Friedman Industries, Incorporated (NYSE – American; trading

symbol: FRD)

The Company announced today its results of operations for the

quarter and year ended March 31, 2021. For the quarter ended March

31, 2021 (the “2021 quarter”), the Company recorded net earnings of

$10,403,597 ($1.50 diluted earnings per share) on sales of

$49,214,204 compared to a net loss of $3,018,842 ($0.43 diluted

loss per share) on net sales of $32,980,607 for the quarter ended

March 31, 2020 (the “2020 quarter”). The 2021 quarter results make

it the most profitable quarter in Company history. Results for the

2021 quarter were positively impacted by strong margins primarily

associated with a historic rise in steel prices and a net

recognized gain of $5,502,620 related to hot-rolled coil derivative

instruments.

For the year ended March 31, 2021 (“fiscal 2021”), the Company

recorded net earnings of $11,424,475 ($1.63 diluted earnings per

share) on sales of $126,102,533. For the year ended March 31, 2020

(“fiscal 2020”), the Company recorded a net loss of $5,249,210

($0.75 diluted loss per share) on sales of $142,102,324. Fiscal

2021 results make it the second most profitable fiscal year in

Company history.

“I am proud of how our team responded to a uniquely challenging

year for our company, and our fourth quarter and fiscal year end

results demonstrate that resiliency,” said Michael J. Taylor,

President and Chief Executive Officer. “The pandemic created a lot

of uncertainty about how our employees, our operations, our

customer’s operations and the overall steel industry would be

affected. That coupled with volatility in steel prices created a

complex operating environment.”

Mr. Taylor continued, “We quickly updated our operational and

safety protocols to help ensure the safety and health of our

employees and continuity of operations throughout the crisis. And

in the face of a supply-demand imbalance, we expanded our supply

chain options with the support of newly implemented risk management

practices to drive improved operating results. We continued to

invest strategically in our business, namely in our Hickman,

Arkansas coil processing facility and Decatur, Alabama coil

processing facility, and see tremendous value in our plans for a

new facility in Sinton, Texas which will extend our competitive

footprint to better serve coil segment customers in the Southwest

United States and Mexico.”

Operating results have been favorably impacted by the market

price of hot-rolled steel coil. In August 2020, steel prices began

a historic run up, increasing approximately 200% by the end of

fiscal 2021. The Company believes the historic increase in

steel prices is primarily the result of a supply and demand

imbalance that was created by COVID-19's impact on the steel

industry and its customers. At the onset of the pandemic, some

steel mill production capacity was idled, and Friedman

Industries, and many other industry participants, scaled back

inventory purchases. The Company saw a significant but relatively

brief, dip in demand followed by a resurgence, and this

resurgence in demand was met by historically low inventory on hand

and on order levels in the supply chain and a lower level of

available steel mill capacity. Steel mill capacity was booked

up quickly and lead times extended well beyond normal levels and

due to supportive demand, capacity continued to book up quickly

throughout the remainder of fiscal 2021 and lead times

remained extended. This supply and demand dynamic resulted in

significant margin improvement for our products during the second

half of fiscal 2021.

| SUMMARY OF

OPERATIONS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

Year Ended March 31, |

|

|

|

|

2021 |

|

|

2020 |

|

|

|

2021 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

| Net Sales |

|

$ |

49,214,204 |

|

$ |

32,980,607 |

|

|

$ |

126,102,533 |

|

$ |

142,102,324 |

|

| |

|

|

|

|

|

|

|

|

| Total costs

and |

|

|

|

|

|

|

|

|

other income |

|

35,311,777 |

|

|

36,910,398 |

|

|

|

110,880,560 |

|

|

148,940,526 |

|

| |

|

|

|

|

|

|

|

|

| Earnings (loss)

