Amended Annual Report (10-k/a)

July 06 2021 - 4:31PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D. C. 20549

Form 10-K/A

(Amendment No. 1)

|

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

or

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2020

Commission File No. 1-07109

SERVOTRONICS, INC.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

16-0837866

|

|

(State or other jurisdiction

of

|

(I. R. S. Employer

|

|

incorporation or

organization)

|

Identification No.)

|

1110 Maple Street

Elma, New York

14059

(Address of principal executive offices) (zip

code)

(716) 655-5990

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Ticker symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

SVT

|

NYSE American

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨

No x

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act.

Large accelerated filer

¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company x Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes

¨ No x

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ¨

Based on the closing price of the Common Stock

on June 30, 2020 $7.56 (the last day of the registrant’s most recently completed second fiscal quarter), the aggregate market value

of the voting stock held by non-affiliates of the registrant was $12,053,718.

As of March 1, 2021, the number of $.20 par

value common shares outstanding was 2,478,507

Explanatory Note

Servotronics, Inc. (the “Company”)

is filing this Amendment No. 1 to Form 10-K for the year ended December 31, 2020, as filed with the Securities and Exchange Commission

on April 6, 2021 (“Original Filing”) to amend and restate in its entirety Item 9A, Controls and Procedures.

The Company determined that management’s

evaluation of the effectiveness of internal control over financial reporting was not based on a suitable, recognized control framework

in accordance with Exchange Act Rule 13a-15(c). While the Company has designed such internal control over financial reporting to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes

in accordance with generally accepted accounting principles, the Company has determined that it did not use a recognized control framework

to conduct management’s evaluation since at least December 31, 2017. Subsequent to the filing date of the Original Filing, an evaluation

of the Company’s internal control over financial reporting was conducted based on the framework in Internal Control – Integrated

Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission in 2013. This Amendment No. 1 includes management’s

assessment on the effectiveness of the Company’s internal control over financial reporting as of December 30, 2020.

Notwithstanding the existence of the material

weakness described in Part II. Item 9A – “Controls and Procedures,” the Company believes that the consolidated financial

statements in the Original Filing fairly present, in all material respects, the Company’s financial position, results of operations

and cash flows as of the dates, and for the periods, presented, in conformity with U.S. generally accepted accounting principles.

This Amendment No. 1 also amends Item 15 of Part

IV of the Original Filing solely to include as exhibits the certifications required by Rule 13a-14(a) under the Securities Exchange Act

of 1934, as amended. Because no financial statements have been included in this Amendment No. 1, paragraph 3 of the certifications has

been omitted. The Company is not including the certifications under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements

are being filed with this Amendment No. 1.

Except as expressly stated, this Amendment No.

1 does not reflect events occurring after the filing of the Original Filing or modify or update in any way any of the other items or disclosures

contained in the Original Filing, including, without limitation, the consolidated financial statements and the related footnotes. Accordingly,

this Amendment No. 1 should be read in conjunction with the Original Filing and the Company’s other filings with the SEC subsequent

to the filing of the Original Filing.

|

|

Item 9A.

|

Controls and Procedures

|

(i) Disclosure

Controls and Procedures

Based on the evaluation of

the Company’s disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)) required by Exchange Act Rule 13a-15(e),

the Company’s principal executive officer and principal financial officer have concluded that as of December 31, 2020 the Company’s

disclosure controls and procedures were not effective as a result of the inaccurate disclosure in the Original Filing with respect to

the Company’s evaluation of internal control over financial reporting.

(ii) Management’s

Report on Internal Control over Financial Reporting

The Company’s management

is responsible for establishing and maintaining adequate internal controls over financial reporting (as defined in Exchange Act Rule 13a-15(f)).

The Company determined that its previous disclosure regarding management’s evaluation of the effectiveness of internal control over

financial reporting was inaccurate as such evaluation was not based on a suitable, recognized control framework in accordance with Exchange

Act Rule 13a-15(c). Subsequent to the filing date of the Original Filing, under the supervision and with the participation of management,

including the principal executive officer and principal financial officer, conducted an evaluation of the effectiveness of internal control

over financial reporting based on the framework in Internal Control – Integrated Framework issued by the Committee of Sponsoring

Organizations of the Treadway Commission in 2013 (“COSO”). For effective internal control, each of the five COSO components

and the underlying 17 principles must be present and functioning and operate together in an integrated manner. The COSO components are

(1) control environment, (2) risk assessment, (3) control activities, (4) information and communication and (5) monitoring activities.

Management’s initial evaluation of the Company’s internal control over financial reporting, which included transactional testing

performed by a third-party as well as ongoing observation and evaluation of controls by management in connection with the audit of the

Company’s financial statements, identified significant deficiencies relating to inventory and the accounting for post retirement

benefit obligations, however such significant deficiencies were not considered to be material weaknesses. The subsequent evaluation using

the COSO framework indicated that the Company did not fully consider and document the COSO components and principles on a timely basis.

Management has concluded that the combination of the failure to monitor whether the components of internal control were present and functioning

at December 31, 2020 and the previously identified significant deficiencies, in aggregate, constitute a “major deficiency”

and a material weakness. Under the COSO framework, when a major deficiency exists a company cannot conclude that it has met the requirement

for an effective system of internal control. A material weakness is a deficiency, or a combination of deficiencies, in internal control

over financial reporting such that there is a reasonable possibility that a material misstatement of the financial statements will not

be prevented or detected in a timely basis by the Company’s internal controls. As a result, management has concluded that the Company’s

internal control over financial reporting was not effective at December 31, 2020.

Management has begun implementing a remediation

plan which includes the development of enhanced internal control review procedures and documentation standards aligned with the COSO components

and principles. The Company anticipates having those procedures and standards in place in the third and fourth quarters of 2021 to allow

management to fully evaluate the Company’s internal control over financial reporting at December 31, 2021.

Notwithstanding the existence of the above-mentioned

material weakness, the Company believes that the consolidated financial statements in the Original Filing fairly present, in all material

respects, the Company’s financial position, results of operations and cash flows as of the dates, and for the periods, presented,

in conformity with U.S. generally accepted accounting principles.

(iii)

Changes in Internal Control Over Financial Reporting

There were no changes in the

Company’s internal controls over financial reporting during the fourth quarter of 2020 that have materially affected, or are reasonably

likely to affect, the Company’s internal controls over financial reporting.

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

SIGNATURES

Pursuant to the requirements

of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

SERVOTRONICS, INC.

|

|

|

|

|

|

|

July 6, 2021

|

By

|

/s/ Lisa F. Bencel

|

|

|

|

Lisa F. Bencel

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

|

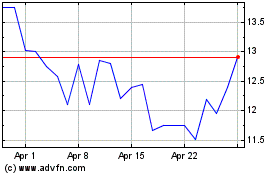

Servotronics (AMEX:SVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

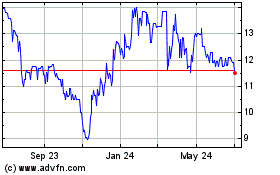

Servotronics (AMEX:SVT)

Historical Stock Chart

From Apr 2023 to Apr 2024