|

Prospectus Supplement

|

Filed Pursuant to Rule 424(b)(5)

|

|

(To prospectus dated May 27, 2020)

|

Registration No. 333-238324

|

Up to $10,000,000 Common Shares

On May 29, 2020, we

entered into an At Market Issuance Sales Agreement, or the Sales Agreement, with B. Riley FBR, Inc. (“B. Riley FBR”

or the “Agent”), relating to our common shares, no par value per share, offered by this prospectus supplement and the

accompanying prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell common shares having a maximum

aggregate sales price of up to $10,000,000 from time to time through or to the Agent, as sales agent or principal.

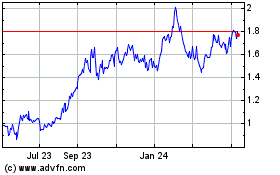

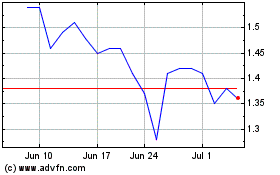

Our common shares

are listed on the NYSE American (“NYSE American”) under the symbol “URG” and on the Toronto Stock Exchange

(“TSX”) under the symbol “URE.” On May 28, 2020, the closing price of our common shares on the NYSE American

was $0.59 and on the TSX was CDN$0.79.

Sales of common shares,

if any, may be made by any method permitted by law deemed to be “at the market” offerings as defined in Rule 415 under

the Securities Act of 1933, as amended, or the Securities Act. The Agent will use commercially reasonable efforts to sell on our

behalf all of the common shares requested to be sold by us, consistent with its normal trading and sales practices, on mutually

agreed terms between the Agent and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The Agent will be

entitled to compensation at a commission rate of up to 3.0% of the gross sales price of all shares sold under the Sales Agreement.

In connection with the sale of common shares on our behalf, the Agent will be deemed to be an “underwriter” within

the meaning of the Securities Act, and the compensation of the Agent will be deemed to be underwriting commissions or discounts.

We have agreed to provide indemnification and contribution to the Agent against certain liabilities, including liabilities under

the Securities Act.

Investing in our

common shares involves significant risks. Before buying common shares, you should carefully consider the risks described under

the caption “Risk Factors” beginning on page S-7 of this prospectus supplement and in the documents incorporated by

reference into this prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

B. Riley FBR

The date of this prospectus

supplement is May 29, 2020.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS

SUPPLEMENT

You should rely only

on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any applicable

free writing prospectus we issue. We have not, and the Agent has not, authorized anyone else to provide you with different or additional

information. We are offering to sell these securities and seeking offers to buy these securities only in jurisdictions where offers

and sales are permitted.

We are responsible

for the information contained and incorporated by reference in this prospectus supplement, the accompanying prospectus and any

applicable free writing prospectus we issue. We have not, and the Agent has not, authorized anyone to give you any other information.

We and the Agent take no responsibility for any other information that others may give you. This prospectus supplement, the accompanying

prospectus and any applicable free writing prospectus we issue do not constitute an offer to sell or the solicitation of an offer

to buy any securities other than the registered securities to which they relate, nor do this prospectus supplement, the accompanying

prospectus and any applicable free writing prospectus we issue constitute an offer to sell or the solicitation of an offer to buy

securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You

should not assume that the information contained in this prospectus supplement, the accompanying prospectus and any applicable

free writing prospectus we issue is accurate on any date subsequent to the date set forth on the front of the document or that

any information we have incorporated by reference is accurate on any date subsequent to the date of the document incorporated by

reference, even though this prospectus supplement, the accompanying prospectus and any applicable free writing prospectus we issue

is delivered or securities are sold on a later date. Our business, financial condition, prospectus and results of operations may

have changed since those respective dates. You should assume that the information appearing in this prospectus supplement, the

accompanying prospectus, any applicable free writing prospectus and the documents incorporated by reference herein or therein is

accurate only as of their respective dates or on the date or dates which are specified in these documents.

This document is in

two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and adds to, updates

and changes information contained in the accompanying prospectus and the documents incorporated by reference into the accompanying

prospectus. The second part is the accompanying prospectus, which gives more general information, some of which may not apply to

this offering. To the extent the information contained in this prospectus supplement differs or varies from the information contained

in the accompanying prospectus or any document incorporated by reference herein or therein that is filed with the Securities and

Exchange Commission (the “SEC”) prior to the date of this prospectus supplement, the information in this prospectus

supplement will supersede such information. In addition, to the extent that any information in a filing that we make with the SEC

adds to, updates or changes information contained in an earlier filing we made with the SEC, the information in such later filing

shall be deemed to modify and supersede such information in the earlier filing.

All references in this

prospectus supplement and the accompanying prospectus to “we,” “us,” “our,” or similar references

refer to Ur-Energy Inc. and its subsidiaries on a consolidated basis, except where the context otherwise requires or as otherwise

indicated.

FORWARD-LOOKING STATEMENTS

This prospectus supplement

and accompanying prospectus and the documents incorporated herein and therein may contain forward-looking statements within the

meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements can be identified

by the use of words such as “expect,” “anticipate,” “estimate,” “believe,” “may,”

“potential,” “intends,” “plans” and other similar expressions or statements that an action,

event or result “may,” “could” or “should” be taken, occur or be achieved, or the negative

thereof or other similar statements, however the absence of such words does not mean that a statement is not forward-looking. These

statements are only predictions and involve known and unknown risks, uncertainties and other factors which may cause our actual

results, performance or achievements, or industry results, to be materially different from any future results, performance, or

achievements expressed or implied by these forward-looking statements. Such statements include, but are not limited to: (i) the

ability to maintain controlled-level operations at Lost Creek, the timing to determine future development and construction priorities,

and the ability to readily and cost-effectively ramp-up production operations when market and other conditions warrant; (ii) the

continuing technical and economic viability of Lost Creek; (iii) the timing and outcome of permitting and regulatory approvals

of the amendments to the Lost Creek permits and licenses; (iv) the ability to complete additional favorable uranium sales agreements

including spot sales when warranted and production inventory is available; (v) the production rates and life of the Lost Creek

Project and subsequent development of and production from adjoining projects within the Lost Creek Property, including plans at

LC East; (vi) the potential of exploration targets throughout the Lost Creek Property (including the ability to expand resources);

(vii) the potential of our other exploration and development projects, including Shirley Basin, the projects in the Great Divide

Basin and the Excel project (viii) the technical and economic viability of Shirley Basin; (ix) the timing and outcome of applications

for regulatory approval to build and operate an in situ recovery mine at Shirley Basin; (x) the outcome of our production projections;

(xi) current market conditions including without limitation supply and demand projections; and (xii) the outcome of the report

and recommendations from the U.S. Nuclear Fuel Working Group, including the timeline and scope of proposed remedies, including

the budget appropriations process related to the establishment of the national uranium reserve.

