value added taxes. The Group recognises

revenue in accordance with IFRS 15 at either a point in time or

over time, depending on the nature of the goods or services and

existence of acceptance clauses.

Revenue from the sale of goods is recognised when delivery has

taken place and the performance obligation of delivering the goods

has taken place. The performance obligation of products sold are

transferred according to the specific delivery terms that have been

formally agreed with the customer, generally upon delivery when the

bill of lading is signed as evidence that they have accepted the

product delivered to them.

Revenue from the provision of consultancy services is recognised

as the services are rendered, in accordance with customer

contractual terms.

2.15. Finance income and cost

Interest income and costs is recognised using the effective

interest method.

2.16. Financial assets and liabilities

Financial assets

On initial recognition, financial assets are recognised at fair

value and are subsequently classified and measured at: (i)

amortised cost; (ii) fair value through other comprehensive income

("FVOCI"); or (iii) fair value through profit or loss ("FVTPL").

The classification of financial assets is generally based on the

business model in which a financial asset is managed and its

contractual cash flow characteristics. A financial asset is

measured at fair value net of transaction costs that are directly

attributable to its acquisition except for financial assets at

FVTPL where transaction costs are expensed. All financial assets

not classified and measured at amortised cost or FVOCI, are

measured at FVTPL. On initial recognition of an equity instrument

that is not held for trading, the Company may irrevocably elect to

present subsequent changes in the investment's fair value in other

comprehensive income.

For a financial asset to be classified and measured at amortised

cost or fair value through OCI, it needs to give rise to cash flows

that are 'solely payments of principal and interest (SPPI)' on the

principal amount outstanding. This assessment is referred to as the

SPPI test and is performed at an instrument level. Financial assets

with cash flows that are not SPPI are classified and measured at

fair value through profit or loss, irrespective of the business

model. The classification determines the method by which the

financial assets are carried on the statement of financial position

subsequent to inception and how changes in value are recorded.

Impairment

An 'expected credit loss' impairment model applies which

requires a loss allowance to be recognised based on expected credit

losses. The estimated present value of future cash flows associated

with the asset is determined and an impairment loss is recognised

for the difference between this amount and the carrying amount as

follows: the carrying amount of the asset is reduced to estimated

present value of the future cash flows associated with the asset,

discounted at the financial asset's original effective interest

rate, either directly or through the use of an allowance account

and the resulting loss is recognised in profit or loss for the

period.

In a subsequent period, if the amount of the impairment loss

related to financial assets measured at amortised cost decreases,

the previously recognised impairment loss is reversed through

profit or loss to the extent that the carrying amount of the

investment at the date the impairment is reversed does not exceed

what the amortised cost would have been had the impairment not been

recognised.

Financial liabilities

Financial liabilities are designated as either: (i) FVTPL; or

(ii) other financial liabilities. All financial liabilities are

classified and subsequently measured at amortised cost except for

financial liabilities at FVTPL. The classification determines the

method by which the financial liabilities are carried on the

statement of financial position subsequent to inception and how

changes in value are recorded. Accounts payable and accrued

liabilities is classified as other financial liabilities and

carried on the statement of financial position at amortised

cost.

Derivatives which are financial liabilities are initially

recognised at fair value and are subsequently remeasured at fair

value at each year-end prior to settlement. The movements in fair

value in each period is recognised within other net gains/(losses)

in the Consolidated Statement of Comprehensive Income.

2.17. Goodwill

Goodwill arises on the acquisition of subsidiaries and

associates and represents the excess of the consideration

transferred and the acquisition date fair value of any previous

equity interest in the acquiree over the fair value of the net

identifiable assets, liabilities and contingent liabilities of the

acquiree. If the total of consideration transferred,

non-controlling interest recognised and previously held interest

measured at fair value is less than the fair value of the net

assets of the subsidiary acquired, in the case of a bargain

purchase, the difference is recognised directly in the Income

Statement.

For the purpose of impairment testing, goodwill acquired in a

business combination or reverse takeover is allocated to each of

the cash-generating units, or groups of cash-generating units, that

are expected to benefit from the synergies of the combination. Each

unit or group of units to which the goodwill is allocated

represents the lowest level within the entity at which the goodwill

is monitored for internal management purposes. Goodwill is

monitored at the operating segment level.

