Filed Pursuant to Rule 424(b)(5)

Registration No. 333-262555

Prospectus Supplement

(to Prospectus dated September 26, 2022)

1,020,000 Shares of Common Stock

Pre-Funded Warrants to Purchase up to 798,182 Shares of Common Stock

Common Warrants to Purchase up to 1,818,182 Shares of Common Stock

Placement Agent Warrants to Purchase up to 90,909 Shares of Common Stock

Shares of Common Stock Underlying the Pre-Funded Warrants

Shares of Common Stock Underlying the Common Warrants and Placement Agent Warrants

We are offering up to 1,020,000 shares of our common stock, par value $0.01 per share, and common warrants to purchase up to 1,818,182 shares of our common stock (the “Common Warrants”) to a certain institutional investor pursuant to this prospectus supplement and the accompanying prospectus. The offering price for each share of common stock and accompanying Common Warrant to purchase one share of common stock is $5.50. The Common Warrants have an exercise price of $5.83 per share, are exercisable beginning six months after the date of issuance, and will expire five and one-half years from the date of issuance. We are also offering the shares of our common stock that are issuable from time to time upon exercise of the Common Warrants.

We are also offering pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to an aggregate of 798,182 shares of common stock (and the shares of common stock issuable from time to time upon exercise of the Pre-Funded Warrants), to the same institutional investor whose purchase of shares of common stock in this offering would otherwise result in the investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock following the consummation of this offering, in lieu of common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. A holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates and certain related parties, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of common stock at an exercise price of $0.0001 per share of common stock. The offering price is $5.4999 per Pre-Funded Warrant and accompanying Common Warrant, which is equal to the offering price per share of common stock and accompanying Common Warrant less $0.0001. Each Pre-Funded Warrant will be exercisable upon issuance and will expire when exercised in full. The shares of common stock or Pre-Funded Warrants, as applicable, and the accompanying Common Warrants, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. There is no established public trading market for the Pre-Funded Warrants or the Common Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Pre-Funded Warrants or the Common Warrants on any securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants and the Common Warrants will be limited.

Effective as of 5:00 p.m. Eastern Time on August 30, 2022, we filed a certificate of amendment of our restated certificate of incorporation to effect a reverse stock split of the issued and outstanding shares of our common stock, at a ratio of 1 share for 25 shares (the “Reverse Stock Split”). Unless otherwise indicated, all share numbers herein, including common stock and all securities convertible into common stock, give effect to the Reverse Stock Split. However, documents incorporated by reference into this prospectus that were filed prior to August 30, 2022, do not give effect to the Reverse Stock Split.

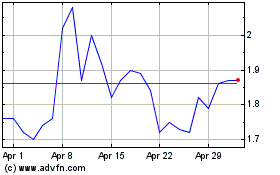

Our common stock is quoted on the NYSE American under the symbol “PTN.” On October 28, 2022, the closing price of our common stock as reported on the NYSE American was $5.83 per share.

We have engaged H.C. Wainwright & Co., LLC to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered in this offering. The placement agent is not purchasing or selling any of the securities we are offering, and the placement agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. There is no required minimum number of securities that must be sold as a condition to completion of this offering, and there are no arrangements to place the funds in an escrow, trust, or similar account.

Investing in our securities involves a high degree of risk. See the information contained under “Risk Factors” on page S-7 of this prospectus supplement, page 10 of the accompanying prospectus and in the documents incorporated herein by reference.

| | | Per Share and Accompanying Common Warrant | | | Per Pre-Funded Warrant and Accompanying Common Warrant | | | Total(1) | |

| Offering Price | | $ | 5.5000 | | | $ | 5.4999 | | | $ | 9,999,921.18 | |

| Placement Agent Fees(2) | | $ | 0.3850 | | | $ | 0.3850 | | | $ | 700,000.07 | |

| Proceeds, Before Expenses, to Us | | $ | 5.1150 | | | $ | 5.1149 | | | $ | 9,299,921.11 | |

| (1) | The amount of the offering proceeds to us presented in this table does not give effect to any exercise of the warrants being issued in this offering. |

| | |

| (2) | In addition, we have agreed to issue to the placement agent or its designees warrants (the “Placement Agent Warrants”) to purchase a number of shares of our common stock equal to 5.0% of the aggregate number of shares of common stock and shares of common stock issuable upon the exercise of Pre-Funded Warrants included in this offering at an exercise price equal to 125% of the offering price of the common stock and accompanying Common Warrant in this offering and to reimburse certain expenses of the placement agent in connection with this offering. This prospectus supplement and the accompanying prospectus also covers the Placement Agent Warrants and the shares of our common stock issuable upon exercise of the Placement Agent Warrants. See “Plan of Distribution” for additional information regarding compensation payable to the placement agent, including the Placement Agent Warrants. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of common stock, Pre-Funded Warrants, and Common Warrants is expected to be made on or about November 2, 2022, subject to satisfaction of customary closing conditions.

H.C. Wainwright & Co.

The date of this prospectus supplement is October 31, 2022

TABLE OF CONTENTS

PROSPECTUS

Palatin Technologies® and Vyleesi® are registered trademarks of the Company, and Palatin™ and the Palatin logo are trademarks of the Company. This prospectus supplement and the accompanying prospectus may refer to brand names, trademarks, service marks, or trade names of other companies and organizations, and those brand names, trademarks, service marks, and trade names are the property of their respective holders.

About This Prospectus Supplement

This prospectus supplement and the accompanying prospectus are part of a “shelf” registration statement on Form S-3 (File No. 333-262555) that we originally filed with the U.S. Securities and Exchange Commission (the “SEC”), on February 7, 2022 and which became effective on September 26, 2022.

This prospectus supplement describes the specific terms of an offering of shares of our common stock, Pre-Funded Warrants, and Common Warrants and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. The second part, the accompanying prospectus, provides more general information. If the information in this prospectus supplement is inconsistent with the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement.

We have not and the placement agent has not authorized anyone to provide you with any information or to make any representations other than those included or incorporated by reference in this prospectus supplement and the accompanying prospectus and any relevant free writing prospectus. If you receive any information not authorized by us, we and the placement agent take no responsibility for, and can provide no assurance as to the reliability of, such information. We are not making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus or any relevant free writing prospectus is accurate as of any date other than its respective date.

