Filed pursuant to Rule 424(b)(5)

Registration No. 333-250904

Prospectus Supplement

(To prospectus dated December 2, 2020)

$3,600,000

Common Stock

PEDEVCO

Corp. (the

“Company”,

“we”,

or “us”)

has, which we refer to as the Sales Agreement, with Roth

Capital Partners, LLC, or Roth Capital Partners, the

“Sales

Agent,” relating to the issuance and sale of our

common stock, par value $0.001 per share offered by this

prospectus supplement and the accompanying prospectus. In

accordance with the terms of the Sales Agreement, we may offer and

sell shares of our comment stock under this prospectus supplement

and the accompanying prospectus, having an aggregate offering price

of up to $3,600,000 from time to time through or to Roth Capital

Partners, as sales agent or principal.

Our

common stock is listed on the NYSE American under the symbol

“PED.”

On November 16, 2021, the last reported sales price of our common

stock was $1.29.

Sales of shares of our common stock under this

prospectus supplement, if any, may be made by any method deemed to

be an “at the market

offering” as defined in

Rule 415 under the Securities Act of 1933, as amended (the

“Securities

Act”).

The Sales Agent is not required to sell any

specific number or dollar amount of securities. Instead, the Sales

Agent has agreed to use its commercially reasonable efforts

consistent with its normal trading and sales practices, on mutually

agreed terms between the Sales Agent and the Company. There is no

arrangement for funds to be received in any escrow, trust or

similar arrangement. The Sales Agent will be entitled to

compensation under the terms of the Sales Agreement at a commission

rate equal to 3.0% of the gross sales price from sales of shares

under this offering, provided that the first $40,000 of fees

payable under the Sales Agreement is to be refunded to the Company.

We will use the net proceeds from any sales under this prospectus

supplement as described under “Use

of Proceeds”.

The

amount of proceeds we receive from sales of our common stock, if

any, will depend on the number of shares actually sold and the

offering price of such shares.

In

connection with the sale of common stock on our behalf, the Sales

Agent will be deemed to be an underwriter within the meaning of the

Securities Act, and its compensation as the Sales Agent will be

deemed to be underwriting commissions or discounts. We have agreed

to provide indemnification and contribution to the Sales Agent with

respect to certain liabilities, including liabilities under the

Securities Act.

As

of November 17, 2021, the aggregate market value of our voting and

non-voting common stock held by non-affiliates pursuant to General

Instruction I.B.6. of Form S-3 was $58,819,742 which was calculated

based on 84,210,203 shares of our common stock outstanding held by

non-affiliates and at a price of $2.11 per share, the closing price

of our common stock on October 1, 2021. Pursuant to General

Instruction I.B.6 of Form S-3, in no event will we sell shares

pursuant to this prospectus supplement with a value of more than

one-third of the aggregate market value of our common stock held by

non-affiliates in any 12-month period, so long as the aggregate

market value of our common stock held by non-affiliates is less

than $75,000,000. We have sold $15,952,752 of shares of common

stock pursuant to General Instruction I.B.6 of Form S-3 during the

prior 12-month calendar period that ends on, and includes, the date

of this prospectus supplement.

Because

there is no minimum offering amount required as a condition to

close this offering, the actual total public offering amount,

commissions and net proceeds to us, if any, are not determinable at

this time. There is no arrangement to place proceeds of the

offering in escrow, trust or similar arrangement. See

“Plan of

Distribution.”

Investing

in the Shares involves a high degree of risk. Before deciding

whether to invest in our securities, you should consider carefully

the risks that we have described under the caption

“Risk

Factors” beginning on page S-9 of this

prospectus supplement, on page 1 of the

accompanying prospectus and under the caption “Risk

Factors” in our most recently filed Annual Report on Form

10-K and most recently filed Quarterly Reports on Form 10-Q, each

as filed with the Securities and Exchange Commission, which are

incorporated herein by reference in their entirety.

Neither

the U.S. Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

Lead Agent

Roth Capital Partners

Co-Agent

EF Hutton

division of Benchmark Investments, LLC

The date of this prospectus supplement is November 17,

2021.

TABLE OF CONTENTS

Prospectus Supplement

|

|

|

|

|

S-1

|

|

|

S-3

|

|

|

S-4

|

|

|

S-8

|

|

|

S-9

|

|

|

S-17

|

|

|

S-17

|

|

|

S-17

|

|

|

S-18

|

|

|

S-19

|

|

|

S-19

|

|

|

S-20

|

|

|

S-21

|

TABLE OF CONTENTS

Prospectus

|

|

|

|

|

Page

|

|

About

This Prospectus

|

1

|

|

Risk

Factors

|

1

|

|

About

PEDEVCO

|

1

|

|

Forward-Looking

Statements

|

1

|

|

Use

of Proceeds

|

3

|

|

Description

of Capital Stock

|

3

|

|

Description

of Warrants

|

6

|

|

Description

of Units

|

7

|

|

Plan

of Distribution

|

8

|

|

Legal

Matters

|

9

|

|

Experts

|

9

|

|

Where

You Can Find More Information

|

9

|

|

Incorporation

of Certain Documents by Reference

|

10

|

ABOUT

THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus, dated December 2, 2020, are part of a registration

statement on Form S-3 (File No. 333-250904) that we filed with the

Securities and Exchange Commission, utilizing a

“shelf”

registration process on November 23, 2020 and that was declared

effective on December 2, 2020. Under this process, we may sell from

time to time in one or more offerings up to an aggregate of

$100,000,000 in our securities described in the accompanying

prospectus. To date, we have sold $15,952,752 of securities under

the “shelf”

registration statement, when not including securities proposed to

be sold in this offering.

You

should rely only on the information contained or incorporated by

reference into this prospectus supplement, the accompanying

prospectus and any free writing prospectus. We have not, and the

Sales Agent have not, authorized anyone to provide you with

different information. If anyone provides you with different or

additional information, you should not rely on it. We are not, and

the Sales Agent are not, making an offer to sell these securities

in any state or jurisdiction where the offer or sale is not

permitted. You should not assume that the information contained in

this prospectus supplement, the accompanying prospectus and any

free writing prospectus is accurate on any date subsequent to the

date set forth on the front of the document or that any information

we have incorporated by reference is correct on any date subsequent

to the date of the document incorporated by reference, even though

this prospectus supplement, the accompanying prospectus and any

free writing prospectus is delivered or securities are sold on a

later date. We have filed with the SEC a registration statement on

Form S-3 with respect to the securities offered hereby. This

prospectus supplement and the accompanying prospectus do not

contain all of the information set forth in the registration

statement, parts of which are omitted in accordance with the rules

and regulations of the SEC. For further information with respect to

us and the securities offered hereby, reference is made to the

registration statement and the exhibits that are a part of the

registration statement. We will disclose any material changes in

our affairs in a post-effective amendment to the registration

statement and the accompanying prospectus of which this prospectus

supplement is a part, a future prospectus supplement, a free

writing prospectus or a future filing with the Securities and

Exchange Commission incorporated by reference in this prospectus

supplement. It is important for you to read and consider all the

information contained in this prospectus supplement and the

accompanying prospectus, including the documents incorporated by

reference therein, in making your investment decision.