Although we believe

that our plans, intentions and expectations reflected in these forward-looking statements are reasonable, we cannot be certain

that these plans, intentions or expectations will be achieved. Actual results, performance or achievements could differ materially

from those contemplated, expressed or implied by the forward-looking statements contained in this prospectus supplement.

Forward-looking statements

are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results

to differ from those expressed or implied by the forward-looking statements, including, without limitation, risks related to:

|

|

·

|

significant increases or decreases in uranium prices;

|

|

|

·

|

future estimates for production, development and production operations, capital expenditures, operating

costs, mineral resources, recovery rates, grades and market prices;

|

|

|

·

|

business strategies and measures to implement such strategies;

|

|

|

·

|

estimates of goals for expansion and growth of the business and operations;

|

|

|

·

|

plans and references to our future successes;

|

|

|

·

|

our history of operating losses and uncertainty of future profitability;

|

|

|

·

|

status as an exploration stage company;

|

|

|

·

|

the lack of mineral reserves;

|

|

|

·

|

risks associated with obtaining permits and other authorizations in the U.S.;

|

|

|

·

|

risks associated with current variable economic conditions;

|

|

|

·

|

challenges presented by current inventories and largely unrestricted imports of uranium products

into the U.S.;

|

|

|

·

|

our ability to service our debt and maintain compliance with all restrictive covenants related

to the debt facility and security documents;

|

|

|

·

|

the possible impact of future financings;

|

|

|

·

|

the hazards associated with mining production;

|

|

|

·

|

compliance with environmental laws and regulations;

|

|

|

·

|

uncertainty regarding the pricing and collection of accounts;

|

|

|

·

|

the possibility for adverse results in potential litigation;

|

|

|

·

|

uncertainties associated with changes in government policy and regulation;

|

|

|

·

|

uncertainties associated with a Canada Revenue Agency or U.S. Internal Revenue Service audit of

any of our cross border transactions;

|

|

|

·

|

adverse changes in general business conditions in any of the countries in which we do business;

|

|

|

·

|

changes in size and structure;

|

|

|

·

|

the effectiveness of management and our strategic relationships;

|

|

|

·

|

ability to attract and retain key personnel;

|

|

|

·

|

uncertainties regarding the need for additional capital;

|

|

|

·

|

sufficiency of insurance coverage;

|

|

|

·

|

uncertainty regarding the fluctuations of quarterly results;

|

|

|

·

|

foreign currency exchange risks;

|

|

|

·

|

ability to enforce civil liabilities under U.S. securities laws outside the United States;

|

|

|

·

|

ability to maintain our listing on the NYSE American and TSX;

|

|

|

·

|

risks associated with the expected classification as a “passive foreign investment company”

under the applicable provisions of the U.S. Internal Revenue Code of 1986, as amended;

|

|

|

·

|

risks associated with our investments;

|

|

|

·

|

risk factors described or referenced in this prospectus; and

|

|

|

·

|

other factors, many of which are beyond our control.

|

This list is not exhaustive

of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect

forward-looking statements are described further under the section heading “Risk Factors” in this prospectus supplement

and the accompanying prospectus. Although we have attempted to identify important factors that could cause actual results to differ

materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated,

estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue

reliance on any such forward-looking statements, which speak only as of the date made. Except as required by law, we disclaim any

obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements

or to reflect the occurrence of anticipated or unanticipated events. We qualify all of the forward-looking statements contained

or incorporated by reference in this prospectus supplement by the foregoing cautionary statements.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING

DISCLOSURE OF

MINERAL RESOURCES

Unless otherwise indicated,

all resource estimates, included or incorporated by reference in this prospectus supplement and accompanying prospectus and the

documents incorporated herein and therein have been, and will be, prepared in accordance with Canadian National Instrument 43-101 Standards

of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum

Definition Standards for Mineral Resources and Mineral Reserves (“CIM Definition Standards”). NI 43-101 is a rule developed

by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and

technical information concerning mineral projects. NI 43-101 permits the disclosure of an historical estimate made prior to the

adoption of NI 43-101 that does not comply with NI 43-101 to be disclosed using the historical terminology if the disclosure: (a)

identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate;

(c) to the extent known, provides the key assumptions, parameters and methods used to prepare the historical estimate; (d) states

whether the historical estimate uses categories other than those prescribed by NI 43-101; and (e) includes any more recent estimates

or data available.

Canadian standards,

including NI 43-101, differ significantly from the requirements of the SEC, and resource information contained or incorporated

by reference in this prospectus supplement and accompanying prospectus and the documents incorporated herein and therein may not

be comparable to similar information disclosed by U.S. companies. In particular, the term “resource” does not equate

to the term “‘reserves.” Under SEC Industry Guide 7, mineralization may not be classified as a “reserve”

unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time

the reserve determination is made. SEC Industry Guide 7 does not define and the SEC’s disclosure standards normally do not

permit the inclusion of information concerning “measured mineral resources,” “indicated mineral resources”

or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not

constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that

“inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their

economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever

be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis

of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an

“inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces”

in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization

that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures.

Accordingly, information concerning mineral deposits set forth herein may not be comparable to information made public by companies

that report in accordance with U.S. standards.

CURRENCY AND EXCHANGE RATES

Unless otherwise indicated,

all references to “$” or “dollars” in this prospectus supplement and the accompanying prospectus refer

to United States dollars. References to “Cdn$” in this prospectus supplement and the accompanying prospectus refer

to Canadian dollars.

The rate of exchange

on May 28, 2020, as reported by the Bank of Canada for the conversion of Canadian dollars to U.S. dollars, was Cdn$1.00 equals

$0.7265 and, for the conversion of U.S. dollars to Canadian dollars, was $1.00 equals Cdn$1.3764.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information

contained elsewhere in this prospectus supplement and accompanying prospectus or incorporated by reference herein. This summary

is not complete and may not contain all of the information that you should consider before investing. You should read the entire

prospectus supplement and accompanying prospectus carefully, including the section entitled “Risk Factors” beginning

on page S-7 of this prospectus supplement, and all other information included or incorporated by reference in this prospectus

supplement and accompanying prospectuses in its entirety before you decide whether or invest. See “Where You Can Find More

Information” and “Incorporation of Certain Documents by Reference.”

