Platinum Group Metals Ltd. (PTM:TSX; PLG:NYSE

American) (“Platinum Group” “PTM” or the “Company”) reports the

Company’s financial results for the six months ended February 28,

2019 and provides a summary of recent events and outlook. For

details of the condensed consolidated interim financial statements

for the six months ended February 28, 2019 (the “Financial

Statements”) and Management’s Discussion and Analysis for the six

months ended February 28, 2019 please see the Company’s filings on

SEDAR (www.sedar.com) or on EDGAR (www.sec.gov). Shareholders

are encouraged to visit the Company’s website at

www.platinumgroupmetals.net. Shareholders may receive a hard

copy of the complete Financial Statements from the Company free of

charge upon request.

All amounts herein are reported in United States

dollars (“USD”) unless otherwise specified. The Company holds cash

in Canadian dollars, United States dollars and South African

Rand. Changes in exchange rates may create variances in the

cash holdings or results reported.

The Company is focused on completing a

Definitive Feasibility Study (“DFS”) for the large scale, palladium

dominant and bulk mineable Waterberg Project in South Africa (the

“Waterberg Project”). The strong price outlook for palladium

along with DFS optimization work have helped the Company to better

estimate the potential mine scale for the Waterberg Project.

Optimization work has determined that higher extraction rates for

mineralized material are achievable by using tailings as

backfill. See more details below in “Outlook”.

A technical committee of Waterberg JV Resources

Pty Ltd. (“Waterberg JV Co.”) is overseeing the DFS with

participation from all partners. A formal Mining Right

Application has been filed and community consultation is

ongoing. Power and water planning for the project is

advancing well including work under a regional water co-operation

agreement with the Capricorn Municipality and engineering and

permitting work with power utility Eskom.

Impala Platinum Holdings Ltd. (“Implats”) made a

strategic investment of $30.0 million in November 2017 to purchase

a 15% stake in the Waterberg Project, from which the Company

received $17.2 million for its 8.6% project interest sold.

Implats may elect to increase its stake to 50.01% by additional

share purchases from Japan Oil, Gas and Metals National Corporation

(“JOGMEC”) for an amount of $34.8 million and a commitment to spend

$130 million for development of the Waterberg Project.

Implats will also have a right of first refusal to smelt and refine

Waterberg Project concentrate.

Recent Events

Prior to April 2, 2019 common

share purchase warrants representing 968,670 shares at a price of

$1.70 each were exercised by holders. Proceeds to the Company

totalled $1,646,739. The Company’s two largest shareholders

exercised approximately 91% of these warrants.

On March 7, 2019, the Company

reported the transfer of a 9.755% interest in Waterberg JV Co. to

Hanwa Co. Ltd. (“Hanwa”) by JOGMEC. Prior to the transfer

JOGMEC held a 21.95% interest in the Waterberg Project. Hanwa

was the successful bidder in a public tender process for Japanese

companies conducted by JOGMEC. Hanwa is a leading Japanese

trading company supplying a broad spectrum of products, including

steel, non-ferrous metals, metals and alloys, food, petroleum,

chemicals, machinery, lumber and many other items, to a diverse

range of global customers.

On January 11, 2019, the

Company paid $8.0 million to Liberty Metals & Mining Holdings,

LLC (“LMM”) in partial settlement of a secured loan facility due to

LMM. The amount paid represented net proceeds from the sale of 4.52

million common shares of JSE listed Royal Bafokeng Platinum Ltd.

received by the Company in April 2018 upon completion of stage two

of the sale of the Maseve Mine.

On November 16, 2018, the

Company filed a National Instrument 43-101 technical report for an

updated independent mineral resource estimate for the Waterberg

Project. The report, entitled “Technical Report on the

Mineral Resource Update for the Waterberg Project Located in the

Bushveld Igneous Complex, South Africa” is dated October 22, 2018

(with the effective date of the mineral resources being September

27, 2018) and was prepared by Charles J Muller, B. Sc. (Hons)

(Geology), Pr. Sci. Nat., of CJM Consulting (Pty) Ltd. A copy

of the report can be found at www.sedar.com, at www.sec.gov and on

the Company’s website.