It is important for you to read and consider all of the information contained in this prospectus supplement and the accompanying prospectus, including the information incorporated by reference into this prospectus supplement and the accompanying prospectus, in making your investment decision. We include cross-references in this prospectus supplement and the accompanying prospectus to captions in these materials where you can find additional related discussions. The table of contents in this prospectus supplement provides the pages on which these captions are located. You should read both this prospectus supplement and the accompanying prospectus, together with the additional information described in the sections entitled “Where You Can Find More Information” and “Incorporation by Reference” of this prospectus supplement, before investing in our common stock, the Pre-Funded Warrants, or the Common Warrants.

We are offering to sell, and seeking offers to buy, securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless the context otherwise requires, “Palatin,” the “Company,” “we,” “us,” “our” and similar names refer to Palatin Technologies, Inc.

Prospectus Supplement Summary

The following summary is qualified in its entirety by, and should be read together with, the more detailed information and financial statements and related notes thereto appearing elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. Before you decide to invest in our securities, you should read the entire prospectus supplement and the accompanying prospectus carefully, including the risk factors and the financial statements and related notes included or incorporated by reference in this prospectus supplement and the accompanying prospectus.

Our Business

We are a biopharmaceutical company developing first-in-class medicines based on molecules that modulate the activity of the melanocortin receptor (“MCr”) system. Our product candidates are targeted, receptor-specific therapeutics for the treatment of diseases with significant unmet medical need and commercial potential. Palatin’s strategy is to develop products and then form marketing collaborations with industry leaders to maximize product commercial potential.

The MCr system has effects on inflammation and immune system response, food intake, metabolism, and sexual function. There are five melanocortin receptors, MC1r through MC5r. Modulation of these receptors, through use of receptor-specific agonists, which activate receptor function, or receptor-specific antagonists, which block receptor function, can have significant pharmacological effects.

Our new product development activities in inflammation disease indications focus primarily on development of MCr peptides for ocular conditions, but also include conditions in the gut and kidney. Utilizing peptides which are agonists at MC1r, and in some instances agonists at additional melanocortin receptors, we are developing products to treat inflammatory and autoimmune diseases such as dry eye disease, which is also known as keratoconjunctivitis sicca, uveitis, diabetic retinopathy, and inflammatory bowel disease. We believe that our MC1r agonist peptides have broad anti-inflammatory effects and utilize mechanisms engaged by the endogenous melanocortin system in regulation of the immune system and resolution of inflammatory responses. We are also developing peptides that are active at more than one melanocortin receptor and small molecule MCr agonists.

Our U.S. Food and Drug Administration (“FDA”) approved melanocortin receptor agonist, Vyleesi® (bremelanotide injection), is an “as needed” therapy used in anticipation of sexual activity and self-administered in the thigh or abdomen via a single-use subcutaneous auto-injector by premenopausal women with hypoactive sexual desire disorder (“HSDD”). Vyleesi is the first FDA-approved melanocortin agent and the first and only FDA-approved as-needed treatment for premenopausal women with HSDD.

Our Current Product Development Strategy. We are designing and developing potent and highly selective MC1r agonist peptides and agonist peptides specific for more than one melanocortin receptor for treatment of a variety of inflammatory and autoimmune indications. We believe that our agonist peptides regulate certain inflammatory cytokines, and modulate the activities of immune cells, such as monocytes and T cells, to reduce immune response, and may utilize mechanisms engaged by the endogenous melanocortin system in regulation of the immune system and resolution of inflammatory responses.

We have conducted preclinical animal studies with MC1r and multiple MCr peptide drug candidates for selected inflammatory disease and autoimmune indications. MC1r plays a role in many diseases, including inflammatory bowel disease and ocular indications such as uveitis, diabetic retinopathy, and dry eye disease. Work with rodent animal models have demonstrated therapeutic responses that are statistically significant compared to placebo, and that are equal to or superior to established positive controls in animal models. However, success in animal models does not necessarily mean that any of our drug candidates will be able to successfully treat diseases in human patients.

PL9643 for Dry Eye Disease and Anti-Inflammatory Ocular Indications. PL9643, a peptide melanocortin agonist active at multiple MCrs, including MC1r and MC5r, is our lead clinical development candidate for anti-inflammatory ocular indications, including dry eye disease, which is also known as keratoconjunctivitis sicca. Dry eye disease is a syndrome with symptoms including irritation, redness, discharge and blurred vision. It may result from an autoimmune disease such as Sjögren’s syndrome, an ocular lipid or mucin deficiency, blink disorders, abnormal corneal sensitivity, or environmental factors. It is estimated to affect over 30 million people in the United States.

We have developed a PL9643 ophthalmic solution (topical eye drops) in a single use delivery device, and a Phase 3 pivotal clinical trial (“MELODY-1”) designed to support a New Drug Application (“NDA”) is ongoing. An interim analysis by an independent Data Monitoring Committee (“DMC”) of the first 120 patients who had completed the MELODY-1 trial recommended the study continue with a sample size of up to 350 patients. Topline results from the MELODY-1 trial are now expected in the second quarter of calendar 2023. Our Phase 2 clinical trial demonstrated improvements in both the signs and symptoms of dry eye disease in moderate to severe patients after just two weeks of treatment, with no adverse safety signals and excellent tolerability. We held an end-of-Phase 2 meeting with the FDA in June 2021, which included all aspects of the PL9643 development plan, including study design, endpoints, interim assessment, and patient population for the Phase 3 program. If results of the MELODY-1 clinical trial are positive, we will initiate a second Phase 3 clinical trial.

Oral PL8177 for Inflammatory Bowel Diseases. PL8177, a selective MC1r agonist peptide, is our lead clinical development candidate for inflammatory bowel diseases, including ulcerative colitis. We have completed subcutaneous dosing of human subjects in a Phase 1 single and multiple ascending dose clinical safety study, and a human microdose pharmacokinetic study to evaluate a polymer-encapsulated, delayed-release, oral formulation of PL8177.

For ulcerative colitis and other inflammatory bowel diseases we will administer PL8177 in our oral formulation to deliver PL8177 to the interior wall of the diseased bowel. PL8177 activates MC1r present on the interior wall of the bowel in ulcerative colitis and other inflammatory bowel diseases. We believe that delivering PL8177 directly to MC1r in the bowel wall will maximize treatment effect while minimizing any systemic or off-target effects.

