Enservco Corporation (NYSE American: ENSV), a diversified national

provider of specialized well-site services to the domestic onshore

conventional and unconventional oil and gas industries, today

reported financial results for its third quarter and nine-month

period ended September 30, 2019.

“Drilling and completion activity slowed in the third quarter

and is expected to continue tapering off through year-end as our

customers focus on capital discipline and living within cash

flows,” said Ian Dickinson, President and CEO. “Our third

quarter was highlighted by double digit growth in both our well

enhancement and water transfer segments, although industry price

compression and some anomalous expense events negatively impacted

our overall profit metrics in the quarter. Nevertheless, for

the nine-month period ended September 30, 2019, we achieved 19%

revenue growth, a reduction of our net loss compared to the same

period last year, and positive adjusted EBITDA. Due to the

seasonality of our business, we believe our full year financial

results are a more accurate reflection of the trajectory of our

business than quarter-to-quarter results. Assuming commodity

prices remain stable, we anticipate an uptick in customer activity

in the first quarter of 2020 as capital budgets are refreshed.

“We continue to take actions to position Enservco for success

over the long term, and we believe that new customer wins and

growing market share are confirmation that our strategy is

working,” Dickinson added. “We have invested in process

improvement initiatives and continue to strengthen our IT

infrastructure, which resulted in a meaningful reduction in our

DSOs in the latter half of 2019. Our e-ticketing and

e-dispatch programs – currently in implementation phase – are

expected to yield further improvements. We have also driven

significant cost synergies following our acquisition of Adler Hot

Oil Service, taking approximately $1.0 million in redundant costs

out of our business related to headcount and consolidation of field

locations. We believe these initiatives position us to

achieve meaningful margin expansion and improved shareholder

returns over the long term.”

Nine Month ResultsTotal revenue for the nine

months ended September 30, 2019, increased 19% to $38.1 million

from $32.0 million in the same period last year.

Well enhancement services revenue grew 19% to $34.9 million from

$29.5 million last year. The well enhancement segment included frac

water heating, up 29% to $22.7 million from $17.7 million; hot

oiling, up 9% to $9.5 million from $8.7 million; and acidizing,

down 25% to $1.8 million from $2.4 million. The well enhancement

segment generated income of $9.1 million for the nine-month period,

up 38% from income of $6.6 million in the same period last

year.

Water transfer revenue increased 25% year over year to $3.2

million from $2.6 million in the same period last year. The

water transfer segment generated a loss of $1.1 million through

nine months versus a loss of $28,000 in the same period last

year. The loss was primarily related to first quarter cost

overruns due to multiple line freeze events.

Total operating expenses increased 18% in the first nine months

to $41.3 million from $34.8 million in the same period last year

due primarily to higher direct variable costs associated with

increased activity and to the aforementioned water transfer cost

overruns in the first quarter. Sales, general and administrative

expenses increased 28% to $4.8 million from $3.8 million last year

due largely to the impact of the Adler Hot Oil acquisition,

although in the third quarter of 2019 the Company achieved

approximately $1.0 in cost reductions through elimination of

redundant personnel and facilities. Investment in IT

infrastructure and processes also contributed to higher costs in

the period. Depreciation and amortization expense was up 15%

year over year to $5.1 million from $4.4 million due to the

increased fleet size.

Operating loss through the first nine months was $3.1 million,

up 12% year over year from $2.8 million . Net loss, including

a gain of approximately $1.2 million related to the April

settlement agreement with the sellers of Adler, improved 19% year

over year to $4.3 million versus $5.3 million in the same period

last year. Net loss per diluted share was $0.08 versus a net loss

per diluted share of $0.10 in the same period last year.

Adjusted EBITDA through the first nine months of 2019 was

essentially flat at $2.6 million.

Enservco generated $8.5 million in cash from operations in the

first nine months of 2019, up 50% from $5.7 million in the same

period last year.

Third Quarter ResultsTotal revenue in the third

quarter ended September 30, 2019, increased 23% to $4.7 million

from $3.8 million in the same quarter last year.