Goodwill impairment reviews are undertaken annually, or more

frequently if events or changes in circumstances indicate a

potential impairment. The carrying value of goodwill is compared to

the recoverable amount, which is the higher of value in use and the

fair value less costs to sell. Any impairment is recognised

immediately as an expense and is not subsequently reversed.

3. Financial risk management

3.1. Financial risk factors

The Group's activities expose it to a variety of financial

risks: market risk, credit risk and liquidity risk. The Group's

overall risk management programme focuses on the unpredictability

of financial markets and seeks to minimise potential adverse

effects on the Group's financial performance.

Risk management is carried out by the management team under

policies approved by the Board of Directors.

a) Market Risk

The Group is exposed to market risk, primarily relating to

interest rate and foreign exchange. The Group has not sensitised

the figures for fluctuations in interest rates and foreign exchange

as the Directors are of the opinion that these fluctuations would

not have a significant impact on the Financial Statements at the

present time. The Directors will continue to assess the effect of

movements in market risks on the Group's financial operations and

initiate suitable risk management measures where necessary.

b) Credit Risk

Credit risk arises from cash and cash equivalents as well as

exposure to customers including outstanding receivables. To manage

this risk, the Group periodically assesses the financial

reliability of customers and counterparties .

No credit limits were exceeded during the period, and management

does not expect any losses from non-performance by these

counterparties.

c) Liquidity Risk

The Group 's continued future operations depend on the ability

to raise sufficient working capital through the issue of equity

share capital or debt. The Directors are reasonably confident that

adequate funding will be forthcoming with which to finance

operations. Controls over expenditure are carefully managed.

3.2. Capital risk management

The Group 's objectives when managing capital are to safeguard

the Group 's ability to continue as a going concern, in order to

enable the Group to continue its investment activities, and to

maintain an optimal capital structure to reduce the cost of

capital.

In order to maintain or adjust the capital structure, the Group

may adjust the issue of shares or sell assets to reduce debts.

The Group defines capital based on the total equity of the

Company. The Group monitors its level of cash resources available

against future planned operational activities and the Company may

issue new shares in order to raise further funds from time to

time.

4. Critical accounting estimates

The preparation of the Financial Statements in conformity with

IFRSs requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the

Financial Statements and the reported amount of expenses during the

year. Actual results may vary from the estimates used to produce

these Financial Statements.

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances. Actual results may vary from the estimates used to

produce these Financial Statements and the key estimates and

judgements are described below:

Going concern

The preparation of financial statements requires an assessment

on the validity of the going concern assumption. The Directors have

reviewed projections for a period of at least 12 months from the

date of approval of the financial statements as well as potential

opportunities. Any potential short falls in funding have been

identified and the steps to which Directors are able to mitigate

such scenarios and/or defer or curtail discretionary expenditures

should these be required have been considered.

In approving the financial statements, the Board have recognised

that these circumstances create a level of uncertainty. However,

having made enquiries and considered the uncertainties outlined

above, the Directors have a reasonable expectation that the Group

will continue to be able to raise finance as required over this

period to enable it to continue in operation and existence for the

foreseeable future. Accordingly, the Board believes it is

appropriate to adopt the going concern basis in the preparation of

the financial statements.

Impairment of non-financial assets

Assets that have an indefinite useful life are not subject to

amortisation and are tested annually for impairment. Assets that

are subject to amortisation are reviewed for impairment whenever

events or changes in circumstances indicate that the carrying

amount may not be recoverable. An impairment loss is recognised for

the amount by which the asset's carrying amount exceeds its

recoverable amount. The recoverable amount is the higher of an

asset's fair value less costs to sell and value in use. For the

purposes of assessing impairment, assets are grouped at the lowest

levels for which there are separately identifiable cash flows

(cash-generating units). Non-financial assets that suffered an

impairment are reviewed for possible reversal of the impairment at

each reporting date.

Share based payments

The Company may grant stock options to acquire common shares of

the Company to Directors, Officers, employees and consultants. An

individual is classified as an employee when the individual is an

employee for legal or tax purposes or provides services similar to

those performed by an employee.

The fair value of stock options is measured on the date of

grant, using the Black-Scholes option pricing model, and is

recognized over the vesting period. Consideration paid for the

shares on the exercise of stock options is credited to share

capital. In situations where equity instruments are issued to

non-employees and some or all of the goods or services received by

the entity as consideration cannot be specifically identified, they

are measured at fair value of the share-based payment. Otherwise,

share-based payments are measured at the fair value of goods or

services received.