In October 2022 we enrolled the first patient in our Phase 2 study in ulcerative colitis using our polymer-encapsulated, delayed-release, oral formulation of PL8177. An interim assessment of the trial is expected to occur in the first quarter of calendar year 2023, with topline data anticipated in the third quarter of calendar year 2023. The Phase 2 study is a multi-center, randomized, double-blind, placebo-controlled, adaptive design, parallel group of PL8177 study, with once daily oral dosing in adult ulcerative colitis subjects. The study uses an adaptive design with an interim assessment by an independent DMC after the initial 16 subjects have completed the 8-week evaluation visit.

Melanocortin Peptides for Diabetic Retinopathy. We conducted preclinical studies with melanocortin peptides in diabetic retinopathy models and have selected a peptide candidate for further development work. We are working on a formulation for administration. If results support advancing the program, we will conduct required safety studies and manufacture drug product under Good Manufacturing Practices regulations preparatory to filing an Investigational New Drug application and initiating clinical studies.

Ocular Research Programs. We are conducting research in several additional ocular areas, including both front of the eye and back of the eye indications, exploring use of our compounds to treat additional indications.

Vyleesi for HSDD. Vyleesi, the registered trademark for bremelanotide injection, was approved by the FDA on June 21, 2019 for the treatment of premenopausal women with acquired, generalized HSDD. AMAG Pharmaceuticals, Inc. (“AMAG”), which had exclusively licensed Vyleesi for North America, initiated sales and marketing efforts for Vyleesi in the United States in August 2019, with a national launch in September 2019. In July 2020, Palatin and AMAG entered into a termination agreement, pursuant to which the license agreement was terminated, Palatin regained all North America rights for Vyleesi, and AMAG made a $12.0 million payment to Palatin at closing and a $4.3 million payment to Palatin in the first quarter of calendar 2021. Palatin assumed Vyleesi manufacturing agreements, and AMAG transferred information, data and assets related exclusively to Vyleesi, including existing inventory. AMAG provided certain transition services to Palatin for a period to ensure continued patient access to Vyleesi during the transition period, for which Palatin reimbursed AMAG for the agreed upon costs of the transition services.

Gross product sales of Vyleesi increased to $5.8 million in fiscal 2022, compared to $4.7 million in fiscal 2021, with gross product sales in the fourth quarter ended June 30, 2022 increasing 79% over the prior quarter and 91% over the comparable quarter in 2021. Net sales of Vyleesi were $1.2 million in fiscal 2022, compared to negative net sales of $0.3 million in fiscal 2021.

Corporate Information

We were incorporated under the laws of the State of Delaware on November 21, 1986 and commenced operations in the biopharmaceutical area in 1996. Our corporate offices are located at 4B Cedar Brook Drive, Cedar Brook Corporate Center, Cranbury, New Jersey 08512, and our telephone number is (609) 495-2200. We maintain a website at http://www.palatin.com, where among other things, we make available free of charge on and through this website our Forms 3, 4 and 5, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) and Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our website and the information contained in it or connected to it are not incorporated into this prospectus or any prospectus supplement. The reference to our website is an inactive textual reference only.

A certificate of amendment of Palatin’s certificate of incorporation for a 1-for-25 reverse split of Palatin’s issued and outstanding common stock was effective as of 5:00 p.m. Eastern Time on August 30, 2022. Unless otherwise indicated, all share numbers herein, including common stock and all securities convertible into common stock, give effect to the Reverse Stock Split. However, documents incorporated by reference into this prospectus that were filed prior to August 30, 2022, do not give effect to the Reverse Stock Split.

Our common stock is listed on the NYSE American under the symbol “PTN”.

Palatin Technologies® and Vyleesi® are registered trademarks of the Company, and Palatin™ and the Palatin logo are trademarks of the Company. Other trademarks referred to in this prospectus supplement are the property of their respective owners.

The Offering

| Common stock offered by us | 1,020,000 shares of common stock. |

| Common Warrants offered by us | Common Warrants to purchase an aggregate of 1,818,182 shares of our common stock. Each share of our common stock and each Pre-Funded Warrant to purchase one share of our common stock is being sold together with a Common Warrant to purchase one share of our common stock. Each Common Warrant has an exercise price of $5.83 per share, is exercisable beginning six months after the date of issuance, and will expire five and one-half years following the original date of issuance. The shares of common stock or the Pre-Funded Warrants and the accompanying Common Warrants, as the case may be, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. This offering also relates to the offering of the 1,818,182 shares of common stock issuable upon exercise of the Common Warrants. See “Description of Securities Offered” on page S-15 of this prospectus supplement. |

| Pre-Funded Warrants offered by us | Pre-Funded Warrants to purchase an aggregate of 798,182 shares of our common stock. Each Pre-Funded Warrant to purchase one share of our common stock is being sold together with a Common Warrant to purchase one share of our common stock. Each Pre-Funded Warrant has an exercise price of $0.0001 per share, is immediately exercisable and will expire when exercised in full. The Pre-Funded Warrants and the accompanying Common Warrants can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. This offering also relates to the offering of the 798,182 shares of common stock issuable upon exercise of the Pre-Funded Warrants. See “Description of Securities Offered” on page S-15 of this prospectus supplement. |

| Common stock to be outstanding after this offering | 11,152,108 shares of common stock assuming the exercise of all Pre-Funded Warrants issued in this offering and no exercise of any Common Warrants or Placement Agent Warrants issued in this offering. |

| Use of proceeds | We estimate that the net proceeds to us from this offering will be approximately $9.1 million. We currently intend to use the net proceeds from the sale of securities under this prospectus for general corporate purposes. We may also use a portion of the net proceeds to invest in or acquire businesses that we believe are complementary to our own, although we have no current plans, commitments, or agreements with respect to any acquisitions. |

| Risk factors | Investing in our securities involves risks. See “Risk Factors” beginning on page S-7 of this prospectus supplement or otherwise incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to invest in our securities. |

| NYSE American trading symbol | Our common stock is listed on the NYSE American under the symbol “PTN.” There is no established trading market for the Pre-Funded Warrants or Common Warrants, and we do not expect a trading market to develop. We do not intend to list the Common Warrants or the Pre-Funded Warrants on any securities exchange or nationally recognized trading system. Without a trading market, the liquidity of the Pre-Funded Warrants and Common Warrants will be extremely limited. |

