Tellurian Inc. (Tellurian or the Company) (NYSE American: TELL)

ended the third quarter with a 25% increase in net natural gas

production and a 32% increase in natural gas sales, as compared to

the second quarter of 2022.

President and CEO Octávio Simões said, “Tellurian continues to

increase our domestic natural gas production by adding to our

footprint, having now a total of 22,420 net acres, interests in 131

producing wells located in the Haynesville Shale, and more than 300

drillable locations*. In addition, Bechtel is continuing

construction on the Driftwood terminal, and Tellurian is fully

engaged in our efforts to secure strategic equity partners. The

underlying market fundamentals strongly support our strategy of

seeking the differential value between domestic and international

natural gas prices for our shareholders.”

Upstream segment results

Three Months Ended September

30, 2022

Three Months Ended September

30, 2021

Net production

11.4 Bcf**

3.9 Bcf

Revenue

$81.1 million

$15.6 million

Operating profit

$40.1 million

$3.5 million

Adjusted EBITDA***

$69.5 million

$10.9 million

*

Inventory of reserve locations as of

September 1, 2022 (using August 31, 2022 NYMEX strip pricing and as

prepared by Netherland, Sewell & Associates in accordance with

the definitions and guidelines set forth in the 2018 Petroleum

Resources Management System (PRMS).

**

Billion cubic feet of natural gas

***

Non-GAAP measure – see the end of this

press release for a definition and a reconciliation to the most

comparable GAAP measure.

Consolidated financial results

Tellurian reported a net loss of approximately $14.2 million, or

$0.03 per share (basic and diluted), for the three months ended

September 30, 2022, compared to a net loss of $15.9 million, or

$0.04 per share (basic and diluted), in the third quarter of

2021.

Tellurian ended the third quarter of 2022 with approximately

$1.4 billion in total assets, including approximately $607.5

million of cash and cash equivalents.

About Tellurian Inc.

Tellurian intends to create value for shareholders by building a

low-cost, global natural gas business, profitably delivering

natural gas to customers worldwide. Tellurian is developing a

portfolio of natural gas production, LNG marketing and trading, and

infrastructure that includes an ~ 27.6 mtpa LNG export facility and

an associated pipeline. Tellurian is based in Houston, Texas, and

its common stock is listed on the NYSE American under the symbol

“TELL”.

For more information, please visit www.tellurianinc.com. Follow

us on Twitter at twitter.com/TellurianLNG

Tellurian will post a video by Executive Chairman Charif Souki

on its website at www.tellurianinc.com/news-and-presentations at 10

am Central on November 2, 2022.

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING

STATEMENTS

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws. The words

“anticipate,” “assume,” “believe,” “budget,” “estimate,” “expect,”

“forecast,” “initial,” “intend,” “may,” “plan,” “potential,”

“project,” “proposed,” “should,” “will,” “would,” and similar

expressions are intended to identify forward-looking statements.

Forward-looking statements herein relate to, among other things,

the capacity, timing, and other aspects of the Driftwood LNG

project, drilling locations, the benefits of Tellurian’s business

model, and construction and financing activities. These statements

involve a number of known and unknown risks, which may cause actual

results to differ materially from expectations expressed or implied

in the forward-looking statements. These risks include the matters

discussed in Item 1A of Part I of the Annual Report on Form 10-K of

Tellurian for the fiscal year ended December 31, 2021, filed by

Tellurian with the Securities and Exchange Commission (the SEC) on

February 23, 2022, and other Tellurian filings with the SEC, all of

which are incorporated by reference herein. The forward-looking

statements in this press release speak as of the date of this

release. Although Tellurian may from time to time voluntarily

update its prior forward-looking statements, it disclaims any

commitment to do so except as required by securities laws.

Explanation and Reconciliation of Non-GAAP

Financial Measures

The Company reports its financial results in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”). However, management believes that upstream

segment Adjusted EBITDA may provide financial statement users with

additional meaningful comparisons between current results, the

results of the Company’s peers and of prior periods.

Upstream segment Adjusted EBITDA excludes certain charges or

expenditures. Upstream segment Adjusted EBITDA is a supplemental

measure of performance and should not be viewed as a substitute for

any GAAP measure.

Management presents Upstream segment Adjusted EBITDA because (i)

it is consistent with the manner in which the Company’s position

and performance are measured relative to the position and

performance of its peers and (ii) it is more comparable to earnings

estimates provided by securities analysts.

(In thousands, unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

Upstream segment Adjusted

EBITDA:

Upstream segment operating profit

(loss)

Add back:

$

40,071

$

3,491

$

83,170

$

(4,542

)

Depreciation, depletion and

amortization

12,762

3,635

22,441

8,419

Allocated corporate general and

administrative

16,709

3,766

31,155

10,925

Upstream segment Adjusted

EBITDA

$

69,542

$

10,892

$

136,766

$

14,802

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221101006229/en/

Media: Joi Lecznar EVP Public and Government Affairs

Phone +1.832.962.4044 joi.lecznar@tellurianinc.com

Investors: Matt Phillips Vice President, Investor

Relations Phone +1.832.320.9331

matthew.phillips@tellurianinc.com

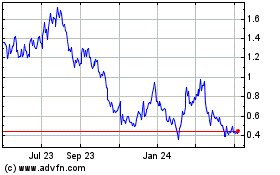

Tellurian (AMEX:TELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

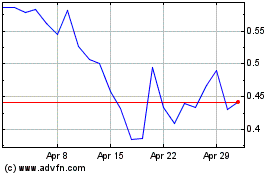

Tellurian (AMEX:TELL)

Historical Stock Chart

From Apr 2023 to Apr 2024