India Globalization Capital, Inc. (NYSE American: IGC) today

announced financial results for the quarter ended September 30,

2019, which is the second quarter of its 2020 fiscal year.

Revenue for the September 2019 quarter rose 125% to

approximately $1.8 million compared to approximately $0.81 million

reported in the September 2018 quarter. In the September 2019

quarter, the plant and cannabinoid business, consisting of the sale

of cannabinoid products under the brands Holi Hemp™ and Hyalolex™,

in accordance with applicable law and regulations, accounted for

20% of the quarter’s revenue versus zero a year ago.

The remaining 80% of the revenue was primarily derived from the

Company’s India-based infrastructure business which consists of (i)

rental of heavy equipment, (ii) execution of construction

contracts, and (iii) sale of infrastructure commodities.

SG&A expense, inclusive of R&D expenses for the

September 2019 quarter was approximately $1.31 million compared to

approximately $0.87 million for the September 2018 quarter. The

majority of the increase in SG&A was due to legal and

professional fees including those incurred in connection with

defending shareholder lawsuits.

Net loss for the September 2019 quarter was approximately $1.32

million or $0.03 per share, compared to approximately $1.19 million

or $0.03 per share for the September 2018 quarter. Increased

expenses from the plant and cannabinoid business and legal

expenses, as noted above, were the primary factors for the larger

loss.

During the three months ended September 30, 2019, the Company

took the following steps, among others:

- Pharmaceutical Trial for Hyalolex™: The Company

continued to diligently pursue its double-blind,

placebo-controlled, 100-person trial, for its proprietary patent

pending formulation based on IGC-AD1 that uses ultra-low doses of

THC with other natural compounds and is intended to assist in

management of the care of patients suffering from Alzheimer’s

disease. The Company’s efforts include investigating and securing a

site for patient interaction. During the September 2019 quarter,

the Company obtained Puerto Rico Institutional Review Board

approval to conduct the trial.

- Hyalolex™ in Puerto Rico: The Company expanded the

number of dispensaries in Puerto Rico where Hyalolex™ (the

Company’s flagship product) is sold and began the next phase of

marketing, including patient and doctor engagement.

- Team Expansion: IGC opened a marketing and research hub

in Bogota, Colombia. The Company’s beneficially-owned subsidiary,

Hamsa Biochem SAS, will focus on three goals – (1) expanding the

distribution of the Company’s products in Latin America, (2)

securing a low cost-basis for procuring raw materials like CBD

(cannabidiol) and hemp extracts, and (3) advancing the Company’s

research platform through medical trials and advanced natural

product chemistry. The Company also expanded its supply chain, for

the sale of Holi Hemp™ branded products such as hemp crude,

cannabidiol (“CBD”) distillate, tetrahydrocannabinol-free

(“T-free”) oil, and other hemp derivatives.

- New Product Launch: IGC is in the late stage of building

a patented pain relief brand and intends to begin test marketing

online in calendar year 2020.

- Hemp Crop: The Company’s subsidiary, Holi Hemp LLC,

started growing hemp on 100 acres in Arizona. The first harvest is

expected in calendar year 2020.

- Investments: The Company continues to invest in hemp

processing and growing facilities.

The Company operates both of its business lines in compliance

with applicable laws and regulations.

About IGC:

IGC currently has two lines of business: (i) infrastructure and

(ii) plant and cannabinoid-based products. The company is based in

Bethesda, Maryland, U.S.A. Its corporate website is www.igcinc.us.

Twitter @IGCIR.

Forward-looking Statements:

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934.