On October 25, 2018, the

Company published an updated independent mineral resource estimate

for the Waterberg Project on a 100% basis totalling 26.34 million

ounces of platinum, palladium, rhodium and gold (together known as

“4E”) (242.5 million tonnes at 3.38 g/t 4E comprised of 63.04%

palladium, 29.16% platinum, 6.37% gold and 1.43% rhodium), with

6.26 million 4E ounces recognized in the higher confidence Measured

category. The updated resource assessment forms the basis for

mine design, scheduling and capital cost estimation as part of the

DFS. The Waterberg deposit is dominated by palladium and also

contains copper and nickel. Inferred mineral resources are

estimated at 7.0 million 4E ounces (66.67 million tonnes at 3.26

g/t 4E). The T zone Measured and Indicated mineral resources

increased in grade from 3.88 g/t 4E in 2016 to 4.51 g/t 4E in

2018. All of the preceding was estimated at a 2.5 g/t 4E

cut-off grade, which is the preferred scenario for the

project.

On October 10, 2018, the

Company announced that a recent Mining Right Application for the

Waterberg Project had been accepted by South Africa’s Department of

Mineral Resources. The application is supported by the

Company and all of the Waterberg Project partners including

Implats, JOGMEC and Mnombo Wethu Consultants (Pty) Ltd. The

process of consultation under the Mineral and Petroleum Resources

Development Act, 2002 and current Environmental Assessment

regulations has commenced. Many public meetings have already

been completed. Significant feedback from the meetings has

been considered in the DFS designs. Local training and employment

are key components of the project to maximize the value of the

project for all stakeholders.

Results For The Six Months Ended February 28,

2019

During the six months ended February 28, 2019

the Company incurred a net loss of $9.5 million (February 28, 2018

– net loss of $26.9 million). General and administrative expenses

during the six-month period were $2.9 million (February 28, 2018 -

$3.1 million), losses on foreign exchange were $0.6 million

(February 28, 2018 – $3.2 million) due to the US Dollar increasing

in value relative to the Company’s functional currency of the

Canadian Dollar.

At February 28, 2019, finance income consisting

of interest earned and property rental fees in the period amounted

to $0.3 million (February 28, 2018 - $0.4 million), while a gain on

marketable securities of $0.6 million was recognized in the current

period (February 28, 2018 - $Nil). Loss per share for the

period amounted to $0.32 as compared to a loss of $1.65 per share

for the six months ended February 28, 2018.

Accounts receivable at February 28, 2019

totalled $0.2 million (February 28, 2018 - $2.8 million) while

accounts payable and accrued liabilities amounted to $3.7 million

(February 28, 2018 - $10.8 million). Accounts receivable were

comprised of mainly of amounts receivable for value added taxes

repayable to the Company in South Africa and amounts due from joint

venture partners and related parties. Accounts payable at

February 28, 2019 related mostly to ongoing work at the Waterberg

Project with the decrease as compared to February 28, 2018 being

primarily due to settlement of payables related to mine closure

costs.

Total expenditures on the Waterberg Project,

before partner reimbursements, for the six-month period were

approximately $5.1 million (February 28, 2018 - $3.9

million). At February 28, 2019, $36 million in accumulated

net costs had been capitalized to the Waterberg Project.

Total expenditures by all parties on the property since

inception are approximately $67 million.

For more information on mineral properties, see

Note 4 of the Financial Statements.

Outlook

The Company’s key business objective is to

advance the Waterberg Project to development. The Waterberg project

is dominated by palladium at a time when palladium supply is

estimated to be in deficit. Mines with palladium as their primary

economic mineral are rare.

Waterberg JV Co. is advancing the Waterberg

Project to completion of a DFS. The DFS is being managed by

Platinum Group and a technical committee with comprehensive input

at all levels from the Waterberg Project partners.

The positive long-term market outlook for

platinum group elements and the value increase created by higher

extraction per mining level supports the DFS design change to

utilize backfill. Backfill utilizes tailings and concrete to

fill in mined out stopes to allow the extraction of mineralized

material that would otherwise be left as support pillars. The

Company expects that the mining extraction of pillars in the DFS

versus the PFS design will have a positive effect on tonnes and

ounces for reserves. Ancillary benefits include a reduced tailings

foot print, as tailings are put underground in backfill, and

increased safety and certainty on the production profile. Two twin

declines systems are now planned in the working DFS design rather

than three in the PFS design.

The DFS owner’s team, including representatives

from Impala Platinum, have visited Canadian bulk underground mining

operations and have worked closely with the independent mining

engineering team at Stantec.

As a result of the DFS design optimization

described above, additional time and budget are required to

complete the DFS. Waterberg JV Co. has approved a change order for

Rand 21.5 million (approximately $1.51 million) to fund the

required work. The DFS is now targeted for completion in August

2019. The additional time and investment are warranted to

achieve the production profile improvements in the DFS that are

indicated by the design optimizations described above.

