|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule 424(b)(5)

|

|

(To Prospectus Effective December 26, 2018)

|

Registration No. 333-228158

|

ENERGY FUELS INC.

Up to $33,500,000

Common Shares

Energy Fuels Inc. (the "Company" or "Energy Fuels") is hereby offering to sell common shares ("Common Shares") having an aggregate offering price of up to $33,500,000 under this prospectus supplement (the "Prospectus Supplement") to the accompanying prospectus of the Company which was declared effective by the United States Securities and Exchange Commission (the "SEC") on December 26, 2018 (the "Prospectus").

We previously entered into a Controlled Equity OfferingSM sales agreement dated May 6, 2019 (the "Sales Agreement") with Cantor Fitzgerald & Co. (the "Lead Agent"), H.C. Wainwright & Co., LLC and Roth Capital Partners, LLC (collectively with the Lead Agent, the "Agents") relating to the sale of Common Shares. In accordance with the terms of the Sales Agreement and this Prospectus Supplement, we may offer and sell Common Shares having an aggregate offering price of up to $33,500,000 (the "Offering"), from time to time on or after the date hereof, through the Lead Agent.

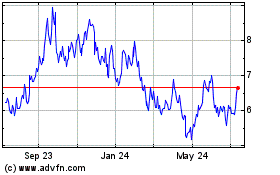

Our Common Shares are listed on the NYSE American LLC ("NYSE American") under the symbol "UUUU" and on the Toronto Stock Exchange (the "TSX") under the symbol "EFR." On April 7, 2021, the closing price of the Common Shares on the NYSE American was $6.34 and on the TSX was Cdn$8.02.

Upon our delivery of a placement notice, and subject to the terms and conditions of the Sales Agreement, sales of Common Shares, if any, under this Prospectus Supplement and the accompanying Prospectus are anticipated to be made in transactions that are deemed to be an "at the market offering" as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended ("Securities Act"). Subject to the terms of the Sales Agreement, the Lead Agent is not required to sell any specific number or dollar amounts of securities but will act as a sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between the Agents and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

We will pay the Agents compensation for their services in acting as agents in the sale of Common Shares pursuant to the terms of the Sales Agreement. We will pay the Agents compensation up to, but not exceeding, 3.0% of the gross proceeds from sales of Common Shares made thereunder. In connection with the sale of Common Shares on our behalf, each Agent will be deemed to be an "underwriter" within the meaning of the Securities Act, and the compensation of each Agent will be deemed to be underwriting commissions or discounts.

No common shares will be sold on the TSX or on other trading markets in Canada as at-the-market distributions.

AN INVESTMENT IN OUR COMMON SHARES INVOLVES A HIGH DEGREE OF RISK AND MUST BE CONSIDERED SPECULATIVE DUE TO THE NATURE OF OUR BUSINESS AND THE PRESENT STAGE OF EXPLORATION AND DEVELOPMENT OF CERTAIN OF OUR PROPERTIES. PROSPECTIVE INVESTORS SHOULD CAREFULLY CONSIDER THE RISK FACTORS DESCRIBED IN THIS PROSPECTUS SUPPLEMENT AND THE PROSPECTUS UNDER "RISK FACTORS" AND "CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS" AND THE RISK FACTORS DISCUSSED IN OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2020 THAT IS INCORPORATED BY REFERENCE INTO THIS PROSPECTUS SUPPLEMENT AND THE PROSPECTUS.

NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION, NOR ANY STATE SECURITIES REGULATOR, HAS APPROVED OR DISAPPROVED THE SECURITIES OFFERED HEREBY OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT OR THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Lead Agent

Cantor

Co-Agents

|

H.C. Wainwright & Co.

|

Roth Capital Partners

|

The date of this prospectus supplement is April 8, 2021.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

TABLE OF CONTENTS

PROSPECTUS

i

ABOUT THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

This document is in two parts. The first part is the Prospectus Supplement, including the documents incorporated by reference, which describes the specific terms of this Offering. The second part, the Prospectus, including the documents incorporated by reference therein, provides more general information. References to this Prospectus may refer to both parts of this document combined. You are urged to carefully read this Prospectus Supplement and the Prospectus, and the documents incorporated herein and therein by reference, before buying any of the Common Shares being offered under this Prospectus Supplement. This Prospectus Supplement may add, update or change information contained in the Prospectus. To the extent that any statement made in this Prospectus Supplement is inconsistent with statements made in the Prospectus or any documents incorporated by reference herein, the statements made in this Prospectus Supplement will be deemed to modify or supersede those made in the Prospectus and such documents incorporated by reference.

Only the information contained or incorporated by reference in this Prospectus Supplement and the Prospectus should be relied upon. We have not authorized any other person to provide different information. If anyone provides different or inconsistent information, it should not be relied upon. The Common Shares offered hereunder may not be offered or sold in any jurisdiction where the offer or sale is not permitted. It should be assumed that the information appearing in this Prospectus Supplement and the Prospectus and the documents incorporated by reference herein are accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

This Prospectus Supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this Prospectus Supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

In this Prospectus Supplement, unless stated otherwise, the "Company," "Energy Fuels," "we," "us" and "our" refer to Energy Fuels Inc. and its subsidiaries, and all references to "dollars" or "$" are references to U.S. dollars unless otherwise specified.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING ESTIMATES OF MINERAL RESERVES AND MINERAL RESOURCES

We are a U.S. Domestic Issuer for United States Securities and Exchange Commission ("SEC") purposes, most of our shareholders are U.S. residents, we are required to report our financial results under U.S. Generally Accepted Accounting Principles ("GAAP"), and our primary trading market is the NYSE American. However, because we are incorporated in Canada and also listed on the TSX, this Prospectus Supplement and the Prospectus contains or incorporates by reference certain disclosure that satisfies the additional requirements of Canadian securities laws, which differ from the requirements of United States' ("U.S.") securities laws. Unless otherwise indicated, all reserve and resource estimates included in this Prospectus Supplement and the Prospectus, and in the documents incorporated by reference herein and therein, have been, and will be, prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") classification system. NI 43-101 is a rule developed by the Canadian Securities Administrators (the "CSA"), which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from the requirements of SEC Industry Guide 7. Thus, reserve and resource information contained herein, or incorporated by reference in this Prospectus Supplement and the Prospectus, and in the documents incorporated by reference herein and therein, may not be comparable to similar information disclosed by companies reporting "reserve" and resource information under SEC Industry Guide 7. In particular, and without limiting the generality of the foregoing, the term "resource" does not equate to the term "reserve" under SEC Industry Guide 7. Under SEC Industry Guide 7 standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report "reserves"; the three-year historical average price, to the extent possible, is used in any "reserve" or cash flow analysis to designate "reserves"; and the primary environmental analysis or report must be filed with the appropriate governmental authority.