Well enhancement services revenue increased 19%

year over year to $3.8 million from $3.2 million. The well

enhancement segment included hot oiling, up 20% to $2.7 million

from $2.2 million; acidizing, up 4% to $635,000 from $609,000; and

frac water heating, flat at $48,000. The well enhancement segment

generated a loss of $737,000 in the third quarter compared to a

loss of $746,000 in the same quarter last year.

Water transfer segment revenue increased 42% in

the third quarter to $899,000 from $634,000 in the same quarter

last year. The segment generated income of $70,000 compared

to a loss of $16,000 in the third quarter last year.

Total operating expenses in the third quarter increased 28% year

over year to $9.3 million from $7.3 million due to additional costs

of supporting increased customer activity and to higher corporate

and depreciation and amortization costs. Sales, general and

administrative expense increased 48% in the third quarter to $1.7

million from $1.2 million due to a one-time insurance accrual,

investments in IT infrastructure and processes, and management

transition costs. Depreciation and amortization expense

increased 20% to $1.7 million from $1.4 million due to the increase

in fleet size following the Adler acquisition.

Operating loss in the third quarter increased 33% to $4.6

million from an operating loss of $3.5 million in the third quarter

of 2018. Net loss in the third quarter increased 32% to

$5.4 million, or $0.10 per diluted share, from a net loss of $4.1

million, or $0.08 per diluted share, in the same quarter last

year.

Adjusted EBITDA loss in the third quarter was $2.7 million, up 38%

from a loss of $1.9 million in the same quarter last year.

Conference Call InformationManagement will hold

a conference call today to discuss these results. The call

will begin at 2:30 p.m. Mountain Time (4:30 p.m. Eastern) and will

be accessible by dialing 844-369-8770 (862-298-0840 for

international callers). No passcode is necessary. A

telephonic replay will be available through November 27, 2019, by

calling 877-481-4010 (919-882-2331 for international callers) and

entering the Conference ID #55929. To listen to the webcast,

participants should go to the ENSERVCO website at www.enservco.com

and link to the “Investors” page at least 15 minutes early to

register and download any necessary audio software. A replay of the

webcast will be available for 90 days. The webcast also is

available at the following

link: https://www.investornetwork.com/event/presentation/55929

About EnservcoThrough its various operating

subsidiaries, Enservco provides a wide range of oilfield services,

including hot oiling, acidizing, frac water heating, water transfer

and related services. The Company has a broad geographic

footprint covering seven major domestic oil and gas basins and

serves customers in Colorado, Montana, New Mexico, North Dakota,

Oklahoma, Pennsylvania, Ohio, Texas, Wyoming and West

Virginia. Additional information is available at

www.enservco.com

*Note on non-GAAP Financial Measures This press

release and the accompanying tables include a discussion of EBITDA

and Adjusted EBITDA, which are non-GAAP financial measures provided

as a complement to the results provided in accordance with

generally accepted accounting principles ("GAAP"). The term

"EBITDA" refers to a financial measure that we define as earnings

(net income or loss) plus or minus net interest plus taxes,

depreciation and amortization. Adjusted EBITDA excludes from EBITDA

stock-based compensation and, when appropriate, other items that

management does not utilize in assessing Enservco’s operating

performance (as further described in the attached financial

schedules). None of these non-GAAP financial measures are

recognized terms under GAAP and do not purport to be an alternative

to net income as an indicator of operating performance or any other

GAAP measure. We have reconciled Adjusted EBITDA to GAAP net income

in the Consolidated Statements of Operations table at the end of

this release. We intend to continue to provide these non-GAAP

financial measures as part of our future earnings discussions and,

therefore, the inclusion of these non-GAAP financial measures will

provide consistency in our financial reporting.

