UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

| Servotronics, INC. |

(Name of Registrant as Specified in Its Charter)

|

| |

STAR EQUITY FUND, LP

STAR EQUITY FUND GP, LLC

STAR VALUE, LLC

STAR EQUITY HOLDINGS, INC.

STAR INVESTMENT MANAGEMENT, LLC

JEFFREY E. EBERWEIN

HANNAH M. BIBLE

BASHARA (BO) BOYD

RICHARD K. COLEMAN, JR.

JOHN W. GILDEA

DANIEL M. KOCH

LOUIS A. PARKS

ROBERT G. PEARSE

G. MARK POMEROY

BRANDON G. STRANZL

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Star Equity Fund, LP (“Star

Equity Fund”), together with the other participants named herein, intends to file a preliminary proxy statement and accompanying

WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of highly-qualified

director nominees at the 2022 annual meeting of shareholders of Servotronics, Inc., a Delaware corporation.

On March 2, 2022, Star

Equity Fund issued the following press release:

Star Equity Fund Announces Director Nominations

at Servotronics

Believes Significant Board Change is Necessary

to Create Shareholder Value

Old Greenwich, CT – March 2, 2022 –

Star Equity Fund, LP (“Star Equity Fund” or “we”) is a shareholder of Servotronics, Inc. (NYSE American: SVT)

(“Servotronics” or “the Company”). We are an investment fund focused on maximizing shareholder value and improving

corporate governance at companies in our portfolio.

Servotronics shareholders have long suffered value

destruction during the tenure of the Company’s incumbent board of directors. We believe significant change to the board is needed

to create value for all shareholders. We have nominated a diverse, highly qualified slate of candidates to act in the best interests of

all shareholders, and we are fully prepared to take this matter to a shareholder vote at the 2022 Servotronics Annual Meeting of Shareholders,

which we expect to be held in the second quarter of 2022.

We believe the incumbent Servotronics board has not

acted consistent with its fiduciary duty to shareholders. Under the incumbent board’s watch, the Company’s previous CEO abused

his authority and perpetuated a culture of harassment at the expense of employees and shareholders (as alleged by a lawsuit filed by a

former employee on June 7, 2021), with an internal investigation finding that he committed willful malfeasance in violation of his employment

agreement with the Company. In addition, the incumbent board has overseen and continued to support the Company’s unprofitable Consumer

Products Group without having taken meaningful action to maximize shareholder value.

In addition, the incumbent board has a track record

of poor corporate governance. Proxy advisory firms ISS and Glass Lewis have cited numerous issues with Servotronics’s board of directors

and the Company’s corporate governance, including in its report on the Company’s 2021 annual meeting:

| • | The board is not comprised of a majority of independent directors |

| • | The chairman of the board’s nominating and governance committee is not independent |

| • | The board maintains a long-term poison pill that has not been ratified by shareholders |

| • | The Company maintains a triennial frequency for the inclusion of say-on-pay on its annual meeting ballot

rather than including annually |

Servotronics shareholders have the right to vote for

new leadership on the board, and we strongly urge the incumbent board not to take any actions to encumber this right or jeopardize shareholder

value before shareholders have the opportunity to vote for new representation on the board. Such actions include:

| • | Adding anyone to the board before the 2022 annual meeting |

| • | Delaying the 2022 annual meeting beyond 13 months after the 2021 annual meeting |

| • | Lowering the ownership threshold of, or extending, the poison pill |

| • | Selling all or parts of the Company |

| • | Making significant acquisitions |

| • | Issuing equity or equity-linked securities |

| • | Taking any other action harmful to shareholder interests and rights |

Star Equity Fund reminds each of the incumbent board

members that any actions taken against the interests of shareholders can entail serious personal legal and financial consequences. Personal

liability can result from taking certain actions that impair shareholder value or harm shareholder rights. This liability can exceed D&O

insurance coverage. Also, D&O insurance and corporate indemnification may not be available or applicable if certain harmful actions

are undertaken.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Star Equity Fund, LP (“Star Equity Fund”),

together with the other participants named herein (collectively, “Star Equity”), intends to file a preliminary proxy statement

and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the

election of its slate of highly-qualified director nominees at the 2022 annual meeting of stockholders of Servotronics, Inc., a Delaware

corporation (the “Company”).

STAR EQUITY STRONGLY ADVISES ALL STOCKHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS

PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation are

anticipated to be Star Equity Fund, Star Equity Fund GP, LLC (“Star Equity Fund GP”), Star Value, LLC (“Star Value”),

Star Equity Holdings, Inc. (“Star Equity Holdings”), Star Investment Management, LLC (“Star Investment Management”),

Jeffrey E. Eberwein, Hannah M. Bible, BaShara (Bo) Boyd, Richard K. Coleman, Jr., John W. Gildea, Daniel M. Koch, Louis A. Parks, Robert

G. Pearse, G. Mark Pomeroy and Brandon G. Stranzl.

As of the date hereof, Star Equity Fund beneficially

owns directly 28,555 shares of common stock, par value $0.20 per share, of the Company (the “Common Stock”). Star Equity Fund

GP, as the general partner of Star Equity Fund, may be deemed to beneficially own the 28,555 shares of Common Stock owned directly by

Star Equity Fund. Star Value, as the sole member of Star Equity Fund GP, may be deemed to beneficially own the 28,555 shares of Common

Stock owned directly by Star Equity Fund. Star Equity Holdings, as the parent company of Star Equity Fund, may be deemed to beneficially

own the 28,555 shares of Common Stock owned directly by Star Equity Fund. Star Investment Management, as the investment manager of Star

Equity Fund, may be deemed to beneficially own the 28,555 shares of Common Stock owned directly by Star Equity Fund. Mr. Eberwein, as

the Portfolio Manager of Star Equity Fund, may be deemed to beneficially own the 28,555 shares of Common Stock owned directly by Star

Equity Fund. As of the date hereof, none of Mses. Bible or Boyd or Messrs. Coleman, Gildea, Koch, Parks, Pearse, Pomeroy or Stranzl beneficially

owns any Common Stock.

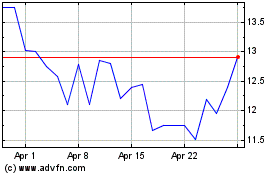

Servotronics (AMEX:SVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

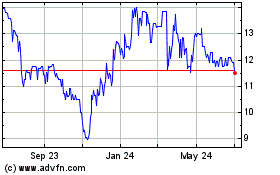

Servotronics (AMEX:SVT)

Historical Stock Chart

From Apr 2023 to Apr 2024