This

document is in two parts. The first part is this prospectus

supplement, which adds to and updates information contained in the

accompanying prospectus and the documents incorporated by reference

into the accompanying prospectus. The second part is the

accompanying prospectus, which gives more general information, some

of which may not apply to this offering of shares. This prospectus

supplement adds, updates and changes information contained in the

accompanying prospectus and the information incorporated by

reference. To the extent the information contained in this

prospectus supplement differs or varies from the information

contained in the accompanying prospectus or any document

incorporated by reference, the information in this prospectus

supplement shall control.

We further note that

the representations, warranties and covenants made by us or

the Sales Agent

in any

agreement that is filed as an exhibit to any document that is

incorporated by reference in the accompanying prospectus were made

solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties

to such agreements, and should not be deemed to be a

representation, warranty or covenant to you. Moreover, such

representations, warranties or covenants were accurate only as of

the date when made. Accordingly, such representations, warranties

and covenants should not be relied on as accurately representing

the current state of our affairs.

Persons outside the United States who come into possession of this

prospectus supplement or the accompanying prospectus must inform

themselves about, and observe any restrictions relating to, the

offering of the securities and the distribution of this prospectus

supplement and accompanying prospectus outside of the United

States.

Our

logo and other trade names, trademarks, and service marks of

PEDEVCO Corp. appearing in this prospectus supplement and the

accompanying prospectus are the property of our company. Other

trade names, trademarks, and service marks appearing in this

prospectus supplement and the accompanying prospectus are the

property of their respective holders.

The market data and certain other statistical

information used throughout this prospectus supplement and the

accompanying prospectus are based on independent industry

publications, government publications and other published

independent sources. Although we believe that these third-party

sources are reliable and that the information is accurate and

complete, we have not independently verified the information. Some

data is also based on our good faith estimates. While we believe

the market data included in this prospectus supplement, the

accompanying prospectus and the information incorporated herein and

therein by reference is generally reliable and is based on

reasonable assumptions, such data involves risks and uncertainties

and is subject to change based on various factors, including those

discussed under the heading “Risk

Factors” beginning on page S-9 of this prospectus supplement and on page

1 of the accompanying

prospectus.

All references to “we”, “our”, “us”, the “Company”,

and “PEDEVCO”

in this prospectus supplement mean PEDEVCO Corp. and all entities

owned or controlled by us except where it is made clear that the

term means only the parent company. The term

“you” refers to a prospective investor. Please

carefully read this prospectus supplement, the accompanying

prospectus, any free writing prospectus and any pricing supplement,

in addition to the information contained in the documents we refer

to under the headings “Where

You Can Find More Information” and “Incorporation of Certain Documents by

Reference”.

In

addition, unless the context otherwise requires and for the

purposes of this prospectus and the accompanying prospectus

supplement:

●

"Bbl" refers to one stock tank barrel,

or 42 U.S. gallons liquid volume, used in this report in reference

to crude oil or other liquid hydrocarbons;

●

"Boe” refers "Boe" refers to barrels of oil

equivalent, determined using the ratio of one Bbl of crude oil,

condensate, or natural gas liquids, to six Mcf of natural

gas;

● “Bopd”

refers to barrels of oil day;

● “Exchange

Act” refers to the

Securities Exchange Act of 1934, as amended;

● “Mcf”

refers to a thousand cubic feet of natural gas;

● “NGL”

refers to natural gas liquids;

● “NYMEX”

New York Mercantile Exchange;

● “SEC”

or the “Commission”

refers to the United States Securities and Exchange Commission;

and

● “Securities

Act” refers to the

Securities Act of 1933, as amended.

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in this prospectus supplement, the

prospectus, any free writing prospectus we may file, the documents

or information incorporated by reference herein, other reports

filed by us under the Exchange Act contain forward-looking

statements within the meaning of Section 27A of the Securities Act,

Section 21E of the Exchange Act, and the Private Securities

Litigation Reform Act of 1995, as amended. These forward-looking

statements are based on our management’s belief and

assumptions and on information currently available to our

management. Although we believe that the expectations reflected in

these forward-looking statements are reasonable, these statements

relate to future events or our future financial performance, and

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, levels of activity, performance

or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or

implied by these forward-looking statements.

In some

cases, you can identify forward-looking statements by terminology

such as “may,” “should,”

“expects,”

“intends,”

“plans,”

“anticipates,”

“believes,”

“estimates,”

“predicts,”

“potential,”

“continue” or the negative

of these terms or other comparable terminology. These statements

are only predictions. You should not place undue reliance on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors, which are, in some cases,

beyond our control and which could materially affect results.

Factors that may cause actual results to differ materially from

current expectations include, among other things, those listed

under, and incorporated by reference in, “Risk Factors” and

elsewhere in this prospectus supplement.

If

one or more of these risks or uncertainties occur, or if our

underlying assumptions prove to be incorrect, actual events or

results may vary significantly from those implied or projected by

the forward-looking statements. No forward-looking statement is a

guarantee of future performance. You should read this prospectus,

those documents incorporated by reference herein, and those

documents which we have filed with the SEC as exhibits to the

registration statement, of which this prospectus is a part,

completely and with the understanding that our actual future

results may be materially different from any future results

expressed or implied by these forward-looking

statements.

Forward-looking

statements speak only as of the date of this prospectus supplement

or the date of any document incorporated by reference in this

prospectus supplement or any free writing prospectus, as

applicable. We anticipate that subsequent events and developments

will cause our views to change. However, while we may elect to

update these forward-looking statements at some point in the

future, we have no current intention of doing so except to the

extent required by applicable law. You should therefore not rely on

these forward-looking statements as representing our views as of

any date subsequent to the date of this prospectus.

You should also consider carefully the statements

under “Risk Factors” and

other sections of this prospectus supplement and the accompanying

prospectus, and the documents we incorporate by reference herein or

therein, or which we file as part of any free writing prospectus,

which address additional facts that could cause our actual results

to differ from those set forth in the forward-looking statements.

We caution investors not to place significant reliance on the

forward-looking statements contained in this prospectus supplement,

any free writing prospectus, and the documents we incorporate by

reference. We undertake no obligation to publicly update or review

any forward-looking statements, whether as a result of new

information, future developments or otherwise, except as otherwise

required by law.