Reverse takeover accounting

When considering how the acquisition of Apollon Formularies

Limited via a reverse takeover should be accounted for, the

Directors have been required to make a judgment on whether the

acquisition falls within the scope of IFRS 3 or not. The directors

assessed the accounting acquiree, Apollon Formularies Plc, at the

time of acquisition to not be a business as defined by IFRS 3. As a

result, the acquisition was assessed as falling outside the scope

of IFRS 3. Refer to Note 24 for commentary on how the reverse

takeover was accounted for.

5. Dividends

No dividend has been declared or paid by the Group during the

year ended 31 December 2021 (31 December 2020: GBPNil).

6. Revenue from contracts with customers

Group

--------------------------

For the For the

year ended year ended

31 December 31 December

2021 2020

GBP GBP

--------------------- ------------ ------------

Consultancy services 197,671 -

197,671 -

------------ ------------

Consultancy services were provided to Apollon Formularies

Jamaica Limited, an associate of the Group.

7. Administrative Expenses

Group

--------------------------

For the For the

year end year end

31 December 31 December

2021 2020

GBP GBP

------------------------------ ------------ ------------

Directors' salaries 222,222 -

Directors' benefits 31,747

Employee salaries and wages 54,571 -

Audit 46,500 -

Accountancy 3,700 -

Exchange fees 22,553 -

Consulting and professional 388,708 53,293

Insurance 45,502 -

Office and administration 19,743 982

Travel and entertainment 17,263 -

Share based payments 85,363 -

Advertising and marketing 11,548 -

Other 9,992 1,870

------------ ------------

Total administrative expenses 959,412 56,145

------------ ------------

During the year the Group (including its subsidiaries) obtained

the following services from the Company's auditors and its

associates:

Group

--------------------------

For the For the

year ended year ended

31 December 31 December

2021 2020

GBP GBP

----------------------------------------------- ------------ ------------

Fees payable to the Company's auditor

and its associates for the audit of the

Company and Consolidated Financial Statements 46,500 -

46,500 -

------------ ------------

8. Other net gains/(losses)

Group

--------------------------

For the For the

year ended year ended

31 December 31 December

2021 2020

GBP GBP

------------------------------------- ------------ ------------

Loss of CBev option and loan (218,910) -

Gain on debt settlement of Directors

fees 11,239 -

Other losses (33,673) -

--------------------------------------- ------------ ------------

(241,344) -

------------ ------------

During the year the right to purchase option to acquire CBev

Ventures Inc was allowed to expire and subsequently the receivable

was written off.

9. Finance Costs

Group

----------------------------

For the For the

year ended year ended

31 December 31 December

2021 2020

GBP GBP

------------------ ------------ ------------

Interest on loans 3,799 2,427

3,799 2,427

------------ ------------

10. Employee benefits expense

Group

--------------------------

For the For the

year ended year ended

31 December 31 December

2021 2020

GBP GBP

------------------------------------ ------- ----- ------------ --------------

Salaries and wages 46,889 -

Social security contributions and

similar taxes 6,937 -

Other employment costs 745 -

54,571 -

------------ --------------

11. Directors' remuneration

At at 31 December 2020

------------- ---------------------------

For the

Fees Written year ended

and Salaries off Salary 31 December

GBP Payments 2020

GBP GBP

----------------------- ------------- ----------- ------------

David Lenigas - (179,000) (179,000)

Donald Strang 10,000 (95,000) (85,000)

Hamish Harris 10,000 (130,000) (120,000)

------------- -----------

20,000 (404,000) (384,000)

------------- ----------- ------------

At at 31 December 2021

------------- ------------------------

Fees Benefits For the

and Salaries in kind year ended

GBP 31 December

2021

GBP GBP

----------------------- ------------- -------- ------------

Nicholas Ingrassia 9,478 - 9,478

Stephen Barnhill 195,097 31,747 226,844

Nicholas Barnhill 9,000 - 9,000

Kevin Sheil 8,647 - 8,647

------------- --------

222,222 - 253,969

------------- -------- ------------

Nicholas Ingrassia's fees for the period, totalling GBP9,478,

have been accrued and remain unpaid as at 31 December 2021.

Stephen Barnhill's fees and benefits in kind are paid to Apollon

Formularies Inc of which Stephen Barnhill is the sole director.