Our Company

Incorporated on March 22, 2004, Ur-Energy

is an exploration stage mining company, as that term is defined in SEC Industry Guide 7. We are engaged in uranium mining, recovery

and processing activities, including the acquisition, exploration, development and operation of uranium mineral properties in the

United States. We began operation of our first in situ recovery (ISR) uranium mine at our Lost Creek Project, Wyoming in 2013.

Ur-Energy is a corporation continued under the Canada Business Corporations Act on August 8, 2006. Our common shares are

listed on the NYSE American under the symbol “URG” and on the TSX under the symbol “URE.”

The registered office of the Company is

located at 55 Metcalfe Street, Suite 1300, Ottawa, Ontario K1P 6L5, and head office of the Company is located at 10758 W. Centennial

Road, Suite 200, Littleton, Colorado 80127; telephone: 1-720-981-4588.

The address of the Company's website is

www.ur-energy.com. Information contained on the Company's website is not part of this prospectus supplement nor is it incorporated

by reference herein.

THE OFFERING

|

Issuer

|

|

Ur-Energy Inc.

|

|

|

|

|

|

Securities Being Offered

|

|

Common shares, no par value per share, having a maximum aggregate sales price of up to $10,000,000. The Sales Agreement replaces the prior At Market Issuance Sales Agreement entered into by the Company on May 27, 2016, as amended. Any securities remaining unissued under the prior sales agreement will not be issued.

|

|

|

|

|

|

Manner of Offering

|

|

“At the market offering” of common shares through or to B. Riley FBR, Inc., our Agent. See “Plan of Distribution” on page S-10 of this prospectus supplement.

|

|

|

|

|

|

Use of Proceeds

|

|

We intend to use the net proceeds from

this offering for working capital and general corporate purposes. See “Use of Proceeds” on page S-10 of this

prospectus supplement.

|

|

Trading Symbol

|

|

Our common shares are listed on the NYSE American under the symbol “URG” and on the TSX under the symbol “URE.”

|

|

|

|

|

|

Risk Factors

|

|

Investing in our common shares

involves significant risks. Please read the information contained in and incorporated by reference under the caption “Risk

Factors” beginning on page S-7 of this prospectus supplement and page 8 of the accompanying prospectus.

|

|

|

|

|

|

Tax Considerations

|

|

Purchasing our common shares may have tax

consequences in the United States and Canada. This prospectus supplement and the accompanying base shelf prospectus may not describe

these consequences fully for all investors. Investors should read the tax discussion in the accompanying base shelf prospectus

and consult with their tax adviser. See “Certain Canadian Federal Income Tax Considerations” and “Certain U.S.

Federal Income Tax Considerations” in the accompanying base shelf prospectus.

|

|

|

|

|

|

Dividend Policy

|

|

We have not paid dividends on

our common shares and do not intend to pay cash dividends in the foreseeable future.

|

RISK FACTORS

Prior to making

an investment decision investors should consider the investment risks set out below including those set out in our most recent

Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q and other filings with the SEC and incorporated herein

by reference, which are in addition to the usual risks associated with an investment in a business at an early stage of development.

If any of these risks materialize into actual events or circumstances or other possible additional risks and uncertainties of which

the board of directors of the Company are currently unaware or which they consider not to be material in relation to the Company's

business, actually occur, the Company's assets, liabilities, financial condition, results of operations (including future results

of operations), business and business prospects are likely to be materially and adversely affected. You should also refer to the

other information set forth or incorporated by reference in this prospectus supplement and accompanying base shelf prospectus,

including our consolidated financial statements and related notes.

Risks Related to Our Common Shares and

This Offering

The trading price of the common shares

may experience substantial volatility.

The common shares

may experience substantial volatility that is unrelated to the Company's financial condition or operations. The trading price of

the common shares may also be significantly affected by short-term changes in the price of uranium. The market price of the Company's

securities is affected by many other variables which may be unrelated to its success and are, therefore, not within the Company's

control. These include other developments that affect the market for all resource sector-related securities, the breadth of the

public market for the common shares and the attractiveness of alternative investments. The effect of these and other factors on

the market price of the common shares is expected to make the price of the common shares volatile in the future, which may result

in losses to investors.

Management will have broad discretion

as to the use of the net proceeds from this offering, and we may not use these proceeds effectively.

The Company currently

intends to allocate the net proceeds it will receive from the offering as described under the heading “Use of Proceeds”

below. However, management will have discretion in the actual application of the net proceeds, and the Company may elect to allocate

proceeds differently from that described in “Use of Proceeds” if the Company believes it would be in its best interests

to do so. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and

you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

Our failure to apply these funds effectively could have an adverse effect on our business and cause the price of our common shares

to decline.

Sales of a significant number of

common shares in the public markets, or the perception that such sales could occur, could depress the market price of our common

shares.

Sales of a significant

number of our common shares in the public markets, or the perception that such sales could occur as a result of our utilization

of a universal shelf registration statement or otherwise could depress the market price of our common shares and impair our ability

to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our common

shares or the market perception that we are permitted to sell a significant number of our securities would have on the market price

of our common shares.

The market price of our common shares may fluctuate significantly.

The market price of

our common shares has fluctuated and could fluctuate substantially in the future. This volatility may subject our stock price to

material fluctuations due to the factors discussed under “Risk Factors” in this prospectus supplement, the accompanying

prospectus and the documents incorporated herein by reference, and other factors including market reaction to the estimated fair

value of our portfolio; rumors or dissemination of false information; changes in coverage or earnings estimates by analysts; our

ability to meet analysts’ or market expectations; and sales of common shares by existing shareholders.

We have never paid cash dividends

on our common shares, and we do not anticipate paying any cash dividends on our common shares in the foreseeable future. Therefore,

if our share price does not appreciate, our investors may not gain and could potentially lose on their investment in our shares.

We have never declared

or paid cash dividends on our common shares, nor do we anticipate paying any cash dividends on our common shares in the foreseeable

future. We currently intend to retain all available funds and any future earnings to fund the growth of our business. As a result,

capital appreciation, if any, of our shares will be an investor’s sole source of gain for the foreseeable future.

You may experience immediate and

substantial dilution.

The offering price

per share in this offering may exceed the net tangible book value per share of our common shares outstanding prior to this offering.