PROSPECTUS

SUPPLEMENT SUMMARY

This summary is not complete and does not contain all of the

information that you should consider before investing in the

securities offered by this prospectus supplement and accompanying

prospectus. You should read this summary together with the entire

prospectus supplement and the accompanying prospectus, including

our consolidated financial statements, the notes to those

consolidated financial statements and the other documents that are

incorporated by reference in this prospectus supplement and the

accompanying prospectus, before making an investment decision. See

“Risk

Factors” beginning on page S-9 of

this prospectus supplement, and beginning on

page 1 of the accompanying prospectus, along with the

risk factors in our most recent Annual Report on Form 10-K, and our

most recent Quarterly Reports on Form 10-Q, which are incorporated

by reference herein, for a discussion of the risks involved in

investing in our securities.

General Overview

We are

an oil and gas company focused on the acquisition and development

of oil and natural gas assets where the latest in modern drilling

and completion techniques and technologies have yet to be applied.

In particular, we focus on legacy proven properties where there is

a long production history, well-defined geology, and existing

infrastructure that can be leveraged when applying modern field

management technologies. Our current properties are located in the

San Andres formation of the Permian Basin situated in West Texas

and eastern New Mexico (the “Permian Basin”) and in

the Denver-Julesberg Basin (“D-J Basin”) in Colorado.

As of September 30, 2021, we held 33,392 net Permian Basin acres located in

Chaves and Roosevelt Counties, New Mexico, through our wholly-owned

operating subsidiary, Pacific Energy Development Corp.

(“PEDCO”), which we refer

to as our “Permian

Basin Asset,” and approximately 11,580 net D-J Basin acres located in Weld

and Morgan Counties, Colorado, through our wholly-owned operating

subsidiary, Red Hawk Petroleum, LLC (“Red Hawk”), which asset

we refer to as our “D-J Basin Asset.” As of

September 30, 2021, we held interests in 382 gross (303 net) wells

in our Permian Basin Asset of which 35 are active producers, 14 are

active injectors and two are active Saltwater Disposal Wells

(“SWDs”), all of which are held by PEDCO and operated

by its wholly-owned operating subsidiaries, and interests in 74

gross (21.0 net) wells in our D-J Basin Asset, of which 18 gross

(16.2 net) wells are operated by Red Hawk and currently producing,

35 gross (5.2 net) wells are non-operated, and 21 wells have an

after-payout interest.

Strategy

We

believe that horizontal development and exploitation of

conventional assets in the Permian Basin and development of the

Wattenberg and Wattenberg Extension in the D-J Basin, represent

among the most economic oil and natural gas plays in the U.S. We

plan to optimize our existing assets and opportunistically seek

additional acreage proximate to our currently held core acreage, as

well as other attractive onshore U.S. oil and gas assets that fit

our acquisition criteria, that Company management believes can be

developed using our technical and operating expertise and be

accretive to stockholder value.

Specifically,

we seek to increase stockholder value through the following

strategies:

●

Grow

production, cash flow, and reserves by developing our operated

drilling inventory and participating opportunistically in

non-operated projects. We believe our extensive inventory of

drilling locations in the Permian Basin and the D-J Basin, combined

with our operating expertise, will enable us to continue to deliver

accretive production, cash flow, and reserves growth. We have

identified approximately 150 gross drilling locations across our

Permian Basin acreage based on 20-acre spacing. We believe the

location, concentration, and scale of our core leasehold positions,

coupled with our technical understanding of the reservoirs will

allow us to efficiently develop our core areas and to allocate

capital to maximize the value of our resource base.

●

Apply modern

drilling and completion techniques and technologies. We own

and intend to own additional properties that have been historically

underdeveloped and underexploited. We believe our attention to

detail and application of the latest industry advances in

horizontal drilling, completions design, frac intensity, and

locally optimal frac fluids will allow us to successfully develop

our properties.

●

Optimization of

well density and configuration. We own properties that are

legacy conventional oil fields characterized by widespread vertical

development and geological well control. We utilize the extensive

petrophysical and production data of such legacy properties to

confirm optimal well spacing and configuration using modern

reservoir evaluation methodologies.

●

Maintain a high

degree of operational control. We believe that by retaining

high operational control, we can efficiently manage the timing and

amount of our capital expenditures and operating costs, and thus

key in on the optimal drilling and completions strategies, which we

believe will generate higher recoveries and greater rates of return

per well.

●

Leverage

extensive deal flow, technical and operational experience to

evaluate and execute accretive acquisition opportunities.

Our management and technical teams have an extensive track record

of forming and building oil and gas businesses. We also have

significant expertise in successfully sourcing, evaluating, and

executing acquisition opportunities. We believe our understanding

of the geology, geophysics, and reservoir properties of potential

acquisition targets will allow us to identify and acquire highly

prospective acreage to grow our reserve base and maximize

stockholder value.

●

Preserve

financial flexibility to pursue organic and external growth

opportunities. We intend to maintain a disciplined financial

profile that will provide us flexibility across various commodity

and market cycles. We intend to utilize our strategic partners and

public currency to continuously fund development and

operations.

Our strategy is to be the operator and/or a

significant working interest owner, directly or through our

subsidiaries and joint ventures, in the majority of our acreage so

that we can dictate the pace of development in order to execute our

business plan. Our 2021 development plan includes several projects

delayed from our 2019 Phase II Permian Basin Asset development

program, which were put on hold through 2020 due to the COVID-19

outbreak and the related low oil price environment through most of

2020. In late 2020, we resumed work on these carryover projects,

including the completion of a SWD well in the Chaveroo field

(Chaves and Roosevelt Counties, New Mexico) which was brought

online in September 2020. In September 2020, we brought online one

horizontal San Andres well from our 2019 Phase I Permian Basin

Asset development program that was previously shut in due to salt

water disposal capacity constraints. In January 2021, we initiated

production hookup and commencement of two horizontal San Andres

wells drilled in our 2019/2020 Phase II Permian Basin Asset

development program. Over the remainder of 2021, we plan to permit

up to ten horizontal San Andres wells in our Permian Basin Asset

and anticipate drilling and completing at least two of these wells

in late 2021 or early 2022, with the remainder planned to be

drilled and completed in 2022. We have also completed several well

reactivation projects and completed several enhancement and

facilities projects across our operated Permian Basin

Asset. We also plan to spend

approximately $1.2 million for participation in four non-operated

well projects (with a working interest of 6.52%) on our D-J Basin

Asset that were drilled and completed in the third quarter of 2021.

We expect to pay those costs and begin to receive revenue from

those four wells in the fourth quarter of 2021. Additionally, we

have elected to participate in eight wells in the D-J Basin that

are currently planned to be drilled in the first quarter of 2022,

at a net cost of approximately $2.1 million (with a working

interest of 4.699%) pursuant to well proposals received from third

party operators on lands in which we share a leasehold interest;

provided that no money has been spent to date on these eight well

proposals. We have advanced our business development activities in

the D-J Basin over the past year, which we believe will add

opportunities for growth and development. We plan to continue to

evaluate D-J Basin well proposals as received from third party

operators and participate in those we deem most economic and

prospective. Our 2021 development program is based upon our current

outlook for the remainder of the year and is subject to revision,

if and as necessary, to react to market conditions, product

pricing, contractor availability, requisite permitting and capital

availability, additional non-operated well projects on our D-J

Basin Asset that may become available, capital allocation changes

between assets, acquisitions, divestitures and other adjustments

determined by the Company in the best interest of its shareholders

while prioritizing our financial strength and

liquidity.