Notwithstanding a fee of GBP195,097 was paid for the year ended 31

December 2021 to Apollon Formularies Inc are for the services of

two Executives being a Chief Executive Officer (Stephen Barnhill

Snr) and the Chief Operating Officer (Stephen Barnhill Jnr). A

further GBP41,868 was paid to Apollon Formularies Inc for health

insurance costs.

Nicholas Barnhill fees are paid via Apollon Formularies Inc.

David Lenigas, Donald Strang and Hamish Harris resigned on the

date of completion of the reverse take-over of the Company, 12

April 2021. Stephen Barnhill, Nicholas Barnhill, Nicholas Ingrassia

and Kevin Sheil were appointed on 12 April 2021.

12. Taxation

For the For the

year end year end

31 December 31 December

2021 2020

GBP GBP

---------------------------------------------------- ------------ ------------

Total Current tax - -

Total tax in the Income Statement - credit/(expense) - -

------------ ------------

The tax charges for the period use the standard rate applicable

in the Isle of Man of 0% (2020- 0%).

For the For the

year end year end

31 December 31 December

2021 2020

GBP GBP

--------------------------------------- ------------ ------------

Profit/(loss) on ordinary activities

before tax (2,530,556) 330,942

Tax on loss on ordinary activities at

standard CT rate of 0% - -

------------ ------------

Profit/(Losses) arising in territories

where no tax is charged (2,530,556) 330,942

------------ ------------

13. Trade and other receivables

Current:

Group Company

---------------------------- --------------------------------

For the For the For the year For the

year end year end end 31 December year end

31 December 31 December 2021 31 December

2021 2020 2020

------------- ------------- ----------------- -------------

GBP GBP GBP GBP

Trade receivables 197,671 - 197,671 673

Prepayments 6,604 - 6,604 8,331

VAT receivables 120,429 21,946 96,483 -

Other receivables 35,953 218,911 35,702 -

------------- ------------- ----------------- -------------

360,657 240,857 336,460 9,004

------------- ------------- ----------------- -------------

14. Cash and cash equivalents

Group Company

---------------------------------- ----------------------------------

For the year For the year For the year For the year

end 31 December end 31 December end 31 December end 31 December

2021 2020 2021 2020

---------------- ---------------- ---------------- ----------------

GBP GBP GBP GBP

Cash at bank and on

hand 304,986 2,369 202,133 12,162

---------------- ---------------- ---------------- ----------------

304,986 2,369 202,133 12,162

---------------- ---------------- ---------------- ----------------

The carrying amounts of the Group's cash and cash equivalents

are denominated in pounds sterling.

15. Trade and other payables

Current: Group Company

---------------------------------- ----------------------------------

For the year For the year For the year For the year

end 31 December end 31 December end 31 December end 31 December

2021 2020 2021 2020

---------------- ---------------- ---------------- ----------------

GBP GBP GBP GBP

Trade payables 32,269 1,298 32,238 10,388

Accrued liabilities 50,747 - 50,747 -

Directors Loan - 32,289 - -

Tax and payroll - - - 1,266

Other creditors - 51,635 - 85,000

---------------- ---------------- ---------------- ----------------

83,016 85,222 82,985 96,654

---------------- ---------------- ---------------- ----------------

The carrying amounts of the Group's trade and other payables are

denominated in pounds sterling.

16. Financial instruments by category

For the year end

Consolidated 31 December 2021

---------------------

At amortised

cost Total

Assets per Statement GBP GBP

---------------------------------------------------- ------------ ---------

Trade and other receivables (excluding prepayments) 354,053 354,053

Cash and cash equivalents 304,986 304,986

------------ -------

659,039 659,039

------------ -------

At amortised

cost Total

Liabilities per Statement GBP GBP

---------------------------------------------------- ------------ -------

Trade and other payables (excluding non-financial

liabilities) 32,289 32,289

------------ -------

32,289 32,289

------------ -------

For the year end

Company 31 December 2021

---------------------------

At amortised

cost Total

Assets per Statement GBP GBP

---------------------------------------------------- ---------------- ---------

Trade and other receivables (excluding prepayments) 329,856 329,856

Cash and cash equivalents 202,133 202,133

---------------- ---------

531,989 531,989

---------------- ---------

At amortised

cost Total

Liabilities per Statement GBP GBP

---------------------------------------------------- ---------------- ---------

Borrowings (excluding finance leases) - -

Trade and other payables (excluding non-financial

liabilities) 32,238 32,238

---------------- ---------

32,238 32,238

---------------- ---------

The Company's financial instruments comprise cash at bank and

payables which arise in the normal course of business. It is, and

has been throughout the period under review, the Company's policy

that no speculative trading in financial instruments shall be

undertaken. The Company has been solely equity funded during the

period. As a result, the main risk arising from the Company's

financial instruments is currency risk. The Company's financial

instruments are held at fair value through profit or loss.