Assuming that an aggregate of 20,000,000 shares of our common shares are sold at an assumed public offering price of $0.50 per

share, for aggregate gross proceeds of $10,000,000, and after deducting commissions and estimated offering expenses payable by

us, you would experience immediate dilution of $0.22 per share, representing the difference between our as adjusted net tangible

book value per share as of March 31, 2020, after giving effect to this offering, and the assumed offering price. See the section

entitled "Dilution" below for a more detailed illustration of the dilution you would incur if you participate in this

offering. Because the sales of the shares offered hereby will be made directly into the market, the prices at which we sell these

shares will vary and these variations may be significant. Purchasers of the shares we sell, as well as our existing shareholders,

will experience significant dilution if we sell shares at prices significantly below the price at which they invested.

You may experience future dilution

as a result of future equity offerings.

To raise additional

capital, we may in the future offer additional shares of our common shares or other securities convertible into or exchangeable

for our common shares at prices that may not be the same as the price per share in this offering. We may sell shares or other

securities in any other offering at a price per share that is less than the price per share paid by investors in this offering,

and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price

per share at which we sell additional shares of our common shares, or securities convertible or exchangeable into common shares,

in future transactions may be higher or lower than the price per share paid by investors in this offering.

DILUTION

Purchasers of common

shares offered by this prospectus supplement and the accompanying base prospectus may experience immediate dilution in

the net tangible book value of their common shares from the price paid in the offering. The net tangible book value of our common

shares as of March 31, 2020 was approximately $40,953,000 or $0.26 per share. Net tangible book value per share is determined by

dividing our total tangible assets, less total liabilities, by the number of common shares outstanding as of March 31, 2020.

Dilution per

share represents the difference between the public offering price per common share and the adjusted net tangible book value per

common share after giving effect to this offering. After reflecting the sale in this offering of 20,000,000 common shares at an

assumed public offering price of $0.50 per share, less commissions and estimated offering expenses, the adjusted net tangible book

value of our common shares as of March 31, 2020 would have been approximately $50,603,000, or approximately $0.28 per share. The

change represents an immediate increase in net tangible book value per common share of $0.02 per share to existing stockholders

and an immediate dilution of $0.22 per share to new investors purchasing the common shares in this offering. The following

table illustrates this per share dilution:

|

Assumed public offering price per common share

|

|

|

|

|

|

$

|

0.50

|

|

|

Net tangible book value per share as of March 31, 2020

|

|

$

|

0.26

|

|

|

|

|

|

|

Increase per share attributable to this offering

|

|

$

|

0.02

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net tangible book value per share as of March 31, 2020

|

|

|

|

|

|

$

|

0.28

|

|

|

Dilution per share attributable to this offering

|

|

|

|

|

|

$

|

0.22

|

|

The foregoing calculations

are based on 160,478,059 common shares outstanding as of March 31, 2020 and exclude (i) 11,052,694 common shares issuable

upon the exercise of outstanding stock options having a weighted average exercise price of $0.64 per share; (ii) 1,149,955 common

shares issuable upon of redemption of outstanding restricted stock units having a weighted-average grant date fair value of $0.59

per unit; and (iii) 6,531,439 common shares issuable upon the exercise of 13,062,878 outstanding warrants having a per share

exercise price of $1.00 per full share.

The table above assumes

for illustrative purposes that an aggregate of 20,000,000 common shares are sold during the term of the Sales Agreement at a price

of $0.50 per share for aggregate gross proceeds of $10,000,000. In fact, the shares subject to the Sales Agreement will be sold,

if at all, from time to time at prices that may vary. An increase of $0.50 per share in the price at which the shares are sold

from the assumed offering price of $0.50 per share shown in the table above, assuming all of our common shares in the aggregate

amount of $10,000,000 during the term of the Sales Agreement with B. Riley FBR is sold at that price, would increase our adjusted

net tangible book value per share after the offering to $0.30 per share and would increase the dilution in net tangible book value

per share to new investors in this offering to $0.70 per share, after deducting commissions and estimated aggregate offering expenses

payable by us. A decrease of $0.25 per share in the price at which the shares are sold from the assumed offering price of $0.50

per share shown in the table above, assuming all of our common shares in the aggregate amount of $10,000,000 during the term of

the Sales Agreement with B. Riley FBR is sold at that price, would decrease our adjusted net tangible book value per share after

the offering to $0.25 per share and would essentially eliminate the dilution in net tangible book value per share to new investors

in this offering. This information is supplied for illustrative purposes only.

USE OF PROCEEDS

We are not guaranteed

to receive any particular amount of proceeds from this offering. The amount of proceeds we receive from this offering, if any,

will depend upon the number of common shares sold and the market price at which they are sold.

We intend to use the

net proceeds from this offering, after deducting the Agent’s commission and our offering expenses, for working capital and

general corporate purposes.

Our management will

have broad discretion in the application of the net proceeds of this offering.

PLAN OF DISTRIBUTION

On May 29, 2020,

we entered into an At Market Issuance Sales Agreement (the “Sales Agreement”) with the Agent, under which we may issue

and sell common shares having aggregate sales proceeds of up to $10,000,000 from time to time through or to the Agent, as sales

agent or principal. The Sales Agreement replaces the prior At Market Issuance Sales Agreement entered into by the Company on May

27, 2016, as amended. The form of the Sales Agreement will be filed as an exhibit to a report filed under the Exchange Act and

incorporated by reference in this prospectus supplement. The Agent may sell the common shares by any method that is deemed to be

an “at the market offering” as defined in Rule 415 promulgated under the Securities Act. We may instruct the Agent

not to sell our common shares if the sales cannot be effected at or above the price designated by us from time to time. We or the

Agent may suspend the offering of our common shares upon notice and subject to other conditions. The Agent will not engage in any

transactions that stabilize the price of our common shares.

From time to time during

the term of the Sales Agreement, we will notify the Agent of the amount of shares to be sold, the dates on which such sales are

requested to be made, the minimum price below which sales may not be made and any limitation on the number of shares that may be

sold in any one day. Once we have so instructed the Agent, unless the Agent declines to accept the terms of such notice or until

such notice is terminated or suspended as permitted by the Sales Agreement, the Agent shall use commercially reasonable efforts

consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations

of the Agent under the Sales Agreement are subject to a number of customary conditions that we must meet. The obligation of the

Agent under the Sales Agreement to sell shares pursuant to any notice is subject to a number of conditions, which the Agent reserves

the right to waive in its sole discretion.

The Agent will provide

written confirmation to us no later than the opening of the trading day following the trading day on which the Agent has sold common

shares for us under the Sales Agreement. Each confirmation will include the number of shares sold on that day, the aggregate compensation

payable by us to the Agent in connection with the sale and the net proceeds to us from the sale of the shares.