Unless otherwise indicated, all information in this prospectus related to the number of shares of our common stock to be outstanding immediately after this offering is based on 9,333,926 shares of our common stock outstanding as of October 31, 2022. The number of shares outstanding as of October 31, 2022 excludes:

| | · | 2,629 shares issuable on the conversion of our immediately convertible Series A Preferred Stock, subject to adjustment, for no further consideration; |

| | | |

| | · | 1,200,000 shares issuable on the conversion of our immediately convertible Series B Preferred Stock, subject to adjustment, for no further consideration; |

| | | |

| | · | 133,333 shares issuable on the conversion of our immediately convertible Series C Preferred Stock, subject to adjustment, for no further consideration; |

| | | |

| | · | 1,143,774 shares issuable upon the exercise of stock options at a weighted-average exercise price of $15.95 per share; |

| | | |

| | · | 282,774 shares issuable under restricted stock units which vested or will vest on dates between June 16, 2023 and June 22, 2026, subject to the fulfillment of service or performance conditions; |

| | | |

| | · | 280,500 shares of common stock which have vested under restricted stock unit agreements, but are subject to provisions to delay delivery; |

| | | |

| | · | 66,666 shares issuable upon the exercise of warrants at an exercise price of $12.50 per share, issued in conjunction with the Series B and Series C Preferred Stock, of which 33,333 are currently exercisable and expire on May 11, 2026, and the remaining are exercisable only in the event that a Redemption Consideration Election (as defined in the Certificates of Designation for the Series B and Series C Preferred Stock) is made and expire on May 11, 2026; |

| | | |

| | · | 234,617 shares of common stock available for future issuance under our 2011 Stock Incentive Plan; |

| | | |

| | · | 1,818,182 shares of common stock issuable upon exercise of the Common Warrants issued in this offering; and |

| | | |

| | · | up to 90,909 shares of common stock issuable upon exercise of the Placement Agent Warrants with an exercise price of $6.875 per share to be issued to the placement agent or its designees as compensation in connection with this offering. |

Unless otherwise indicated, all information in this prospectus supplement assumes (i) no exercise of outstanding stock options or settlement of unvested restricted stock units or unvested performance-based restricted stock units or shares issued from the 2011 Stock Incentive Plan after October 31, 2022, (ii) no exercise of the Pre-Funded Warrants, Common Warrants, or Placement Agent Warrants offered and sold in this offering, and (iii) approximately 754 additional shares of common stock issuable upon conversion of the Series A Preferred Stock as a result of a conversion price adjustment upon closing of this offering.

Risk Factors

Investing in our securities involves a high degree of risk. You should carefully consider the risk factors described below, together with the risks under the heading “Risk Factors” beginning on page 10 of the accompanying prospectus and under Part I, Item A of our Annual Report on Form 10-K for the fiscal year ended June 30, 2022, filed with the SEC on September 22, 2022, and all other information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus, including our financial statements and the related notes, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and in any free writing prospectus that we have authorized for use in connection with this offering before acquiring any of our securities. These risks could have a material and adverse impact on our business, results of operations, financial condition, and growth prospects, which may cause the trading price of our common stock to decline and you could lose all or part of your investment.

Risks Related to this Offering

You will experience immediate and substantial dilution.

Because the effective offering price per share in this offering exceeds the net tangible book value per share of our common stock outstanding prior to this offering you will incur an immediate and substantial dilution in the net tangible book value of the shares of common stock you purchase in this offering or the shares of common stock underlying the Pre-Funded Warrants and Common Warrants you purchase in this offering. After giving effect to the sale by us of: (i) 1,020,000 shares of our common stock and accompanying Common Warrants to purchase 1,020,000 shares of our common stock at the offering price of $5.50 per share of common stock and accompanying Common Warrant; and (ii) 798,182 Pre-Funded Warrants to purchase shares of common stock and accompanying Common Warrants at an effective offering price of $5.4999 per Pre-Funded Warrant and accompanying Common Warrant, and after deducting placement agent fees and estimated offering expenses payable by us and assuming full exercise of the Pre-Funded Warrants, you will experience immediate dilution of $3.53 per share, representing the difference between the effective offering price per share and our as adjusted net tangible book value per share as of June 30, 2022 after giving effect to this offering. The exercise of warrants, including the Common Warrants issued in this offering, exercise of outstanding stock options, conversion of outstanding preferred stock, and vesting of other stock awards may result in further dilution of your investment. See the section entitled “Dilution” appearing elsewhere in this prospectus supplement for a more detailed illustration of the dilution you would incur if you participate in this offering.

Any issuance of our common stock upon conversion of the Series B Preferred Stock or Series C Preferred Stock will cause dilution to our then existing stockholders and may depress the market price of our common stock.

As of October 31, 2022, holders of our Series B Preferred Stock had the right to acquire 1,200,000 shares of our common stock and Series C Preferred Stock had the right to acquire 133,333 shares of our common stock, upon conversion of their shares of Series B Preferred Stock or Series C Preferred Stock, respectively. If the holders of our Series B Preferred Stock or Series C Preferred Stock elect to convert their shares of preferred stock to shares of common stock, stockholders may experience dilution in the net book value of their common stock. In addition, the sale or availability for sale of the conversion shares in the marketplace could depress our stock price. Holders of registered underlying shares could resell the shares immediately upon issuance, which could result in significant downward pressure on our stock price.

The trading price of our common stock could be highly volatile, which could result in substantial losses for purchasers of our common stock in this offering.

Our stock price is volatile. The stock market in general and the market for pharmaceutical and biotechnology companies in particular have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, you may not be able to sell your common stock at or above the offering price and you may lose some or all of your investment. The market price for our common stock may be influenced by many factors, including:

| | · | volatility resulting from the economic turmoil caused by the COVID-19 pandemic, including any, increase in costs of and delays in conducting human clinical trials and the performance of our contractors and suppliers; |

| | | |

| | · | the success of existing or new competitive products or technologies; |

| | | |

| | · | regulatory actions with respect to our products or our competitors’ products and product candidates; |

| | | |

| | · | announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures, collaborations or capital commitments; |

| | · | results of clinical trials of product candidates of our competitors; |

| | | |

| | · | regulatory or legal developments in the United States and other countries; |

| | | |

| | · | developments or disputes concerning patent applications, issued patents or other proprietary rights; |

| | | |

| | · | the recruitment or departure of key personnel; |

| | | |

| | · | our ability to successfully commercialize Vyleesi® (the trade name for bremelanotide) for the treatment of premenopausal women with HSDD in the United States, which may be adversely affected by delays or disruptions related to the ongoing COVID-19 pandemic and economic disruptions, including a decrease in discretionary spending; |