Cautionary Note Regarding Forward-Looking

StatementsThis news release contains information that is

"forward-looking" in that it describes events and conditions

Enservco reasonably expects to occur in the future. Expectations

for the future performance of Enservco are dependent upon a number

of factors, and there can be no assurance that Enservco will

achieve the results as contemplated herein. Certain statements

contained in this release using the terms "may," "expects to," and

other terms denoting future possibilities, are forward-looking

statements. The accuracy of these statements cannot be guaranteed

as they are subject to a variety of risks, which are beyond

Enservco's ability to predict, or control and which may cause

actual results to differ materially from the projections or

estimates contained herein. Among these risks are those set forth

in Enservco’s annual report on Form 10-K for the year ended

December 31, 2018, and subsequently filed documents with the

SEC. Forward looking statements in this news release that are

subject to risk include the ability to continue generating positive

financial results; prospects for commodity prices to remain stable

and for producers to refresh capital budgets in 2020;

management’s belief that year-to-year financial results are a

more accurate measure of the company’s trajectory; anticipation of

an uptick in customer activity in early 2020; and expectations for

margin expansion and improved shareholder returns. It is important

that each person reviewing this release understand the significant

risks attendant to the operations of Enservco. Enservco

disclaims any obligation to update any forward-looking statement

made herein.

Contact:

Jay PfeifferPfeiffer High Investor Relations,

Inc.Phone: 303-880-9000Email: jay@pfeifferhigh.com

|

|

|

|

|

ENSERVCO CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS |

|

(in thousands) |

|

|

|

|

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Well enhancement services |

|

$ |

3,798 |

|

|

$ |

3,200 |

|

|

$ |

34,949 |

|

|

$ |

29,490 |

|

|

|

Water transfer services |

|

|

899 |

|

|

|

634 |

|

|

|

3,194 |

|

|

|

2,558 |

|

| |

|

|

|

|

4,697 |

|

|

|

3,834 |

|

|

|

38,143 |

|

|

|

32,048 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Well enhancement services |

|

|

4,535 |

|

|

|

3,946 |

|

|

|

25,897 |

|

|

|

22,937 |

|

| |

Water transfer services |

|

|

829 |

|

|

|

650 |

|

|

|

4,301 |

|

|

|

2,586 |

|

| |

Functional support and other |

|

|

480 |

|

|

|

141 |

|

|

|

922 |

|

|

|

467 |

|

| |

Sales, general and administrative expenses |

|

|

1,723 |

|

|

|

1,161 |

|

|

|

4,801 |

|

|

|

3,750 |

|

| |

Patent litigation and defense costs |

|

|

- |

|

|

|

2 |

|

|

|

10 |

|

|

|

77 |

|

| |

Severance and Transition Costs |

|

|

83 |

|

|

|

- |

|

|

|

83 |

|

|

|

633 |

|

| |

Gain on disposals of equipment |

|

|

(14 |

) |

|

|

- |

|

|

|

(2 |

) |

|

|

(53 |

) |

| |

Impairment loss |

|

|

- |

|

|

|

- |

|

|

|

127 |

|

|

|

- |

|

| |

Depreciation and amortization |

|

|

1,703 |

|

|

|

1,419 |

|

|

|

5,122 |

|

|

|

4,438 |

|

| |

|

Total operating expenses |

|

|

9,339 |

|

|

|

7,319 |

|

|

|

41,261 |

|

|

|

34,835 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from Operations |

|

|

(4,642 |

) |

|

|

(3,485 |

) |

|

|

(3,118 |

) |

|

|

(2,787 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest expense |

|

|

(695 |

) |

|

|

(471 |

) |

|

|

(2,237 |

) |

|

|

(1,482 |

) |

| |

Gain on settlement |

|

|

- |

|

|

|

- |

|

|

|

1,252 |

|

|

|

- |

|

| |

Other income (expense) |

|

|

(67 |

) |

|

|

38 |

|

|

|

(175 |

) |

|

|

(468 |

) |

| |

|

Total other income (expense) |

|

|

(762 |

) |

|

|

(433 |

) |

|

|

(1,160 |

) |

|

|

(1,950 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations Before Tax Expense |

|

|

(5,404 |

) |

|

|

(3,918 |

) |

|

|

(4,278 |

) |

|

|

(4,737 |

) |

|

Income tax expense |

|

|

- |

|

|

|

- |

|

|

|

(32 |

) |

|

|

(32 |

) |

|

Loss from continuing operations |

|

$ |

(5,404 |

) |

|

$ |

(3,918 |

) |

|

$ |

(4,310 |

) |

|

$ |

(4,769 |

) |

|

Discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loss from operations of discontinued operations |