Settlement for sales

of common shares will occur on the second trading day following the date on which any sales are made or on such earlier day as

is then industry practice for regular-way trading, or on some other date that is agreed upon by us and the Agent in connection

with a particular transaction, in return for payment of the net proceeds to us. Sales of our common shares as contemplated by this

prospectus supplement will be settled through the facilities of The Depositary Trust Company or by such other means as we and the

Agent may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay the Agent

a commission of up to 3.0% of the gross proceeds we receive from the sales of our common shares by the Agent. We have also

agreed to pay various fees and expenses related to this offering, including certain of the Agent’s legal expenses up to $50,000

in the aggregate incurred in connection with entering into the transactions contemplated by the Sales Agreement and up to $2,500

in the aggregate, per calendar quarter, for ongoing diligence arising from the transactions contemplated by the Sales Agreement.

Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount,

commissions and proceeds to us, if any, are not determinable at this time. In connection with the sale of common shares on our

behalf hereunder, the Agent will be deemed to be an “underwriter’” within the meaning of the Securities Act,

and the compensation paid to the Agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to the Agent against specified liabilities, including liabilities under the Securities Act.

The offering of common

shares pursuant to the Sales Agreement will terminate upon the earlier of (i) the sale of all common shares subject to the Sales

Agreement or (ii) the termination of the Sales Agreement by the Agent or us in accordance with the Sales Agreement.

This summary of the

material provisions of the Sales Agreement does not purport to be a complete statement of its terms and conditions. A copy of the

Sales Agreement is filed with the SEC and is incorporated by reference into the registration statement of which this prospectus

is a part. See “Where You Can Find More Information” below.

The Agent and its respective

affiliates may in the future provide various investment banking and other financial services for us and our affiliates, for which

services they may in the future receive customary fees. To the extent required by Regulation M, the Agent will not engage in any

market making or stabilizing activities involving our common shares while the offering is ongoing under this prospectus supplement

and the accompanying prospectus.

LEGAL MATTERS

The validity of the

issuance of the securities offered hereby will be passed upon by Fasken Martineau DuMoulin LLP, on behalf of the Company. Certain

U.S. legal matters will be passed upon for the Company by Davis Graham & Stubbs LLP, Denver, Colorado, and for the Agent by

Duane Morris LLP, New York, New York.

EXPERTS

The

consolidated financial statements of the Company and management’s assessment of the effectiveness of the Company’s

internal control over financial reporting included in the Annual Report on Form 10-K incorporated by

reference in this prospectus supplement have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP,

Chartered Professional Accountants, of Vancouver, British Columbia, Canada (“PwC”), an independent registered public

accounting firm, given on the authority of said firm as experts in auditing and accounting.

PwC are the Company’s

auditors and have advised that they are independent from the Company within the meaning of the Code of Professional Conduct of

Chartered Professional Accountants of British Columbia, Canada, and within the meaning of the U.S. Securities Act and the

applicable rules and regulations thereunder adopted by the SEC. PricewaterhouseCoopers LLP is registered with the Public Company

Accounting Oversight Board (United States).

The mineral resource

estimate and related information of the Company’s Lost Creek Property incorporated by reference herein are based upon analyses

performed or overseen by TREC, Inc. Such estimates and related information have been incorporated by reference herein in reliance

upon the authority of such firm as experts in such matters.

The mineral resource

estimate and related information of the Company’s Shirley Basin Project incorporated by reference herein are based upon analyses

performed by Western Water Consultants, Inc., d/b/a WWC Engineers. Such estimates and related information have been incorporated

by reference herein in reliance upon the authority of such firm as experts in such matters.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the

informational requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the rules and regulations

thereunder, and in accordance therewith, we file periodic reports and proxy statements with the Securities and Exchange Commission,

referred to in this prospectus supplement as the SEC. All reports, proxy statements and the other information that we file with

the SEC may be inspected and copied at the Public Reference Room maintained by the SEC at 100 F Street, N.E., Washington, D.C.

20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. Our SEC filings are also available

to the public from the SEC’s website at www.sec.gov and our website at www.ur-energy.com. Information on our website is not

incorporated by reference in this prospectus supplement.

We have filed with

the SEC a registration statement (of which this prospectus supplement and the accompanying prospectus are a part) on Form S-3 under

the Securities Act with respect to our securities. This prospectus supplement and the accompanying prospectus do not contain all

of the information set forth in the registration statement, including the exhibits and schedules thereto, certain parts of which

are omitted as permitted by the rules and regulations of the SEC.

We also maintain an

Internet website at www.ur-energy.com, which provides additional information about our company and through which you can also access

our SEC filings. Our website and the information contained in and connected to it are not a part of or incorporated by reference

into this prospectus supplement or the accompanying prospectus.

INCORPORATION OF

CERTAIN DOCUMENTS BY REFERENCE

This prospectus supplement

and the accompanying prospectus incorporate by reference information we have filed with the SEC, which means that we can disclose

important information to you be referring you to those documents. The information incorporated by reference is considered to be

part of this prospectus supplement and the accompanying prospectus, and later information that we file with the SEC will automatically

update and supersede this information. We incorporate by reference the documents listed below and all documents that we file with

the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement and prior to

the termination of this offering (other than information in documents that is deemed not to be filed):

|

|

·

|

Our Annual Report on Form 10-K for the

year ended December 31, 2019 filed with the SEC on February 28, 2020;

|

|

|

·

|

The information specifically incorporated by reference into our annual report on Form 10-K for

the year ended December 31, 2019 from our Definitive Proxy Statement on Schedule 14A filed on April 1, 2020;

|

|

|

·

|

Our Quarterly Report on Form 10-Q for

quarter ended March 31, 2020 filed with the SEC on May 8, 2020;

|

|

|

·

|

The description

of common shares contained in our registration statement on Form 40-F filed on January 7, 2008, and as amended

on July 7, 2008, including any amendment or report filed for purposes of updating such description.

|

Any statement in a

document incorporated by reference in this prospectus supplement will be deemed to be modified or superseded to the extent a statement

contained in this prospectus supplement or any other subsequently filed document that is incorporated by reference in this prospectus

supplement modifies or supersedes such statement.

You may obtain, free

of charge, a copy of any of these documents (other than exhibits to these documents unless the exhibits specifically are incorporated

by reference into these documents or referred to in this prospectus supplement) by writing or calling us at the following address

and telephone number:

Ur-Energy Inc.