SEC Industry Guide 7's disclosure standards historically have not permitted the inclusion of information concerning "Measured Mineral Resources," "Indicated Mineral Resources" or "Inferred Mineral Resources" or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves" By SEC Industry Guide standards. United States investors should also understand that "Inferred Mineral Resources" have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of an "Inferred Mineral Resource" will ever be upgraded to a higher category. Under Canadian rules, estimated "Inferred Mineral Resources" may not form the basis of feasibility or pre-feasibility studies. United States investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into mineral "reserves" as defined by SEC Industry Guide 7. Investors are cautioned not to assume that all or any part of an "Inferred Mineral Resource" exists or is economically or legally mineable.

Disclosure of "contained pounds" or "contained ounces" in a resource estimate is permitted and typical disclosure under Canadian regulations; however, SEC Industry Guide 7 historically only permitted issuers to report mineralization that does not constitute "reserves" by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of reserves are also not the same as those of SEC Industry Guide 7, and reserves reported by us in compliance with NI 43-101 may not qualify as "reserves" under SEC Industry Guide 7 standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable to information made public by companies that report in accordance with SEC Industry Guide 7 standards.

All reserves that were reported in our Annual Report on Form 10-K for the year ended December 31, 2020 were estimated in accordance with the definitions set forth in NI 43-101. We do not have any mineral "reserves" within the meaning of SEC Industry Guide 7.

On October 31, 2018, the SEC adopted the Modernization of Property Disclosures for Mining Registrants (the "New Rule"), introducing significant changes to the existing mining disclosure framework to better align it with international industry and regulatory practice including NI 43-101. The New Rule became effective as of February 25, 2019 and issuers are required to comply with the New Rule as of the annual report for their first fiscal year beginning on or after January 1, 2021, and earlier in certain circumstances. We do not anticipate needing to comply with the New Rule until the filing of our annual report for the fiscal year ending December 31, 2021 and, at this time, we do not know the full effect of the New Rule on our mineral resources and reserves and, therefore, the disclosure related to our mineral resources and reserves may be significantly different when computed using the requirements set forth in the New Rule.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus Supplement and the Prospectus, including the documents incorporated herein and therein by reference, contain "forward-looking statements" within the meaning of applicable U.S. and Canadian securities laws, which may include, but are not limited to, statements with respect to: our anticipated results and progress of our operations in future periods, planned exploration, if warranted, development of our properties, plans related to our business, including our rare earth element ("REE") initiatives, and other matters that may occur in the future, any expectation related to the proposed establishment of a uranium reserve for the United States (the "U.S. Uranium Reserve") pursuant to the COVID-Relief and Omnibus Spending Bill, which includes $75 million for the establishment of a strategic U.S. Uranium Reserve, and was signed into law on December 27, 2020, any expectation related to any additional or future recommendations of the United States Nuclear Fuel Working Group (the "U.S. Nuclear Fuel Working Group" or "Working Group"), any plans we may have to evaluate the ramp up of production at any of our properties, and the expected costs of production of any properties that may be ramped up. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, schedules, assumptions, future events, or performance (often, but not always, using words or phrases such as "expects" or "does not expect," "is expected," "is likely," "budgets," "scheduled," "forecasts," "intends," "anticipates" or "does not anticipate," "continues," "plans," "estimates," or "believes," and similar expressions or variations of such words and phrases or statements stating that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Energy Fuels believes that the expectations reflected in these forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct, and such forward-looking statements included in, or incorporated by reference into, this Prospectus should not be unduly relied upon. This information speaks only as of the date of this Prospectus or as of the date of the document incorporated by reference herein.

Readers are cautioned that it would be unreasonable to rely on any such forward-looking statements and information as creating any legal rights, and that the statements and information are not guarantees and may involve known and unknown risks and uncertainties, and that actual results are likely to differ (and may differ materially) and objectives and strategies may differ or change from those expressed or implied in the forward-looking statements or information as a result of various factors. Such risks and uncertainties include global economic risks such as the occurrence of a pandemic, risks associated with our planned production of REE carbonate commencing in 2021, and risks generally encountered in the exploration, development, operation, and closure of mineral properties and processing and recovery facilities, as well as risks related to the proposed establishment of a U.S. Uranium Reserve, and risks related to any additional or future recommendations of the U.S. Nuclear Fuel Working Group not benefiting us in any material way. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

• global economic risks, including the occurrence of unforeseen or catastrophic events, such as the emergence of a pandemic or other widespread health emergency (or concerns over the possibility of such an emergency), which could create economic and financial disruptions and require us to reduce or cease operations at some or all of our facilities for an indeterminate period of time, and which could have a material impact on our business, operations, personnel and financial condition;

• risks associated with mineral reserve and resource estimates, including the risk of errors in assumptions or methodologies;

• risks associated with changes to applicable mineral reserve and resource estimates disclosure rules and regulations;

• risks associated with estimating mineral extraction and recovery, forecasting future price levels necessary to support mineral extraction and recovery, and our ability to increase mineral extraction and recovery in response to any increases in commodity prices or other market conditions;

• uncertainties and liabilities inherent to conventional mineral extraction and recovery and/or in-situ uranium recovery operations;

• risks associated with our planned entry into commercial production of REE carbonate in 2021, including: the risk that we may not be able to produce REE carbonate that meets commercial specifications at commercial levels or at all, or at acceptable cost levels; the risk of not being able to secure adequate supplies of uranium and REE bearing ores in the future at satisfactory costs to us; the risk of not being able to increase our sources of uranium and REE bearing ores to meet future planned production goals; the risk of not being able to sell the REE carbonate we produce at acceptable prices to us; the risk of not being able to successfully construct and operate an REE separation facility, and potentially other downstream REE activities, including metal-making and alloying, in the future, which are currently being evaluated; and the risk of legal and regulatory challenges and delays;

• risks associated with the establishment of a Uranium Reserve for the U.S., being subject to appropriation by the Congress of the U.S., and the details of implementation of the Uranium Reserve and other recommendations of the U.S. Nuclear Fuel Working Group not yet having been defined;