An environmental authorization and mining right

application are also being advanced. Public consultation has

occurred in a positive climate of mutual respect. Local involvement

and personnel training are a key part of the design for a modern,

safe, responsible mine operating at world class standards. The DFS

team is working with NORCAT, a Sudbury, Canada based global

training specialist, to incorporate local skills development into

the DFS.

We are also pleased to report advancement on our

co-operation agreement with the Capricorn Municipality for the

supply of water to the project and planned increases in water

delivery to the local community as a component of the mine

plan.

The Waterberg JV Co. team is working very well

together with value-add contributions coming from all partners,

including senior team members from Impala working with Platinum

Group Metals as Manager of the DFS. We look forward to the

finalization of the DFS.

In the near term, the Company’s liquidity will

be constrained until financing has been obtained to repay and

discharge remaining amounts of secured debt and for working capital

purposes. The Company remains focussed on completing the

Waterberg DFS. At the same time the Company has started reviewing

several new business opportunities focused on platinum group

element metals, including extraction opportunities and potential

new uses. The Company will continue to work closely with its major

shareholders and lenders. The Company continues to actively assess

corporate and strategic alternatives with advisor BMO Nesbitt Burns

Inc.

Qualified Person

R. Michael Jones, P.Eng., the Company’s

President, Chief Executive Officer and a shareholder of the

Company, is a non-independent qualified person as defined in

National Instrument 43-101 Standards of Disclosure for Mineral

Projects and is responsible for preparing the technical information

contained in this news release. He has verified the data by

reviewing the detailed information of the geological and

engineering staff and independent qualified person reports as well

as visiting the Waterberg Project site regularly.

About Platinum Group Metals

Ltd.

Platinum Group is the operator of the Waterberg

Project, a bulk mineable underground palladium deposit in northern

South Africa. Waterberg was discovered by the Company and has the

potential to be a low-cost producer of palladium, platinum, rhodium

and gold.

On behalf of the Board of

Platinum Group Metals Ltd.

Frank R. HallamCFO, Corporate Secretary and

Director

For further information

contact: R. Michael Jones,

President or Kris Begic, VP, Corporate

Development Platinum Group Metals Ltd.,

Vancouver Tel: (604) 899-5450 / Toll Free: (866)

899-5450 www.platinumgroupmetals.net

Disclosure

The Toronto Stock Exchange and the NYSE American

have not reviewed and do not accept responsibility for the accuracy

or adequacy of this news release, which has been prepared by

management.

This press release contains forward-looking

information within the meaning of Canadian securities laws and

forward-looking statements within the meaning of U.S. securities

laws (collectively “forward-looking statements”). Forward-looking

statements are typically identified by words such as: believe,

expect, anticipate, intend, estimate, plans, postulate and similar

expressions, or are those, which, by their nature, refer to future

events. All statements that are not statements of historical fact

are forward-looking statements. Forward-looking statements in

this press release include, without limitation, statements

regarding the completion of a DFS by approximately July 31, 2019;

Waterberg Project’s potential to be a bulk mineable, low cost,

dominantly palladium mine producing platinum and palladium based on

a fully mechanized mine plan; the potential for the Company to

obtain financing to repay and discharge remaining amounts of

secured debt and for working capital purposes; new business

opportunities; and corporate and strategic alternatives.