10758 W. Centennial Road, Suite 200

Littleton, Colorado 80127

Attention: General Counsel

(720) 981-4588

|

|

Filed pursuant to Rule 424(b)(3)

Registration No. 333-238324

|

PROSPECTUS

$100,000,000

Common Shares

Warrants

Units

Rights

Senior Debt Securities

Subordinated Debt Securities

Ur-Energy Inc. (the “Company,”

“we,” “us,” or “our”) may offer and sell from time to time, in one or more offerings, in amounts,

at prices and on terms determined at the time of any such offering, of our common shares, no par value (“Common Shares”),

warrants to purchase Common Shares (the “Warrants”), our senior and subordinated debt securities, rights to purchase

common shares and/or senior or subordinated debt securities, units consisting of two or more of these classes of securities or

any combination thereof up to an aggregate initial offering price of $100,000,000 (all of the foregoing, collectively, the “Securities”).

The prices at which we may sell the Securities will be determined by the prevailing market price for such Securities. We will bear

all expenses of registration incurred in connection with this offering.

We will provide specific

terms of any offering of Securities in one or more supplements to this prospectus. The Securities may be offered separately or

together in any combination and as separate series. You should read this prospectus and any supplement carefully before you invest.

The prospectus supplement may also add, update or change information contained in this prospectus. You should read this prospectus

and the applicable prospectus supplement carefully before you make your investment decision.

We may sell securities

directly to you, through agents we select, or through underwriters or dealers we select. If we use agents, underwriters or dealers

to sell the Securities, we will name them and describe their compensation in a prospectus supplement. The net proceeds we expect

to receive from an offering of Securities will be described in the prospectus supplement.

Our registration of

the Securities covered by this prospectus does not mean that we will offer or sell any of the Securities. We may sell the Securities

covered by this prospectus in a number of different ways and at varying prices. We provide more information about how we may sell

the Securities in the section entitled “Plan of Distribution” beginning on page 18.

Our Common Shares are

traded on the Toronto Stock Exchange (“TSX”) under the symbol “URE” and on the NYSE American (“NYSE

American”) under the symbol “URG.” On May 14, 2020, the last reported sale price of the Common Shares on the

NYSE American was $0.50 per Common Share and on the TSX was Cdn$0.66 per Common Share. Unless otherwise specified in the

applicable prospectus supplement, the Securities other than the Common Shares will not be listed on any securities exchange.

There is currently no

market through which the Securities, other than the Common Shares, may be sold and you may not be able to resell such Securities

purchased under this prospectus and any applicable prospectus supplement. This may affect the pricing of such Securities in the

secondary market, the transparency and availability of trading prices, the liquidity of the securities, and the extent of issuer

regulation.

INVESTING IN OUR

SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ THE “RISK FACTORS” SECTION BEGINNING ON

PAGE 8 OF THIS PROSPECTUS.

Neither the U.S. Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May

27, 2020.

TABLE OF CONTENTS

In this prospectus and in any prospectus supplement,

unless the context otherwise requires, references to “Ur-Energy,” the “Company,” “we,” “us”

and “our” refer to Ur-Energy Inc., either alone or together with our subsidiaries as the context requires. When we

refer to “shares” throughout this prospectus, we include all rights attaching to our Common Shares under any shareholder

rights plan then in effect.

ABOUT THIS PROSPECTUS

This prospectus is part

of a registration statement that we filed with the Securities and Exchange Commission, which we refer to as the “SEC”

or the “Commission,” using a “shelf” registration process. Under the shelf registration, we may sell any

combination of the securities described in this prospectus in one or more offerings. This prospectus provides you with a general

description of the securities that we may offer. Each time that we sell securities, we will provide a prospectus supplement that

will contain specific information about the terms of that offering. The prospectus supplement also may add, update or change information

contained in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information

incorporated by reference in this prospectus before making an investment in our securities. See “Where You Can Find More

Information” for more information. We may use this prospectus to sell securities only if it is accompanied by a prospectus

supplement.

You should not assume that

the information in this prospectus, any accompanying prospectus supplement or any document incorporated by reference is accurate

as of any date other than the date of such document.

WHERE YOU CAN FIND MORE INFORMATION

We

are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and the rules and regulations thereunder and, in accordance therewith, we file periodic reports and proxy statements with the SEC.

All reports, proxy statements and the other information that we file with the SEC may be inspected and copied at the Public Reference

Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further

information on the Public Reference Room. Our SEC filings are also available to the public from the SEC's website at www.sec.gov

and our website at www.ur-energy.com.

INCORPORATION OF CERTAIN INFORMATION BY

REFERENCE

The SEC allows us to “incorporate

by reference” information into this prospectus and any accompanying prospectus supplement, which means that we can disclose

important information to you by referring you to other documents filed separately with the SEC. The information incorporated by

reference is considered part of this prospectus, and information filed with the SEC subsequent to this prospectus and prior to

the termination of the particular offering referred to in such prospectus supplement will automatically be deemed to update and

supersede this information. We incorporate by reference into this prospectus and any accompanying prospectus supplement the documents

listed below (excluding any portions of such documents that have been “furnished” but not “filed” for purposes

of the Exchange Act):

|

|

(a)

|

Our Annual Report on Form 10-K for the fiscal year ended December

31, 2019 filed with the SEC on February 28, 2020;

|

|

|

(b)

|

Our Quarterly Report on Form 10-Q for the quarterly period ended

March 31, 2020 filed with the SEC on May 8, 2020;

|

|

|

(c)

|

Our Current Reports on Form 8-K as filed with the SEC on April 20, 2020, April 27, 2020 and May 11, 2020; all to the extent “filed” and not “furnished” pursuant to Section

13(a) of the Exchange Act;

|

|

|

(d)

|

The description of common shares contained in our registration statement on Form 40-F filed on January 7, 2008, and as amended on July 7, 2008, including any amendment or report filed for purposes of updating such description; and

|

|

|

(e)

|

All other documents filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this prospectus but before the end of the offering of the Common Shares made by this prospectus.

|

We also incorporate by

reference all documents we subsequently file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after

the initial filing of the registration statement of which this prospectus is a part (including prior to the effectiveness of the

registration statement) and prior to the termination of the offering. Any statement in a document incorporated by reference in

this prospectus will be deemed to be modified or superseded to the extent a statement contained in this prospectus or any other

subsequently filed document that is incorporated by reference in this prospectus modifies or supersedes such statement.