|

|

- |

|

|

|

(190 |

) |

|

|

- |

|

|

|

(580 |

) |

| |

Income tax benefit |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

Loss from discontinued operations |

|

|

- |

|

|

|

(190 |

) |

|

|

- |

|

|

|

(580 |

) |

|

Net loss |

|

$ |

(5,404 |

) |

|

$ |

(4,108 |

) |

|

$ |

(4,310 |

) |

|

$ |

(5,349 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations per Common Share - Basic |

|

$ |

(0.10 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.09 |

) |

|

Loss from discontinued operations per Common Share - Basic |

|

|

- |

|

|

|

(0.01 |

) |

|

|

- |

|

|

|

(0.01 |

) |

|

Net loss per share - basic |

|

$ |

(0.10 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.10 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations per Common Share - Diluted |

|

$ |

(0.10 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.09 |

) |

|

Loss from discontinued operations per Common Share - Diluted |

|

|

- |

|

|

|

(0.01 |

) |

|

|

- |

|

|

|

(0.01 |

) |

|

Net loss per share - diluted |

|

$ |

(0.10 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.10 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average number of common shares outstanding |

|

$ |

55,457 |

|

|

$ |

54,309 |

|

|

$ |

54,925 |

|

|

$ |

52,389 |

|

|

Add: Dilutive shares assuming exercise of options and warrants |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Diluted weighted average number of common shares outstanding |

|

$ |

55,457 |

|

|

$ |

54,309 |

|

|

$ |

54,925 |

|

|

$ |

52,389 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| ENSERVCO

CORPORATION AND SUBSIDIARIES |

| Calculation

of Adjusted EBITDA * |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended |

|

For the Nine

Months Ended |

|

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net (loss) income |

|

$ |

(5,404 |

) |

|

$ |

(4,108 |

) |

|

$ |

(4,310 |

) |

|

$ |

(5,349 |

) |

| |

Add Back (Deduct) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest Expense |

|

|

695 |

|

|

|

471 |

|

|

|

2,237 |

|

|

|

1,482 |

|

| |

Provision for income tax expense |

|

|

- |

|

|

|

- |

|

|

|

32 |

|

|

|

32 |

|

| |

Depreciation and amortization (including discontinued

operations) |

|

|

1,703 |

|

|

|

1,483 |

|

|

|

5,122 |

|

|

|

4,669 |

|

| |

EBITDA* |

|

|

(3,006 |

) |

|

|

(2,154 |

) |

|

|

3,081 |

|

|

|

834 |

|

| |

Add Back (Deduct) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Stock-based

compensation |

|

|

52 |

|

|

|

103 |

|

|

|

221 |

|

|

|

291 |

|

| |

|

Severance

and transition costs |

|

|

83 |

|

|

|

- |

|

|

|

83 |

|

|

|

633 |

|

| |

|

Patent

litigation and defense costs |

|

|

- |

|

|

|

2 |

|

|

|

10 |

|

|

|

77 |

|

| |

|

Impairment

loss |

|

|

- |

|

|

|

- |

|

|

|

127 |

|

|

|

- |

|

| |

|

Acquisition-related expenses |

|

|

- |

|

|

|

38 |

|

|

|

- |

|

|

|

38 |

|

| |

|

Gain on

settlement |

|

|

- |

|

|

|

- |

|

|

|

(1,252 |

) |

|

|

- |

|

| |

|

Adler

consolidation |

|

|

156 |

|

|

|

- |

|

|

|

156 |

|

|

|

- |

|

| |

|

Other

(income) expense |

|

|

67 |

|

|

|

(38 |

) |

|

|

175 |

|

|

|

468 |

|

| |

|

Gain on

disposal of assets |

|

|

(14 |

) |

|

|

- |

|

|

|

(2 |

) |

|

|

(53 |

) |

| |

|

EBITDA

related to discontinued operations |

|

|

- |

|

|

|

126 |

|

|

|

- |

|

|

|

350 |

|

| |

Adjusted EBITDA* |

|

$ |

(2,662 |

) |

|

$ |

(1,923 |

) |

|

$ |

2,599 |

|

|

$ |

2,638 |

|

| |

|

*Note: See

below for discussion of the use of non-GAAP financial

measurements. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Use of Non-GAAP

