Matinas BioPharma Holdings, Inc. (NYSE AMER: MTNB), a

clinical-stage biopharmaceutical company focused on improving the

intracellular delivery of nucleic acids and small molecules with

its lipid nanocrystal (LNC) platform delivery technology, today

reported financial results for the second quarter ended June 30,

2022, along with a corporate update.

“The second quarter of 2022 through today has

been a period of significant execution for our Company, and

especially for our lead, late stage clinical asset, MAT2203,”

commented Jerome D. Jabbour, Chief Executive Officer of Matinas.

“Several meetings with the U.S. Food and Drug Administration (FDA)

over the past few months have provided clarity around a flexible,

streamlined approval pathway for this potentially game-changing

drug, based on a single Phase 3 registration trial now scheduled to

commence in the first quarter of 2023. We also remain very

enthusiastic about our ongoing exclusive research collaboration

with BioNTech and are diligently working toward what we believe

will be a mutually beneficial licensing arrangement for the

application of our proprietary LNC platform in the rapidly

developing mRNA space. Additional validation of the capabilities of

the LNC platform and developing an internal and external pipeline

of LNC-based drug candidates continue to be key objectives for

Matinas in the second half of 2022 and throughout 2023.”

Second Quarter 2022 Highlights and

Recent Events

Internal Pipeline Progress

MAT2203

-

Enrollment continues in Cohort 4 of the ongoing EnACT study

(Encochleated Oral Amphotericin for Cryptococcal Meningitis Trial)

of MAT2203 (oral amphotericin B) for the treatment of cryptococcal

meningitis (CM), with 42 patients (out of a total of 56) enrolled

to date. Cohort 4 is testing an all-oral regimen of MAT2203 during

the 14-day induction period, followed by four additional weeks of

oral consolidation therapy with MAT2203. The Company anticipates

reporting topline data from Cohort 4 either late in the third

quarter or early in the fourth quarter of 2022. The Company

recently opened an additional site in Uganda to facilitate

enrollment.

- With

guidance from multiple positive meetings with FDA over the last few

months, the Company has finalized the design of a single pivotal

Phase 3 registration trial for MAT2203 supporting submission of a

New Drug Application (NDA) for a simplified blanket indication for

the treatment of CM. The open-label trial, which the Company

expects will be partially financially supported by the National

Institutes of Health, involves a three arm non-inferiority design

in HIV patients with CM: (A) step-down therapy with MAT2203 with

treatment continuing for 2 weeks; (B) step-down therapy with

MAT2203 with treatment out to 6 weeks; and (C) a standard of care

(SOC) control arm of IV amphotericin induction transitioning to

fluconazole. The non-inferiority margin for both the primary and

key secondary endpoints will be 10% and total enrollment is

expected to be approximately 270 patients, with an adaptive,

de-risking design allowing for the potential for additional

patients once enrollment has reached 75%.

Key

trial elements include:

• A primary endpoint of 2-week

all-cause mortality, with a pooled analysis across the two MAT2203

treatment arms compared with SOC control to support a potential

indication for the treatment of CM for up to 2 weeks.

• To evaluate opportunities for

extending MAT2203 therapy, a key secondary analysis of 10-week

relapse free survival of optimized treatment (2-weeks or 6-weeks)

against SOC will be evaluated for non-inferiority. Selection of the

optimal treatment regimen will be based on predefined and

protocolized clinical criteria and will then form the basis for a

final NDA submission.

• The Company has also received

recent positive feedback from EMA on both its Request for

Scientific Advice and its Orphan Drug Application; this provides

alignment with FDA and positions MAT2203 for global registration in

key commercial markets.

External Collaborations

- In April

2022, Matinas and BioNTech entered an exclusive research

collaboration centered on the combination of Matinas’ proprietary

LNC platform technology and BioNTech mRNA formats. The companies

have initiated collaborative formulation work, ultimately directed

toward planned preclinical testing. The parties remain in advanced

discussions for a potential option to exclusively license the LNC

platform for all mRNA applications.

-

Additional recent data from an in vivo study of oral LNC-remdesivir

in mice infected with SARS-CoV-2 demonstrated significant

improvement in multiple histologic markers of lung injury with oral

LNC remdesivir at both Day 2 and Day 5. The study was performed in

collaboration with the National Institute of Allergy &

Infectious Diseases and the Department of Epidemiology at the

University of North Carolina at Chapel Hill. The Company expects to

engage with Gilead Sciences to discuss the data and potential

expansion of the LNC-remdesivir program.