• risks associated with any additional recommendations of the U.S. Nuclear Fuel Working Group not benefiting us in any material way;

• risks associated with the change in administration, and the new administration not supporting mining, uranium mining, nuclear energy or other aspects of our business, including not supporting the proposed establishment of a U.S. Uranium Reserve included in the COVID Relief and Omnibus Spending Bill passed by the U.S. Congress in December 2020, or any or all of the other recommendations of the U.S. Nuclear Fuel Working Group;

• geological, technical and processing problems, including unanticipated metallurgical difficulties, less than expected recoveries, ground control problems, process upsets, and equipment malfunctions;

• risks associated with the depletion of existing mineral resources through mining or extraction, without replacement with comparable resources;

• risks associated with identifying and obtaining adequate quantities of alternate feed materials and other feed sources required for operation of our White Mesa Mill in Utah (the "White Mesa Mill" or the "Mill") in Utah;

• risks associated with labor costs, labor disturbances, and unavailability of skilled labor;

• risks associated with the availability and/or fluctuations in the costs of raw materials and consumables used in our production processes;

• risks and costs associated with environmental compliance and permitting, including those created by changes in environmental legislation and regulation, and delays in obtaining permits and licenses that could impact expected mineral extraction and recovery levels and costs;

• actions taken by regulatory authorities with respect to mineral extraction and recovery activities;

• risks associated with our dependence on third parties in the provision of transportation and other critical services;

• risks associated with our ability to obtain, extend or renew land tenure, including mineral leases and surface use agreements, on favorable terms or at all;

• risks associated with our ability to negotiate access rights on certain properties on favorable terms or at all;

• risks associated with potential information security incidents, including cybersecurity breaches, which could have negative impacts on us;

• risks associated with us potentially not being able to successfully develop, attract and retain qualified management personnel in the future, given that the number of individuals with significant experience in the uranium industry is relatively small;

• the adequacy of our insurance coverage;

• uncertainty as to reclamation and decommissioning liabilities;

• the ability of our bonding companies to require increases in the collateral required to secure reclamation obligations;

• the potential for, and outcome of, litigation and other legal proceedings, including potential injunctions pending the outcome of such litigation and proceedings;

• our ability to meet our obligations to our creditors;

• our ability to access credit facilities on favorable terms;

• risks associated with our relationships with our business and joint venture partners;

• failure to obtain industry partner, government, and other third-party consents and approvals, when required;

• competition for, among other things, capital, mineral properties, and skilled personnel;

• failure to complete and integrate proposed acquisitions and incorrect assessments of the value of completed acquisitions;

• risks posed by fluctuations in share price levels, exchange rates and interest rates, and general economic conditions;

• risks inherent in our and industry analysts' forecasts or predictions of future uranium, vanadium, copper and REE price levels, including the prices for REE carbonates, REE oxides, REE metals and REE metal alloys;

• fluctuations in the market prices of uranium, vanadium, copper and REEs, which are cyclical and subject to substantial price fluctuations;

• risks associated with our uranium sales, if any, being required to be made at spot prices, unless we are able to enter into new long-term contracts at satisfactory prices in the future;

• risks associated with our vanadium sales, if any, generally being required to be made at spot prices;

• risks associated with our proposed REE carbonate sales, if any, being tied in whole or in part to REE spot prices;

• failure to obtain suitable uranium sales terms at satisfactory prices in the future, including spot and term sale contracts;

• failure to obtain suitable vanadium sales terms at satisfactory prices in the future;

• failure to obtain suitable copper or REE sales terms at satisfactory prices in the future;

• risks associated with any expectation that we will be successful in helping the U.S. Environmental Protection Agency and Navajo Nation address historic abandoned uranium mines;

• risks associated with asset impairment as a result of market conditions;

• risks associated with lack of access to markets and the ability to access capital;

• the market price of our securities;

• public resistance to nuclear energy or uranium extraction and recovery;

• governmental resistance to nuclear energy or uranium extraction or recovery;

• risks associated with inaccurate or nonobjective media coverage of our activities and the impact such coverage may have on the public, the market for our securities, government relations, permitting activities and legal challenges, as well as the costs to us of responding to such coverage;

• uranium industry competition, international trade restrictions and the impacts on world commodity prices of foreign state subsidized production;

• risks associated with foreign governmental actions, policies, laws, rules and regulations, and foreign state subsidized enterprises, with respect to REE production and sales, which could impact REE prices available to us and impact our access to world and domestic markets for the supply of REE-bearing ores and the sale of REE carbonate and other REE products and services to world and domestic markets;

• risks associated with our involvement in industry petitions for trade remedies and the extension of the Russian Suspension Agreement, including the costs of pursuing such remedies and the potential for negative responses or repercussions from various interest groups, consumers of uranium and participants in other phases of the nuclear fuel cycle, both domestically and abroad;

• risks associated with governmental actions, policies, laws, rules and regulations with respect to nuclear energy or uranium extraction and recovery;

• risks related to potentially higher than expected costs related to any of our projects or facilities;

• risks related to our ability to recover copper from our Pinyon Plain uranium project ores;

• risks related to securities regulations;

• risks related to stock price and volume volatility;

• risks related to our ability to maintain our listing on the NYSE American and TSX;

• risks related to our ability to maintain our inclusion in various stock indices;

• risks related to dilution of currently outstanding shares, from additional share issuances, depletion of assets or otherwise;

• risks related to our lack of dividends;

• risks related to recent market events;

• risks related to our issuance of additional common shares ("Common Shares") under our At-the-Market ("ATM") program or otherwise to provide adequate liquidity in depressed commodity market circumstances;

• risks related to acquisition and integration issues;

• risks related to defects in title to our mineral properties;

• risks related to our securities; and

• risks related to any material weakness that may be identified in our internal controls over financial reporting. If we are unable to implement and maintain effective internal controls over financial reporting, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our common stock may be negatively affected.

Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, the following assumptions: that there is no material deterioration in general business and economic conditions; that there is no unanticipated fluctuation of interest rates and foreign exchange rates; that the supply and demand for, deliveries of, and the level and volatility of prices of uranium, vanadium, REEs and our other primary metals and minerals develop as expected; that uranium, vanadium and REE prices required to reach, sustain or increase expected or forecasted production levels are realized as expected; that our proposed REE carbonate production or any other REE activities will be technically or commercially successful; that we receive regulatory and governmental approvals for our development projects and other operations on a timely basis; that we are able to operate our mineral properties and processing facilities as expected; that we are able to implement new process technologies and operations as expected; that existing licenses and permits are renewed as required; that we are able to obtain financing for our development projects on reasonable terms; that we are able to procure mining equipment and operating supplies in sufficient quantities and on a timely basis; that engineering and construction timetables and capital costs for our development and expansion projects and restarting projects on standby, are not incorrectly estimated or affected by unforeseen circumstances; that costs of closure of various operations are accurately estimated; that there are no unanticipated changes in collateral requirements for surety bonds; that there are no unanticipated changes to market competition; that our reserve and resource estimates are within reasonable bounds of accuracy (including with respect to size, grade and recoverability) and that the geological, operational and price assumptions on which these are based are reasonable; that environmental and other administrative and legal proceedings or disputes are satisfactorily resolved; that there are no significant changes to regulatory programs and requirements that would materially increase regulatory compliance costs, bonding costs, or licensing/permitting requirements; and that we maintain ongoing relations with our employees and with our business and joint venture partners.

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further in the documents incorporated by reference into this Prospectus Supplement and Prospectus. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated, or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as required by law, we disclaim any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Statements relating to "Mineral Reserves" or "Mineral Resources" are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions that the Mineral Reserves and Mineral Resources described may be profitably extracted in the future. We qualify all the forward-looking statements contained in this Prospectus by the above cautionary statements.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus Supplement from documents filed with the SEC and is therefore deemed to be incorporated by reference into the Prospectus for purposes of this Offering. Copies of documents incorporated herein by reference may be obtained on request without charge from our Chief Financial Officer at 225 Union Boulevard, Suite 600, Lakewood, Colorado 80228 USA, telephone (303) 974-2140. These documents are also available on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com under our profile. Our filings through SEDAR and the SEC's Electronic Data Gathering, Analysis and Retrieval system, which is commonly known by the acronym "EDGAR," and may be accessed at www.sec.gov, are not incorporated by reference in this Prospectus except as specifically set out herein.

The following documents which have been filed by us with the SEC, are also specifically incorporated by reference into, and form an integral part of the Prospectus, as supplemented by this Prospectus Supplement (excluding, unless otherwise provided therein or herein, information furnished pursuant to Item 2.02 and Item 7.01 of any Current Report on Form 8-K):

(a) Our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on March 22, 2021;

(b) Our Current Report on Form 8-K, filed with the SEC on March 2, 2021;

(c) Our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 2, 2021 in connection with our May 26, 2021 annual and special meeting of shareholders (other than the portions thereof that are furnished and not filed);

(d) The description of the Common Shares contained in our Registration Statement on Form 40-F, as filed with the SEC on November 11, 2013, as amended by our Form 8-A12B dated August 7, 2018; and

(e) all other documents filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the U.S. Exchange Act (excluding, unless otherwise provided therein or herein, information furnished pursuant to Item 2.02 and Item 7.01 on any Current Report on Form 8-K), after the date of this Prospectus Supplement but before the end of the offering of securities made by this Prospectus Supplement and the accompanying Prospectus.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Prospectus Supplement and the Prospectus to the extent that a statement contained herein, or in any other subsequently filed document which also is incorporated or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus Supplement and the Prospectus.

We will provide to each person, including any beneficial owner, to whom a Prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in the Prospectus but not delivered with the Prospectus. We will provide this information, at no cost to the requester, upon written or oral request at the following address or telephone number: Energy Fuels Inc., 225 Union Blvd., Ste. 600, Lakewood, CO 80228; telephone number (303) 974-2140.

RISK FACTORS

An investment in the Common Shares is subject to a number of risks. A prospective purchaser of the Common Shares should carefully consider the information and risks faced by us described in this Prospectus Supplement, the Prospectus and the documents incorporated herein and therein by reference, including without limitation the risk factors set out under the headings "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2020.

Our operations are highly speculative due to the high-risk nature of our business, which includes the acquisition, financing, exploration, permitting, development and mining of, or recovery of product from, mineral properties, the recovery, milling and processing of minerals and other feed materials and the marketing of the resulting products. The risks and uncertainties incorporated by reference herein are not the only ones that we face. Additional risks and uncertainties not currently known to us, or that we currently deem immaterial, may also impair our operations. If any of the risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of the Common Shares could decline in value and investors could lose part or all of their investment.

Risks Related to this Offering and our Securities

Management will have broad discretion as to the use of the proceeds from this Offering and may not use the proceeds effectively.

Because we have not designated the amount of net proceeds from this Offering to be used for any particular purpose, our management will have broad discretion as to the application of the net proceeds from this Offering and could use them for purposes other than those contemplated at the time of the Offering. Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

You will experience dilution as a result of the Offering.

Giving effect to the issuance of Common Shares in this Offering, the receipt of the expected net proceeds and the use of those proceeds, this Offering will have a dilutive effect on our expected net income available to our shareholders per share and funds from operations per share. The dilution per share to investors participating in this Offering will be $5.00 (see "Dilution" below).

You may experience future dilution as a result of future equity offerings.

We are not restricted from issuing additional securities in the future, including Common Shares, securities that are convertible into or exchangeable for, or that represent the right to receive, Common Shares or substantially similar securities. To the extent that we raise additional funds through the sale of equity or convertible debt securities, the issuance of such securities could result in dilution to our shareholders. We may sell Common Shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this Offering, and investors purchasing Common Shares or other securities in the future could have rights superior to existing shareholders. The price per share at which we sell additional Common Shares, or securities convertible or exchangeable into Common Shares, in future transactions may be higher or lower than the price per share paid by investors in this Offering.

THE COMPANY

Overview

We were incorporated on June 24, 1987 in the Province of Alberta under the name "368408 Alberta Inc." In October 1987, we changed our name to "Trevco Oil & Gas Ltd." In May 1990, we changed our name to "Trev Corp." In August 1994, we changed our name to "Orogrande Resources Inc." In April 2001 we changed our name to "Volcanic Metals Exploration Inc." On September 2, 2005,we were continued under the Business Corporations Act (Ontario). On March 26, 2006, we acquired 100% of the outstanding shares of "Energy Fuels Resources Corporation." On May 26, 2006, we changed our name to "Energy Fuels Inc."

