EVI Industries to Acquire Professional Laundry Systems and Affiliates

May 13 2019 - 9:00AM

Business Wire

EVI Industries, Inc. (NYSE American:EVI) announced today that it

previously executed a definitive purchase agreement to acquire

substantially all the assets and certain liabilities of Commercial

Laundry Products, Inc., Professional Laundry Systems of PA, Inc.,

and Professional Laundry Systems West, Inc. (collectively “PLS”)

using a combination of cash and EVI common stock. PLS is a New

York-based distributor of commercial and vended laundry products

and a provider of related installation and maintenance

services.

Alex Harris and Paul Cousins, Co-Owners of PLS, jointly said,

“We are honored to join the EVI family of commercial laundry

businesses. We are excited about the new opportunities available to

our employees and we look forward to working with the EVI

businesses and our loyal suppliers in the pursuit of long-term

growth.”

Given EVI’s recent acquisition of PAC Industries in February of

2019, the addition of PLS is consistent with the Company’s stated

goal to grow its sales and service operations across the northeast.

The acquired companies will operate under the name “Professional

Laundry Systems,” with its current team of over fifteen laundry

professionals and with the support and resources provided by

EVI.

Henry M. Nahmad, EVI’s Chairman and CEO, commented, “Alex Harris

and Paul Cousins built a successful business servicing thousands of

commercial laundry customers in the northeast. We welcome them and

their team to the EVI family and look forward to working together

to build PLS.”

The transaction is expected to close upon the satisfaction of

customary closing conditions.

About EVI Industries

EVI Industries, Inc., through its wholly-owned subsidiaries, is

a distributor that generates revenues by selling, leasing or

renting, through its extensive sales organization, commercial,

industrial and vended laundry, dry-cleaning, and material handling

equipment, steam and hot water boilers, water reuse and filtration

systems, and related replacement parts and accessories.

Additionally, EVI designs, plans, and installs turn-key laundry,

dry cleaning, boiler, and water filtration systems and provides

maintenance services through its robust technical service

organization.

The EVI’s customers include retail, commercial, industrial,

institutional, and government customers. Purchases made by

customers range from parts and accessories, to single or multiple

units of equipment, to large complex systems, as well as

installation and maintenance services. EVI believes that the

increase in equipment sales provides a strong foundation for EVI to

further strengthen its customer relationships, including that they

may in the future result in higher gross margin opportunities from

the sale of parts, accessories, supplies, and technical services

related to the equipment.

Forward-Looking Statements

Except for the historical matters contained herein, statements

in this press release are forward- looking and are made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are subject to a

number of known and unknown risks and uncertainties that may cause

actual results, trends, performance or achievements of EVI, or

industry trends and results, to differ from the future results,

trends, performance or achievements expressed or implied by such

forward-looking statements. These risks and uncertainties include,

among others, that the proposed acquisitions of PLS and its

affiliates may not be accretive to EVI’s earnings or otherwise have

a positive impact on EVI’s operating results or financial condition

to the extent anticipated or at all, integration risks, risks

related to the business, operations and prospects of each of PLS’

and its affiliates’ plans with respect thereto, the risk that the

conditions to closing the proposed acquisitions may not be

satisfied and that the proposed acquisitions may not otherwise be

consummated when expected, in accordance with the contemplated

terms, or at all, and the risks related to EVI’s operations,

results, financial condition, financial resources, and growth

strategy, including EVI’s ability to find and complete other

acquisition opportunities, and the impact of any such acquisitions

on EVI’s operations, results and financial condition. Reference is

also made to other economic, competitive, governmental,

technological and other risks and factors discussed in EVI’s

filings with the Securities and Exchange Commission, including,

without limitation, those disclosed in the “Risk Factors” section

of EVI’s Annual Report on Form 10-K for the fiscal year ended June

30, 2018, filed with the SEC on September 13, 2018. Many of these

risks and factors are beyond EVI’s control. In addition, past

performance and perceived trends may not be indicative of future

results. EVI cautions that the foregoing factors are not exclusive.

The reader should not place undue reliance on any forward- looking

statement, which speaks only as of the date made. EVI does not

undertake to, and specifically disclaims any obligation to, update

or supplement any forward-looking statement, whether as a result of

changes in circumstances, new information, subsequent events or

otherwise, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190513005412/en/

EVI Industries, Inc.Henry M. Nahmad (305) 754-8676Michael

Steiner (305) 754-8676

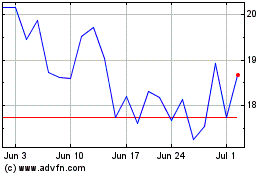

EVI Industries (AMEX:EVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

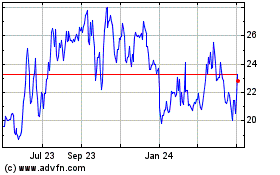

EVI Industries (AMEX:EVI)

Historical Stock Chart

From Apr 2023 to Apr 2024