LYPDISO™

- While

data from the Company’s clinical development program for LYPDISO

are compelling, the process to identify a partner to continue the

development of LYPDISO has been suspended.

Planned Retirement of Raphael J.

Mannino, Chief Scientific Officer

The Company also announced the planned

retirement of Raphael J. Mannino, Chief Scientific Officer of the

Company, who joined Matinas in 2015 following its acquisition of

Aquarius Biotechnologies, Inc. Dr. Mannino has informed the Company

that he intends to retire from employment effective December 31,

2022, whereupon he has agreed to transition to a consulting role

and will continue to serve as a key strategic advisor to the

Company.

“On behalf of our board of directors,

stockholders and employees, I want to thank Raphael for his

tremendous contributions to Matinas BioPharma, and for his

dedication to the LNC platform over the past 30+ years,” said

Jerome D. Jabbour, Chief Executive Officer of Matinas BioPharma.

“Raphael has been a visionary in the world of intracellular drug

delivery and has helped to position our Company and our technology

for a very bright future. We wish him all the best in retirement,

but also genuinely look forward to continued contributions from him

as we seek to maximize the significant opportunity afforded by this

disruptive drug delivery platform.”

“I am extremely proud of all of the work that

has been done on the LNC platform over the years and grateful to

the talented and dedicated team at Matinas for helping us to

achieve remarkable clinical results with MAT2203,” commented

Raphael J. Mannino, Chief Scientific Officer of Matinas. “Although

I plan to take a step back in my retirement, I could not be more

excited about the scientific talent we have been able to attract to

the Company and the prospects for the LNC platform, especially in

the field of nucleic acids. I look forward to being a key resource

for Jerry and the rest of the organization as they advance and

progress this exciting technology.”

Second Quarter 2022 Financial

Results

Cash, cash equivalents and marketable securities

at June 30, 2022, were approximately $38.5 million, compared to

$49.6 million at December 31, 2021. Based on current projections,

the Company believes that cash on hand is sufficient to fund

planned operations through 2023.

For the second quarter of 2022, net loss

attributable to common shareholders was $5.9 million, or a net loss

of $0.03 per share (basic and diluted), compared to a net loss

attributable to common shareholders of $5.0 million, or a net loss

of $0.02 per share (basic and diluted), for the same period in

2021. The increase was due primarily to an increase in research and

development expenses, partially offset by $1.1 million of revenue

resulting from the research collaboration with BioNTech

SE.Conference Call and Webcast DetailsThe Company

will host a live conference call and webcast to discuss these

results today, Thursday, August 11, 2022, at 8:30 a.m. ET.To

participate in the call, please dial (877) 407-5976 (Toll-Free) or

(412) 902-0031 (Toll) and reference conference ID 13730276. The

live webcast will be accessible on the Investors section of

Matinas’ website, www.matinasbiopharma.com, and archived for 90

days.

About Matinas BioPharma

Matinas BioPharma is a biopharmaceutical company

focused on improving the intracellular delivery of nucleic acids

and small molecules with its lipid nanocrystal (LNC) platform

technology. The Company is developing its own internal portfolio of

products as well as partnering with leading pharmaceutical

companies to develop novel formulations that capitalize on the

unique characteristics of the LNC platform.

Preclinical and clinical data have demonstrated

that this novel technology can provide solutions to many of the

challenges in achieving safe and effective intracellular delivery,

for both small molecules and larger, more complex molecules, such

as mRNA, DNA plasmids, antisense oligonucleotides, and vaccines.

The combination of a unique mechanism of action and flexibility

with formulation and route of administration (including oral),

positions Matinas’ LNC technology to potentially become the

preferred next-generation intracellular drug delivery vehicle with

distinct advantages over both lipid nanoparticles and viral

vectors.

The Company is focused on developing an internal

and external pipeline of drugs candidates based on the LNC

platform. Internally, the Company has two clinical stage

assets. MAT2203 is an oral, LNC formulation of the highly

potent antifungal medicine amphotericin B, currently preparing to

commence a Phase 3 registration trial in the first quarter of

2023; MAT2501 is an oral, LNC formulation of the

broad-spectrum aminoglycoside, amikacin, primarily used to treat

chronic and acute bacterial infections, and currently in Phase

1. Externally, the Company has established a broad set of

relationships with multiple global pharmaceutical collaborators,

including BioNTech (mRNA), the National Institutes of Health and

Gilead Sciences (antivirals), and Genentech, a member of the

Roche Group (small molecules, antisense oligonucleotides, and

antibody fragments).