We are engaged in conventional extraction and in situ recovery ("ISR") of uranium, along with the exploration, permitting, and evaluation of uranium properties in the United States. We are additionally engaged in the recovery of vanadium, historically a byproduct of the uranium recovery process, and are also planning to commence the commercial production of REE carbonate in 2021, another byproduct of the uranium recovery process. Energy Fuels owns the Nichols Ranch uranium recovery facility in Wyoming (the "Nichols Ranch Project"), which is an ISR production center currently on standby, and the Alta Mesa Project in Texas ("Alta Mesa"), which is an ISR production center also currently on standby. In addition, Energy Fuels owns the White Mesa Mill in Utah, which is the only conventional uranium recovery facility operating in the U.S. The Mill can also recover vanadium as a co-product of mineralized material produced from certain of our projects in Colorado and Utah and, from time to time, from solutions in our tailings impoundment system, as market conditions warrant, as well as REE carbonate from various uranium- and REE-bearing ores. We also own uranium and uranium/vanadium properties and projects in various stages of exploration, permitting, and evaluation, as well as fully-permitted uranium and uranium/vanadium projects on standby. In addition, Energy Fuels recovers uranium from other uranium-bearing materials not derived from conventional material, referred to as "alternate feed materials," at the Mill.

For a detailed description of the business of Energy Fuels, please refer to "Item 1. Description of Business" in our Annual Report on Form 10-K for the year ended December 31, 2020.

Our registered office is located at 82 Richmond St. East, Suite 308, Toronto, ON M5C 1P1, Canada. Our principal place of business and the head office of our U.S. subsidiaries is located at 225 Union Boulevard, Suite 600, Lakewood, Colorado, 80228 USA.

DILUTION

As of December 31, 2020, our net tangible book value was approximately $153.8 million, or $1.15 per share. Net tangible book value is total assets minus the sum of liabilities, intangible assets and non-controlling interests. Net tangible book value per share is net tangible book value divided by the total number of our common shares outstanding as of December 31, 2020.

Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of our Common Shares in this Offering and the net tangible book value per share of our Common Shares immediately after completion of this Offering. Assuming that an aggregate of 5,283,912 Common Shares are sold at a price of $6.34 per share, which was the last reported sale price of our Common Shares on the NYSE American on April 7, 2021, for aggregate proceeds of $33.5 million in this Offering, and after deducting the commissions and estimated Offering expenses payable by us, our as-adjusted net tangible book value as of December 31, 2020 would have been approximately $186.5 million, or $1.34 per share. This represents an immediate increase in net tangible book value of $0.19 per share to existing shareholders and immediate dilution in net tangible book value of $5.00 per share to investors purchasing our Common Shares in this Offering. The following table illustrates this dilution on a per share basis:

|

Assumed public Offering price per share

|

$

|

|

6.34

|

|

|

|

|

|

|

|

|

Net tangible book value per share as of December 31, 2020

|

$

|

1.15

|

|

|

|

Increase in net tangible book value per share attributable to this Offering

|

$

|

0.19

|

|

|

|

As adjusted net tangible book value per share as of December 31, 2020 after giving effect to this Offering

|

$

|

|

1.34

|

|

|

|

|

|

|

|

|

Dilution per share to investor participating in this Offering

|

$

|

|

5.00

|

|

The table above assumes for illustrative purposes that an aggregate of 5,283,912 Common Shares are sold during the term of the Offering at an Offering price of $6.34 per share, which was the last reported sale price of our Common Shares on the NYSE American on April 7, 2021, for aggregate gross proceeds of $33.5 million. The Common Shares subject to the Sales Agreement are being sold from time to time at various prices. An increase of $0.20 per share in the price at which the shares are sold from the assumed Offering price of $6.54 per share shown in the table above, assuming all of our Common Shares in the aggregate amount of $33.5 million during the term of the Offering are sold at that price, would increase our adjusted net tangible book value per share after the Offering to $1.34 per share and would represent immediate dilution in net tangible book value of $5.20 per share to investors purchasing Common Shares in this Offering, after deducting commissions and estimated aggregate Offering expenses payable by us. A decrease of $0.20 per share in the price at which the shares are sold from the assumed Offering price of $6.34 per share shown in the table above, assuming all of our Common Shares in the aggregate amount of $33.5 million during the term of the Offering are sold at that price, would increase our adjusted net tangible book value per share after the Offering to $1.33 per share and would represent immediate dilution in net tangible book value of $4.81 per share, after deducting commissions and estimated Offering expenses payable by us. This information is supplied for illustrative purposes only and may differ based on the actual Offering price and the actual number of shares offered.

The discussion and table above are based on 134,311,033 Common Shares outstanding as of December 31, 2020, and excludes the following, in each case as of such date:

20,920 Common Shares held in treasury;

1,609,087 Common Shares issuable upon the exercise of outstanding stock options having a weighted-average exercise price of $2.91 per share;

1,094,056 Common Shares issuable upon vesting of outstanding restricted stock units;

1,720,623 Common Shares issuable upon vesting and exercise of outstanding share appreciation rights; and

4,165,860 Common Shares issuable upon the exercise of warrants having an exercise price of $2.45 per share.

To the extent that any of these shares are issued upon exercise of outstanding options, vesting of restricted stock units, vesting and exercise of stock appreciation rights, exercise of warrants or otherwise, investors purchasing our Common Shares in this Offering may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our shareholders.

Subsequent to the year ended December 31, 2020, we issued 6,251,178 million common shares under our existing at-the-market offering, 32,369 common shares for consulting services, 421,012 common shares for employee exercises of Stock Options, 478,781 common shares for the vesting of restricted stock units, 407,776 for warrant exercises, and our number of issued and outstanding common shares as of April 7, 2021 was 141,902,149.

USE OF PROCEEDS

The net proceeds from the Offering are not determinable in light of the nature of the distribution. The net proceeds of any given distribution of Common Shares through the Agents in an "at the market offering" will represent the gross proceeds after deducting the applicable compensation payable to the Agents under the Sales Agreement and the expenses of the distribution.

