Gold is finally glittering -- and don't be surprised if it

continues to shine. Gold, remember, is supposed to be a store of

value, and has kept up with inflation over the long term. As Andrew

Bary noted in our September cover story on gold, an ounce would

have bought a good men's suit in 1918, and still does today.

Gold can also act as a buffer in tough times. While the S&P

500 has tumbled 16% during the past three months, gold has gained

8%, acting as just the hedge against market chaos that investors

hope for when they buy it. The SPDR Gold Shares exchange-traded

fund gained 1%, to $120.86, on Thursday, while the VanEck Vectors

Gold Miners ETF climbed 1.5%, to $20.93.

That role as insurance from market volatility was also apparent

in currency markets. In 2018, gold outperformed every Group of 10

currency except the Japanese yen, the U.S. dollar, and the Swiss

franc, observes Société Générale currency strategist Kit Juckes:

"Fair to say, then, that it's mixing it with the safer-haven

crowd."

Given continued uncertainty in currency markets, there's a good

chance that gold prices keep rallying. The dollar won't look great

in a slowing U.S. economy with a large fiscal deficit. Meanwhile,

the euro looks cheap relative to the dollar, but the main argument

for that is that the news out of Europe can't get much worse -- not

a great reason. "The reason for thinking positively about gold at

the moment is that we have deteriorating dollar fundamentals and an

absence of reasons to like pretty much any other currency," Juckes

writes.

--Ben Levisohn

Monday 31

Many markets around the world, including exchanges in Germany

and Japan, are closed for New Year's Eve.

The Federal Reserve Bank of Dallas releases its Texas

Manufacturing Outlook Survey for December. Economists forecast a 15

reading, down from November's 17.6, suggesting that economic growth

is moderating.

Tuesday 1

The nation's first minimum-wage law for ride-sharing firms like

Lyft and Uber goes into effect in New York City. The minimum wage

will be $17.22, after expenses, which is a $5 bump from the current

pay rate of $11.90, as estimated by the Independent Drivers Guild,

which represents over 70,000 app-based drivers.

Brazil's President-elect Jair Bolsonaro is inaugurated in

Brasilia. U.S. Secretary of State Mike Pompeo is expected to attend

the ceremony.

Wednesday 2

Japan's stock market remains closed. Trading resumes on

Friday.

Thursday 3

The 116th U.S. Congress is scheduled to be sworn in. Republicans

maintain control of the Senate, as they have since 2015, while

Democrats are back in control of the House of Representatives for

the first time since 2011. The first order of business will be

electing a new speaker of the House. Nancy Pelosi, who was the

nation's first female speaker, is expected to reclaim the gavel she

first wielded in 2007. Democrats netted 40 house seats in the 2018

midterm elections.

Ford Motor reports U.S. sales data for December, while General

Motors releases data for fourth-quarter 2018.

Goldman Sachs hosts its 11th annual Healthcare CEO Conference in

New York. Agilent Technologies , Alexion Pharmaceuticals, and

Humana are some of the companies slated to attend.

ADP releases its National Employment Report for December.

Consensus estimates are for a gain of 180,000 private-sector jobs

after adding 179,000 in November.

The Institute for Supply Management releases its Purchasing

Managers' Index for December. Expectations are for a 57.8 reading,

down from November's 59.3.

The Department of Labor reports jobless claims for the week

ending on Dec. 22.

Friday 4

Cal-Maine Foods, Lamb Weston Holdings , and RPM International

report quarterly results.

The Bureau of Labor Statistics releases the employment report

for December. The headline unemployment rate is expected to remain

at a half-century low of 3.7%. Economist are forecasting a gain of

180,000 for nonfarm payrolls, up from November's 155,000 increase,

while average hourly earnings should rise 0.3% after gaining 0.2%

in November.

Federal Reserve Chairman Jerome Powell and his two immediate

predecessors, Janet Yellen and Ben Bernanke, are scheduled to be

interviewed jointly at the American Economic Association's annual

meeting in Atlanta.

The Energy Information Administration releases its petroleum

status report. U.S. crude-oil inventories (excluding those in the

Strategic Petroleum Reserve) are about 7% above the five year

average for this time of year.

--Robert Teitelman and Dan Lam

Email: editors@barrons.com

To subscribe to Barron's, visit

http://www.barrons.com/subscribe

(END) Dow Jones Newswires

December 29, 2018 06:15 ET (11:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

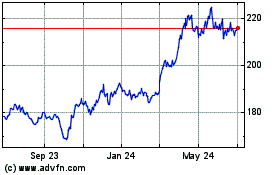

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

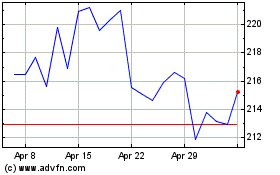

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Apr 2023 to Apr 2024