Current Report Filing (8-k)

April 02 2020 - 9:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 2, 2020 (March 30, 2020)

GOLDEN MINERALS COMPANY

(Exact name of registrant as specified in

its charter)

|

DELAWARE

|

1-13627

|

26-4413382

|

(State or other jurisdiction

of incorporation or

organization)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification Number)

|

350 Indiana Street, Suite 650

Golden, Colorado 80401

(Address of principal executive offices)

(Zip Code)

Registrant’s

telephone number, including area code: (303) 839-5060

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value

|

|

AUMN

|

|

NYSE American

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Sentient

Loan

On March 30,

2020, Golden Minerals Company (the “Company”) entered into a Short-Term Loan Agreement (the “Loan

Agreement”) with Sentient Global Resources Fund IV, L.P., a Cayman Islands exempted limited partnership

(“Sentient”), pursuant to which Sentient granted to the Company an unsecured loan in an amount equal to

US$1,000,000 (the “Sentient Loan”). Sentient is a private equity fund, and together with certain

other Sentient equity funds, Sentient is the Company’s largest stockholder, holding

in the aggregate approximately 38% of the Company’s outstanding common stock. The Sentient Loan bears interest at a

rate of 10% per annum and the Company shall repay the Sentient Loan, together with accrued interest and any other amount

outstanding under the Loan Agreement, in full on December 31, 2020. The Loan Agreement contains customary representations,

warranties, covenants and default provisions.

The Company’s

borrowing from Sentient is a “related party transaction” pursuant to Canada’s Multilateral Instrument 61-101

Protection of Minority Security Holders in Special Transactions (“MI 61-101”). However, the Sentient Loan is

exempt from the formal valuation and minority stockholder approval requirements of MI 61-101, as the principal amount of such loan

is less than 25% of the Company’s market capitalization. Accordingly, the Company is relying on the exemption from the formal

valuation and minority stockholder approval requirements set forth in sections 5.5(a) and 5.7(a) of MI 61-101.

The foregoing description

of the Loan Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Loan

Agreement, which is attached hereto as Exhibit 10.1.

Item 2.03 Creation of a

Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set

forth pursuant to Item 1.01 is hereby incorporated by reference in this Item 2.03.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date: April 2, 2020

|

|

|

|

|

|

|

Golden Minerals Company

|

|

|

|

|

|

By:

|

/s/ Robert P. Vogels

|

|

|

|

Name: Robert P. Vogels

|

|

|

|

Title: Senior Vice President, Chief Financial Officer and Corporate Secretary

|

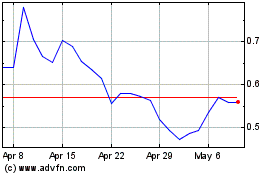

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

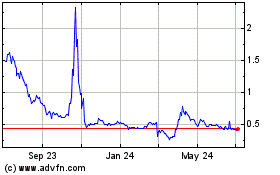

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Apr 2023 to Apr 2024