The Company announced today its results of operations for the

fiscal second quarter. For the quarter ended September 30, 2021

(the “2021 quarter”), the Company recorded net earnings of

$13,177,614 ($1.91 diluted earnings per share) on sales of

$92,570,895 compared to a net loss of $250,005 ($0.04 diluted loss

per share) on sales of $24,861,680 for the quarter ended September

30, 2020 (the “2020 quarter”). The 2021 quarter results make it the

most profitable quarter in Company history. Results for the 2021

quarter were positively impacted by strong margins primarily

associated with a historic rise in steel prices. The 2021 quarter

was also positively impacted by the continued ramp up of the

Decatur, Alabama facility’s new stretcher leveler cut-to-length

line.

“We continued to position our business to take

advantage of opportunities in an unprecedented industry environment

during the second fiscal quarter,” said Michael J. Taylor,

President and Chief Executive Officer. “Hot-rolled steel prices for

the 2021 quarter were approximately 280% higher than prices for the

2020 quarter. Our coil segment sales volume was solid and exceeded

pre-pandemic levels while our tubular segment sales volume was

below pre-pandemic levels but improved from the prior year quarter.

Physical margins across all products remained at historic

levels.”

|

SUMMARY OF OPERATIONS (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

92,570,895 |

|

|

$ |

24,861,680 |

|

|

$ |

158,487,334 |

|

|

$ |

48,386,280 |

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and other |

|

|

|

|

|

|

|

|

income or loss |

|

75,078,581 |

|

|

|

25,174,401 |

|

|

|

126,726,343 |

|

|

|

49,835,631 |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) before |

|

|

|

|

|

|

|

|

income taxes |

|

17,492,314 |

|

|

|

(312,721 |

) |

|

|

31,760,991 |

|

|

|

(1,449,351 |

) |

|

|

|

|

|

|

|

|

|

|

|

Provision for (benefit from) |

|

|

|

|

|

|

|

|

income taxes |

|

4,314,700 |

|

|

|

(62,716 |

) |

|

|

7,271,580 |

|

|

|

(340,484 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) |

$ |

13,177,614 |

|

|

$ |

(250,005 |

) |

|

$ |

24,489,411 |

|

|

$ |

(1,108,867 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

6,903,450 |

|

|

|

7,067,898 |

|

|

|

6,901,504 |

|

|

|

7,074,137 |

|

|

Diluted |

|

|

6,903,450 |

|

|

|

7,067,898 |

|

|

|

6,901,504 |

|

|

|

7,074,137 |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) per share: |

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.91 |

|

|

$ |

(0.04 |

) |

|

$ |

3.55 |

|

|

$ |

(0.16 |

) |

|

Diluted |

|

$ |

1.91 |

|

|

$ |

(0.04 |

) |

|

$ |

3.55 |

|

|

$ |

(0.16 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COIL SEGMENT OPERATIONS

Coil segment sales for the 2021 quarter totaled

$78,323,927 compared to $18,456,086 for the 2020 quarter. The

increase in sales was driven by an increase in the average selling

price associated with higher hot-rolled steel prices and an

increase in sales volume. The average per ton selling price of coil

segment inventory increased from approximately $548 per ton in

the 2020 quarter to approximately $1,884 per ton in the 2021

quarter. Inventory tons sold increased from approximately

33,000 tons in the 2020 quarter to approximately 43,000 tons in the

2021 quarter. Sales volume for the 2020 quarter was impacted by the

onset of the COVID-19 pandemic with volume for the 2020 quarter

being down approximately 13% compared to pre-pandemic volumes.

Volume for the 2021 quarter was approximately 13% higher than

pre-pandemic volumes. Volume for the 2021 quarter benefitted from

the continued ramp up of new equipment at the Decatur facility

which was placed into service in March 2021. The prior equipment at

the Decatur facility was removed in June 2020 for the equipment

replacement project. Coil segment operations recorded an operating

profit of approximately $24,273,000 for the

2021 quarter compared to an operating profit of approximately

$751,000 for the 2020 quarter. Operating results for the

2021 quarter benefitted from a significant increase in steel prices

and associated improvement in our margins. The 2020 quarter was

negatively impacted by low margins associated with declines in

hot-rolled steel prices.