Forward Looking Statements

This release contains "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995, including those relating to our business

activities, our strategy and plans, our collaboration with

BioNTech, the potential of our LNC platform delivery technology,

and the future development of its product candidates, including

MAT2203, MAT2501, the anticipated timing of regulatory submissions,

the anticipated timing of clinical studies, the anticipated timing

of regulatory interactions, the Company’s ability to identify and

pursue development and partnership opportunities for its products

or platform delivery technology on favorable terms, if at all, and

the ability to obtain required regulatory approval and other

statements that are predictive in nature, that depend upon or refer

to future events or conditions. All statements other than

statements of historical fact are statements that could be

forward-looking statements. Forward-looking statements include

words such as "expects," "anticipates," "intends," "plans,"

"could," "believes," "estimates" and similar expressions. These

statements involve known and unknown risks, uncertainties and other

factors which may cause actual results to be materially different

from any future results expressed or implied by the forward-looking

statements. Forward-looking statements are subject to a number of

risks and uncertainties, including, but not limited to, our ability

to obtain additional capital to meet our liquidity needs on

acceptable terms, or at all, including the additional capital which

will be necessary to complete the clinical trials of our product

candidates; our ability to successfully complete research and

further development and commercialization of our product

candidates; the uncertainties inherent in clinical testing; the

timing, cost and uncertainty of obtaining regulatory approvals; our

ability to protect the Company’s intellectual property; the loss of

any executive officers or key personnel or consultants;

competition; changes in the regulatory landscape or the imposition

of regulations that affect the Company’s products; and the other

factors listed under "Risk Factors" in our filings with the SEC,

including Forms 10-K, 10-Q and 8-K. Investors are cautioned not to

place undue reliance on such forward-looking statements, which

speak only as of the date of this release. Except as may be

required by law, the Company does not undertake any obligation to

release publicly any revisions to such forward-looking statements

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events. Matinas BioPharma’s

product candidates are all in a development stage and are not

available for sale or use.