Financial Measures: Non-GAAP results are presented only as a

supplement to the financial statements and for use within

management’s discussion and analysis based on U.S. generally

accepted accounting principles (GAAP). The non-GAAP financial

information is provided to enhance the reader's understanding of

the Company’s financial performance, but no non-GAAP measure should

be considered in isolation or as a substitute for financial

measures calculated in accordance with GAAP. Reconciliations of the

most directly comparable GAAP measures to non-GAAP measures are

provided herein. |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

EBITDA is defined

as net (loss) income (earnings), before interest expense, income

taxes, and depreciation and amortization. Adjusted EBITDA excludes

stock-based compensation from EBITDA and, when appropriate, other

items that management does not utilize in assessing the Company’s

ongoing operating performance as set forth in the next paragraph.

None of these non-GAAP financial measures are recognized terms

under GAAP and do not purport to be an alternative to net income as

an indicator of operating performance or any other GAAP

measure. |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

All of the items

included in the reconciliation from net income to EBITDA and from

EBITDA to Adjusted EBITDA are either (i) non-cash items (e.g.,

depreciation, amortization of purchased intangibles, stock-based

compensation, impairment losses, etc.) or (ii) items that

management does not consider to be useful in assessing the

Company’s ongoing operating performance (e.g., income taxes, gain

or losses on sale of equipment, severance and transition

costs, gain on settlement, expenses to consolidate former Adler

facilities, patent litigation and defense costs, other expense

(income), EBITDA related to discontinued operations, etc.). In the

case of the non-cash items, management believes that investors can

better assess the company’s operating performance if the measures

are presented without such items because, unlike cash expenses,

these adjustments do not affect the Company’s ability to generate

free cash flow or invest in its business. |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

We use, and we

believe investors benefit from the presentation of, EBITDA and

Adjusted EBITDA in evaluating our operating performance because it

provides us and our investors with an additional tool to compare

our operating performance on a consistent basis by removing the

impact of certain items that management believes do not directly

reflect our core operations. We believe that EBITDA is useful to

investors and other external users of our financial statements in

evaluating our operating performance because EBITDA is widely used

by investors to measure a company’s operating performance without

regard to items such as interest expense, taxes, and depreciation

and amortization, which can vary substantially from company to

company depending upon accounting methods and book value of assets,

capital structure and the method by which assets were acquired.

Additionally, our fixed charge coverage ratio

covenant associated with our Loan and Security

Agreement with East West Bank require the use of Adjusted

EBITDA in specific calculations. |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Because not all

companies use identical calculations, the Company’s presentation of

non-GAAP financial measures may not be comparable to other

similarly titled measures of other companies. However, these

measures can still be useful in evaluating the Company’s

performance against its peer companies because management believes

the measures provide users with valuable insight into key

components of GAAP financial disclosures. |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