TUBULAR SEGMENT OPERATIONS

Tubular segment sales for the 2021 quarter

totaled $14,246,968 compared to $6,405,594 for the 2020 quarter.

Sales increased due to both an increase in the volume

sold and an increase in the average selling price per ton. The

average per ton selling price of tubular segment inventory

increased from approximately $634 per ton in the 2020 quarter

to approximately $1,223 per ton in the 2021 quarter. Tons sold

increased from approximately 10,000 tons in the 2020 quarter

to approximately 11,500 tons in the 2021

quarter. Sales volume for the 2020 quarter was significantly

impacted by the onset of the COVID-19 pandemic with volume for the

2020 quarter being down approximately 29% compared to pre-pandemic

volumes. Volume for the 2021 quarter was approximately 15% lower

than pre-pandemic volumes. The tubular segment operations

recorded an operating profit of approximately $1,997,000 for

the 2021 quarter compared to an operating loss of approximately

$344,000 for the 2020 quarter. Operating results for the

2021 quarter benefitted from a significant increase in steel prices

and associated improvement in our margins. The 2020 quarter was

negatively impacted by low margins associated with declines in

hot-rolled steel prices and weak energy industry

conditions.

SINTON, TEXAS FACILITY

UPDATE

The Company broke ground on the construction of

its new coil processing facility in Sinton, Texas during August

2021. The new facility will be on the campus of Steel Dynamics,

Inc.'s ("SDI") new flat roll steel mill currently under

construction in Sinton, Texas. The Company's new location will

consist of an approximately 70,000 square foot building located on

approximately 26.5 acres leased from SDI under a 99-year agreement.

The Company has selected Red Bud Industries to build one of the

world’s largest stretcher leveler cut-to-length lines, capable of

handling material up to 1” thick, widths up to 96” and yields

exceeding 100,000 psi. The Company expects the location to commence

operations in April 2022 and estimates the total cost of the

project to be $21 million. At September 30, 2021, the construction

in process balance was approximately $6 million consisting of $2.8

million in cash payments and $3.2 million of accrued capital

expenditures.

“We are excited about the future of our new

Sinton facility and the growth opportunity it provides for the

Company,” said Mr. Taylor. “We continue to be encouraged by our

customers and prospects that share in our excitement about the new

facility. After an initial ramp up period during calendar 2022, we

expect the facility’s annual shipments could be in the range of

110,000 tons to 140,000 tons for calendar 2023. Based on these

volumes and historical average margins, we currently believe annual

EBITDA for our Sinton facility could be in the range of $4.5

million to $5.5 million.”

OUTLOOK

The Company expects physical margins to decline

slightly during its fiscal third quarter ending December 31, 2021

but to remain at a level well above historical average margins. A

modest decline in sales volume is expected due to a combination of

typical demand seasonality around the holidays and customer

hesitancy with steel prices showing decline in the third quarter.

The Company also expects to reclassify a loss of approximately

$14.7 million into earnings during the third quarter related to

derivatives designated for hedge accounting.

“The COVID-19 pandemic and related supply chain

disruptions have had a profound impact on the steel industry and

our operations,” Mr. Taylor commented. “We have mitigated the

downside through hedges and captured the upside by securing

additional supply and expanding production capacity. During the

outset of the pandemic steel pricing declined but then increased on

a historic magnitude by approximately 350%. At the apex of the

increase, steel prices were approximately 80% higher than the prior

historic level. With these circumstances, we have seen physical

margins higher than we ever expected and have also experienced

hedging-related losses as a result. We do not believe that the

magnitude and timing of hedging-related losses we expect to

recognize in the third quarter will be indicative of our future

operations. I strongly believe that our Company is executing a

long-term strategy that will create growth and value for the

Company and its shareholders across a range of market conditions

and despite short-term fluctuations in prices. The foundation is

being laid for the Company to double its coil segment sales volume

with successful execution of our investments in Decatur, Alabama

and Sinton, Texas. We are actively evaluating additional growth

opportunities and expect our fiscal year ended March 31, 2022 to be

the most profitable fiscal year in Company history. I look forward

to the opportunities that lie ahead for Friedman Industries.”