| | | |

| | · | our ability to manage the infrastructure to successfully manufacture, through contract manufacturers, Vyleesi, and to successfully market and distribute Vyleesi in the United States , including potentially qualifying a new contract manufacturer for the Vyleesi active drug ingredient; |

| | | |

| | · | the extent to which we in-license, acquire or invest in other indications or product candidates; |

| | | |

| | · | actual or anticipated changes in estimates as to financial results or development timelines; |

| | | |

| | · | announcement or expectation of additional financing efforts; |

| | | |

| | · | sales of our common stock by us, our insiders, or other stockholders; |

| | | |

| | · | variations in our financial results or those of companies that are perceived to be similar to us; |

| | | |

| | · | changes in estimates or recommendations by securities analysts, if any, that cover us; |

| | | |

| | · | changes in the structure of healthcare payment systems; |

| | | |

| | · | market conditions in the pharmaceutical and biotechnology sectors; and |

| | | |

| | · | general economic, industry, and market conditions. |

In the past, securities class action litigation has often been brought against a company following a decline in the market price of its securities. This risk is especially relevant for pharmaceutical and biotechnology companies, which have experienced significant stock price volatility in recent years.

We have broad discretion in the use of the net proceeds from this offering and may invest or spend the proceeds in ways with which you do not agree and in ways that may not yield a return on your investment.

Although we currently intend to use the net proceeds from this offering in the manner described in the section titled “Use of Proceeds” in this prospectus supplement, our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. You will not have the opportunity to influence our decisions on how to use the net proceeds from this offering. The failure by our management to apply these funds effectively could result in financial losses that could harm our business, cause the price of our common stock to decline, and delay the development of our product candidates. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. If we sell common stock, convertible securities, or other equity securities, investors may be materially diluted by subsequent sales.

The sale of our common stock in this offering, including any shares issuable upon exercise of any Pre-Funded Warrants or Common Warrants, and any future sales of our common stock, or the perception that such sales could occur, may depress our stock price and our ability to raise funds in new stock offerings.

We may from time to time issue additional shares of common stock at a discount from the current trading price of our common stock. As a result, our stockholders would experience immediate dilution upon the purchase of any shares of our common stock sold at such discount. In addition, as opportunities present themselves, we may enter into financing or similar arrangements in the future, including the issuance of debt securities, preferred stock or common stock. Sales of shares of our common stock in this offering, including any shares issuable upon exercise of any Pre-Funded Warrants and Common Warrants issued in this offering and in the public market following this offering, or the perception that such sales could occur, may lower the market price of our common stock and may make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price that our management deems acceptable, or at all.

There is no public market for the Pre-Funded Warrants or Common Warrants being offered in this offering.

There is no established public trading market for the Pre-Funded Warrants or Common Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants or Common Warrants on any securities exchange or nationally recognized trading system, including the NYSE or NYSE American. Without an active market, the liquidity of the Pre-Funded Warrants and Common Warrants will be limited.

The Common Warrants being offered may not have value.

The Common Warrants being offered by us in this offering have an exercise price of $5.83 per share, subject to certain adjustments, and expire five and one-half years from the date of issuance, upon which date such warrants will be automatically exercised on a cashless basis. The Common Warrants are exercisable beginning six months after the date of issuance. In the event that the applicable volume weighted average price of our common stock does not exceed the exercise price of the Common Warrants during the period when they are exercisable, Common Warrants may not have any value.

Holders of Pre-Funded Warrants and Common Warrants purchased in this offering will have no rights as common stockholders until such holders exercise their Pre-Funded Warrants or Common Warrants and acquire our common stock.

Until holders of Pre-Funded Warrants and Common Warrants acquire shares of our common stock upon exercise of such warrants, holders of Pre-Funded Warrants and Common Warrants will have no rights with respect to the shares of our common stock underlying such Pre-Funded Warrants and Common Warrants. Upon exercise of the Pre-Funded Warrants or Common Warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

Risks Related to our Common Stock

There are risks associated with the Reverse Stock Split.

A certificate of amendment of Palatin’s certificate of incorporation for a 1-for-25 reverse split of Palatin’s issued and outstanding common stock was effective as of 5:00 p.m. Eastern Time on August 30, 2022. There are risks associated with the Reverse Stock Split and there is no assurance that:

| | · | the market price per share of our common stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split or if it does rise that it will sustain the increase in the share price; |

| | | |

| | · | the Reverse Stock Split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks; |

| | | |

| | · | the Reverse Stock Split will result in a per share price that will increase our ability to attract and retain employees and other service providers and maintain the minimum stock price required for continued listing on the NYSE American; and |

| | | |

| | · | the liquidity of our common stock will increase. |

Cautionary Statement Regarding Forward-Looking Statements

This prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein and therein contain forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Prospectus Supplement Summary” and “Risk Factors” in this prospectus or the documents incorporated herein by reference. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| | · | our significant operating losses since our inception and our need to obtain additional financing has caused management to determine there is substantial doubt regarding our ability to continue as a going concern; |

| | | |

| | · | our expectation that we will incur losses for the foreseeable future and may never achieve or maintain profitability; |

| | | |

| | · | our business, financial condition, and results of operations may be adversely affected by global health epidemics, including the COVID-19 pandemic, such as, for example, the increase in costs of and delays in conducting human clinical trials and the performance of our contractors and suppliers, reduction in our productivity or the productivity of our contractors and suppliers, supply chain constraints, and labor shortages; |

| | | |

| | · | our ability to successfully commercialize Vyleesi® (the trade name for bremelanotide) for the treatment of premenopausal women with HSDD in the United States, which may be adversely affected by delays or disruptions related to the ongoing COVID-19 pandemic and economic disruptions, including a decrease in discretionary spending; |

| | | |

| | · | our ability to manage the infrastructure to successfully manufacture, through contract manufacturers, Vyleesi, and to successfully market and distribute Vyleesi in the United States , including potentially qualifying a new contract manufacturer for the Vyleesi active drug ingredient; |

| | | |

| | · | our ability to meet postmarketing commitments of the FDA; |

| | | |

| | · | our expectations regarding the potential market size and market acceptance for Vyleesi for HSDD in the United States and elsewhere in the world; |

| | | |

| | · | our expectations regarding performance of our exclusive licensees of Vyleesi for the treatment of premenopausal women with HSDD, which is a type of female sexual dysfunction, or FSD, including: |

