Current Report Filing (8-k)

April 06 2023 - 8:01AM

Edgar (US Regulatory)

0000061398

false

0000061398

2023-04-04

2023-04-04

0000061398

us-gaap:CommonStockMember

2023-04-04

2023-04-04

0000061398

tell:SeniorNotes8.25PercentDue2028Member

2023-04-04

2023-04-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

April 4, 2023 |

|

Tellurian

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-5507 |

|

06-0842255 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 1201

Louisiana Street, Suite

3100, Houston,

TX |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| Registrant’s telephone number, including

area code: |

(832)

962-4000 |

|

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

TELL |

|

NYSE

American LLC |

| |

|

|

|

|

| 8.25%

Senior Notes due 2028 |

|

TELZ |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On April 4, 2023, Tellurian

Inc. (the “Company”) entered into a binding letter of intent (the “LOI”) with a New York-based institutional

investor with approximately $120 billion in assets under management (the “Investor”) regarding the sale and leaseback

of approximately 800 acres of land (the “Property”) owned and/or leased by Driftwood LNG LLC, a wholly owned subsidiary

of the Company or an affiliate (“Driftwood LNG”), to be used for the proposed Driftwood liquefied natural gas terminal

facility (the “Driftwood terminal”) in Lake Charles, Louisiana.

Pursuant to the LOI, the transaction

(the “Transaction”) will consist of (i) the sale by Driftwood LNG, and purchase by a special purpose entity to

be formed by the Investor (the “Purchaser”), of Driftwood LNG’s interests in the Property for $1.0 billion

pursuant to a purchase and sale agreement (the “Purchase Agreement”) and (ii) upon (and as a condition to) the

closing of the transactions contemplated by the Purchase Agreement, a 40-year lease of the Property from the Purchaser to Driftwood LNG

pursuant to a master lease (the “Master Lease”). Terms of the Master Lease will include, among others, (i) a capitalization

rate of 8.75%, (ii) annual rent escalators of 3.00%, (iii) a requirement that Driftwood LNG post a letter of credit equal to

12 months of rent, (iv) a requirement that the equity investors in Driftwood LNG or its affiliates be joint and several contingent

guarantors of the Master Lease (the “Contingent Guarantors”) and (v) a requirement that the Contingent Guarantors

hold an investment grade rating of BBB or higher or attain an equivalent shadow credit rating, or be otherwise acceptable to the Purchaser.

The LOI contemplates that the parties will use commercially reasonable efforts to finalize the Purchase Agreement and Master Lease on

or before July 14, 2023. The LOI will terminate on July 14, 2023 if Driftwood LNG fails to identify the Contingent Guarantors by

such date and will terminate on July 31, 2023 if the Purchaser elects, in its sole discretion, not to approve such Contingent Guarantors.

The LOI is binding on the parties but is subject to the negotiation of definitive transaction documents and the approval of those documents

by the Company’s board of directors.

The closing of the Transaction

will occur on the later of (i) 91 days after the Purchase Agreement is executed by the parties thereto and (ii) the satisfaction of the closing

conditions in the Purchase Agreement, including Driftwood LNG securing financing commitments for Phase 1 of the Driftwood project on

terms satisfactory to the Purchaser.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TELLURIAN INC. |

| |

|

|

| |

|

|

Date: April 6, 2023 |

By: |

/s/

Daniel A. Belhumeur |

| |

Name: |

Daniel A. Belhumeur |

| |

Title: |

Executive Vice President and General Counsel |

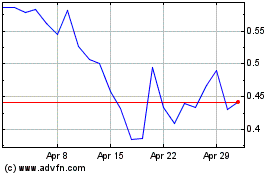

Tellurian (AMEX:TELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

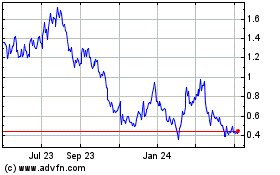

Tellurian (AMEX:TELL)

Historical Stock Chart

From Apr 2023 to Apr 2024