Tanzanian Gold Corporation (TSX:TNX)(NYSE MKT:TRX) (the "Company")

announces the voting results from its 2021 annual general and

special meeting held on February 25, 2021.

A total of 61,239,388 common shares were voted

representing 29.28% of the issued and outstanding common shares of

the Company. Shareholders voted in favour of all items of business

before the Meeting, as follows:

|

Item Voted Upon |

Result of Vote |

|

Set the number of directors at six |

Votes For |

Votes Against |

|

48,671,309 (97.21%) |

1,395,199 (2.79%) |

|

Appoint James E. Sinclair as director |

Votes For |

Votes Withheld |

|

48,827,174 (97.53%) |

1,239,334 (2.47%) |

|

Appoint Norman Betts as director |

Votes For |

Votes Withheld |

|

50,042,466 (99.95%) |

24,042 (0.05%) |

|

Appoint William Harvey as director |

Votes For |

Votes Withheld |

|

49,959,718 (99.79%) |

106,970 (0.21%) |

|

Appoint Rosalind Morrow as director |

Votes For |

Votes Withheld |

|

50,053,073 (99.97%) |

13,435 (0.03%) |

|

Appoint Andrew Cheatle as director |

Votes For |

Votes Withheld |

|

48,788,524 (97.45%) |

1,277,984 (2.55%) |

|

Appoint Stephen Mullowney as director |

Votes For |

Votes Withheld |

|

48,778,524 (97.43%) |

1,287,984 (2.57%) |

|

Appointment of Dale Matheson Carr-Hilton Labonte LLP, Chartered

Professional Accountants, as auditors and authorize the directors

to fix the remuneration of the auditors. |

Votes For |

Votes Withheld |

|

60,889,068 (99.80%) |

121,306 (0.20%) |

|

Approval of Shareholder Rights Plan |

Votes For |

Votes Against |

|

48,781,324 (97.43%) |

1,285,184 (2.57%) |

Adoption of Shareholder Rights

Plan

The Shareholder Rights Plan (the

“Plan”) will ensure the fair and equal treatment

of shareholders in connection with any takeover bid for common

shares of the Company (the “Common Shares”). The

Plan is similar to rights plans adopted by other companies and has

not been adopted in response to any pending or threatened takeover

bid for the Company nor is the Company aware of any such effort.

The primary objective of the Plan is to provide shareholders with

adequate time to properly assess a takeover bid without undue

pressure. It will also provide the Company’s board of directors

(the “Board”) with more time to fully consider an

unsolicited takeover bid and, if considered appropriate, to

identify, develop and negotiate other alternative to maximize

shareholder value.

The rights issued under the Plan will become

exercisable only when a person (an “Acquiring

Person”), including any party related to it, acquires or

announces its intention to acquire beneficial ownership of Common

Shares, which when aggregated with its current holdings total 20%

or more of the outstanding Common Shares without complying with the

"Permitted Bid" provisions of the Plan or without approval of the

Board. In the event a takeover bid does not meet the Permitted Bid

requirements of the Plan, the rights will entitle shareholders,

other than the Acquiring Person, to purchase additional Common

Shares at a substantial discount to the market price of the Common

Shares at that time.

Under the Plan, those bids that meet certain

requirements intended to protect the interests of all shareholders

are deemed to be "Permitted Bids”. Permitted Bids must be made by

way of a takeover bid circular prepared in compliance with

applicable securities laws and, among other conditions, must remain

open for at least 105 days.

The Plan must be reconfirmed at the Company’s

annual meeting of shareholders to be held in 2024 and every third

annual meeting thereafter or it will expire. The Plan may also be

terminated at an earlier time in accordance with the terms of the

Plan.