We expect that we will have sufficient cash

available to meet our needs over the foreseeable future, including

to fund the remainder of our 2021 development program, discussed

above, which cash we anticipate being available from (i) projected

cash flow from our operations, (ii) existing cash on hand, (iii)

equity infusions or loans (which may be convertible) made available

from SK Energy LLC (“SK

Energy”), which is 100%

owned and controlled by Simon Kukes, our Chief Executive Officer

and director, which funding SK Energy is under no obligation to

provide, (iv) public or private debt or equity financings,

including funds which we may raise through the sale of the Shares,

and (v) funding through credit or loan facilities. In addition, we

may seek additional funding through asset sales, farm-out

arrangements, and credit facilities to fund potential

acquisitions during the remainder of 2021.

Impact of COVID-19

In December 2019, a novel strain of coronavirus,

which causes the infectious disease known as COVID-19, was reported

in Wuhan, China. The World Health Organization declared COVID-19 a

“Public Health

Emergency of International Concern” on January 30, 2020, and a global pandemic

on March 11, 2020. COVID-19 and the governmental responses thereto

significantly reduced worldwide economic activity during much of

2020, and continues to threaten the global economy, as variants and

mutations of the disease continue to spread, even as vaccines have

become more widely available. While oil and gas prices have

increased above pre-pandemic levels, it is not possible at this

time for the Company to estimate the full impact that COVID-19 will

have on the Company’s business in the future as such estimate

would need to be based on whether or not COVID-19 continues to

spread and the effectiveness of the containment of the virus, by

the governments of countries affected and in which the Company

operates. However, the Company’s operations have previously

been disrupted, and may be disrupted again in the future due to

COVID-19. The COVID-19 outbreak and mitigation measures have also

had an adverse impact on global economic conditions, as well as an

adverse effect on the Company’s business and financial

condition and may continue to have an adverse effect on the

Company, including on its potential to conduct financings on terms

acceptable to the Company, if at all. The Company implemented

temporary precautionary measures intended to help minimize the risk

of the virus to its employees, vendors, and guests, including

limiting the number of occupants at the Company’s Houston

headquarters and requiring all others to work remotely, and

discouraged employee attendance at in-person work-related meetings,

which could negatively affect the Company’s business, which

measures have recently eased in accordance with federal, state and

local guidance, and the vaccination of substantially all of the

Company’s office-based employees. The extent to which the

COVID-19 outbreak will continue to impact the Company’s

results will depend on future developments that are highly

uncertain and cannot be predicted, including new information that

may emerge concerning the severity of the virus, the continued

availability and efficacy of vaccines and booster shots, the

willingness of individuals to be vaccinated initially, and to

obtain booster shots, the effect of virus mutations, and the

actions to contain its impact. Any future decrease in the price of

oil, or the demand for oil and gas, as a result of COVID-19 or

otherwise, will likely have a negative impact on our results of

operations and cash flows.

In response to the effects of COVID-19, the

Company has adopted policies, procedures, and practices both in its

Houston office headquarters and across its field operations to

protect its employees, contractors, and guests from COVID-19,

including the adoption of a COVID-19 Response Plan, implementation

of contractor questionnaires to assess COVID-19 risk and exposure

prior to entering any Company facility or worksite, adopting best

practices, guidelines and protocols recommended by the Centers for

Disease Control (the “CDC”) and the Office of the Texas Governor for

the prevention of exposure and spread of COVID-19, and instituting

twice-monthly management calls discussing the COVID-19 pandemic and

the Company’s ongoing response to the COVID-19 pandemic and

effectiveness thereof. Given the Company’s robust online

systems and workflow practices and procedures, the Company has not

experienced any material challenges or reductions in efficiency or

effectiveness of its office-based workforce, while its field

personnel continue to attend to their daily field operations

uninterrupted, while mindful of social distancing and other

preventative measures and safeguards recommended by the CDC, and

subject to the CDC’s updated guidance.

We plan to continue to closely monitor the global

energy markets and oil and gas pricing, with the remainder of

our 2021 development plan being

subject to revision, if and as necessary, to react to market

conditions in the best interest of its shareholders, while

prioritizing its financial strength and

liquidity.

Risks That We Face

An investment in our securities involves a high

degree of risk. You should carefully consider the risks summarized

below. The risks are discussed more fully in, and incorporated by

reference in, the “Risk Factors”

section of this prospectus supplement and the accompanying

prospectus. These risks include, but are not limited to, the

following:

● Risks

associated with this offering, including dilution investors will

experience; the use of proceeds associated therewith; and further

dilution investors may experience;

● The

future price of oil, natural gas and NGL;

● The

effect of COVID-19 on the Company’s operations, future

prospects, the value of its properties, and the economy in general,

including the related effect on the supply and demand, and ultimate

price of oil and natural gas;

● Current

and future declines in economic activity and rescissions, and their

effect on the Company, its property, prospects and the supply and

demand, and ultimate price of oil and natural

gas;

● The

status and availability of oil and natural gas gathering,

transportation, and storage facilities owned and operated by third

parties;

● An

increase in the differential between the NYMEX or other benchmark

prices of oil and natural gas and the wellhead price we receive for

our production may adversely affected our business, financial

condition, and results of operations;

● New

or amended environmental legislation or regulatory initiatives

which could result in increased costs, additional operating

restrictions, or delays, or have other adverse effects on

us;

● The

effect of future shut-ins of our operated production, should market

conditions significantly deteriorate;

● Write-downs

of a material portion of our assets due to the recent economic

downturn resulting from COVID-19 or otherwise;

● Our

need for additional capital to complete future acquisitions,

conduct our operations and fund our business, and our ability to

obtain such necessary funding on favorable terms, if at

all;

● Our

ability to generate sufficient cash flow to meet any future debt

service and other obligations due to events beyond our

control;

● The

fact that all our assets and operations are located in the Permian

Basin and the D-J Basin, making us vulnerable to risks associated

with operating in only two geographic areas;

● The

speculative nature of our oil and gas operations, and general risks

associated with the exploration for, and production of oil and gas;

including accidents, equipment failures or mechanical problems

which may occur while drilling or completing wells or in production

activities; operational hazards and unforeseen interruptions for

which we may not be adequately insured; the threat and impact of

terrorist attacks, cyber-attacks or similar hostilities; declining

reserves and production; and losses or costs we may incur as a

result of title deficiencies or environmental issues in the

properties in which we invest, any one of which may adversely

impact our operations;

● Potential

conflicts of interest that could arise for certain members of our

management team and board of directors that hold management

positions with other entities and our largest

stockholder;

● The

limited control we have over activities on properties we do not

operate;

