Current Report Filing (8-k)

October 28 2020 - 6:05AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): October 27, 2020

POWER

REIT

(Exact

name of registrant as specified in its charter)

Maryland

(State

or other jurisdiction of incorporation)

001-36312

(Commission

File Number)

45-3116572

(IRS

Employer Identification No.)

301

Winding Road

Old

Bethpage, NY 11804

(Address

of principal executive offices and Zip Code)

Registrant’s

telephone number, including area code: (212) 750-0371

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol

|

|

Name

of Each Exchange on Which Registered

|

|

Common

Shares

|

|

PW

|

|

NYSE

(American)

|

|

|

|

|

|

|

|

7.75%

Series A Cumulative Redeemable Perpetual Preferred Stock, Liquidation Preference $25 per Share

|

|

PW.PRA

|

|

NYSE

(American)

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

2.02. Results of Operations and Financial Condition.

On October 28, 2020, Power REIT (the

“Company”) issued a press release announcing its financial results for the quarter ended September 30, 2020. A copy

of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”)

and is incorporated herein by reference.

The information in this Item 2.02 and in

the press release attached as Exhibit 99.1 to this Current Report shall not be deemed to be “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections

11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the press release

attached as Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the U.S.

Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general

incorporation language in such filing.

Item

8.01. Other Events

Guidance Regarding Character of Dividends

Power REIT has retained BDO USA LLP (“BDO”)

as its tax advisor and for the preparation of its tax returns since 2011. In 2017, as a result of previously described litigation,

Power REIT has an approximately $17 million Net Operating Loss for tax purposes. In reliance on tax advice from BDO, Power

REIT disclosed to investors on a number of occasions that dividends paid to investors would be treated as a Return of Capital

until the Net Operating Loss was exhausted. Based on BDO’s current tax advice, Power REIT is now providing guidance that

investors should not expect that the character of dividends for 2020 and subsequent years will be treated as a Return of Capital

regardless of the availability of the Net Operating Loss.

Declaration of Dividend

On October 27, 2020, the Registrant declared

a quarterly dividend of $0.484375 per share on Power REIT’s 7.75% Series A Cumulative Redeemable Perpetual Preferred Stock,

par value $25.00 per share, payable on December 15, 2020 to shareholders of record on November 15, 2020.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

October 28, 2020

|

POWER

REIT

|

|

|

|

|

|

By

|

/s/

David H. Lesser

|

|

|

|

David

H. Lesser

|

|

|

|

Chairman

of the Board and Chief Executive Officer

|

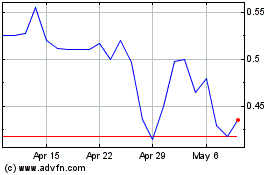

Power REIT (AMEX:PW)

Historical Stock Chart

From Mar 2024 to Apr 2024

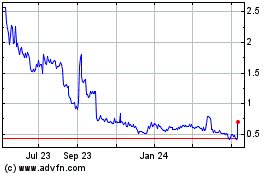

Power REIT (AMEX:PW)

Historical Stock Chart

From Apr 2023 to Apr 2024