About Tanzanian Gold Corporation

Tanzanian Gold Corporation along with its joint

venture partner, STAMICO is building a significant gold project at

Buckreef in Tanzania that is based on an expanded Mineral Resource

base and the treatment of its mineable Mineral Reserves in two

standalone plants. Measured Mineral Resource now stands at 19.98MT

at 1.99g/t gold containing 1,281,161 ounces of gold and Indicated

Mineral Resource now stand at 15.89MT at 1.48g/t gold containing

755,119 ounces of gold for a combined tonnage of 35.88MT at 1.77g/t

gold containing 2,036,280 ounces of gold. The Buckreef Project also

contains an Inferred Mineral Resource of 17.8MT at 1.11g/t gold for

contained gold of 635,540 ounces of gold. The Company is actively

investigating and assessing multiple exploration targets on its

property. Please refer to the Company’s Updated Mineral Resources

Estimate for Buckreef Gold Project, dated May 15, 2020, for more

information.

Tanzanian Gold Corporation is advancing on three

value-creation tracks:

- Strengthening its balance sheet by

expanding near-term production to 15,000 - 20,000 oz. of gold per

year from the processing of oxide material from an expanded oxide

plant.

- Advancing the Final Feasibility

Study for a stand-alone sulphide treating plant that is

substantially larger than previously modelled and targeting

significant annual gold production.

- Continuing with a drilling program

to further test the potential of its property, Exploration Targets

and Mineral Resource base by: (i) identifying new prospects; (ii)

drilling new oxide/sulphide targets; (iii) infill drilling to

upgrade Mineral Resources currently in the Inferred category; and

(iv) a step-out drilling program in the Northeast Extension.

For further information, please contact Michael Martin, Investor

Relations, m.martin@tangoldcorp.com, 860-248-0999, or visit the

Company website at www.tangoldcorp.com

The Toronto Stock Exchange and NYSE American

have not reviewed and do not accept responsibility for the adequacy

or accuracy of this release.

U.S. Investors are urged to consider closely the

disclosure in our SEC filings. You can review and obtain copies of

these filings from the SEC's website at

http://www.sec.gov/edgar.shtml

Forward-Looking StatementsThis

press release contains certain forward-looking statements as

defined in the applicable securities laws. All statements, other

than statements of historical facts, are forward-looking

statements. Forward-looking statements are frequently, but not

always, identified by words such as “expects”, “anticipates”,

“believes”, “hopes”, “intends”, “estimated”, “potential”,

“possible” and similar expressions, or statements that events,

conditions or results “will”, “may”, “could” or “should” occur or

be achieved. Forward-looking statements relate to future events or

future performance and reflect Tanzanian Gold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to the estimation of

mineral reserves and resources, recoveries, subsequent project

testing, success and viability of mining operations, the timing and

amount of estimated future production, and capital expenditure.

Although TanGold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TanGold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks,

uncertainties and factors include general business, legal,

economic, competitive, political, regulatory and social

uncertainties; actual results of exploration activities and

economic evaluations; fluctuations in currency exchange rates;

changes in costs; future prices of gold and other minerals; mining

method, production profile and mine plan; delays in exploration,

development and construction activities; changes in government

legislation and regulation; the ability to obtain financing on

acceptable terms and in a timely manner or at all; contests over

title to properties; employee relations and shortages of skilled

personnel and contractors; the speculative nature of, and the risks

involved in, the exploration, development and mining business.

These risks are set forth under Item 3.D in Tanzanian Gold’s Form

20-F for the year ended August 31, 2020, as amended, as filed with

the SEC.

The information contained in this press release

is as of the date of the press release and TanGold assumes not duty

to update such information.

Note to U.S. Investors

US investors are advised that the mineral

resource and mineral reserve estimated disclosed in this press

release have been calculated pursuant to Canadian standards which

use terminology consistent with the requirements CRIRSCO reporting

standards. For its fiscal year ending August 31, 2021, and

thereafter, the Company will follow new SEC regulations which uses

a CRIRSCO based templet for mineral resources and mineral reserves,

that includes definitions for inferred, indicated, and measured

mineral resources.

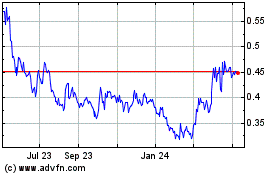

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Apr 2023 to Apr 2024