Amended Statement of Beneficial Ownership (sc 13d/a)

September 06 2022 - 6:02AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No. 2)*

The Marygold Companies, Inc.

(Name

of Issuer)

Common Stock

(Title

of Class of Securities)

206065203

(CUSIP

Number)

Nicholas Daniel Gerber

C/O The Marygold Companies, Inc.

120 Calle Iglesia, Unit B

San Clemente, CA 92672

925-297-9465

(Name, Address

and Telephone Number of Person Authorized

to Receive Notices and Communications)

May 20, 2022

(Date

of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

* The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in

a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| |

|

|

|

|

| CUSIP

No. 206065203 |

|

Schedule 13D/A Amendment No. 2 |

|

Page

2 of 7 |

| |

|

|

|

|

| 1. |

NAME(S)

OF REPORTING PERSON(S)

I.R.S. IDENTIFICATION NOS.

OF ABOVE PERSONS (ENTITIES ONLY)

Nicholas And Melinda Gerber Living Trust |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a) o

(b) o |

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

PF |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE

VOTING POWER

|

| 8. |

SHARED

VOTING POWER

18,250,015 |

| 9. |

SOLE

DISPOSITIVE POWER

|

| 10. |

SHARED

DISPOSITIVE POWER

18,250,015 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

18,250,015 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) |

o |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

45.21% |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

OO |

| |

|

|

|

|

|

| |

|

|

|

|

| CUSIP

No. 206065203 |

|

Schedule 13D/A Amendment No. 2 |

|

Page

3 of 7 |

| |

|

|

|

|

| 1. |

NAME(S)

OF REPORTING PERSON(S)

I.R.S. IDENTIFICATION NOS.

OF ABOVE PERSONS (ENTITIES ONLY)

Nicholas Daniel Gerber |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a) o

(b) o |

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

PF |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE

VOTING POWER

|

| 8. |

SHARED

VOTING POWER

18,250,015 |

| 9. |

SOLE

DISPOSITIVE POWER

|

| 10. |

SHARED

DISPOSITIVE POWER

18,250,015 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

18,250,015 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) |

o |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

45.21% |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

| |

|

|

|

|

|

| |

|

|

|

|

| CUSIP

No. 206065203 |

|

Schedule 13D/A Amendment No. 2 |

|

Page

4 of 7 |

| |

|

|

|

|

Item 1. Security and Issuer

This statement

on Schedule 13D (the “Statement”) relates to the shares of common stock, par value $0.001 per share (the “Common

Stock”) and shares of Series B Voting, Convertible Preferred Stock, par value $0.001 per share, each of which is convertible

into 20 shares of Common Stock and, until converted, has 20 votes on all matters brought before the Issuer’s shareholders

(the “Series B Preferred Stock” and together with the Common Stock, the “Shares”), of The

Marygold Companies, Inc. (the “Issuer”) by each of the reporting persons named herein (each, individually,

a “Reporting Person” and collectively the “Reporting Persons”).

The

address of the principal executive offices of the Issuer is 120 Calle Iglesia, Unit B, San Clemente, CA 92672.

Item 2. Identity

and Background.

| (a) | This

statement on Amendment Number 2 to Schedule 13D is being filed jointly by the following

Reporting Persons: |

| a. | The

Nicholas and Melinda Gerber Living Trust (the “Gerber

Trust”) is a trust organized under

the laws of the state of California. The situs of the Gerber Trust is California. The

principal business of the Gerber Trust is to manage and hold investments for the benefit

of the Gerber Trust’s beneficiaries. The address of the principal office of the

Gerber Trust, Trustee is 1850 Mt. Diablo Blvd., Suite 640, Walnut Creek, CA 94596. |

| b. | Nicholas

Daniel Gerber, a United States citizen (“Mr. Gerber”), is the Chairman,

President and Principal Executive Officer of the Issuer and the Vice President at USCF

Advisers LLC. The principal business and office address for Mr. Gerber is 120 Calle Iglesia,