Details of the significant accounting policies and methods

adopted, including the criteria for recognition, the basis of

measurement and the basis on which income and expenses are

recognised, in respect of each class of financial asset, financial

liability and equity instrument are disclosed in Note 2 of the

accounts.

Interest rate risk and liquidity risk

As the Company has no borrowings, it only has limited interest

rate risk. The impact is on income and operating cash flow and

arises from changes in market interest rates. Cash resources are

held in current, floating rate accounts.

Currency risk

The Directors consider that there is no significant currency

risk faced by the Company. The Company is denominated in pound

sterling. Apollon Formularies Jamaica, has currency exposure to

Jamaican dollars. As the interest in this entity is 49% this is not

considered a significant risk to the Company.

Fair values

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash held by

the company with an original maturity of three months or less. The

carrying amount of these assets approximates their fair value.

The directors consider there to be no material difference

between the book value of financial instruments and their values at

the balance sheet date.

17. Share capital and share premium

Number of shares Share capital Share premium Total

--------------------------- ---------------- ------------- ------------- -----------

GBP GBP GBP

Issued and fully

paid

As at 31 December

2019 31,360,011 17,309 3,861,592 3,878,901

--------------------------- ---------------- ------------- ------------- -----------

Issue of Shares 350,000 35 48,965 49,000

--------------------------- ---------------- ------------- ------------- -----------

As at 31 December

2020 31,710,011 17,344 3,910,557 3,927,901

--------------------------- ---------------- ------------- ------------- -----------

Transfer to reverse

acquisition reserve (31,710,011) (17,344) (3,910,557) (3,927,901)

Recognition of AfriAg

plc equity at acquisition

date 31,710,011 - 11,704,388 11,704,388

13 April 2021 -

Investment in Apollon

Limited 666,666,666 - 40,000,000 40,000,000

14 April 2021 50,000,000 - 2,500,000 2,500,000

Cost of capital - - (153,624) (153,624)

--------------------------- ---------------- ------------- ------------- -----------

As at 31 December

2021 748,376,677 - 54,050,764 54,050,764

--------------------------- ---------------- ------------- ------------- -----------

On 27 November 2019 at a General Meeting of the AfriAg plc it

was approved that the Ordinary Shares were consolidated to new

Ordinary Shares with no par value. Therefore the share capital

balance at 31 December 2021 is nil. Due to the reverse takeover,

the share capital comparative stated in 2019 and 2020 is that of

Apollon Formularies Limited.

On 13 April 2021, the proposed reverse takeover of Apollon

Formularies Limited had completed. The Company acquired the full

share capital of Apollon Formularies Limited via the issuance of

666,666,666 shares based on 3.95 consideration shares being issued

for every 1 ordinary share in Apollon Formularies Limited. The

acquisition constitutes a reverse acquisition as the shareholders

of Apollon Formularies Limited will acquire control of Apollon

Formularies Plc (formerly AfriAg Global plc).

On 13 April 2021, the Company issued 50,000,000 Ordinary Shares

at a price of 5 pence per share raising a total of GBP2,500,000

18. Share Option Reserve

Share options and warrants

Share options and warrants outstanding and exercisable at the

end of the period have the following expiry dates and exercise

prices:

Vesting date Expiry date Exercise price 31 December 31 December

GBP 2021 2020

-------------- ------------- --------------- ------------ ------------

13/04/2021 13/04/2026 0.055 4,000,000 -

-------------- ------------- --------------- ------------ ------------

The Company and Group have no legal or constructive obligation

to settle or repurchase the options or warrants in cash.

