Written Communication Relating to an Issuer or Third Party (sc To-c)

June 05 2019 - 6:03AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section

14(d)(1) or Section 13(e)(1)

of the Securities Exchange Act of 1934

GRAN TIERRA ENERGY INC.

(Name of Subject Company and Filing Person

(Issuer) and Name of Filing Person (Offeror))

5.00% Convertible Senior Notes due 2021

(Title of Class of Securities)

38500T AA9

(CUSIP Number of Class of Securities)

Gary S. Guidry

President and Chief Executive Officer

Suite 900, 520 – 3

rd

Avenue SW

Calgary, Alberta, Canada, T2P 0R3

(403) 265-3221

(Name, address and telephone number of

person authorized to receive notices and communications on behalf of filing persons)

with a copy to:

Hillary H. Holmes

Gibson, Dunn & Crutcher LLP

811 Main Street, Suite 3000

Houston, TX 77002

Tel: (346) 718-6600

CALCULATION OF FILING FEE

|

Transaction valuation*

|

Amount of filing fee*

|

|

Not Applicable

|

Not Applicable

|

* Pursuant

to General Instruction D to Schedule TO, no filing fee is required in connection with this filing as it relates solely to preliminary

communications made before the commencement of a tender offer.

|

¨

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount Previously Paid:

|

Not Applicable

|

|

Form of Registration No.:

|

Not Applicable

|

|

Filing Party:

|

Not Applicable

|

|

Date Filed:

|

Not Applicable

|

|

x

|

Check the box if filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions

to which the statement relates:

|

|

¨

|

third-party tender offer subject to Rule 14d-1.

|

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

|

¨

|

going-private transaction subject to Rule 13e-3.

|

|

|

¨

|

amendment to Schedule 13D under Rule 13d-2.

|

Check

the following box if the filing is a final amendment reporting the results of the tender offer:

¨

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

|

|

¨

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

¨

|

issuer tender offer subject to Rule 13e-4 (Cross-Border Third-Party Tender Offer)

|

IMPORTANT INFORMATION

Attached as Exhibit 99.1 to this Schedule TO is a press release

issued by Gran Tierra Energy Inc., a Delaware corporation (the “

Company

”) on June 4, 2019, announcing that

its board of directors has approved an issuer bid (the “

Offer

”) pursuant to which the Company will offer to

purchase for cancellation all of the issued and outstanding 5.00% Convertible Senior Notes due 2021 (being US$115 million aggregate

principal amount) of Gran Tierra (the “

Convertible Notes

”).

This communication does not constitute an offer to sell or

the solicitation of an offer to buy any securities. The Company has not commenced a tender offer for the Convertible Notes in this

communication.

In connection with the Offer, the Company intends to file

with the Securities and Exchange Commission (the “SEC”) an offer to purchase, issuer bid circular and a related letter

of transmittal, containing the terms and conditions of the Offer and instructions for depositing such Convertible Notes, and related

materials on Schedule TO (the “Offer Documents”).

This communication is not intended to be, and is not, a substitute

for such filings or any other documents that the Company may file with the SEC in connection with the Offer. Holders of the Convertible

Notes are urged to read the Offer Documents and its exhibits regarding the Offer when it becomes available, because it will contain

important information that you should consider before making any decision regarding the Offer.

You may obtain a free copy of the Offer Documents and its

exhibits and other related documents filed by the Company with the SEC at the SEC’s website at www.sec.gov, or from the Company’s

website at www.grantierra.com, or from the depositary, Computershare Trust Company of Canada, at 1-800-564-6253 (toll-free in North

America), at 1-514-982-7555 (collect call outside North America) or by e-mail at corporateactions@computershare.com.

Item 12. Exhibits.

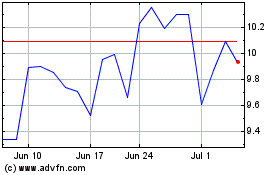

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

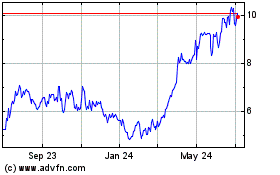

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Apr 2023 to Apr 2024