Unit B, San Clemente, CA 92672. |

| (b) | The

business address of the Reporting Persons are identified above in Item 2(a). |

| (c) | The

employment status of the Reporting Persons are identified above in Item 2(a). |

| (d) | This

filing is a second amendment to a previous Schedule 13(D) filing by the Reporting Persons. |

| (e) | The

Reporting Persons have not been convicted in a criminal proceeding (excluding traffic

violations or similar misdemeanors) during the last five years. |

| (f) | During

the last five years, the Reporting Persons have not been a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and as a result of such

proceeding was or is subject to a judgment, decree or final order enjoining future violations

of, or prohibiting, or mandating activities subject to, United States federal or state

securities laws or finding any violation with respect to such laws. |

| (g) | One

reporting person is a citizen of the United States and the other is a trust organized

under the laws of the state of California. |

| |

|

|

|

|

| CUSIP

No. 206065203 |

|

Schedule 13D/A Amendment No. 2 |

|

Page

5 of 7 |

| |

|

|

|

|

Item 3. Source

and Amount of Funds or Other Consideration.

The

Reporting Persons acquired 120,000 shares of Common Stock on May 20, 2022. The funds to purchase the Common Shares were derived

from the personal funds of the Reporting Persons. An aggregate of $128,507.30 USD was paid, less transaction fees, to acquire

the shares.

Item 4. Purpose

of Transaction.

The

Reporting Persons acquired the shares of Common Stock reported in this Statement for investment purposes. The Reporting Persons

may in the future acquire additional shares of Common Stock or dispose of some or all of the shares of Common Stock beneficially

owned by them in open-market transactions or privately negotiated transactions, on such terms and at such times as the Reporting

Persons may deem advisable

The

Reporting Persons do not have any present plan or proposal that would result in any of the actions described in paragraphs (a)

through (j) of Item 4 of Schedule 13D, except as set forth herein or as may be proposed by Mr. Gerber in his capacity as an officer

or director of the Company or by the Board of Directors (the “Board”) with his participation. The Reporting

Persons reserve the right in the future to formulate any such plans or proposals, and to take any actions with respect to investments

in the Company, including any or all of the actions described in paragraphs (a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest

in Securities of the Issuer.

(a,

b) For information regarding beneficial ownership, see the information presented on the cover page of this Schedule 13D.

| (c) | Except

for the shares of Common Stock purchased by the Reporting Persons identified in Item

3, the Reporting Person has not effected any transaction relating to the Company’s

Common Stock during the past 60 days. |

Item 6. Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The

information set forth, or incorporated by reference, in Items 3 through 5 above is hereby incorporated by this reference in this

Item 6. The Gerber Trust and Schoenberger Family Trust (the “Schoenberger Trust”), which holds the Shares

of Mr. Scott Schoenberger, a member of the Issuer’s Board, have in place a voting agreement (the “Voting Agreement”).

Pursuant to the Voting Agreement, the Gerber Trust and Schoenberger Trust vote all respective Shares owned by them to elect each

of Messrs. Gerber and Schoenberger to the Issuer’s Board, along with other designees mutually agreed upon.

| |

|

|

|

|

| CUSIP

No. 206065203 |

|

Schedule 13D/A Amendment No. 2 |

|

Page

6 of 7 |

| |

|

|

|

|

Item 7. Materials to be Filed

as Exhibits

| Exhibit

Number |

Description

of Exhibit |

| |

|

| Exhibit

1 |

Form

4, disclosing statement of changes in beneficial ownership, previously filed on May 23, 2022. |

| |

|

|

|

|

| CUSIP

No. 206065203 |

|

Schedule 13D/A Amendment No. 2 |

|

Page

7 of 7 |

| |

|

|

|

|

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

| |

|

NICHOLAS AND MELINDA GERBER

LIVING TRUST |

| |

|

|

| Dated: September 2, 2022 |

|

/s/

Nicholas Daniel Gerber |

| |

|

Nicholas Daniel Gerber |

| |

|

Trustee |

| |

|

|

| |

|

NICHOLAS DANIEL GERBER |

| |

|

|

| |

|

/s/

Nicholas Daniel Gerber |

| |

|

Nicholas Daniel Gerber |

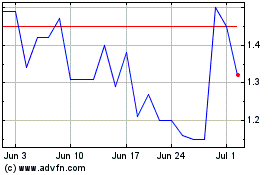

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

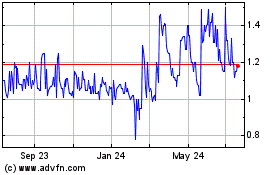

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024