Moving iMage Technologies Announces Closing of Initial Public Offering

July 13 2021 - 8:00AM

Moving iMage Technologies (NYSE: MITQ), a

leading digital cinema company that designs, manufactures,

integrates, installs and distributes a full suite of proprietary

and custom-designed equipment, today announced the closing of its

upsized underwritten public offering of 4,830,000 shares of its

common stock, including the full exercise by the underwriter’s

option to purchase up to 630,000 additional shares of common stock,

at a price to the public of $3.00 per share.

Total gross proceeds to the Company from the

offering, before deducting underwriting discounts and commissions

and other offering expenses, were approximately $14.5 million. The

shares sold in the offering began trading on the NYSE American

under the symbol “MITQ” on July 8, 2021.

The Company expects to use the net proceeds of the

offering to fund the expansion of its sales and marketing

activities, with the balance added to working capital, which may

include the funding of strategic acquisitions. The Company has not

yet identified any acquisition candidates.

Boustead Securities, LLC acted as the sole

underwriter for the offering. Manatt, Phelps & Phillips, LLP

served as legal counsel to Moving iMage Technologies and Schiff

Hardin LLP served legal counsel to the underwriter.

Copies of the prospectus relating to this offering

may be obtained from: Boustead Securities, LLC, via email

at offerings@boustead1828.com, by calling 949-502-4408 or by

standard mail at Boustead Securities, LLC, Attn: Equity Capital

Markets, 6 Venture, Suite 395, Irvine,

CA 92618, USA.

A registration statement relating to the

securities sold in this offering has been filed with the Securities

and Exchange Commission (the “SEC”) on Form S-1 (Reg. No.

333-234159) and was declared effective by the SEC on July 7, 2021.

This registration statement SEC can be obtained by visiting EDGAR

on the SEC website at www.sec.gov.

Moving iMage Technologies is a

leading manufacturer and integrator of purpose-built technology and

equipment to support a wide variety of entertainment applications,

with a focus on motion picture exhibition. MiT offers a wide range

of products and services, including custom engineering, systems

design, integration and installation, enterprise software solution,

digital cinema, A/V integration, as well as customized solutions

for emerging entertainment technology. MiT’s Caddy Products

division designs and sells proprietary cup-holder and other

seating-based products and lighting systems for theaters and

stadiums. For more information, visit

www.movingimagetech.com.

Forward-Looking Statements This

press release contains statements that constitute "forward-looking

statements," including the expected start of trading of the

Company’s common stock, the closing of the Company’s initial public

offering and the anticipated use of the net proceeds received by

the Company from the offering. No assurance can be given that the

offering discussed above will be completed on the terms described,

or at all. Forward-looking statements are subject to numerous

conditions, many of which are beyond the control of the Company,

including those set forth in the Risk Factors section of the

Company's registration statement and preliminary prospectus for the

Company's offering filed with the SEC. Copies of these documents

are available on the SEC's website, www.sec.gov. The Company

undertakes no obligation to update these statements for revisions

or changes after the date of this release, except as required by

law.

Investor Relations and Media

Contacts: Laurie Berman/Judy Sfetcu PondelWilkinson Inc.

310-279-5980 Investors@movingimagetech.com

Underwriter Contact: Boustead

Securities, LLC 949-502-4408 offerings@boustead1828.com

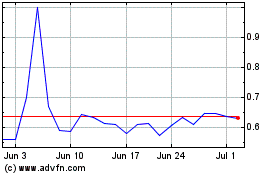

Moving iMage Technologies (AMEX:MITQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

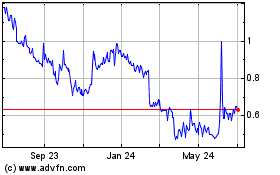

Moving iMage Technologies (AMEX:MITQ)

Historical Stock Chart

From Apr 2023 to Apr 2024