Current Report Filing (8-k)

September 12 2022 - 4:12PM

Edgar (US Regulatory)

0000061398

false

0000061398

2022-09-12

2022-09-12

0000061398

us-gaap:CommonStockMember

2022-09-12

2022-09-12

0000061398

tell:SeniorNotes8.25PercentDue2028Member

2022-09-12

2022-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

September 12, 2022 |

|

Tellurian

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-5507 |

|

06-0842255 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 1201

Louisiana Street, Suite

3100, Houston,

TX |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| Registrant’s telephone number, including

area code: |

(832)

962-4000 |

|

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

TELL |

|

NYSE

American LLC |

| |

|

|

|

|

| 8.25%

Senior Notes due 2028 |

|

TELZ |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On August 29, 2022, Tellurian

Inc. (“Tellurian” or the “Company”) filed with the Securities and Exchange Commission a preliminary

prospectus supplement to the prospectus dated April 28, 2020 included in the Company’s registration statement on Form S-3ASR

(File No. 333-235793) relating to an offering (the “offering”) of units, with each unit consisting of $1,000 principal

amount of 11.25% Senior Secured Notes due 2027 (the “notes”) and 75 warrants, each of which entitles the holder thereof

to purchase one share of common stock, $0.01 par value per share, of the Company, subject to certain adjustments. Following discussions

with potential investors, the Company is proposing to adjust the terms of the offering as described below. The terms of the offering are

subject to further change, and there can be no assurance that the offering will be completed on the contemplated terms or at all.

| · | Security/Collateral: The Company’s obligations under the notes will be secured by a pledge

of the equity interests in the Company’s indirect wholly owned subsidiaries Tellurian Production Holdings LLC, which owns, directly

or indirectly, all of the Company’s upstream oil and gas assets (“Tellurian Production Holdings”), and Driftwood

LNG Holdings LLC, which owns, directly or indirectly, the assets relating to the Company’s Driftwood Project (“Driftwood

Holdings”). Previously, the terms of the offering had provided that the Company’s obligations under the notes would be

secured by a pledge of the equity interests in Driftwood Holdings only. |

As a new term of the offering, there will

be a negative pledge on the assets of Tellurian Production Holdings and its subsidiaries as well as on the capital stock of Tellurian

Production Holdings’ subsidiaries.

| · | Additional Covenant: So long as any notes are outstanding, the Company will not issue any common

stock, or securities convertible or exchangeable into common stock, of the Company as part of a Qualified Driftwood Financing (as described

below), provided that the Company may issue such securities in transactions separate from any Qualified Driftwood Financing. |

| · | Interest Reserve: As a new term of the offering, the Company will establish an interest reserve

equal to one year (12 months) of interest payments on the notes. This interest reserve may be used to make the first two semi-annual interest

payments on the notes. |

| · | Additional Change of Control Triggering Event: Separate and apart from any change of control with

respect to the Company, if there is a change of control at the Driftwood Project level (which does not need to be accompanied by any rating

decline), each holder of the notes may require the Company to repurchase all or a portion of its notes for cash at a price equal to 101%

of the aggregate principal amount of such notes, plus any accrued and unpaid interest, to the date of repurchase. |

| · | Use of Proceeds: The Company intends to use a portion of the net proceeds from the offering to

establish the interest reserve referenced above, with remaining proceeds to be contributed to the Driftwood Project entities to support

the construction of the Driftwood Project. Previously, the proposed use of proceeds did not include the establishment of an interest reserve. |

| · | Matching of Terms: As a new term of the offering, if at any time any Qualified Driftwood Financing

(to be defined as debt for borrowed money of Driftwood Holdings or any of its subsidiaries or disqualified stock of Driftwood Holdings

or any of its subsidiaries with mandatory redemptions or similar features, in a manner to be further agreed) is consummated with an all-in

yield (or preferred return) that exceeds an agreed-upon threshold rate, then the Company will pay additional cash interest on the notes

in an amount equal to the difference of the all-in yield of such Qualified Driftwood Financing in excess of such threshold rate. |

In addition, the Company is

discussing with the holder of all of the Company’s existing 6.00% Senior Secured Convertible Notes due 2025 (the “Convertible

Notes”) and expects to enter into certain changes to the terms of the indenture governing the Convertible Notes in order to

facilitate the offering. Such changes would include the following:

| · | Release of Collateral: The Convertible Notes will no longer be secured by a pledge of the equity

interests in Tellurian Production Holdings and will be senior unsecured obligations of the Company. |

| · | Partial Redemption: Concurrent with the closing of the offering, the Company would redeem 50% of

the outstanding principal amount of the Convertible Notes, together with a 20% redemption premium, for an aggregate payment of $300.0 million,

a portion of which may be paid in shares of Tellurian common stock. |

| · | Adjustment of Conversion Price: The conversion price of the Convertible Notes would be adjusted

to an amount to be determined based on a premium to the trading price of Tellurian common stock, not to exceed $5.00 per share. |

| · | Adjustment of Redemption Right: The right of the holder of the Convertible Notes to cause the Company

to redeem the Convertible Notes on each of May 1, 2023 and May 1, 2024 would be adjusted such that the amount of the redemption

on each such date would be changed from 33% of the original face value of the Convertible Notes to 50% of the outstanding principal amount

after the partial redemption described above, and the redemption price of any such redemptions would be increased from the principal amount

of the redeemed Convertible Notes to 120% of such amount. |

| · | No Forced Conversion: The provision of the indenture governing the Convertible Notes providing

for an automatic conversion of the Convertible Notes if the trading price of Tellurian common stock closes above 200% of the conversion

price of the Convertible Notes for 20 consecutive trading days and certain other conditions are satisfied would be removed. |

| · | Payment at Maturity: The payment to be made by the Company at the maturity of the Convertible Notes

will be increased from the then-outstanding principal amount to 120% of such amount. |

| · | Covenants: Certain amendments to the restrictive covenants contained in the indenture governing

the Convertible Notes may be included. |

The foregoing terms are still

under consideration by the parties. The final amendments to the Convertible Notes, if any, may differ from those described

above.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TELLURIAN INC. |

| |

|

|

| |

|

|

| Date: September 12, 2022 |

By: |

/s/ L. Kian Granmayeh |

| |

Name:

Title: |

L. Kian Granmayeh

Executive Vice President and

Chief Financial Officer |

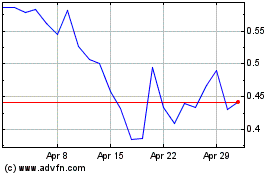

Tellurian (AMEX:TELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

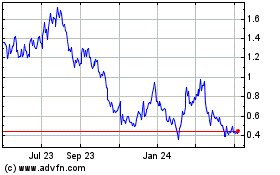

Tellurian (AMEX:TELL)

Historical Stock Chart

From Apr 2023 to Apr 2024