Unless specifically stated

to the contrary, none of the information that we disclose under Items 2.02 or 7.01 or corresponding information furnished under

Item 9.01 or included as an exhibit of any Current Report on Form 8-K that we may from time to time furnish to the SEC will be

incorporated by reference into, or otherwise included in, this prospectus.

We will provide without

charge upon written or oral request, a copy of any or all of the documents which are incorporated by reference into this prospectus.

Requests should be directed to:

Ur-Energy Inc.

Attention: Corporate Secretary

10758 W. Centennial Road, Suite 200

Littleton, CO 80127

(720) 981-4588

Except as provided above,

no other information, including information on our website, is incorporated by reference in this prospectus.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING

DISCLOSURE OF MINERAL RESOURCES

Unless otherwise indicated,

all resource estimates, included or incorporated by reference in this prospectus and any prospectus supplement have been, and will

be, prepared in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI

43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral

Reserves (“CIM Definition Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which

establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

NI 43-101 permits the disclosure of an historical estimate made prior to the adoption of NI 43-101 that does not comply with NI

43-101 to be disclosed using the historical terminology if the disclosure: (a) identifies the source and date of the historical

estimate; (b) comments on the relevance and reliability of the historical estimate; (c) to the extent known, provides the key assumptions,

parameters and methods used to prepare the historical estimate; (d) states whether the historical estimate uses categories other

than those prescribed by NI 43-101; and (e) includes any more recent estimates or data available.

Canadian standards, including

NI 43-101, differ significantly from the requirements of the SEC, and resource information contained or incorporated by reference

in this prospectus and any prospectus supplement may not be comparable to similar information disclosed by U.S. companies. In particular,

the term “resource” does not equate to the term “‘reserves.” Under SEC Industry Guide 7, mineralization

may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically

and legally produced or extracted at the time the reserve determination is made. SEC Industry Guide 7 does not define and the SEC’s

disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources,” “indicated

mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral

deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should

also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great

uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral

resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources”

may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that

all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained

ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers

to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without

reference to unit measures. Accordingly, information concerning mineral deposits set forth herein may not be comparable to information

made public by companies that report in accordance with U.S. standards.

EXCHANGE RATE INFORMATION

Unless stated otherwise

or as the context otherwise requires, all references to dollar amounts in this prospectus and any prospectus supplement are references

to United States dollars. References to “$” or “US$” are to United States dollars and references to “Cdn$”

are to Canadian dollars.

The following tables

set forth (i) the rate of exchange for one U.S. dollar, expressed in Canadian dollars, in effect at the end of the periods

indicated; (ii) the average exchange rates for one U.S. dollar, on the last day of each month during such periods; and (iii)

the high and low exchange rates for one U.S. dollar, expressed in Canadian dollars, during such periods, each based on the

rate of exchange as reported by the Bank of Canada.

|

|

|

Year

Ended December 31

|

|

|

Canadian dollar

|

|

2015

|

|

|

2016

|

|

|

2017

|

|

|

2018

|

|

|

2019

|

|

|

End of period

|

|

$

|

1.3840

|

|

$

|

|

1.3427

|

|

$

|

|

1.2545

|

|

|

$

|

1.3642

|

|

|

$

|

1.2988

|

|

|

Average for the period

|

|

$

|

1.2781

|

|

$

|

|

1.3256

|

|

$

|

|

1.2986

|

|

|

$

|

1.2957

|

|

|

$

|

1.3269

|

|

|

|

|

January

|

|

|

February

|

|

|

March

|

|

|

April

|

|

|

|

|

Canadian dollar

|

|

2020

|

|

|

2020

|

|

|

2020

|

|

|

2020

|

|

|

|

|

High for the month

|

|

$

|

1.3233

|

|

|

$

|

1.3429

|

|

|

$

|

1.4496

|

|

|

$

|

1.4217

|

|

|

|

|

Low for the month

|

|

$

|

1.2970

|

|

|

$

|

1.3224

|

|

|

$

|

1.3356

|

|

|

$

|

1.3904

|

|

|

|

The rate quoted by

the Bank of Canada for the conversion of United States dollars into Canadian dollars on May 14, 2020 is Cdn$1.4090 = US$1.00.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, and

the documents incorporated by reference herein, contain forward-looking statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act, and forward-looking information and forward-looking statements within the meaning of

applicable Canadian securities laws, with respect to our financial condition, results of operations, business prospects, plans,

objectives, goals, strategies, future events, capital expenditures, and exploration and development efforts. These forward-looking

statements can be identified by the use of words such as “expect,” “anticipate,” “estimate,”

“believe,” “may,” “potential,” “intends,” “plans” and other similar

expressions or statements that an action, event or result “may,” “could” or “should” be taken,

occur or be achieved, or the negative thereof or other similar statements, however the absence of such words does not mean that

a statement is not forward-looking. These statements are only predictions and involve known and unknown risks, uncertainties and

other factors which may cause our actual results, performance or achievements, or industry results, to be materially different

from any future results, performance, or achievements expressed or implied by these forward-looking statements. Such statements

include, but are not limited to: (i) the ability to maintain controlled-level operations at Lost Creek, the timing to determine

future development and construction priorities, and the ability to readily and cost-effectively ramp-up production operations

when market and other conditions warrant; (ii) the continuing technical and economic viability of Lost Creek; (iii) the timing

and outcome of permitting and regulatory approvals of the amendments to the Lost Creek permits and licenses; (iv) the ability

to complete additional favorable uranium sales agreements including spot sales when warranted and production inventory is available;

(v) the production rates and life of the Lost Creek Project and subsequent development of and production from adjoining projects

within the Lost Creek Property, including plans at LC East; (vi) the potential of exploration targets throughout the Lost Creek

Property (including the ability to expand resources); (vii) the potential of our other exploration and development projects, including

Shirley Basin, the projects in the Great Divide Basin and the Excel project (viii) the technical and economic viability of

Shirley Basin; (ix) the timing and outcome of applications for regulatory approval to build and operate an in situ recovery mine

at Shirley Basin; (x) the outcome of our production projections; (xi) current market conditions including without limitation

supply and demand projections; and (xii) the outcome of the report and recommendations from the U.S. Nuclear Fuel Working Group,

including the timeline and scope of proposed remedies, including the budget appropriations process related to the establishment

of the national uranium reserve.

Although we believe that

our plans, intentions and expectations reflected in these forward-looking statements are reasonable, we cannot be certain that

these plans, intentions or expectations will be achieved. Actual results, performance or achievements could differ materially from

those contemplated, expressed or implied by the forward-looking statements contained in this prospectus.