ENSERVCO CORPORATION AND SUBSIDIARIES |

|

Condensed Consolidated Balance Sheets |

|

(In thousands) |

|

|

|

|

|

|

|

|

| |

|

|

|

September |

|

December 31, |

|

ASSETS |

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

(Unaudited) |

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

- |

|

|

$ |

257 |

|

|

|

Accounts receivable, net |

|

|

2,914 |

|

|

|

10,729 |

|

|

|

Prepaid expenses and other current assets |

|

|

688 |

|

|

|

1,081 |

|

|

|

Inventories |

|

|

338 |

|

|

|

514 |

|

|

|

Income tax receivable, current |

|

|

85 |

|

|

|

85 |

|

|

|

Current assets of discontinued operations |

|

|

28 |

|

|

|

864 |

|

|

|

|

Total current assets |

|

|

4,053 |

|

|

|

13,530 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

29,368 |

|

|

|

33,057 |

|

|

Goodwill |

|

|

546 |

|

|

|

546 |

|

|

Intangible assets, net |

|

|

880 |

|

|

|

1,033 |

|

|

Income taxes receivable, noncurrent |

|

|

28 |

|

|

|

28 |

|

|

Right-of-use asset - financing, net |

|

|

702 |

|

|

|

- |

|

|

Right-of-use asset - operating, net |

|

|

4,450 |

|

|

|

- |

|

|

Other assets |

|

|

431 |

|

|

|

650 |

|

|

Non-current assets of discontinued operations |

|

|

- |

|

|

|

177 |

|

|

TOTAL ASSETS |

|

$ |

40,458 |

|

|

$ |

49,021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

| |

Accounts payable and accrued liabilities |

|

$ |

2,962 |

|

|

$ |

3,391 |

|

| |

Note Payable |

|

|

- |

|

|

|

3,868 |

|

| |

Lease liability - financing, current |

|

|

238 |

|

|

|

- |

|

| |

Lease liability - operating, current |

|

|

963 |

|

|

|

- |

|

| |

Current portion of long-term debt |

|

|

149 |

|

|

|

149 |

|

| |

Current liabilities of discontinued operations |

|

|

- |

|

|

|

44 |

|

| |

|

Total current liabilities |

|

|

4,312 |

|

|

|

7,452 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Long-Term Liabilities |

|

|

|

|

|

|

|

|

| |

Senior revolving credit facility |

|

|

29,459 |

|

|

|

33,882 |

|

| |

Subordinated debt |

|

|

1,869 |

|

|

|

1,832 |

|

| |

Long-term debt, less current portion |

|

|

219 |

|

|

|

312 |

|

| |

Lease liability - financing, less current portion |

|

|

343 |

|

|

|

- |

|

| |

Lease liability - operating, less current portion |

|

|

3,551 |

|

|

|

- |

|

| |

Other liability |

|

|

94 |

|

|

|

941 |

|

| |

|

Total long-term liabilities |

|

|

35,535 |

|

|

|

36,967 |

|

| |

|

Total liabilities |

|

|

39,847 |

|

|

|

44,419 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

| |

Preferred stock, $.005 par value, 10,000,000 shares authorized, no

shares issued or outstanding |

|

|

- |

|

|

|

- |

|

| |

Common stock. $.005 par value, 100,000,000 shares authorized,

55,602,829 and 54,389,829 shares issued, respectively; 103,600

shares of treasury stock; and 55,499,229 and 54,286,229 shares

outstanding, respectively |

|

|

278 |

|

|

|

271 |

|

| |

Additional paid-in capital |

|

|

22,011 |

|

|

|

21,797 |

|

| |

Accumulated deficit |

|

|

(21,678 |

) |

|

|

(17,466 |

) |

| |

|

Total stockholders' equity |

|

|

611 |

|

|

|

4,602 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

40,458 |

|

|

$ |

49,021 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

ENSERVCO CORPORATION AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENT OF CASH FLOWS |