The fair value of the share options and warrants was determined

using the Black Scholes valuation model. The parameters used are

detailed below:

2021 Warrants

--------------

Granted on: 13/04/2021

Life (years) 5 years

Exercise price (pence

per share) 5.5 p

Risk free rate 1.56%

Expected volatility 24.40%

Expected dividend -

yield

Marketability discount 20%

Total fair value (GBP000) 85,363

The expected volatility of the 2021 warrants has been calculated

based on volatility for the six month period post the date of grant

due to unavailability of data. The risk-free rate of return is

based on zero yield government bonds for a term consistent with the

warrant life. A reconciliation of warrants granted over the period

to 31 December 2021 is shown below:

31 December 2021 31 December 2020

------------------------- ----------------------

Weighted Weighted

average average

exercise exercise

Number price (GBP) Number price (GBP)

-------------------------- ---------- ------------- ------- -------------

Outstanding at beginning - - - -

of period

Granted 4,000,000 0.055 - -

Outstanding as at period

end 4,000,000 0.055 - -

-------------------------- ---------- ------------- ------- -------------

Exercisable at period

end 4,000,000 0.055 - -

-------------------------- ---------- ------------- ------- -------------

31 December 2021 31 December 2020

-------------------------------------------------- --------------------------------------------------

Weighted Weighted Weighted Weighted

Weighted average average Weighted average average

Range average remaining remaining average remaining remaining

of exercise exercise life life exercise life life

prices price Number expected contracted price Number expected contracted

(GBP) (GBP) of shares (years) (years) (GBP) of shares (years) (years)

-------------- ---------- ----------- ----------- ------------ ---------- ----------- ----------- ------------

0.05 -

0.15 0.055 4,000,000 4.2 4.2 - - - -

-------------- ---------- ----------- ----------- ------------ ---------- ----------- ----------- ------------

During the period there was a charge of GBP85,363 (31 December

2020: GBPNil) in respect of and warrants.

19. Earnings per share

For the period ended 31 December 2021, the calculation of the

total basic loss per share of (0.462) pence is calculated by

dividing the loss attributable to shareholders of GBP2,530,556 by

the weighted average number of ordinary shares of 548,102,705 in

issue during the period.

20. Fair Value of Financial Assets and Liabilities Measured at Amortised Costs

Financial assets and liabilities comprise the following:

-- Trade and other receivables

-- Cash and cash equivalents

-- Trade and other payables

The fair values of these items equate to their carrying values

as at the reporting date .

21. Capital Commitments and Contingencies

The Group is not aware of any material personal injury or damage

claims open against the Group. There are no non-cancellable capital

commitments as at the balance sheet date. The Company has no

contingent liabilities at the balance sheet date.

22. Related party transactions

Loan from Apollon Formularies Plc to Apollon Formularies

Limited

As at 31 December 2021 there were amounts receivable of

GBP202,023 from Apollon Formularies Limited.

All intra Group transactions are eliminated on

consolidation.

Loan from Apollon Formularies Plc to Apollon Formularies Jamaica

Ltd

As at 31 December 2021 there were amounts receivable of

GBP402,189 from Apollon Formularies Jamaica.

Loan from Apollon Formularies Limited to Apollon Formularies

Jamaica Ltd

As at 31 December 2021 there were amounts receivable of

GBP1,813.705 from Apollon Formularies Jamaica Ltd.

Loan from Apollon Formularies Plc to Docs Place International

Inc

As at 31 December 2021 there were amounts receivable of

GBP20,383 from Docs Place International Inc. Docs Place

International Inc shares a common director being Stephen

Barnhill.

Other transactions

Apollon Formularies Inc a company of which Stephen Barnhill is a

director, was paid a fee of GBP195,097 for the services of two

Executives being a Chief Executive Officer (Stephen Barnhill Snr)

and the Chief Operating Officer (Stephen Barnhill Jnr).

Nicholas Barnhill's fees of GBP9,000 for the year ended 31

December 2021 were paid via Apollon Formularies Inc.

23. Investments in subsidiary undertakings

Company

31 December

2021

GBP

------------------------------ -------------

Shares in Group Undertakings

At beginning of period 1,160,000

Investment during period 40,000,000

------------------------------ -------------

At end of period 41,160,000

------------------------------ -------------

Loans to Group Undertakings

------------------------------ -------------

At beginning of period -

------------------------------ -------------

Loan during period 202,023

------------------------------ -------------

At end of period 202,023

------------------------------ -------------

Total 41,362,023

------------------------------ -------------

Investments in Group undertakings are stated at cost, which is

the fair value of the consideration paid, less any impairment

provision. Investments and loans to subsidiaries are eliminated

upon consolidation.

In the prior year, Shares in Group undertakings were classified