We intend to use the net proceeds, if any, of the Offering to provide us with additional financial flexibility and enhanced options with respect to any or all of the following: (i) to fund various activities required to maintain our readiness and ability to increase uranium and/or vanadium production at our properties as market conditions may warrant, including: exploration drilling, development activities, wellfield construction and other enhancements at our Nichols Ranch ISR Project in Wyoming, development and mining activities at our La Sal Complex in Utah, development and mining activities at our Pinyon Plain Mine in Arizona, exploration drilling, development activities and wellfield construction at our Alta Mesa Project in Texas, exploration, permitting and development activities at our other projects, and various capital and sustaining capital expenditures at our Mill and other projects; (ii) to continue to finance test work at the Mill in preparation for the commercial production of REE carbonate at the Mill; (iii) to finance capital, operational and working capital expenses associated with the ramp-up and commercial production of REE carbonate at the Mill; (iv) to finance test work and any capital improvements required in connection with the evaluation, testing and implementation of REE separation and potentially other REE value-added processes and facilities at the Mill; (v) to finance any permitting and licensing activities that may be required in connection with the Mill's REE activities; (vi) to continue to pursue additional revenue-generating activities at the Mill, including alternate feed material processing and land clean-up activities; (vii) to continue to finance evaluation of the high-grade uranium and copper mineralization at our Pinyon Plain Mine, including further evaluation of processing options at the Mill for the copper resources; (viii) to continue permitting our projects, including Roca Honda; and/or (ix) for general corporate needs and working capital requirements. However, management of Energy Fuels will have discretion with respect to the actual use of the net proceeds of the Offering, and there may be circumstances where, for sound business reasons, a reallocation of the net proceeds is necessary. See "Risk Factors."

PLAN OF DISTRIBUTION

We have entered into the Sales Agreement with the Agents under which we may issue and sell, from time to time, Common Shares through the Lead Agent. Pursuant to this Prospectus Supplement, we may issue and sell up to an additional $33,500,000 of Common Shares through the Lead Agent from and after the date hereof. The Sales Agreement previously entered into by the Company and the Agents was filed as an exhibit to a Current Report on Form 8-K on May 6, 2019, which is incorporated by reference into this Prospectus Supplement and the accompanying Prospectus.

Sales of Common Shares, if any, will be made in transactions that are deemed to be an "at the market offering," as defined in Rule 415(a)(4) promulgated under the Securities Act. No Common Shares will be sold on the TSX or on other trading markets in Canada. Subject to the terms and conditions of the Sales Agreement and upon instructions from us, the Lead Agent will use its commercially reasonable efforts, consistent with its customary trading and sales practices and applicable laws, to sell the Common Shares in accordance with the parameters specified by us and as set out in the Sales Agreement. The Common Shares will be distributed at market prices prevailing at the time of the sale. As a result, prices may vary as between purchasers and during the period of distribution.

We will instruct the Lead Agent as to the number of Common Shares to be sold by the Lead Agent from time to time by sending the Lead Agent a notice (a "Placement Notice") that requests that the Lead Agent sell up to a specified dollar amount or a specified number of Common Shares and specifies any parameters in accordance with which we require that the Common Shares be sold. The parameters set forth in a Placement Notice may not conflict with the provisions of the Sales Agreement. We or the Lead Agent may suspend the offering of Common Shares upon proper notice and subject to other conditions set forth in the Sales Agreement.

We will pay the Agents for their services in acting as agents in the sale of Common Shares, pursuant to the terms of the Sales Agreement, compensation up to but not exceeding 3.0% of the gross proceeds from sales of Common Shares made thereunder. The Agents will be the only person or company paid an underwriting fee or commission in connection with the Offering. We have also agreed pursuant to the Sales Agreement to reimburse the Agents for certain specified expenses, including the fees and disbursements of their legal counsel in an amount not to exceed $50,000. We estimate that the total expenses that we will incur for the Offering (including fees payable to stock exchanges, securities regulatory authorities, our counsel and our auditors, but excluding compensation payable to the Agents under the terms of the Sales Agreement) will be approximately $0.1 million. Settlement for sales of Common Shares will occur on the second business day following the date on which any sales are made, or on such other date as is current industry practice for regular-way trading, in return for payment of the net proceeds to us. Sales of Common Shares as contemplated in this Prospectus Supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the Lead Agent may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale of the Common Shares on behalf of us, each Agent will be deemed an "underwriter," as defined in applicable securities legislation under the Securities Act, and the compensation of each Agent will be deemed to be underwriting commissions or discounts.

We have agreed to provide indemnification and contribution to the Agents against, among other things, certain civil liabilities, including liabilities under the Securities Act.

The offering of Common Shares pursuant to the Sales Agreement will terminate in accordance with the terms of the Sales Agreement. The Agents may terminate the Sales Agreement under the circumstances specified in the Sales Agreement. We and each Agent may also terminate the Sales Agreement upon giving the other party ten (10) days' notice.

The Agents and their respective affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation M under the Exchange Act, the Agents will not engage in any market making activities involving our Common Shares while the Offering is ongoing under this Prospectus Supplement.

This Prospectus Supplement and the accompanying Prospectus in electronic format may be made available on websites maintained by the Agents, and the Agents may distribute this Prospectus Supplement and the accompanying Prospectus electronically.

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of certain material U.S. federal income tax considerations applicable to a U.S. Holder (as defined below) as a result of the acquisition, ownership, and disposition of Common Shares acquired pursuant to this Prospectus Supplement.

This summary is for general information purposes only and does not purport to be a complete analysis or listing of all potential U.S. federal income tax considerations that may apply to a U.S. Holder as a result of the acquisition, ownership, and disposition of Common Shares. In addition, this summary does not take into account the individual facts and circumstances of any particular U.S. Holder that may affect the U.S. federal income tax consequences to such U.S. Holder, including, without limitation, specific tax consequences to a U.S. Holder under an applicable income tax treaty. Accordingly, this summary is not intended to be, and should not be construed as, legal or U.S. federal income tax advice with respect to any U.S. Holder. This summary does not address the U.S. federal net investment income, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences to U.S. Holders of the acquisition, ownership, and disposition of Common Shares. In addition, except as specifically set forth below, this summary does not discuss applicable tax reporting requirements. Each prospective U.S. Holder should consult its own tax advisor regarding the U.S. federal, U.S. federal net investment income, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating to the acquisition, ownership, and disposition of Common Shares.

No legal opinion from U.S. legal counsel or ruling from the Internal Revenue Service (the "IRS") has been requested, or will be obtained, regarding the U.S. federal income tax consequences of the acquisition, ownership, and disposition of Common Shares. This summary is not binding on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in this summary. In addition, because the authorities on which this summary are based are subject to various interpretations, the IRS and the U.S. courts could disagree with one or more of the conclusions described in this summary.