before |

|

|

|

|

|

|

|

|

income taxes |

|

13,902,427 |

|

|

(3,929,791 |

) |

|

|

15,221,973 |

|

|

(6,838,202 |

) |

| |

|

|

|

|

|

|

|

|

| Income taxes |

|

3,498,830 |

|

|

(910,949 |

) |

|

|

3,797,498 |

|

|

(1,588,992 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net earnings

(loss) |

$ |

10,403,597 |

|

$ |

(3,018,842 |

) |

|

$ |

11,424,475 |

|

$ |

(5,249,210 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

6,921,004 |

|

|

7,000,403 |

|

|

|

7,027,707 |

|

|

7,000,403 |

|

|

Diluted |

|

|

6,921,004 |

|

|

7,000,403 |

|

|

|

7,027,707 |

|

|

7,000,403 |

|

| |

|

|

|

|

|

|

|

|

| Net earnings

(loss) per share: |

|

|

|

|

|

|

|

Basic |

|

$ |

1.50 |

|

$ |

(0.43 |

) |

|

$ |

1.63 |

|

$ |

(0.75 |

) |

|

Diluted |

|

$ |

1.50 |

|

$ |

(0.43 |

) |

|

$ |

1.63 |

|

$ |

(0.75 |

) |

| |

|

|

|

|

|

|

|

|

COIL SEGMENT OPERATIONS

Coil segment sales for fiscal 2021 totaled $95,264,555 compared

to $99,762,892 for fiscal 2020. The decrease in sales was driven by

a decline in sales volume, partially offset by an increase in the

average selling price associated with higher hot-rolled steel

prices. Sales volume decreased from approximately 152,000 tons in

fiscal 2020 to approximately 130,500 tons in fiscal 2021. The

volume decline was related to both the impacts of COVID-19 and

removing the Decatur, Alabama coil processing facility’s equipment

in June 2020 for an equipment replacement project with the new

equipment being put into service in March 2021. Compared to

fiscal 2020's average monthly volume, April 2020 volume was

down 51% and May 2020 volume was down 33% but the rest of

fiscal 2021's monthly volume was only down an average of 9%.

The Company experienced growth in its coil segment customer

portfolio, increasing the number of customers sold from

approximately 185 customers in fiscal 2020 to approximately 200

customers in fiscal 2021. The average selling price of coil segment

shipments increased from approximately $651 per ton in fiscal 2020

to approximately $722 per ton in fiscal 2021.

TUBULAR SEGMENT OPERATIONS

Tubular segment sales for fiscal 2021 totaled

$30,837,978 compared to $42,339,432 for fiscal 2020. The decrease

in tubular segment sales was primarily driven by a decline in sales

volume which decreased from approximately 58,000 tons in

fiscal 2020 to approximately 42,000 tons in fiscal 2021. The volume

decline was related primarily to the impacts of COVID-19 and

challenging energy industry conditions. Compared to

fiscal 2020's average monthly volume, April 2020 volume was

only down 4% due to the fulfillment of pre-pandemic orders but May

2020 volume was down 36% and the remainder of fiscal 2021's

monthly volume was down an average of 27%. The tubular segment

volume did not recover in the same manner as the coil segment's

volume due primarily to energy industry conditions which remained

challenging throughout fiscal 2021. The number of tubular

segment customers sold remained steady at approximately 125

customers for both fiscal 2021 and fiscal 2020. The average selling

price for the tubular segment's products was consistent between

years at approximately $730 per ton for fiscal 2021 compared

to approximately $728 per ton for fiscal 2020.

STRATEGIC INITIATIVES

During fiscal 2021, the Company completed a 22,000 square foot

addition to its Hickman, Arkansas coil processing facility. This

project was completed at an actual cost of approximately $1,083,000

compared to an original estimated cost of $1,100,000. The expansion

provides additional finished goods storage space, removing that

constraint to growth, and also provides safety improvements.

During fiscal 2021, the Company removed its temper mill and

cut-to-length line at our Decatur, Alabama plant and replaced it

with a stretcher leveler cut-to-length line with significantly

enhanced processing capabilities that allow the facility to process

material that is thicker, wider and of higher strength compared to

the prior equipment’s capabilities. The Company began commissioning

the line during March 2021 and is pleased with the initial customer

response to the facility’s new processing capabilities. The

estimated cost of this project is $7,200,000 with approximately

$6,733,000 having been paid as of March 31, 2021.

On May 25, 2021, the Company announced plans for a new facility

in Sinton, Texas that will be part of the coil product segment. The

new facility will be on the campus of Steel Dynamics, Inc.'s

("SDI") new flat roll steel mill currently under construction in

Sinton, Texas. The Company's new location will consist of an

approximately 70,000 square foot building located on approximately

26.5 acres leased from SDI under a 99-year agreement. The Company

has selected Red Bud Industries to build one of the world’s largest

stretcher leveler cut-to-length lines, capable of handling material

up to 1” thick, widths up to 96” and yields exceeding 100,000 psi.

The Company expects the location to commence operations in April

2022 and estimates the total cost of the project to be $21 million.