● The

estimates of the value of our oil and gas properties and accounting

in connection therewith;

● Intense

competition in the oil and natural gas

industry;

● Our

competitors use of superior technology and data resources that we

may be unable to afford or obtain the use of;

●

Changes in the legal and regulatory

environment governing the oil and natural gas industry, including

new or amended environmental legislation or regulatory initiatives

which could result in increased costs, additional operating

restrictions, or delays, or have other adverse effects on

us;

● Uncertainties

associated with enhanced recovery methods which may result in us

not realizing an acceptable return on our investments in such

projects or suffering losses;

● Requirements

that we must drill on certain of acreage in order to hold such

acreage by production;

● Improvements

in or new discoveries of alternative energy technologies that could

have a material adverse effect on our financial condition and

results of operations;

●

Future litigation or governmental proceedings

which could result in material adverse consequences, including

judgments or settlements;

● The

currently illiquid and volatile market for our common

stock;

● Our

dependance on the continued involvement of our present

management;

● The

fact that Mr. Simon Kukes, our Chief Executive Officer and a member

of board of directors, beneficially owns a majority of our common

stock and that his interests may be different from other

shareholders; and

● Our

ability to maintain the listing of our common stock on the NYSE

American.

Corporate Information

Our

principal executive offices are located at 575 N. Dairy Ashford,

Suite 210, Houston, Texas 77079, and our telephone number is (713)

221-1768.

Additional Information

For

additional information about us, please refer to the documents set

forth under “Information Incorporated by

Reference” in this prospectus supplement,

including our Annual Report on Form 10-K for the year ended

December 31, 2020, and our Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2021, June 30, 2021 and September 30,

2021, which are incorporated by reference herein.

Additional information about us is available on

our website at www.pedevco.com.

We do not incorporate the information on or accessible through our

websites into this prospectus supplement or the accompanying

prospectus, and you should not consider any information on, or that

can be accessed through, our websites as part of this prospectus

supplement or the accompanying

prospectus.

The following is a brief summary of some of the terms of the

offering and is qualified in its entirety by reference to the more

detailed information appearing elsewhere in this prospectus

supplement and the accompanying prospectus. For a more complete

description of the terms of the Shares, see the “Description of the

Securities We Are Offering” section in this

prospectus supplement.

|

Issuer

|

|

PEDEVCO

Corp.

|

|

|

|

|

|

Common Stock Offered

|

|

Shares

of our common stock having an aggregate offering price of up to

$3,600,000 (the “Shares”).

|

|

|

|

|

|

Manner of Offering

|

|

“At

the market offering” that may be made from time to time

through or to, Roth Capital Partners, as sales agent or principal.

See “Plan of Distribution” on

page S-18.

|

|

|

|

|

|

Common Stock to Be Outstanding After This Offering(1)

|

|

Up to

87,000,900 shares, assuming sales of 2,790,697 shares of our common

stock in this offering at an offering price at a price of $1.29 per

share, which was the closing price of our common stock on the NYSE

American on November 16, 2021. The actual number of shares issued

will vary depending on the sales price under this

offering.

|

|

|

|

|

|

NYSE Symbol

|

|

“PED”

|

|

|

|

|

|

Use of Proceeds

|

|

Because

there is no minimum offering amount required as a condition to

close this offering, the actual public offering amount, commissions

to Roth Capital Partners and proceeds to us, if any, are not

determinable at this time. There can be no assurance that we will

sell any Shares under the Sales Agreement. We intend to use the net

proceeds, if any, from this offering for working capital and

general corporate purposes and capital expenditures. We may also

use a portion of the net proceeds to acquire or invest in

complementary businesses or products; however, we have no current

commitments or obligations to do so. Pending such use, we may

invest the net proceeds in short-term interest-bearing accounts,

securities or similar investments. See “Use of

Proceeds.” on page S-17.

|

|

|

|

|

|

Risk Factors

|

|

An

investment in the Shares involves significant risks. Please refer

to “Risk Factors” beginning on page

S-9 and other information included or incorporated by reference in

this prospectus supplement and the accompanying prospectus for a

discussion of factors you should carefully consider before

investing in the Shares.

|

|

|

|

|

|

Transfer Agent and Registrar

|

|

The

transfer agent and registrar for our common stock is American Stock

Transfer & Trust Company, LLC.

|

(1) The number of shares of common stock outstanding after

the offering is based on 84,210,203 shares of our common stock

outstanding as of November 17, 2021 and the sale of 2,790,697

shares of our common stock at an assumed offering price of $1.29

per share, the last reported sale price of our common stock on the

NYSE American on November 16, 2021, and excludes the

following:

●

1,278,436 shares of common stock issuable upon the exercise of

options outstanding at a weighted-average exercise price of $1.70

per share; and

●

8,000,000 shares of common stock reserved for future issuance under

our equity incentive plans, as well as any automatic increases in

the number of shares of common stock reserved for future issuance

under the plans.

Except

as otherwise indicated, all information in this prospectus assumes

no exercise of outstanding options.

Before making an investment decision, you should

consider the “Risk Factors”

below, in the section

entitled “Risk

Factors” contained under Item 1A

of Part I of our most recent annual report on Form 10-K, and under

“Risk

Factors” under Item 1A

of Part II of our subsequent quarterly reports on Form 10-Q, as the

same may be amended, supplemented or superseded from time to time

by our subsequent filings and reports under the Securities Act or

the Exchange Act, each of which are incorporated by reference in

this prospectus supplement. For more information, see

“Incorporation of Certain Documents by

Reference” and “Where

You Can Find More Information”,

below. The

market or trading price of our securities could decline due to any

of these risks. In addition, please read “Cautionary Note Regarding

Forward-Looking Statements” in this prospectus

supplement, where we describe additional uncertainties associated

with our business and the forward-looking statements included or

incorporated by reference in this prospectus

supplement.

The

securities offered herein are highly speculative and should only be

purchased by persons who can afford to lose their entire investment

in us. You should carefully consider the following risk factors and

the aforementioned risk factors that are incorporated herein by

reference and other information in this prospectus supplement

before deciding to become a holder of our common stock. The risks

and uncertainties described in these incorporated documents and

described below are not the only risks and uncertainties that we

face. Additional risks and uncertainties not presently known to us

may also impair our business operations. If any of these risks

actually occur, our business and financial results could be

negatively affected to a significant extent. In that event, the

trading price of our common stock could decline, and you may lose

all or part of your investment in our common stock.

Our

securities are subject to the following risk factors:

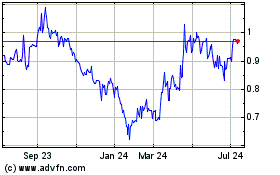

We currently have a sporadic and volatile market for our common

stock, and the market for our common stock is and may remain

sporadic and volatile in the future.