| | o | Shanghai Fosun Pharmaceutical Industrial Development Co. Ltd. (“Fosun”), a subsidiary of Shanghai Fosun Pharmaceutical (Group) Co., Ltd., for the territories of the People’s Republic of China, Taiwan, Hong Kong S.A.R. and Macau S.A.R. (collectively, “China”); and |

| | | |

| | o | Kwangdong Pharmaceutical Co., Ltd. (“Kwangdong”) for the Republic of Korea (“Korea”); |

| | · | our expectations and the ability of our licensees to timely obtain approvals and successfully commercialize Vyleesi in countries other than the United States; |

| | | |

| | · | the results of clinical trials with our late stage products, including PL9643, an ophthalmic peptide solution for dry eye disease, which entered Phase 3 clinical trials in the fourth quarter of calendar year 2021, and PL8177, an oral peptide formulation for treatment of ulcerative colitis, which entered Phase 2 clinical trials in the third quarter of calendar year 2022; |

| | · | estimates of our expenses, future revenue and capital requirements; |

| | | |

| | · | our ability to achieve profitability; |

| | | |

| | · | our ability to obtain additional financing on terms acceptable to us, or at all, including unavailability of funds or delays in receiving funds as a result of the ongoing COVID-19 pandemic and economic disruptions; |

| | | |

| | · | our ability to advance product candidates into, and successfully complete, clinical trials; |

| | | |

| | · | the initiation, timing, progress and results of future preclinical studies and clinical trials, and our research and development programs; |

| | | |

| | · | the timing or likelihood of regulatory filings and approvals; |

| | | |

| | · | our expectations regarding the clinical efficacy and utility of our melanocortin agonist product candidates for treatment of inflammatory and autoimmune related diseases and disorders, including ocular indications; |

| | | |

| | · | our ability to compete with other products and technologies treating the same or similar indications as our product candidates; |

| | | |

| | · | the ability of our third-party collaborators to timely carry out their duties under their agreements with us; |

| | | |

| | · | the ability of our contract manufacturers to perform their manufacturing activities for us in compliance with applicable regulations; |

| | | |

| | · | our ability to recognize the potential value of our licensing arrangements with third parties; |

| | | |

| | · | the potential to achieve revenues from the sale of our product candidates; |

| | | |

| | · | our ability to obtain adequate reimbursement from private insurers and other healthcare payers; |

| | | |

| | · | our ability to maintain product liability insurance at a reasonable cost or in sufficient amounts, if at all; |

| | | |

| | · | the performance and retention of our management team, senior staff professionals, other employees, and third-party contractors and consultants; |

| | | |

| | · | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology in the United States and throughout the world; |

| | | |

| | · | our compliance with federal and state laws and regulations; |

| | | |

| | · | the timing and costs associated with obtaining regulatory approval for our product candidates, including delays and additional costs related to the ongoing COVID-19 pandemic; |

| | | |

| | · | the impact of fluctuations in foreign exchange rates; |

| | · | the impact of any geopolitical instability, economic uncertainty, financial markets volatility, or capital markets disruption resulting from the ongoing military conflict between Russia and Ukraine, and any resulting effects on our revenue, financial condition, or results of operations; |

| | | |

| | · | the impact of legislative or regulatory healthcare reforms in the United States; |

| | | |

| | · | our ability to adapt to changes in global economic conditions as well as competing products and technologies; and |

| | | |

| | · | our ability to remain listed on the NYSE American stock exchange. |

In some cases, you can identify these statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes. These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this prospectus supplement and are subject to risks and uncertainties. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus supplement, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should carefully read this prospectus supplement, the accompanying prospectus, any related free writing prospectus, the documents that we incorporate by reference into this prospectus supplement and the accompanying prospectus, and the documents we reference in this prospectus supplement and the accompany prospectus and have filed as exhibits to the registration statement, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in this prospectus supplement by these cautionary statements.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Proceeds

We estimate that the net proceeds from this offering will be approximately $9.1 million after deducting estimated placement agent fees and estimated offering expenses payable by us. These estimates exclude the proceeds, if any, from the exercise of Common Warrants sold in this offering.

We currently intend to use the net proceeds from the sale of securities under this prospectus supplement for general corporate purposes. We may also use a portion of the net proceeds to invest in or acquire businesses that we believe are complementary to our own, although we have no current plans, commitments, or agreements with respect to any acquisitions. The amounts and timing of our use of the net proceeds from this offering will depend on a number of factors, such as the timing, scope, progress, and results of our development efforts and the timing and progress of any collaboration efforts. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses of the proceeds from the sale of securities under this prospectus supplement. Accordingly, we will retain broad discretion over the use of such proceeds. Pending the use of the net proceeds from the sale of securities under this prospectus supplement as described above, we intend to invest the net proceeds in investment-grade, interest-bearing instruments.

Dilution

If you invest in our securities in this offering, your ownership interest will be diluted to the extent of the difference between the effective offering price per share of our common stock and/or Pre-Funded Warrants and Common Warrants in this offering and the as adjusted net tangible book value per share of our common stock immediately after this offering. The net tangible book value of our common stock as of June 30, 2022 was approximately $16.3 million, or approximately $1.75 per share of common stock based upon 9,270,947 shares outstanding. Net tangible book value per share is equal to our total tangible assets, less our total liabilities, divided by the total number of shares of common stock outstanding as of June 30, 2022.

Net tangible book value dilution per share to investors participating in this offering represents the difference between the effective offering price per share paid by purchasers of securities in this offering and the as adjusted net tangible book value per share of our common stock immediately after this offering. After giving effect to the sale of 1,020,000 shares of our common stock, Pre-Funded Warrants to purchase 798,182 shares in this offering, accompanying Common Warrants to purchase 1,818,182 shares of common stock in this offering at an offering price of $5.50 per share and accompanying Common Warrant and $5.4999 per Pre-Funded Warrant and accompanying Common Warrant, as applicable, and after deducting estimated placement agent fees and offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2022 would have been approximately $25.4 million, or $1.97 per share. This represents an immediate increase in net tangible book value of $0.22 per share to existing stockholders and immediate dilution of $3.53 per share to investors purchasing our securities in this offering at the offering price. The following table illustrates this dilution on a per share basis:

| Offering price per share and accompanying Common Warrant | | | | | $ | 5.50 | |

| Historical net tangible book value per share as of June 30, 2022 | | $ | 1.75 | | | | | |

| Increase in net tangible book value per share attributable to this offering | | $ | 0.22 | | | | | |

| As adjusted net tangible book value per share after giving effect to this offering | | $ | 1.97 | | | | | |

| Dilution in net tangible book value per share to investors participating in this offering | | | | | | $ | 3.53 | |

The discussion and table above assume no exercise of Common Warrants and full exercise of the Pre-Funded Warrants sold in this offering.