ABOUT FRIEDMAN INDUSTRIES

Friedman Industries, Incorporated, headquartered

in Longview, Texas, is a manufacturer and processor of steel

products with operating plants in Hickman, Arkansas; Decatur,

Alabama and Lone Star, Texas. The Company has two reportable

segments: coil products and tubular products. The coil product

segment consists of the operations in Hickman and Decatur where the

Company processes hot-rolled steel coils. The Hickman facility

operates a temper mill and corrective leveling cut-to length line.

The Decatur facility operates a stretcher leveler cut to length

line. The Company has a third coil segment location under

construction in Sinton, Texas with operations expected to commence

in April 2022. The tubular product segment consists of the

operations in Lone Star where the Company manufactures electric

resistance welded pipe and distributes pipe.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

and Section 21E of the Exchange Act, and such statements involve

risk and uncertainty. Forward-looking statements include those

preceded by, followed by or including the words “will,” “expect,”

“intended,” “anticipated,” “believe,” “project,” “forecast,”

“propose,” “plan,” “estimate,” “enable,” and similar expressions,

including, for example, statements about our business strategy, our

industry, our future profitability, growth in the industry sectors

we serve, our expectations, beliefs, plans, strategies, objectives,

prospects and assumptions, future production capacity, product

quality and estimates and projections of future activity and trends

in the oil and natural gas industry. These forward-looking

statements may include, but are not limited to, future changes in

the Company’s financial condition or results of operations, future

production capacity, product quality and proposed expansion plans.

Forward-looking statements may be made by management orally or in

writing including, but not limited to, this news

release.

Forward-looking statements are not guarantees of

future performance. These statements are based on management’s

expectations that involve a number of business risks and

uncertainties, any of which could cause actual results to differ

materially from those expressed in or implied by the

forward-looking statements. Although forward-looking statements

reflect our current beliefs, reliance should not be placed on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors, which may cause our actual

results, performance or achievements to differ materially from

anticipated future results, performance or achievements expressed

or implied by such forward-looking statements.

Actual results and trends in the future may

differ materially depending on a variety of factors including, but

not limited to, changes in the demand for and prices of the

Company’s products, the continuing impact of the COVID-19 pandemic,

changes in government policy regarding steel, changes in the demand

for steel and steel products in general and the Company’s success

in executing its internal operating plans, including the timing of

the completion and successful commissioning of our new stretcher

leveler line in Decatur, the cost, timing and successful

commissioning of our new stretcher leveler line in Sinton, changes

in and availability of raw materials, our ability to satisfy our

take or pay obligations under certain supply agreements, unplanned

shutdowns of our production facilities due to equipment failures or

other issues, increased competition from alternative materials and

risks concerning innovation, new technologies, products and

increasing customer requirements. Accordingly, undue reliance

should not be placed on our forward-looking statements. Such risks

and uncertainty are also addressed in our Management’s Discussion

and Analysis of Financial Condition and Results of Operations and

other sections of the Company’s filings with the U.S. Securities

and Exchange Commission (the “SEC”) under the Securities Act of

1933, as amended, and the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), including the Company’s Annual Report

on Form 10-K and its other Quarterly Reports on Form 10-Q. We

undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events, changed circumstances or otherwise, except to the

extent law requires.

For further information, please refer to the

Company's Form 10-Q as filed with the SEC on November 19, 2021 or

contact Alex LaRue, Chief Financial Officer – Secretary and

Treasurer, at (903)758-3431.

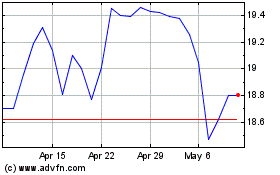

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

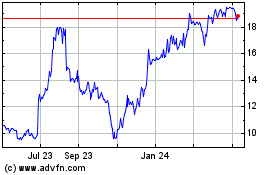

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Apr 2023 to Apr 2024