We currently have a

highly sporadic and volatile market for our common stock, which

market is anticipated to remain sporadic and volatile in the

future. Factors that could

affect our stock price or result in fluctuations in the market

price or trading volume of our common stock

include:

|

|

●

|

our

actual or anticipated operating and financial performance and

drilling locations, including reserves estimates;

|

|

|

|

|

|

|

●

|

quarterly

variations in the rate of growth of our financial indicators, such

as net income per share, net income and cash flows, or those of

companies that are perceived to be similar to us;

|

|

|

|

|

|

|

●

|

changes

in revenue, cash flows or earnings estimates or publication of

reports by equity research analysts;

|

|

|

●

|

speculation

in the press or investment community;

|

|

|

|

|

|

|

●

|

public

reaction to our press releases, announcements and filings with the

SEC;

|

|

|

|

|

|

|

●

|

sales

of our common stock by us or other stockholders, or the perception

that such sales may occur;

|

|

|

|

|

|

|

●

|

the

limited amount of our freely tradable common stock available in the

public marketplace;

|

|

|

|

|

|

|

●

|

general

financial market conditions and oil and natural gas industry market

conditions, including fluctuations in commodity

prices;

|

|

|

|

|

|

|

●

|

the

realization of any of the risk factors described herein and/or

incorporated by reference herein;

|

|

|

|

|

|

|

●

|

the

recruitment or departure of key personnel;

|

|

|

|

|

|

|

●

|

commencement

of, or involvement in, litigation;

|

|

|

|

|

|

|

●

|

the

prices of oil and natural gas;

|

|

|

|

|

|

|

●

|

the

success of our exploration and development operations, and the

marketing of any oil and natural gas we produce;

|

|

|

|

|

|

|

●

|

changes

in market valuations of companies similar to ours; and

|

|

|

|

|

|

|

●

|

domestic

and international economic, health, legal and regulatory factors

unrelated to our performance.

|

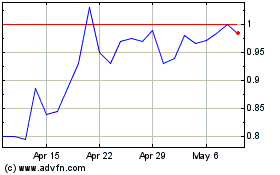

Our common stock is

listed on the NYSE American under the symbol

“PED.”

Our stock price may be impacted by factors that are unrelated or

disproportionate to our operating performance. The stock markets in general have

experienced extreme volatility that has often been unrelated to the

operating performance of particular companies. These broad market

fluctuations may adversely affect the trading price of our common

stock. Additionally, general economic,

political and market conditions, such as recessions, interest rates

or international currency fluctuations may adversely affect the

market price of our common stock. Due to the limited volume of our

shares which trade, we believe that our stock prices (bid, ask and

closing prices) may not be related to our actual value, and

not reflect the actual value of our common stock. Stockholders and

potential investors in our common stock should exercise caution

before making an investment in us.

Additionally,

as a result of the potential illiquidity and sporadic trading of

our common stock, investors may not be interested in owning our

common stock because of the inability to acquire or sell a

substantial block of our common stock at one time. This may have an

adverse effect on the market price of our common stock. In

addition, a stockholder may not be able to borrow funds using our

common stock as collateral because lenders may be unwilling to

accept the pledge of securities having such a limited market. We

cannot assure you that an active trading market for our common

stock will develop or, if one develops, be sustained.

An active and sustained trading market for our common stock may not

develop in the future.

Our

common stock currently trades on the NYSE American, although our

common stock’s trading volume has been low from time to time

and trading in our common stock has historically been sporadic.

Liquid and active trading markets usually result in less price

volatility and more efficiency in carrying out investors’

purchase and sale orders. However, our common stock may continue to

have a sporadic trading volume, and investors may not be interested

in owning our common stock because of the inability to acquire or

sell a substantial block of our common stock at one time. This

could have an adverse effect on the market price of our common

stock. In addition, a stockholder may not be able to borrow funds

using our common stock as collateral because lenders may be

unwilling to accept the pledge of securities having such a limited

market. We cannot assure you that an active trading market for our

common stock will develop or, if one develops, be

sustained.

We have a limited operating history and expect to continue to incur

losses for an indeterminable period of time.

We

have a limited operating history and are engaged in the initial

stages of exploration, development and exploitation of our

leasehold acreage and will continue to be so until commencement of

substantial production from our oil and natural gas properties,

which will depend upon successful drilling results, additional and

timely capital funding, and access to suitable infrastructure.

Companies in their initial stages of development face substantial

business risks and may suffer significant losses. We have generated

substantial net losses and negative cash flows from operating

activities in the past and expect to continue to incur substantial

net losses as we continue our drilling program. In considering an

investment in our common stock, you should consider that there is

only limited historical and financial operating information

available upon which to base your evaluation of our

performance. We have incurred net losses

of $128,108,000 from the date of inception (February 9,

2011) through September 30, 2021. Additionally, we are

dependent on obtaining additional debt and/or equity financing to

roll-out and scale our planned principal business operations.

Management’s plans in regard to these matters consist

principally of seeking additional debt and/or equity financing

combined with expected cash flows from current oil and gas assets

held and additional oil and gas assets that we may acquire. Our

efforts may not be successful, and funds may not be available on

favorable terms, if at all.

We

face challenges and uncertainties in financial planning as a result

of the unavailability of historical data and uncertainties

regarding the nature, scope and results of our future activities.

New companies must develop successful business relationships,

establish operating procedures, hire staff, install management

information and other systems, establish facilities and obtain

licenses, as well as take other measures necessary to conduct their

intended business activities. We may not be successful in

implementing our business strategies or in completing the

development of the infrastructure necessary to conduct our business

as planned. In the event that one or more of our drilling programs

is not completed or is delayed or terminated, our operating results

will be adversely affected and our operations will differ

materially from the activities described in, and incorporated by

reference in, this prospectus supplement. As a result of industry

factors or factors relating specifically to us, we may have to

change our methods of conducting business, which may cause a

material adverse effect on our results of operations and financial

condition. The uncertainty and risks described in, and incorporated

by reference in, this prospectus supplement, may impede our ability

to economically find, develop, exploit, and acquire oil and natural

gas reserves. As a result, we may not be able to achieve or sustain

profitability or positive cash flows provided by our operating

activities in the future.

You may

experience immediate and substantial dilution.

The offering price per share in this offering may

exceed the net tangible book value per share of our common stock.

Assuming that an aggregate of 2,790,697 shares of our common stock

are sold at a price of $1.29 per share pursuant to this prospectus,

which was the last reported sales price of our common stock on the

NYSE American on November 16, 2021, for aggregate net proceeds of

$3.4 million after deducting commissions and estimated aggregate

offering expenses payable by us, you would experience immediate

dilution of $(0.19) per share, representing a difference between

our pro forma as adjusted net tangible book value per share as of

September 30, 2021 after giving effect to this offering and the

assumed offering price. The exercise of outstanding stock options

may result in further dilution of your investment. See

“Dilution” below for

a more detailed discussion of the dilution you will incur if you

purchase our common stock in the offering. Because

the sales of the shares offered hereby will be made directly into

the market or in negotiated transactions, the prices at which we

sell these shares will vary and these variations may be

significant. Purchasers of the shares we sell, as well as our

existing stockholders, will experience significant dilution if we

sell shares at prices significantly below the price at which they

invested.

