Current Report Filing (8-k)

September 18 2020 - 6:11AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): September 18, 2020

POWER

REIT

(Exact

name of registrant as specified in its charter)

Maryland

(State

or other jurisdiction of incorporation)

001-36312

(Commission

File Number)

45-3116572

(IRS

Employer Identification No.)

301

Winding Road

Old

Bethpage, NY 11804

(Address

of principal executive offices and Zip Code)

Registrant’s

telephone number, including area code: (212) 750-0371

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol

|

|

Name

of Each Exchange on Which Registered

|

|

Common Shares

|

|

PW

|

|

NYSE (American)

|

|

|

|

|

|

|

|

7.75% Series A Cumulative Redeemable Perpetual

Preferred Stock, Liquidation Preference $25 per Share

|

|

PW.A

|

|

NYSE (American)

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into a Material Definitive Agreement.

On

September 17, 2020, Power REIT (“Power REIT” or the “Trust”), through a wholly owned subsidiary of the

Trust (“PropCo”), in connection with the acquisition of a 3.0 acre property located in York County, Maine (the “505

Property”), entered into a triple-net lease (the “Lease”) with Sweet Dirt (the “Tenant”). The Lease

provides that Tenant is responsible for paying

all expenses related to the Property, including maintenance expenses, insurance and taxes. The

Lease requires the Tenant to maintain a medical cannabis license and operate in accordance with all Maine regulations with respect

to its operations.

As

part of the agreement, the Trust agreed to fund the construction of an approximately 9,900 square feet of processing building

and the renovation of an existing 2,738 square foot building on the Property for $1.56 million.

The

Lease is structured whereby after a nine month period, the additional rental payments provide PropCo with a full return of its

original invested capital over the next three years and thereafter, provide a 13.2% return increasing 3% rate per annum.

In

addition, on August 25, 2020, Power REIT has entered into an agreement for expansion of a property located in Southern Colorado

(“Sherman 6”) owned by a wholly owned subsidiary of the Trust (“Sherman 6 PropCo”) and leased to Green

Street LLC (“Tenant”) pursuant to a lease (the “Lease”).

The

expansion consists of approximately 2,520 square feet of additional greenhouse/headhouse space. The Tenant is responsible for

implementing the expansion and Sherman 6 PropCo will fund the cost of such expansion up to a total of $151,301, with

any additional amounts funded by Tenant. Once completed, Power REIT’s total investment in Sherman 6 will be $1,995,101.

As

part of the agreement, Sherman 6 PropCo and Tenant have amended the Lease whereby after a nine month period, the additional

rental payments provide Sherman 6 PropCo with a full return of its original invested capital over the next three years

and thereafter, provide a 12.9% return increasing 3% rate per annum.

The

foregoing descriptions of the leases do not purport to be complete and are qualified in its entirety by reference to the complete

text of the Leases, copies of which are attached hereto as Exhibit 10.1 and 10.2 and are incorporated into this

Current Report on Form 8-K by reference.

Item

2.01 Completion of Acquisition or Disposition of Assets.

On

September 18, 2020, the Trust, through PropCo, completed the acquisition of the 505 Property which is a 3.0 acre Property in York,

Maine for $400,000. The Property is adjacent to a property (the “495 Property) acquired by PropCo on May 15, 2020 that is

leased to the Tenant. PropCo exercised its option it received at the time of the acquisition of the 495 Property to purchase the

505 Property. Power REIT’s total investment in the 505 Property at the completion of funding will be approximately $1.96

million.

Item

7.01 Regulation FD Disclosure.

On

September 18, 2020, the Trust issued a press release regarding the acquisition and expansion of the properties.

A copy of the press release is attached hereto as Exhibit 99.1. The information contained in Item 7.01 of this report, including

Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, or otherwise subject to the liabilities of that section. Such information shall not be incorporated by

reference into any filing of the Trust, whether made before or after the date hereof, regardless of any general incorporation

language in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

Forward-Looking

Statements

Some

of the information in this press release contains forward-looking statements and within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this press release,

words such as “believe,” “expect,” “anticipate,” “estimate,” “plan,”

“continue,” “intend,” “should,” “may,” “target,” or similar expressions,

are intended to identify such forward-looking statements. Forward-looking statements are subject to significant risks and uncertainties.

Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set

forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in

the forward-looking statements include those discussed under the caption “Risk Factors” included in our Annual Report

on Form 10-K for our fiscal year ended December 31, 2018, which was filed with the U.S. Securities and Exchange Commission (“SEC”),

as well as in other reports that we file with the SEC.

Forward-looking

statements are based on beliefs, assumptions and expectations as of the date of this press release. We disclaim any obligation

to publicly release the results of any revisions to these forward-looking statements reflecting new estimates, events or circumstances

after the date of this press release.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

POWER

REIT

|

|

|

|

|

Date:

September 18, 2020

|

By

|

/s/

David H. Lesser

|

|

|

|

David H. Lesser

|

|

|

|

Chairman of the Board and Chief Executive Officer

|

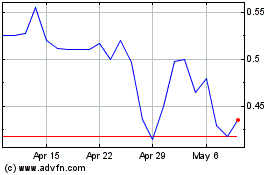

Power REIT (AMEX:PW)

Historical Stock Chart

From Mar 2024 to Apr 2024

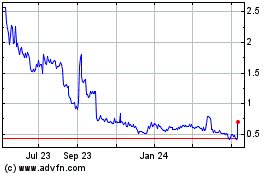

Power REIT (AMEX:PW)

Historical Stock Chart

From Apr 2023 to Apr 2024