| |

| |

| Matinas

BioPharma Holdings Inc. |

| Condensed

Consolidated Balance Sheets |

| |

|

|

|

|

|

| |

June 31, 2022 |

|

December 31, 2021 |

| |

(Unaudited) |

|

(Audited) |

|

ASSETS: |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

10,398,544 |

|

|

$ |

21,029,806 |

|

|

Marketable securities |

|

28,104,146 |

|

|

|

28,592,049 |

|

|

Restricted cash - security deposit |

|

50,000 |

|

|

|

50,000 |

|

|

Prepaid expenses and other current assets |

|

3,371,538 |

|

|

|

1,321,466 |

|

|

Total current assets |

|

41,924,228 |

|

|

|

50,993,321 |

|

| |

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

Leasehold improvements and equipment - net |

|

1,982,975 |

|

|

|

1,537,728 |

|

|

Operating lease right-of-use assets - net |

|

3,944,158 |

|

|

|

4,218,890 |

|

|

Finance lease right-of-use assets - net |

|

10,415 |

|

|

|

22,270 |

|

|

In-process research and development |

|

3,017,377 |

|

|

|

3,017,377 |

|

|

Goodwill |

|

1,336,488 |

|

|

|

1,336,488 |

|

|

Restricted cash - security deposit |

|

200,000 |

|

|

|

200,000 |

|

|

Total non-current assets |

|

10,491,413 |

|

|

|

10,332,753 |

|

|

Total assets |

$ |

52,415,641 |

|

|

$ |

61,326,074 |

|

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY: |

|

|

|

|

|

| |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

497,151 |

|

|

$ |

938,270 |

|

|

Accrued expenses |

|

4,294,396 |

|

|

|

2,850,888 |

|

|

Operating lease liabilities - current |

|

579,260 |

|

|

|

538,546 |

|

|

Financing lease liabilities - current |

|

11,508 |

|

|

|

21,039 |

|

|

Total current liabilities |

|

5,382,315 |

|

|

|

4,348,743 |

|

| |

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

|

|

Deferred tax liability |

|

341,265 |

|

|

|

341,265 |

|

|

Operating lease liabilities - net of current portion |

|

3,843,524 |

|

|

|

4,140,387 |

|

|

Financing lease liabilities - net of current portion |

|

- |

|

|

|

2,621 |

|

|

Total non-current liabilities |

|

4,184,789 |

|

|

|

4,484,273 |

|

|

Total liabilities |

|

9,567,104 |

|

|

|

8,833,016 |

|

| |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Common stock |

|

21,685 |

|

|

|

21,627 |

|

|

Additional paid-in capital |

|

187,116,333 |

|

|

|

184,251,138 |

|

|

Accumulated deficit |

|

(143,535,065 |

) |

|

|

(131,634,208 |

) |

|

Accumulated other comprehensive loss |

|

(754,416 |

) |

|

|

(145,499 |

) |

|

Total stockholders' equity |

|

42,848,537 |

|

|

|

52,493,058 |

|

|

Total liabilities and stockholders' equity |

$ |

52,415,641 |

|

|

$ |

61,326,074 |

|

| |

|

|

|

|

|

| |

|

- |

|

|

|

- |

|

| |

|

| Matinas

BioPharma Holdings, Inc. |

|

| Condensed

Consolidated Statements of Operations and Comprehensive

Loss |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract research revenue |

$ |

1,062,500 |

|

|

$ |

- |

|

|

$ |

1,062,500 |

|

|

$ |

33,333 |

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

4,126,529 |

|

|

|

2,480,764 |

|

|

|

9,104,634 |

|

|

|

5,722,196 |

|

|

|

General and administrative |

|

2,861,421 |

|

|

|

2,308,926 |

|

|

|

5,605,616 |

|

|

|

5,453,936 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

6,987,950 |

|

|

|

4,789,690 |

|

|

|

14,710,250 |

|

|

|

11,176,132 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(5,925,450 |

) |

|

|

(4,789,690 |

) |

|

|

(13,647,750 |

) |

|

|

(11,142,799 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale of New Jersey net operating loss & tax credits |

|

- |

|

|

|

- |

|

|

|

1,734,133 |

|

|

|

1,328,470 |

|

|

|

Other income/(loss), net |

|

2,866 |

|

|

|

(1,415 |

) |

|

|

12,760 |

|

|

|

66,904 |

|

|

|

Net loss |

$ |

(5,922,584 |

) |

|

$ |

(4,791,105 |

) |

|

$ |

(11,900,857 |

) |

|

$ |

(9,747,425 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock series B accumulated dividends |

|

- |

|

|

|

(184,899 |

) |

|

|

- |

|

|

|

(395,799 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common shareholders |

$ |

(5,922,584 |

) |

|

|

(4,976,004 |

) |

|

$ |

(11,900,857 |

) |

|

$ |

(10,143,224 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss

available for common shareholders per share - basic and

diluted |

$ |

(0.03 |

) |

|

|

(0.02 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.05 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic and diluted |

|

216,864,526 |

|

|

|

205,215,259 |

|

|

|

216,755,261 |

|

|

|

204,547,251 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on securities available-for-sale |

|

(125,242 |

) |

|

|

(85,163 |

) |

|

|

(608,917 |

) |

|

|

(176,929 |

) |

|

|

Other comprehensive loss, net of tax |

|

(125,242 |

) |

|

|

(85,163 |

) |

|

|

(608,917 |

) |

|

|

(176,929 |

) |

|

|

Comprehensive loss attributable to shareholders |

$ |

(6,047,826 |

) |

|

$ |

(4,876,268 |

) |

|

$ |

(12,509,774 |

) |

|

$ |

(9,924,354 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Investor and Media Contacts

Peter VozzoICR

Westwicke443-213-0505peter.vozzo@westwicke.com

Source: Matinas BioPharma Holdings, Inc.

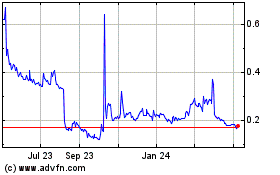

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

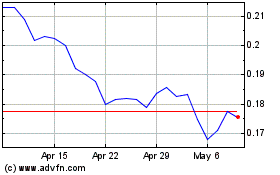

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Apr 2023 to Apr 2024