The above discussion and table are based on 9,270,947 shares of our common stock outstanding as of June 30, 2022. The number of shares outstanding as of June 30, 2022 excludes:

| | · | 2,629 shares issuable on the conversion of our immediately convertible Series A Preferred Stock, subject to adjustment, for no further consideration; |

| | | |

| | · | 1,200,000 shares issuable on the conversion of our immediately convertible Series B Preferred Stock, subject to adjustment, for no further consideration; |

| | | |

| | · | 133,333 shares issuable on the conversion of our immediately convertible Series C Preferred Stock, subject to adjustment, for no further consideration; |

| | | |

| | · | 1,163,962 shares issuable upon the exercise of stock options at a weighted-average exercise price of $15.98 per share; |

| | | |

| | · | 363,781 shares issuable under restricted stock units which vested or will vest on dates between June 16, 2023 and June 22, 2026, subject to the fulfillment of service or performance conditions; |

| | | |

| | · | 285,368 shares of common stock which have vested under restricted stock unit agreements, but are subject to provisions to delay delivery; |

| | | |

| | · | 66,666 shares issuable upon the exercise of warrants at an exercise price of $12.50 per share, issued in conjunction with the Series B and Series C Preferred Stock, of which 33,333 are currently exercisable and expire on May 11, 2026, and the remaining are exercisable only in the event that a Redemption Consideration Election (as defined in the Certificates of Designation for the Series B and Series C Preferred Stock) is made and expire on May 11, 2026; |

| | | |

| | · | 211,821 shares of common stock available for future issuance under our 2011 Stock Incentive Plan; |

| | | |

| | · | 1,818,182 shares of common stock issuable upon exercise of the Common Warrants issued in this offering; and |

| | | |

| | · | up to 90,909 shares of common stock issuable upon exercise of the Placement Agent Warrants with an exercise price of $6.875 per share to be issued to the placement agent or its designees as compensation in connection with this offering. |

To the extent that outstanding options as of June 30, 2022 have been or may be exercised, unvested restricted stock units or performance-based restricted stock units have settled or other shares issued, investors purchasing our securities in this offering may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

Description of Securities Offered

We are offering 1,020,000 shares of our common stock, Pre-Funded Warrants to purchase 798,182 shares of our common stock, and Common Warrants to purchase 1,818,182 shares of our common stock. We are also registering the shares of common stock issuable from time to time upon exercise of the Pre-Funded Warrants and Common Warrants offered hereby.

Common Stock

The material terms and provisions of our common stock and each other class of our securities which qualifies or limits our common stock are described in the section entitled “Description of Securities — Common Stock” beginning on page 16 of the accompanying prospectus and the Description of Securities included as Exhibit 4.12 to our Annual Report on Form 10-K for the year ended June 30, 2019, filed with the SEC on September 12, 2019.

Pre-Funded Warrants

The following summary of certain terms and provisions of Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the Pre-Funded Warrant, the form of which will be filed as an exhibit to a Current Report on Form 8-K in connection with this offering and incorporated by reference into the registration statement of which this prospectus supplement forms a part. Prospective investors should carefully review the terms and provisions of the form of Pre-Funded Warrant for a complete description of the terms and conditions of the Pre-Funded Warrants.

Pre-Funded warrants will be issued in certificated form only.

Duration and Exercise Price

Each Pre-Funded Warrant offered hereby will have an initial exercise price per share equal to $0.0001. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations, or similar events affecting our common stock and the exercise price.

Exercisability

The Pre-Funded Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s Pre-Funded Warrant to the extent that the holder would own more than 4.99% (or, at the election of the purchaser, 9.99%) of the outstanding shares of common stock immediately after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding shares of common stock after exercising the holder’s Pre-Funded Warrants up to 9.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants. No fractional shares of common stock will be issued in connection with the exercise of a Pre-Funded Warrant. In lieu of fractional shares, we will either pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price or round up to the next whole share.

Cashless Exercise

In lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the Pre-Funded Warrants.

Fundamental Transactions

In the event of any fundamental transaction, as described in the Pre-Funded Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of common stock, then upon any subsequent exercise of a Pre-Funded Warrant, the holder will have the right to receive as alternative consideration, for each share of common stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of common stock of the successor or acquiring corporation or of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of common stock for which the Pre-Funded Warrant is exercisable immediately prior to such event.

Transferability

Subject to applicable laws, a Pre-Funded Warrant may be transferred at the option of the holder upon surrender of the Pre-Funded Warrant to us together with the appropriate instruments of transfer and payment of funds sufficient to pay any transfer taxes (if applicable).

Exchange Listing

There is no established trading market for the Pre-Funded Warrants on any securities exchange or nationally recognized trading system. We do not intend to list the Pre-Funded Warrants on any securities exchange or nationally recognized trading system.

Rights as a Stockholder

Except as otherwise provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the Pre-Funded Warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until such Pre-Funded Warrant holders exercise their Pre-Funded Warrants.

Common Warrants

The following summary of certain terms and provisions of the Common Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the Common Warrant, the form of which will be filed as an exhibit to a Current Report on Form 8-K in connection with this offering and incorporated by reference into the registration statement of which this prospectus supplement forms a part. Prospective investors should carefully review the terms and provisions of the form of Common Warrant for a complete description of the terms and conditions of the Common Warrants.

Common Warrants will be issued in certificated form only.

Duration and Exercise Price

Each Common Warrant offered hereby has an initial exercise price per share equal to $5.83. The Common Warrants are exercisable beginning six months after the date of issuance and will expire five and one-half years following the original date of issuance. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations, or similar events affecting our common stock and the exercise price.

Exercisability

The Common Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s Common Warrant to the extent that the holder would own more than 4.99% (or, at the election of the purchaser, 9.99%) of the outstanding shares of common stock immediately after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding shares of common stock after exercising the holder’s Common Warrants up to 9.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Common Warrants. No fractional shares of common stock will be issued in connection with the exercise of a Common Warrant. In lieu of fractional shares, we will either pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price or round up to the next whole share.

Cashless Exercise

If, at the time a holder exercises its Common Warrants, a registration statement registering the issuance of the shares of common stock underlying the Common Warrants under the Securities Act is not then effective or available, then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the Common Warrants. The Common Warrants will be automatically exercised on a cashless basis on the expiration date.

