Current Report Filing (8-k)

December 10 2020 - 4:02PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 4, 2020

GOLDEN MINERALS COMPANY

(Exact name of registrant as specified in

its charter)

|

DELAWARE

|

|

1-13627

|

|

26-4413382

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

350 Indiana Street, Suite 650

Golden, Colorado 80401

(Address of principal executive offices)

(Zip code)

Registrant’s telephone number, including

area code: (303) 839-5060

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange

on which registered

|

|

Common Stock, $0.01

par value

|

|

AUMN

|

|

NYSE American

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

Golden Minerals Company

(the “Company”) previously disclosed on July 14, 2020 that it entered into a binding letter of intent with Fabled Silver

Gold Corp., formerly known as Fabled Copper Corp. (“Fabled”), for a potential transaction pursuant to which Fabled

would acquire the Company’s option to earn a 100% interest in the Santa Maria mining claims located in Chihuahua, Mexico

(the “Option”). Entry into a definitive agreement regarding the Option was subject to a number of contingencies.

On December 4, 2020,

the Company entered into a definitive option agreement (the “Option Agreement”) to sell its Option to Fabled. The period

to exercise the Option (the “Exercise Period”) expires on December 4, 2022, unless extended by the parties under the

terms of the Option Agreement. As consideration for the Option, Fabled (i) will pay $500,000 in cash to the Company and issue to

the Company 1,000,000 shares of Fabled’s common stock (the “Closing Consideration”); (ii) will pay $1,500,000

in cash to the Company on the one year anniversary date following the closing of the Option Agreement; (iii) will pay $2,000,000

in cash to the Company on the two year anniversary date following the closing of the Option Agreement; and (iv) upon exercise of

the Option, will grant the Company a 1% net smelter return royalty on the Maria, Martia III, Maria II Frac. I, Santa Maria and

Punto Com concessions (the “Concessions”). The Company expects to receive the Closing Consideration promptly following

the closing of the Option Agreement.

Pursuant to the Option

Agreement, during the Exercise Period, Fabled is obligated to pay to each of the owners of the Concessions (the “Owners”)

any remaining required payments due to the Owners pursuant to the various underlying option agreements between the Owners and the

Company, and to make all payments and perform all other requirements needed to maintain the Concessions in good standing.

Should Fabled not complete

its obligations described above, the Santa Maria mining claims will revert to the Company and the Company will be entitled to keep

any payments made by Fabled under the terms of the Option Agreement.

The Option Agreement

contains standard representations, warranties, covenants, and indemnification rights and obligations of the parties.

The foregoing description

of the Option Agreement does not purport to be complete and is qualified in its entirety by the full text of the Option Agreement

which has been filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: December 10,

2020

|

|

Golden Minerals Company

|

|

|

|

|

|

|

|

|

By:

|

/s/ Robert P. Vogels

|

|

|

|

Name:

|

Robert P. Vogels

|

|

|

|

Title:

|

Senior Vice President, Chief Financial Officer and Corporate Secretary

|

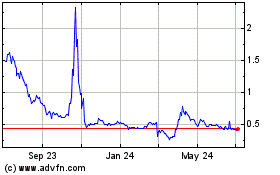

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

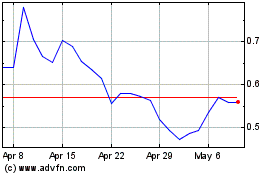

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Apr 2023 to Apr 2024