Management will have broad discretion as to the use of the proceeds

from this offering, and may not use the proceeds

effectively.

Our

management will have broad discretion in the application of the net

proceeds from this offering and could spend the proceeds in ways

that may not improve our results of operations or enhance the value

of our common stock. Our failure to apply these funds effectively

could have a material adverse effect on our business and cause the

price of our common stock to decline.

It is not possible to predict the actual number of shares we will

sell under the sales agreement, or the gross proceeds resulting

from those sales.

Subject

to certain limitations in the Sales Agreement and compliance with

applicable law, we have the discretion to deliver a placement

notice to the Sales Agent at any time throughout the term of the

Sales Agreement. The number of shares that are sold through the

Sales Agent after delivering a placement notice will fluctuate

based on a number of factors, including the market price of the

common stock during the sales period, the limits we set with the

Sales Agent in any applicable placement notice, and the demand for

our common stock during the sales period. Because the price per

share of each share sold will fluctuate during the sales period, it

is not currently possible to predict the number of shares that we

will sell or the gross proceeds we will receive in connection with

those sales.

The common stock offered hereby will be sold in “at the

market offerings”, and investors who buy shares at different

times will likely pay different prices.

Investors

who purchase shares in this offering at different times will likely

pay different prices, and so may experience different levels of

dilution and different outcomes in their investment results. We

will have discretion, subject to market demand, to vary the timing,

prices, and numbers of shares sold in this offering. In addition,

there is no minimum or maximum sales price for shares to be sold in

this offering. Investors may experience a decline in the value of

the shares they purchase in this offering as a result of sales made

at prices lower than the prices they paid.

There may be future sales of our common stock, which could

adversely affect the market price of our common stock and dilute a

shareholder’s ownership of common stock.

The exercise of any options granted to executive

officers and other employees under our equity compensation plans,

and other issuances of our common stock could have an adverse

effect on the market price of the shares of our common stock. Other

than the restrictions set forth in the section titled

“Plan of

Distribution,” we are not restricted from issuing

additional shares of common stock, including any securities that

are convertible into or exchangeable for, or that represent the

right to receive shares of common stock, provided that we are

subject to the requirements of the NYSE American (which generally

requires shareholder approval for any transactions which would

result in the issuance of more than 20% of our then outstanding

shares of common stock or voting rights representing over 20% of

our then outstanding shares of stock). Sales of a substantial

number of shares of our common stock in the public market or the

perception that such sales might occur could materially adversely

affect the market price of the shares of our common stock. Because

our decision to issue securities in any future offering will depend

on market conditions and other factors beyond our control, we

cannot predict or estimate the amount, timing or nature of our

future offerings. Accordingly, our shareholders bear the risk that

our future offerings will reduce the market price of our common

stock and dilute their stock holdings in us.

You may experience future dilution as a result of future equity

offerings.

In

order to raise additional capital, we may in the future offer

additional shares of our common stock or other securities

convertible into or exchangeable for our common stock. We cannot

assure you that we will be able to sell shares or other securities

in any other offering at a price per share that is equal to or

greater than the price per share paid by investors in this

offering, and investors purchasing our shares or other securities

in the future could have rights superior to existing shareholders.

The price per share at which we sell additional shares of our

common stock or other securities convertible into or exchangeable

for our common stock in future transactions may be higher or lower

than the price per share in this offering.

We do not intend to pay dividends on our common stock for the

foreseeable future.

We

have never paid cash dividends on our capital stock and do not

anticipate paying any cash dividends on our common stock for the

foreseeable future. Investors should not rely on an investment in

us if they require income generated from dividends paid on our

capital stock. Because we do not intend to pay dividends on our

common stock, any income derived from our common stock would only

come from a rise in the market price of our common stock, which is

uncertain and unpredictable.

Future sales of our common stock could cause our stock price to

decline.

If our shareholders sell substantial amounts of

our common stock in the public market, the market price of our

common stock could decrease significantly. The perception in the

public market that our shareholders might sell shares of our common

stock could also depress the market price of our common stock. Up

to $100,000,000 in total aggregate value of securities have been

registered by us on a “shelf”

registration statement on Form S-3 (File No. 333-250904) that we

filed with the Securities and Exchange Commission on November 23,

2020, and which was declared effective on December 2, 2020. To date

we have sold $15.95 million of securities under the

“shelf”

registration statement, when not including securities proposed to

be sold in this offering, leaving an aggregate of approximately

$84.05 million in securities which will be eligible for sale in the

public markets from time to time, not including the securities

offered pursuant to the offering described in this prospectus, when

sold and issued by us, subject to the requirements of Form S-3,

which limits us, until such time, if ever, as our public float

exceeds $75 million, from selling securities in a public primary

offering under Form S-3 with a value exceeding more than one-third

of the aggregate market value of the common stock held by

non-affiliates of the Company every twelve months. Additionally, if

our existing shareholders sell, or indicate an intention to sell,

substantial amounts of our common stock in the public market, the

trading price of our common stock could decline significantly. The

market price for shares of our common stock may drop significantly

when such securities are sold in the public markets. A decline in

the price of shares of our common stock might impede our ability to

raise capital through the issuance of additional shares of our

common stock or other equity securities.

Declines in

oil and, to a lesser extent, NGL and natural gas prices, have in

the past, and will continue in the future to, adversely affect our

business, financial condition or results of operations and our

ability to meet our capital expenditure obligations or targets and

financial commitments.