We believe this is a great growth opportunity for the Company and

will allow us to expand our competitive footprint to the

Southwest United States and Mexico.

OUTLOOK

The Company continued to see margin strength throughout its

fiscal 2022 first quarter ended June 30, 2021 with hot-rolled steel

prices rising approximately 30%, and expects results for the first

quarter to be slightly better than its fourth quarter fiscal 2021

results. The Company expects margins to remain strong for its

second quarter ending September 30, 2021 and expects further

improvement in operating results.

ABOUT FRIEDMAN INDUSTRIES

Friedman Industries, Incorporated, headquartered in Longview,

Texas, is a manufacturer and processor of steel products with

operating plants in Hickman, Arkansas; Decatur, Alabama and Lone

Star, Texas. The Company has two reportable segments: coil products

and tubular products. The coil product segment consists of the

operations in Hickman and Decatur where the Company processes

hot-rolled steel coils. The Hickman facility operates a temper mill

and corrective leveling cut-to length line. The Decatur facility

operates a stretcher leveler cut to length line. The tubular

product segment consists of the operations in Lone Star where the

Company manufactures electric resistance welded pipe and

distributes pipe.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This news release contains forward-looking statements within the

meaning of Section 27A of the Securities Act and Section 21E of the

Exchange Act, and such statements involve risk and uncertainty.

Forward-looking statements include those preceded by, followed by

or including the words “will,” “expect,” “intended,” “anticipated,”

“believe,” “project,” “forecast,” “propose,” “plan,” “estimate,”

“enable,” and similar expressions, including, for example,

statements about our business strategy, our industry, our future

profitability, growth in the industry sectors we serve, our

expectations, beliefs, plans, strategies, objectives, prospects and

assumptions, future production capacity, product quality and

estimates and projections of future activity and trends in the oil

and natural gas industry. These forward-looking statements

may include, but are not limited to, future changes in the

Company’s financial condition or results of operations, future

production capacity, product quality and proposed expansion plans.

Forward-looking statements may be made by management orally or in

writing including, but not limited to, this news

release.

Forward-looking statements are not guarantees of future

performance. These statements are based on management’s

expectations that involve a number of business risks and

uncertainties, any of which could cause actual results to differ

materially from those expressed in or implied by the

forward-looking statements. Although forward-looking statements

reflect our current beliefs, reliance should not be placed on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors, which may cause our actual

results, performance or achievements to differ materially from

anticipated future results, performance or achievements expressed

or implied by such forward-looking statements.

Actual results and trends in the future may differ materially

depending on a variety of factors including, but not limited to,

changes in the demand for and prices of the Company’s products, the

continuing impact of the COVID-19 pandemic, changes in government

policy regarding steel, changes in the demand for steel and steel

products in general and the Company’s success in executing its

internal operating plans, including the timing of the completion

and successful commissioning of our new stretcher leveler line in

Decatur, the cost, timing and successful commissioning of our new

stretcher leveler line in Sinton, changes in and availability of

raw materials, our ability to satisfy our take or pay obligations

under certain supply agreements, unplanned shutdowns of our

production facilities due to equipment failures or other issues,

the continuing shifting of governmental policy relating to PPP

loans and forgiveness of such loans, increased competition from

alternative materials and risks concerning innovation, new

technologies, products and increasing customer requirements.

Accordingly, undue reliance should not be placed on our

forward-looking statements. Such risks and uncertainty are also

addressed in our Management’s Discussion and Analysis of Financial

Condition and Results of Operations and other sections of the

Company’s filings with the U.S. Securities and Exchange Commission

(the “SEC”) under the Securities Act of 1933, as amended, and the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

including the Company’s Annual Report on Form 10-K and its other

Quarterly Reports on Form 10-Q. We undertake no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events, changed circumstances

or otherwise, except to the extent law requires.

For further information, please refer to the Company's Form 10-K

as filed with the SEC on July 7, 2021 or contact Alex LaRue, Chief

Financial Officer – Secretary and Treasurer, at (903)758-3431.

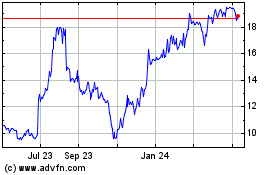

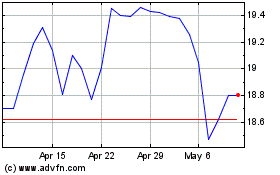

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Apr 2023 to Apr 2024