Forward-looking statements

are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results

to differ from those expressed or implied by the forward-looking statements, including, without limitation, risks related to:

|

|

·

|

significant

increases or decreases in uranium prices;

|

|

|

·

|

future

estimates for production, development and production operations, capital expenditures,

operating costs, mineral resources, recovery rates, grades and market prices;

|

|

|

·

|

business

strategies and measures to implement such strategies;

|

|

|

·

|

estimates

of goals for expansion and growth of the business and operations;

|

|

|

·

|

plans

and references to our future successes;

|

|

|

·

|

our

history of operating losses and uncertainty of future profitability;

|

|

|

·

|

status

as an exploration stage company;

|

|

|

·

|

the

lack of mineral reserves;

|

|

|

·

|

risks

associated with obtaining permits and other authorizations in the U.S.;

|

|

|

·

|

risks

associated with current variable economic conditions;

|

|

|

·

|

challenges

presented by current inventories and largely unrestricted imports of uranium products

into the U.S.;

|

|

|

·

|

our

ability to service our debt and maintain compliance with all restrictive covenants related

to the debt facility and security documents;

|

|

|

·

|

the

possible impact of future financings;

|

|

|

·

|

the

hazards associated with mining production;

|

|

|

·

|

compliance

with environmental laws and regulations;

|

|

|

·

|

uncertainty

regarding the pricing and collection of accounts;

|

|

|

·

|

the

possibility for adverse results in potential litigation;

|

|

|

·

|

uncertainties

associated with changes in government policy and regulation;

|

|

|

·

|

uncertainties

associated with a Canada Revenue Agency or U.S. Internal Revenue Service audit of any

of our cross border transactions;

|

|

|

·

|

adverse

changes in general business conditions in any of the countries in which we do business;

|

|

|

·

|

changes

in size and structure;

|

|

|

·

|

the

effectiveness of management and our strategic relationships;

|

|

|

·

|

ability

to attract and retain key personnel;

|

|

|

·

|

uncertainties

regarding the need for additional capital;

|

|

|

·

|

sufficiency

of insurance coverage;

|

|

|

·

|

uncertainty

regarding the fluctuations of quarterly results;

|

|

|

·

|

foreign

currency exchange risks;

|

|

|

·

|

ability

to enforce civil liabilities under U.S. securities laws outside the United States;

|

|

|

·

|

ability

to maintain our listing on the NYSE American and TSX;

|

|

|

·

|

risks

associated with the expected classification as a “passive foreign investment company”

under the applicable provisions of the U.S. Internal Revenue Code of 1986, as amended;

|

|

|

·

|

risks

associated with our investments;

|

|

|

·

|

risk

factors described or referenced in this prospectus; and

|

|

|

·

|

other factors, many of which are beyond our control.

|

This list is not exhaustive

of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect

forward-looking statements are described further under the section headings “Our Business” and “Risk

Factors” in this prospectus and any additional risks or uncertainties described in any prospectus supplements. Although

we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking

statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of

these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially

from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking

statements, which speak only as of the date made. Except as required by law, we disclaim any obligation subsequently to revise

any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence

of anticipated or unanticipated events. We qualify all of the forward-looking statements contained or incorporated by reference

in this prospectus by the foregoing cautionary statements.

OUR BUSINESS

Incorporated on

March 22, 2004, Ur-Energy is an exploration stage mining company, as that term is defined in the SEC Industry Guide 7. We are

engaged in uranium mining, recovery and processing activities, including the acquisition, exploration, development and operation

of uranium mineral properties in the U.S. Through our Wyoming operating subsidiary, Lost Creek ISR, LLC, we began operating our

first in situ recovery uranium mine at our Lost Creek project in 2013. Ur-Energy is a corporation continued under the Canada

Business Corporations Act on August 8, 2006. Our Common Shares are listed on the Toronto Stock Exchange (the “TSX”)

under the symbol “URE” and on the NYSE American LLC (the “NYSE American”) under the symbol “URG.”

Ur-Energy has one

direct wholly-owned subsidiary: Ur-Energy USA Inc., incorporated under the laws of the State of Colorado. It has offices in Colorado

and Wyoming and has employees in both states, in addition to having one employee based in Arizona.

Ur-Energy USA has

three wholly-owned subsidiaries: NFU Wyoming, LLC, a limited liability company formed under the laws of the State of Wyoming to

facilitate acquisition of certain property and assets and, currently, to act as our land holding and exploration entity; Lost

Creek ISR, LLC, a limited liability company formed under the laws of the State of Wyoming to hold and operate our Lost Creek project

and certain other of our Lost Creek properties and assets; and Pathfinder Mines Corporation (“Pathfinder”), incorporated

under the laws of the State of Delaware, which holds, among other assets, the Shirley Basin and Lucky Mc properties in Wyoming.

Lost Creek ISR, LLC employs personnel at the Lost Creek Project.

We utilize in situ recovery

(“ISR”) of the uranium at our flagship project, Lost Creek, and will do so at other projects where possible. The ISR

technique is employed in uranium extraction because it allows for an effective recovery of roll front uranium mineralization at

a lower cost. At Lost Creek, we extract and process U3O8, for shipping to a third-party conversion facility

for further processing, storage and sales.

Our Lost Creek processing

facility, which includes all circuits for the production, drying and packaging of uranium for delivery into sales, is designed

and anticipated to process up to one million pounds of U3O8 annually from the Lost Creek mine. The

processing facility has the physical design capacity to process two million pounds of U3O8 annually,

which provides additional capacity to process material from other sources. We expect that the Lost Creek processing facility may

be utilized to process captured U3O8 from our Shirley Basin Project. However, the Shirley

Basin permit application contemplates the construction of a full processing facility, providing greater construction and operating

flexibility as may be dictated by market conditions.

In this prospectus

and in any prospectus supplement, unless the context otherwise requires, references to “Ur-Energy,” the “Company,”

“we,” “us” and “our” refer to Ur-Energy Inc., either alone or together with our subsidiaries

as the context requires.

Our corporate office

is located at 10758 W. Centennial Road, Suite 200, Littleton, CO 80127 and our telephone number is (720) 981-4588. Our website

address is www.ur-energy.com. The information on our website is not part of this prospectus.

RISK FACTORS

The following sets forth

certain risks and uncertainties that could have a material adverse effect on our business, financial condition and/or results of

operations and the trading price of our Common Shares, which may decline, and investors may lose all or part of their investment.