The price we receive for our oil and, to a lesser

extent, natural gas and NGLs, heavily influences our revenue,

profitability, cash flows, liquidity, access to capital, present

value and quality of our reserves, the nature and scale of our

operations, and future rate of growth. Oil, NGL, and natural gas

are commodities and, therefore, their prices are subject to wide

fluctuations in response to relatively minor changes in supply and

demand. In recent years, the markets for oil and natural gas have

been volatile. These markets will likely continue to be volatile in

the future. Further, oil prices and natural gas prices do not

necessarily fluctuate in direct relation to each

other. Because approximately 84% of our estimated proved

reserves as of December 31, 2020, were oil, our financial

results are more sensitive to movements in oil prices. The price of

crude oil has experienced significant volatility over the last

several years, with the price per barrel of West Texas Intermediate

(“WTI”) crude rising from a low of $27 in

February 2016 to a high of $76 in October 2018, then, in 2020,

dropping below $20 per barrel due in part to reduced global demand

stemming from the recent global COVID-19 outbreak, and most

recently climbing back around $75 a barrel. A prolonged period of

low market prices for oil and natural gas, or further declines in

the market prices for oil and natural gas, will likely result in

capital expenditures being further curtailed and will adversely

affect our business, financial condition and liquidity and our

ability to meet obligations, targets or financial commitments and

could ultimately lead to restructuring or filing for bankruptcy,

which would have a material adverse effect on our stock price and

indebtedness. Additionally, lower oil and natural gas prices have,

and may in the future, cause, a decline in our stock price. During

the year ended December 31, 2019, the daily NYMEX WTI oil spot

price ranged from a high of $66.24 per Bbl to a low of $46.31 per

Bbl and the NYMEX natural gas Henry Hub spot price ranged from a

high of $4.25 per MMBtu to a low of $1.75 per MMBtu. During

the year ended December 31, 2020, the daily NYMEX WTI oil spot

price ranged from a high of $63.27 per Bbl to a low of ($36.98) per

Bbl and the NYMEX natural gas Henry Hub spot price ranged from a

high of $3.14 per MMBtu to a low of $1.33 per MMBtu. During the

nine months ended September 30, 2021, the daily NYMEX WTI oil spot

price ranged from a high of $75.37 per Bbl to a low of $47.47 per

Bbl and the NYMEX natural gas Henry Hub spot price ranged from a

high of $23.86 per MMBtu to a low of $2.43 per MMBtu. From October

1, 2021, to November 16, 2021, the daily NYMEX WTI oil spot price

ranged from a high of $85.64 per Bbl to a low of $76.01 per Bbl and

the NYMEX natural gas Henry Hub spot price ranged from a high of

$6.37 per MMBtu to a low of $4.56 per MMBtu.

Our success is dependent on the prices of oil, NGLs, and natural

gas. Low oil or natural gas prices and the substantial volatility

in these prices have adversely affected, and are expected to

continue to adversely affect, our business, financial condition and

results of operations, and our ability to meet our capital

expenditure requirements and financial obligations.

The

prices we receive for our oil, NGLs and natural gas heavily

influence our revenue, profitability, cash flow available for

capital expenditures, access to capital, and future rate of growth.

Oil, NGLs, and natural gas are commodities and, therefore, their

prices are subject to wide fluctuations in response to relatively

minor changes in supply and demand. Historically, the commodities

market has been volatile. For example, the price of crude oil has

experienced significant volatility over the last several years,

with the price per barrel of WTI crude rising from a low of $27 in

February 2016 to a high of $76 in October 2018, then dropping below

$20 per barrel in April 2020 due in part to reduced global demand

stemming from the recent global COVID-19 outbreak, before

recovering to around $75-$80 per barrel more recently. Prices for

natural gas and NGLs experienced declines of similar magnitude. An

extended period of continued lower oil prices, or additional price

declines, will have further adverse effects on us. The prices we

receive for our production, and the levels of its production, will

continue to depend on numerous factors, including the

following:

● the

domestic and foreign supply of oil, NGLs and natural

gas;

● the

domestic and foreign demand for oil, NGLs and natural

gas;

● the

prices and availability of competitors’ supplies of oil, NGLs

and natural gas;

● the

actions of the Organization of Petroleum Exporting Countries, or

OPEC, and state-controlled oil companies relating to oil price and

production controls;

● the

price and quantity of foreign imports of oil, NGLs and natural

gas;

● the

impact of U.S. dollar exchange rates on oil, NGLs, and natural gas

prices;

● domestic

and foreign governmental regulations and taxes;

● speculative

trading of oil, NGLs, and natural gas futures

contracts;

● localized

supply and demand fundamentals, including the availability,

proximity, and capacity of gathering and transportation systems for

natural gas;

● the

availability of refining capacity;

● the

prices and availability of alternative fuel sources;

● the

threat, or perceived threat, or results, of viral pandemics, for

example, as experienced with the COVID-19 pandemic in 2020 and

2021;

● weather

conditions and natural disasters;

● political

conditions in or affecting oil, NGLs, and natural gas producing

regions, including the Middle East and South America;

● the

continued threat of terrorism and the impact of military action and

civil unrest;

● public

pressure on, and legislative and regulatory interest within,

federal, state and local governments to stop, significantly limit,

or regulate hydraulic fracturing activities;

● the

level of global oil, NGL, and natural gas inventories and

exploration and production activity;

● authorization

of exports from the United States of liquefied natural

gas;

● the

impact of energy conservation efforts;

● technological

advances affecting energy consumption; and

● overall

worldwide economic conditions.

Declines

in oil, NGL or natural gas prices have not, and will not, only

reduce our revenue, but have and will reduce the amount of oil,

NGL and natural gas that we can produce economically. Should

natural gas, NGL or oil prices decline from current levels and

remain there for an extended period of time, we may choose to

shut-in our operated wells (similar to our shut-in of our operated

wells in 2020), delay some or all of our exploration and

development plans for our prospects, or to cease exploration or

development activities on certain prospects due to the anticipated

unfavorable economics from such activities, and, as a result, we

may have to make substantial downward adjustments to our estimated

proved reserves, each of which would have a material adverse effect

on our business, financial condition and results of

operations.

Our business and

operations have been adversely affected by, and are expected to

continue to be adversely affected by, the recent COVID-19

outbreak, and may be adversely affected by other similar

outbreaks.

As

a result of the recent COVID-19 outbreak or other adverse

public health developments, including voluntary and mandatory

quarantines, travel restrictions, and other restrictions, our

operations, and those of our subcontractors, customers, and

suppliers, have and are anticipated to continue to experience

delays or disruptions and temporary suspensions of operations. In

addition, our financial condition and results of operations have

been and are likely to continue to be adversely affected by

the COVID-19 outbreak.

The timeline and potential magnitude of

the COVID-19 outbreak are currently unknown. The

continuation or amplification of this virus could continue to more

broadly affect the United States and global economy, including its

business and operations, and the demand for oil and gas. For

example, the outbreak of coronavirus has resulted in a widespread

health crisis that will adversely affect the economies and

financial markets of many countries, resulting in an economic

downturn that will affect our operating results. Other contagious

diseases in the human population could have similar adverse

effects. In addition, the effects of COVID-19 and concerns

regarding its global spread have negatively impacted the domestic

and international demand for crude oil and natural gas, which has

contributed to price volatility, impacted the price we receive for

oil and natural gas, and materially and has materially and

adversely affected the demand for and marketability of our

production, which production we temporarily shut-in from mid-April

2020 through early June 2020, and may adversely affect the same in

the future. As the potential impact from COVID-19 is difficult to

predict, the extent to which it will negatively affect our

operating results, or the duration of any potential business

disruption is uncertain. The magnitude and duration of any impact

will depend on future developments and new information that may

emerge regarding the severity and duration of COVID-19 and the

actions taken by authorities to contain it or treat its impact,

including the efficiency of recent vaccines, the ability of the

government to roll such vaccines out to the general public, and the

willingness of individuals to obtain such vaccines, all of which

are beyond our control. These potential impacts, while uncertain,

have already negatively affected our results of operations for the

first three quarters of 2021, and may have a negative impact on

multiple future quarters’ results as well.