|

(In thousands) |

|

(Unaudited) |

|

|

|

|

|

For the Nine Months Ended |

|

|

|

|

|

September 30, |

|

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

| |

Net loss |

|

$ |

(4,310 |

) |

|

$ |

(5,349 |

) |

| |

Net loss from discontinued operations |

|

|

- |

|

|

|

(580 |

) |

| |

Net loss from continuing operations |

|

|

(4,310 |

) |

|

|

(4,769 |

) |

| |

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

| |

|

Depreciation and amortization |

|

|

5,122 |

|

|

|

4,438 |

|

| |

|

Gain on disposal of equipment |

|

|

(2 |

) |

|

|

(53 |

) |

| |

|

Impairment loss |

|

|

127 |

|

|

|

- |

|

| |

|

Gain on settlement |

|

|

(1,252 |

) |

|

|

- |

|

| |

|

Change in fair value of warrant liability |

|

|

- |

|

|

|

540 |

|

| |

|

Stock-based compensation |

|

|

221 |

|

|

|

291 |

|

| |

|

Amortization of debt issuance costs and discount |

|

|

273 |

|

|

|

164 |

|

| |

|

Lease termination expense |

|

|

62 |

|

|

|

- |

|

| |

|

Provision for bad debt expense |

|

|

171 |

|

|

|

32 |

|

| |

Changes in operating assets and liabilities |

|

|

|

|

|

|

|

|

| |

|

Accounts receivable |

|

|

7,636 |

|

|

|

8,913 |

|

| |

|

Inventories |

|

|

176 |

|

|

|

49 |

|

| |

|

Prepaid expense and other current assets |

|

|

305 |

|

|

|

(128 |

) |

| |

|

Amortization of operating lease asset |

|

|

599 |

|

|

|

- |

|

| |

|

Other assets |

|

|

239 |

|

|

|

231 |

|

| |

|

Accounts payable and accrued liabilities |

|

|

(477 |

) |

|

|

(3,340 |

) |

| |

|

Operating lease liabilities |

|

|

(546 |

) |

|

|

- |

|

| |

|

Other liabilities |

|

|

104 |

|

|

|

- |

|

| |

|

Net cash provided by operating activities - continuing

operations |

|

|

8,448 |

|

|

|

6,368 |

|

| |

|

Net cash provided by (used in) operating activities - discontinued

operations |

|

|

40 |

|

|

|

(704 |

) |

| |

|

Net cash provided by operating activities |

|

|

8,488 |

|

|

|

5,664 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

| |

Purchases of property and equipment |

|

|

(1,206 |

) |

|

|

(1,586 |

) |

| |

Proceeds from disposals of property and equipment |

|

|

219 |

|

|

|

145 |

|

| |

Proceeds from insurance claims |

|

|

27 |

|

|

|

122 |

|

| |

|

Net cash used in investing activities - continuing operations |

|

|

(960 |

) |

|

|

(1,319 |

) |

| |

|

Net cash provided by (used in) investing activities - discontinued

operations |

|

|

760 |

|

|

|

(44 |

) |

| |

|

Net cash used in investing activities |

|

|

(200 |

) |

|

|

(1,363 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

| |

Net line of credit payments |

|

|

(4,474 |

) |

|

|

(4,544 |

) |

| |

Repayment of long-term debt |

|

|

(3,700 |

) |

|

|

(79 |

) |

| |

Payments of finance leases |

|

|

(278 |

) |

|

|

- |

|

| |

Repayment of note |

|

|

(92 |

) |

|

|

- |

|

| |

Other financing activities |

|

|

(1 |

) |

|

|

(30 |

) |

| |

|

Net Cash used in financing activities |

|

|

(8,545 |

) |

|

|

(4,653 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

Net Increase (Decrease) in Cash and Cash

Equivalents |

|

|

(257 |

) |

|

|

(352 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents, beginning of

period |

|

|

257 |

|

|

|

391 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents, end of period |

|

$ |

- |

|

|

$ |

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Supplemental Cash Flow Information: |

|

|

|

|

|

|

|

|

| |

Cash paid for interest |

|

$ |

1,794 |

|

|

$ |

1,273 |

|

| |

Cash paid for income taxes |

|

$ |

32 |

|

|

$ |

32 |

|

|

Supplemental Disclosure of Non-cash Investing and Financing

Activities: |

|

|

|

|

|

|

|

|

| |

Non-cash proceeds from revolving credit facility |

|

$ |

125 |

|

|

$ |

103 |

|

| |

Cashless exercise of stock options |

|

$ |

- |

|

|

|

994 |

|

| |

Non-cash pconversion of warrant liability to equity |

|

$ |

- |

|

|

|

500 |

|

| |

Non-cash subordinated debt principal payment |

|

$ |

- |

|

|

|

(500 |

) |

| |

Non-cash conversion of warrant liability to equity |

|

$ |

- |

|

|

|

1,371 |

|

| |

|

|

|

|

|

|

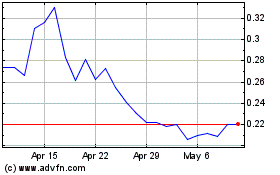

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Mar 2024 to Apr 2024

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Apr 2023 to Apr 2024