Mineral resource and reserve estimates are also forward-looking

statements because such estimates involve estimates of

mineralization that may be encountered in the future if a

production decision is made, as well as estimates of future costs

and values. Although the Company believes the forward-looking

statements in this press release are reasonable, it can give no

assurance that the expectations and assumptions in such statements

will prove to be correct. The Company cautions investors that any

forward-looking statements by the Company are not guarantees of

future results or performance and that actual results may differ

materially from those in forward-looking statements as a result of

various factors, including the Company’s inability to generate

sufficient cash flow or raise sufficient additional capital to make

payment on its indebtedness, and to comply with the terms of such

indebtedness; additional financing requirements; the Company’s

credit facility (the “LMM Facility”) with Liberty Metals &

Mining Holdings, LLC (“LMM”) is, and any new indebtedness may be,

secured and the Company has pledged its shares of Platinum Group

Metals (RSA) Proprietary Limited (“PTM RSA”), and PTM RSA has

pledged its shares of Waterberg JV Resources (Pty) Limited

(“Waterberg JV Co.”) to Liberty Metals & Mining Holdings, LLC,

a subsidiary of LMM, under the LMM Facility, which potentially

could result in the loss of the Company’s interest in PTM RSA and

the Waterberg Project in the event of a default under the LMM

Facility or any new secured indebtedness; the Company’s history of

losses and negative cash flow; the Company’s ability to continue as

a going concern; the Company’s properties may not be brought into a

state of commercial production; uncertainty of estimated

production, development plans and cost estimates for the Waterberg

Project; discrepancies between actual and estimated mineral

reserves and mineral resources, between actual and estimated

development and operating costs, between actual and estimated

metallurgical recoveries and between estimated and actual

production; fluctuations in the relative values of the U.S. Dollar,

the Rand and the Canadian Dollar; volatility in metals prices; the

failure of the Company or the other shareholders to fund

their pro rata share of funding obligations for the Waterberg

Project; any disputes or disagreements with the other shareholders

of Waterberg JV Co., Mnombo Wethu Consultants (Pty) Ltd. or Maseve;

completion of a DFS for the Waterberg Project is subject to

economic analysis requirements; the ability of the Company to

retain its key management employees and skilled and experienced

personnel; conflicts of interest; litigation or other

administrative proceedings brought against the Company; actual or

alleged breaches of governance processes or instances of fraud,

bribery or corruption; the Company may become subject to the U.S.

Investment Company Act; exploration, development and mining risks

and the inherently dangerous nature of the mining industry, and the

risk of inadequate insurance or inability to obtain insurance to

cover these risks and other risks and uncertainties; property and

mineral title risks including defective title to mineral claims or

property; changes in national and local government legislation,

taxation, controls, regulations and political or economic

developments in Canada and South Africa; equipment shortages and

the ability of the Company to acquire necessary access rights and

infrastructure for its mineral properties; environmental

regulations and the ability to obtain and maintain necessary

permits, including environmental authorizations and water use

licences; extreme competition in the mineral exploration industry;

delays in obtaining, or a failure to obtain, permits necessary for

current or future operations or failures to comply with the terms

of such permits; risks of doing business in South Africa, including

but not limited to, labour, economic and political instability and

potential changes to and failures to comply with legislation; the

Company’s common shares may be delisted from the NYSE American or

the TSX if it cannot maintain or regain compliance with the

applicable listing requirements; and other risk factors described

in the Company’s most recent Form 20-F annual report, annual

information form and other filings with the SEC and Canadian

securities regulators, which may be viewed at www.sec.gov and

www.sedar.com, respectively. Proposed changes in the mineral

law in South Africa if implemented as proposed would have a

material adverse effect on the Company’s business and potential

interest in projects. Any forward-looking statement speaks only as

of the date on which it is made and, except as may be required by

applicable securities laws, the Company disclaims any intent or

obligation to update any forward- looking statement, whether as a

result of new information, future events or results or

otherwise.

Estimates of mineralization and other technical

information included herein have been prepared in accordance with

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”). The definitions of proven and probable

reserves used in NI 43-101 differ from the definitions in SEC

Industry Guide 7. Under SEC Industry Guide 7 standards, a

“final” or “bankable” feasibility study is required to report

reserves, the three-year historical average price is used in any

reserve or cash flow analysis to designate reserves and the primary

environmental analysis or report must be filed with the appropriate

governmental authority. As a result, the reserves reported by the

Company in accordance with NI 43-101 may not qualify as “reserves”

under SEC Industry Guide 7. In addition, the terms “mineral

resource” and “measured mineral resource” are defined in and

required to be disclosed by NI 43-101; however, these terms are not

defined terms under SEC Industry Guide 7 and historically have not

been permitted to be used in reports and registration statements

filed with the SEC pursuant to SEC Industry Guide 7. Mineral

resources that are not mineral reserves do not have demonstrated

economic viability. Investors are cautioned not to assume that any

part or all of the mineral deposits in these categories will ever

be converted into reserves. Accordingly, descriptions of the

Company’s mineral deposits in this press release may not be

comparable to similar information made public by U.S. companies

subject to the reporting and disclosure requirements of SEC

Industry Guide 7.

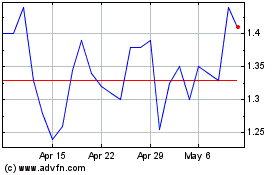

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

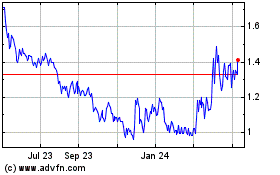

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Apr 2023 to Apr 2024