These forward-looking statements are based largely on IGC’s

expectations and are subject to a number of risks and

uncertainties, certain of which are beyond IGC’s control. Actual

results could differ materially from these forward-looking

statements as a result of, among other factors, competitive

conditions in the industries in which IGC operates, failure to

commercialize one or more of the products or technologies of IGC,

including any new products identified herein, failure to obtain an

R&D license or any other applicable license or regulatory

approval necessary for conducting our trial protocol, any changes

in federal, state, or local law applicable to our businesses and

the locations where we operate, weather and/or climate events which

impact the Company’s ability to harvest its hemp crop, failure to

reach agreement on specific terms to resolve the shareholder and

shareholder derivative suits currently pending against the Company

as described in the Company’s public filings, general economic and

political conditions that are less favorable than expected, the

Federal Food and Drug Administration’s (FDA) general position

regarding hemp-based and related products in particular, and other

factors, many of which are discussed in our SEC filings. The Risk

Factors identified in the Company’s annual report, filed on Form

10-K with the SEC on June 14, 2019, and in the Company’s quarterly

report, filed on Form 10-Q with the SEC on August 9, 2019, and on

November 5, 2019, are incorporated herein by reference. In light of

these risks and uncertainties, there can be no assurance that the

forward-looking information contained in this release will in fact

occur.

< Financial Tables to Follow >

India Globalization Capital,

Inc.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

(Unaudited)

September 30,

2019

(Unaudited)

($)

March 31,

2019

(Audited)

($)

ASSETS

Current assets:

Cash and cash equivalents

14,063

25,610

Accounts receivable, net of allowances of

$6 and $6

244

84

Inventory

3,108

248

Short-term investment

5,039

-

Deposits & advances

1,446

781

Total current assets

23,900

26,723

Intangible assets, net

203

184

Property, plant and equipment, net

7,123

5,886

Investments in unlisted securities

794

794

Claims and advances

867

878

Total non-current assets

8,987

7,742

Total assets

32,887

34,465

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

903

319

Accrued and other liabilities

677

509

Short-term loan

50

50

Total current liabilities

1,630

878

Other liabilities

15

15

Total non-current liabilities

15

15

Total liabilities

1,645

893

Commitments and Contingencies – See Note

10

Stockholders' equity:

Common stock and additional paid in

capital, $0.0001 par value: 150,000,000 shares authorized;

39,571,407 and 39,501,407 shares issued and outstanding as of

September 30, 2019 and March 31, 2019, respectively.

94,395

94,043

Accumulated other comprehensive loss

(2,543)

(2,419)

Accumulated deficit

(60,610)

(58,052)

Total stockholders' equity

31,242

33,572

Total liabilities and stockholders'

equity

32,887

34,465

See accompanying Notes to the Condensed

Consolidated Financial Statements in the Quarterly Report on Form

10-Q for the quarter ended September 30, 2019, as filed with the

SEC on November 5, 2019.

India Globalization Capital,

Inc.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

AND COMPREHENSIVE LOSS

(in thousands, except loss per

share)

(Unaudited)

Three months ended Sept. 30,

2019

($)

2018

($)

Revenue

1,821

811

Cost of revenue

(1,793

)

(793

)

Gross Profit

28

18

General and administrative expenses

(1,094

)

(595

)

Research and development expenses

(222

)

(278

)

Operating loss

(1,288

)

(855

)

Other income/(expense), net

109

(4

)

Loss before income taxes

(1,179

)

(859

)

Income taxes expense/benefit

-

-

Net loss attributable to common

stockholders

(1,179

)

(859

)

Foreign currency translation

adjustments

(143)

(334

)

Comprehensive loss

(1,322

)

(1,193

)

Loss per share attributable to common

stockholders:

Basic & Diluted

$

(0.03

)

$

(0.03

)

Weighted-average number of shares used in

computing loss per share amounts:

39,551

31,345

See accompanying Notes to the Condensed

Consolidated Financial Statements in the Quarterly Report on Form

10-Q for the quarter ended September 30, 2019, as filed with the

SEC on November 5, 2019.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191106005360/en/

Claudia Grimaldi 301-983-0998

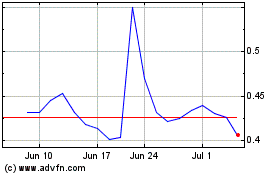

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

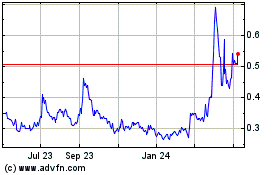

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Apr 2023 to Apr 2024