Fundamental Transaction

In the event of any fundamental transaction, as described in the Common Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of common stock, then upon any subsequent exercise of a Common Warrant, the holder will have the right to receive as alternative consideration, for each share of common stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of common stock of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of common stock for which the Common Warrant is exercisable immediately prior to such event. Notwithstanding the foregoing, in the event of a fundamental transaction, the holders of the Common Warrants have the right to require us or a successor entity to redeem the Common Warrants for cash in the amount of the Black-Scholes Value (as defined in each Common Warrant) of the unexercised portion of the Common Warrants concurrently with or within 30 days following the consummation of a fundamental transaction. However, in the event of a fundamental transaction which is not in our control, including a fundamental transaction not approved by our board of directors, the holders of the Common Warrants will only be entitled to receive from us or our successor entity, as of the date of consummation of such fundamental transaction the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of the Common Warrant that is being offered and paid to the holders of our common stock in connection with the fundamental transaction, whether that consideration is in the form of cash, stock or any combination of cash and stock, or whether the holders of our common stock are given the choice to receive alternative forms of consideration in connection with the fundamental transaction.

Transferability

Subject to applicable laws, a Common Warrant may be transferred at the option of the holder upon surrender of the Common Warrant to us together with the appropriate instruments of transfer and payment of funds sufficient to pay any transfer taxes (if applicable).

Exchange Listing

There is no trading market available for the Common Warrants on any securities exchange or nationally recognized trading system. We do not intend to list the Common Warrants on any securities exchange or nationally recognized trading system.

Rights as a Stockholder

Except as otherwise provided in the Common Warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the Common Warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their Common Warrants.

Dividend Policy

We have never declared or paid any dividends. We currently intend to retain earnings, if any, for use in our business. We do not anticipate paying dividends in the foreseeable future. Any future determination to declare dividends will be made at the discretion of our board of directors and will depend on our financial condition, operating results, capital requirements, general business conditions, and other factors that our board of directors may deem relevant.

Plan of Distribution

Pursuant to a letter agreement dated as of October 18, 2022, we have retained H.C. Wainwright & Co., LLC (“Wainwright”), to act as our exclusive placement agent in connection with this offering. Under the terms of the engagement letter, Wainwright is not purchasing or selling any of the securities offered by us in this offering, and is not required to arrange for the sale of any specific number or dollar amount of securities, other than to use its reasonable best efforts to arrange for the sale of such securities by us. The terms of this offering were subject to market conditions and negotiations between us, Wainwright and the prospective investor.

We are entering into a securities purchase agreement directly with the investor in connection with this offering of our common stock, Common Warrants, and Pre-Funded Warrants pursuant to this prospectus supplement and accompanying prospectus under which we will sell the securities offered hereby directly to such investor.

Wainwright will have no authority to bind us by virtue of the engagement letter. Further, Wainwright does not guarantee that it will be able to raise new capital in any prospective offering.

Delivery of the securities offered hereby is expected to occur on or about November 2, 2022, subject to satisfaction or waiver of customary closing conditions.

We have agreed to pay Wainwright a cash fee equal to 7.0% of the gross proceeds of this offering. We have also agreed to reimburse Wainwright $20,000 for non-accountable expenses and up to $100,000 for legal fees and expenses and other out-of-pocket expenses and pay $15,950 for clearing fees. We estimate the total offering expenses of this offering that will be payable by us, excluding the placement agent’s fees and expenses, will be approximately $140,000.

Upon closing of this offering, we will issue to Wainwright or its designees warrants to purchase up to 90,909 shares of common stock, representing 5.0% of the aggregate number of shares of common stock and shares of common stock issuable upon the exercise of Pre-Funded Warrants sold in this offering at an exercise price of $6.875 per share, representing 125% of the offering price of the common stock and accompanying Common Warrant in this offering, subject to any reductions necessary to comply with the rules and regulations of the Financial Industry Regulatory Authority, Inc., or FINRA. The Placement Agent Warrants will have substantially the same terms as the Common Warrants, will be exercisable, in whole or in part, beginning six months after the closing of this offering, and will expire October 31, 2027.

The issuance of the Placement Agent Warrants and underlying shares of common stock are being registered pursuant to the registration statement of which this prospectus supplement is a part, and we have agreed to maintain such registration during the term of the Placement Agent Warrants.

We have agreed to indemnify Wainwright and specified other persons against certain liabilities, including liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”), relating to or arising out of Wainwright’s activities under the engagement letter and to contribute to payments that Wainwright may be required to make in respect of such liabilities.

We have also agreed to pay Wainwright a tail fee equal to the cash and warrant compensation in this offering if any investor, subject to certain exemptions, who was brought over-the-wall, participated in the offering or participated in a meeting or discussion with us, during the term of our engagement of Wainwright, provides us with capital in any public or private offering or other financing or capital raising transaction during the 12-month period following expiration or termination of our engagement of Wainwright.

Under the terms of the securities purchase agreements, from the date of such agreements until one hundred twenty (120) days after the closing of this offering, neither we nor any subsidiary shall (i) issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of common stock or common stock equivalents, or (ii) file any registration statement or prospectus, or any amendment or supplement thereto, subject to certain exceptions.

We have also agreed, subject to certain exceptions, until one hundred twenty (120) days after the closing of the securities purchase agreement in connection with this offering, not to (i) issue or sell any debt or equity securities that are convertible into, exchangeable or exercisable for, or include the right to receive, additional shares of common stock either (A) at a conversion price, exercise price or exchange rate or other price that is based upon, and/or varies with, the trading prices of or quotations for the shares of common stock at any time after the initial issuance of such debt or equity securities or (B) with a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such debt or equity security or upon the occurrence of specified or contingent events directly or indirectly related to our business or the market for our common stock or (ii) enter into, or effect a transaction under, any agreement, including, but not limited to, an equity line of credit or an “at-the-market offering”, subject certain exceptions.

Wainwright may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of the securities sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, Wainwright would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of common stock by Wainwright acting as principal. Under these rules and regulations, Wainwright:

| | · | may not engage in any stabilization activity in connection with our securities; and |

| | | |

| | · | may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution. |

The securities purchase agreement is included as an exhibit to a Current Report on Form 8-K that we will file with the SEC and that is incorporated by reference into the registration statement of which this prospectus supplement forms a part.