Scope of this Summary

Authorities

This summary is based on the Internal Revenue Code of 1986, as amended (the "Code"), Treasury Regulations (whether final, temporary or proposed), published rulings of the IRS, published administrative positions of the IRS, the Convention Between Canada and the United States of America with Respect to Taxes on Income and on Capital, signed September 26, 1980, as amended (the "Canada-U.S. Tax Convention"), and U.S. court decisions that are applicable, and, in each case, as in effect and available, as of the date of this document. Any of the authorities on which this summary is based could be changed in a material and adverse manner at any time, and any such change could be applied on a retroactive or prospective basis which could affect the U.S. federal income tax considerations described in this summary. This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed legislation.

U.S. Holders

For purposes of this summary, the term "U.S. Holder" means a beneficial owner of Common Shares acquired pursuant to this Prospectus Supplement that is for U.S. federal income tax purposes:

• an individual who is a citizen or resident of the United States;

• a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) organized under the laws of the United States, any state thereof or the District of Columbia;

• an estate whose income is subject to U.S. federal income taxation regardless of its source; or

• a trust that (1) is subject to the primary supervision of a court within the United States and the control of one or more U.S. persons for all substantial decisions, or (2) has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person.

U.S. Holders Subject to Special U.S. Federal Income Tax Rules Not Addressed

This summary does not address the U.S. federal income tax considerations applicable to U.S. Holders that are subject to special provisions under the Code, including, but not limited to, U.S. Holders that: (a) are tax-exempt organizations, qualified retirement plans, individual retirement accounts, or other tax-deferred accounts; (b) are financial institutions, underwriters, insurance companies, real estate investment trusts, or regulated investment companies; (c) are broker-dealers, dealers, or traders in securities or currencies that elect to apply a mark-to-market accounting method; (d) have a "functional currency" other than the U.S. dollar; (e) own Common Shares as part of a straddle, hedging transaction, conversion transaction, constructive sale, or other integrated transaction; (f) acquire Common Shares in connection with the exercise of employee stock options or otherwise as compensation for services; (g) hold Common Shares other than as a capital asset within the meaning of Section 1221 of the Code (generally, property held for investment purposes); (h) are subject to special tax accounting rules; (i) are partnerships and other pass-through entities (and investors in such partnerships and entities); (j) U.S. expatriates or former long-term residents of the U.S.; (k) subject to taxing jurisdictions other than, or in addition to, the U.S.; or (l) own, have owned or will own (directly, indirectly, or by attribution) 10% or more of the voting power or the value of the outstanding shares of the Company. U.S. Holders that are subject to special provisions under the Code, including, but not limited to, U.S. Holders described immediately above, should consult their own tax advisor regarding the U.S. federal, U.S. federal net investment income, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating to the acquisition, ownership and disposition of Common Shares.

If an entity or arrangement that is classified as a partnership (or other "pass-through" entity) for U.S. federal income tax purposes holds Common Shares, the U.S. federal income tax consequences to such entity and the partners (or other owners) of such entity generally will depend on the activities of the entity and the status of such partners (or owners). This summary does not address the tax consequences to any such partner (or owner). Partners (or other owners) of entities or arrangements that are classified as partnerships or as "pass-through" entities for U.S. federal income tax purposes should consult their own tax advisors regarding the U.S. federal income tax consequences arising from and relating to the acquisition, ownership, and disposition of Common Shares.

Ownership and Disposition of Common Shares

The following discussion is subject to the rules described below under the heading "Passive Foreign Investment Company Rules."

Taxation of Distributions

A U.S. Holder that receives a distribution, including a constructive distribution, with respect to a Common Share will be required to include the amount of such distribution in gross income as a dividend (without reduction for any foreign income tax withheld from such distribution) to the extent of our current or accumulated "earnings and profits", as computed for U.S. federal income tax purposes. To the extent that a distribution exceeds our current and accumulated "earnings and profits", such distribution will be treated first as a tax-free return of capital to the extent of a U.S. Holder's tax basis in the Common Shares and thereafter as gain from the sale or exchange of such Common Shares (see "Sale or Other Taxable Disposition of Common Shares" below). However, we may not maintain the calculations of our earnings and profits in accordance with U.S. federal income tax principles, and each U.S. Holder may have to assume that any distribution by us with respect to the Common Shares will constitute dividend income. Dividends received on Common Shares by corporate U.S. Holders generally will not be eligible for the "dividends received deduction." Subject to applicable limitations, dividends paid by us to non-corporate U.S. Holders, including individuals, generally will be eligible for the preferential tax rates applicable to long-term capital gains for dividends, provided certain holding period and other conditions are satisfied, including that we not be classified as a PFIC (as defined below) in the tax year of distribution or in the preceding tax year. The dividend rules are complex, and each U.S. Holder should consult its own tax advisor regarding the application of such rules.

Sale or Other Taxable Disposition of Common Shares

A U.S. Holder will generally recognize gain or loss on the sale or other taxable disposition of Common Shares in an amount equal to the difference, if any, between (a) the amount of cash plus the fair market value of any property received, and (b) such U.S. Holder's tax basis in such Common Shares sold or otherwise disposed of. Subject to the PFIC Rules discussed below, any such gain or loss generally will be capital gain or loss, which will be long-term capital gain or loss if, at the time of the sale or other disposition, such Common Shares are held for more than one year.

Preferential tax rates apply to long-term capital gains of a U.S. Holder that is an individual, estate or trust. There are currently no preferential tax rates for long-term capital gains of a U.S. Holder that is a corporation. Deductions for capital losses are subject to significant limitations under the Code.

Passive Foreign Investment Company Rules

If we were to constitute a "passive foreign investment company" ("PFIC") for any year during a U.S. Holder's holding period, then certain potentially adverse rules would affect the U.S. federal income tax consequences to a U.S. Holder resulting from the acquisition, ownership and disposition of Common Shares. We believe that we were not a PFIC for our prior tax year ended December 31, 2020, and based on current business plans and financial expectations, we expect that we should not be a PFIC for our current tax year ending December 31, 2021. We have not made any determination as to our PFIC status for future tax years. No opinion of legal counsel or ruling from the IRS concerning the status of the Company as a PFIC has been obtained or is currently planned to be requested. PFIC classification is fundamentally factual in nature, generally cannot be determined until the close of the tax year in question and is determined annually. Additionally, the analysis depends, in part, on the application of complex U.S. federal income tax rules, which are subject to differing interpretations. Consequently, there can be no assurance that we have never been and will not become a PFIC for any tax year during which U.S. Holders hold Common Shares.

