Millennium Investment & Acquisition Co. Inc. (US-OTC: MILC)

(“MILC” or the “Company”) today announced that it has agreed to

invest in a newly formed cannabis operator - VinCann LLC (“VC”). As

part of the transaction, MILC has agreed to invest $750,000. The

investment will take the form of a preferred equity interest that

receives a full return of invested capital plus a preferred return

of 12.5% after which MILC has a 77.5% ownership stake. The

remaining subordinated ownership will be held by the management

team of VC.

Concurrent with MILC’s investment, VC entered

into a 20-year lease (the “Lease”) for a 9.35 acre plot of land

with approximately 40,000 square feet of greenhouse, 3,000 square

feet of office space, and 100,000 square feet of fully fenced

outdoor growing area with 20,000+ square feet of hoop structures

that have been purchased by Power REIT (NYSE-American: PW). This

property has significant potential to become a low-cost producer of

high-quality cannabis to compete effectively in the Oklahoma

market.

Oklahoma is a relatively new cannabis market and

due to its open licensing represents an interesting opportunity. It

is referred to as the “wild-wild-west” of cannabis and is projected

to see rapid growth in the coming years. This investment positions

MILC for attractive risk adjusted returns and by working with Power

REIT provides significant leverage to its investment.

David Lesser,

MILC’s Chairman and CEO,

commented, “MILC recently announced an initial foray

into cannabis cultivation with a transaction in southern Colorado.

This transaction expands MILC’s entry into the cannabis cultivation

space as MILC transitions to an operating company from an

Investment Company under Securities and Exchange Act of 1940. As

previously disclosed, MILC has now completed the sale of its sole

investment in securities and is now focused on two areas:

sustainable cannabis cultivation in greenhouses and production of

activated carbon. MILC is enthusiastic about the prospects for

these two focus areas and its portfolio expansion with this

investment in Oklahoma. I look forward to announcing additional

exciting developments in the near future.”

VC is led by Jared Schrader, an experienced

cannabis cultivation operator with a solid track record growing

revenue at a Colorado cultivation facility from $150,000 annually

to over $150,000 weekly (i.e. > $8 million annually) across the

span of two years.

Jared Schrader,

VinCann’s

President, commented, “This cannabis cultivation

facility is already operational and has significant potential for

growth in undeveloped areas that can be easily constructed to

expand the operation. This allows VC to pursue a strategy focused

on speed to revenue and has the potential for rapid revenue growth

given the nature of Oklahoma cannabis licensing which is based on

an unlimited plant count per property. Based on the initial

property configuration, VC intends to quickly establish

approximately 32,000 cannabis plants which can be harvested

approximately five times per year. Based on recent prices for

cannabis in Oklahoma, this can result in an annual run rate of

revenue in excess of $8 million.”

Deregistration as a 1940 Act Company

On October 14, 2020, shareholders approved a

proposal to change the nature of the Company’s business from a

registered investment company under the Investment Company Act of

1940 (the “1940 Act”) and to a holding company that focuses

primarily on owning and operating businesses that produce activated

carbon and acquiring other private businesses (collectively, the

“Deregistration Proposal”). The Company is in the process of

implementing the Deregistration Proposal so that it is no longer an

“investment company” under the 1940 Act and has applied to the

Securities and Exchange Commission (the “SEC”) for an order under

the 1940 Act declaring that the Company has ceased to be an

investment company (the “Deregistration Order”).

While the Company is committed to fully

implementing the Deregistration Proposal, it is still contingent

upon regulatory approval and the ability to reconfigure the

Company’s portfolio to deregister as an investment company. The

time required to reconfigure the Company’s portfolio could be

impacted by, among other things, the COVID-19 pandemic and related

market volatility, determinations to preserve capital, the

Company’s ability to identify and execute on desirable acquisition

opportunities, and applicable regulatory, lender and governance

requirements. The conversion process could take up to 24 months;

and there can be no assurance that the Deregistration Proposal,

even if fully implemented, will improve the Company’s performance.

Further, the SEC may determine not to grant the Company’s request

for the Deregistration Order, which would materially change the

Company’s plans for its business.

As previously announced, MILC has now completed

the liquidation of its sole investment in securities - its

investment in SMC and plans to invest the proceeds in operating

businesses.

ABOUT MILLENNIUM INVESTMENT & ACQUISITION COMPANY

INC.

Millennium Investment and Acquisition Co. Inc.

(ticker: MILC) is an internally managed, non-diversified,

closed-end investment company. During 2020, MILC announced that it

was seeking to de-register as an Investment Company that is

regulated under Investment Company Act of 1940. MILC is currently

seeking an Order from the SEC declaring that it has ceased to be an

Investment Company as it no longer meets the definition of holding

itself out as investing in securities but rather has pivoted to

focus on direct investments in operating businesses.

MILC is currently focusing on opportunities in

sustainable cannabis cultivation and the production of activated

carbon.

Additional information about MILC can be found

on its website: www.millinvestment.com

ABOUT POWER REIT

Power REIT is a specialized real estate

investment trust (REIT) that owns sustainable real estate related

to infrastructure assets including properties for Controlled

Environment Agriculture, Renewable Energy and Transportation. Power

REIT is actively seeking to expand its real estate portfolio

related to Controlled Environment Agriculture for the cultivation

of food and cannabis.

Power REIT is focuses on the “Triple Bottom

Line” with a commitment to Profit, Planet and People.

Additional information about Power REIT can be

found on its website: www.pwreit.com

CAUTIONARY STATEMENT ABOUT

FORWARD-LOOKING STATEMENTS

This document includes forward-looking

statements within the meaning of the U.S. securities laws.

Forward-looking statements are those that predict or describe

future events or trends and that do not relate solely to historical

matters. You can generally identify forward-looking statements as

statements containing the words "believe," "expect," "will,"

"anticipate," "intend," "estimate," "project," "plan," "assume",

"seek" or other similar expressions, or negatives of those

expressions, although not all forward-looking statements contain

these identifying words. All statements contained in this document

regarding our future strategy, future operations, future prospects,

the future of our industries and results that might be obtained by

pursuing management's current or future plans and objectives are

forward-looking statements. You should not place undue reliance on

any forward-looking statements because the matters they describe

are subject to known and unknown risks, uncertainties and other

unpredictable factors, many of which are beyond our control. Our

forward-looking statements are based on the information currently

available to us and speak only as of the date of the filing of this

document. Over time, our actual results, performance, financial

condition or achievements may differ from the anticipated results,

performance, financial condition or achievements that are expressed

or implied by our forward-looking statements, and such differences

may be significant and materially adverse to our security

holders.

CONACT:

David H. Lesser, Chairman &

CEOdavid@dlesser.com 212-750-0371

301 Winding Road Old Bethpage, NY

11804www.millinvestment.com

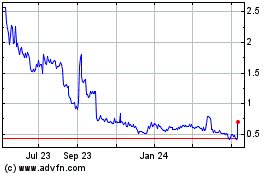

Power REIT (AMEX:PW)

Historical Stock Chart

From Mar 2024 to Apr 2024

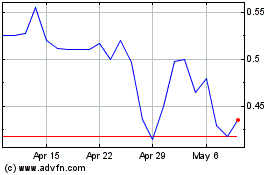

Power REIT (AMEX:PW)

Historical Stock Chart

From Apr 2023 to Apr 2024