In any year in which we are classified as a PFIC, a U.S. Holder will be required to file an annual report with the IRS containing such information as Treasury Regulations and/or other IRS guidance may require. In addition to penalties, a failure to satisfy such reporting requirements may result in an extension of the time period during which the IRS can assess a tax. U.S. Holders should consult their own tax advisors regarding the requirements of filing such information returns under these rules, including the requirement to file an IRS Form 8621.

We generally will be a PFIC if, after the application of certain "look-through" rules with respect to subsidiaries in which we hold at least 25% of the value of such subsidiary for a tax year, (a) 75% or more of our gross income for such tax year is passive income (the "income test"), or (b) 50% or more of the value of our assets either produce passive income or are held for the production of passive income (the "asset test"), based on the quarterly average of the fair market value of such assets. "Gross income" generally includes all sales revenues less the cost of goods sold, plus income from investments and from incidental or outside operations or sources, and "passive income" generally includes, for example, dividends, interest, certain rents and royalties, certain gains from the sale of stock and securities, and certain gains from commodities transactions; however, certain active business gains arising from the sale of commodities generally are excluded from passive income.

If we were a PFIC in any tax year during which a U.S. Holder held Common Shares, such holder generally would be subject to special rules with respect to "excess distributions" made by us on the Common Shares and with respect to gain from the disposition of Common Shares. An "excess distribution" generally is defined as the excess of distributions with respect to the Common Shares received by a U.S. Holder in any tax year over 125% of the average annual distributions such U.S. Holder has received from us during the shorter of the three preceding tax years, or such U.S. Holder's holding period for the Common Shares.

Generally, a U.S. Holder would be required to allocate any excess distribution or gain from the disposition of the Common Shares pro rata over its holding period for the Common Shares. Such amounts allocated to the year of the disposition or excess distribution and any year prior to the first year in which we were a PFIC would be taxed as ordinary income in the year of the disposition or excess distribution, and amounts allocated to each other tax year would be taxed as ordinary income at the highest tax rate in effect for each such year for the applicable class of taxpayer and an interest charge at a rate applicable to underpayments of tax would apply.

While there are U.S. federal income tax elections that sometimes can be made to mitigate these adverse tax consequences (including the "QEF Election" under Section 1295 of the Code and the "Mark-to-Market Election" under Section 1296 of the Code), such elections are available in limited circumstances and must be made in a timely manner.

U.S. Holders should be aware that, for each tax year, if any, that we are a PFIC, we can provide no assurances that we will satisfy the record keeping requirements or make available to U.S. Holders the information such U.S. Holders require to make a QEF Election with respect to us or any subsidiary that also is classified as a PFIC.

Certain additional adverse rules may apply with respect to a U.S. Holder if we are a PFIC, regardless of whether the U.S. Holder makes a QEF Election. These rules include special rules that apply to the amount of foreign tax credit that a U.S. Holder may claim on a distribution from a PFIC. Subject to these special rules, foreign taxes paid with respect to any distribution in respect of stock in a PFIC are generally eligible for the foreign tax credit. U.S. Holders should consult their own tax advisors regarding the potential application of the PFIC rules to the ownership and disposition of Common Shares, and the availability of certain U.S. tax elections under the PFIC rules.

Additional Considerations

Receipt of Foreign Currency

The amount of any distribution paid to a U.S. Holder in foreign currency, or on the sale, exchange or other taxable disposition of Common Shares, generally will be equal to the U.S. dollar value of such foreign currency based on the exchange rate applicable on the date of receipt (regardless of whether such foreign currency is converted into U.S. dollars at that time). A U.S. Holder will have a basis in the foreign currency equal to its U.S. dollar value on the date of receipt. Any U.S. Holder who converts or otherwise disposes of the foreign currency after the date of receipt may have a foreign currency exchange gain or loss that would be treated as ordinary income or loss, and generally will be U.S. source income or loss for foreign tax credit purposes. Different rules apply to U.S. Holders who use the accrual method with respect to foreign currency. Each U.S. Holder should consult its own U.S. tax advisor regarding the U.S. federal income tax consequences of receiving, owning, and disposing of foreign currency.

Foreign Tax Credit

Subject to the PFIC rules discussed above, a U.S. Holder that pays (whether directly or through withholding) Canadian income tax with respect to dividends paid on the Common Shares generally will be entitled, at the election of such U.S. Holder, to receive either a deduction or a credit for such Canadian income tax. Generally, a credit will reduce a U.S. Holder's U.S. federal income tax liability on a dollar-for-dollar basis, whereas a deduction will reduce a U.S. Holder's income that is subject to U.S. federal income tax. This election is made on a year-by-year basis and applies to all foreign taxes paid (whether directly or through withholding) by a U.S. Holder during a year. The foreign tax credit rules are complex and involve the application of rules that depend on a U.S. Holder's particular circumstances. Accordingly, each U.S. Holder should consult its own U.S. tax advisor regarding the foreign tax credit rules.

Backup Withholding and Information Reporting

Under U.S. federal income tax law, certain categories of U.S. Holders must file information returns with respect to their investment in, or involvement in, a foreign corporation. For example, U.S. return disclosure obligations (and related penalties) are imposed on individuals who are U.S. Holders that hold certain specified foreign financial assets in excess of certain threshold amounts. The definition of specified foreign financial assets includes not only financial accounts maintained in foreign financial institutions, but also, unless held in accounts maintained by a financial institution, any stock or security issued by a non-U.S. person, any financial instrument or contract held for investment that has an issuer or counterparty other than a U.S. person and any interest in a foreign entity. U.S. Holders may be subject to these reporting requirements unless their Common Shares are held in an account at certain financial institutions. Penalties for failure to file certain of these information returns are substantial. U.S. Holders should consult their own tax advisors regarding the requirements of filing information returns, including the requirement to file an IRS Form 8938.

Payments made within the U.S. or by a U.S. payor or U.S. middleman, of dividends on, and proceeds arising from the sale or other taxable disposition of, Common Shares will generally be subject to information reporting and backup withholding tax, at the rate of 24%, if a U.S. Holder (a) fails to furnish such U.S. Holder's correct U.S. taxpayer identification number (generally on Form W-9), (b) furnishes an incorrect U.S. taxpayer identification number, (c) is notified by the IRS that such U.S. Holder has previously failed to properly report items subject to backup withholding tax, or (d) fails to certify, under penalty of perjury, that such U.S. Holder has furnished its correct U.S. taxpayer identification number and that the IRS has not notified such U.S. Holder that it is subject to backup withholding tax. However, certain exempt persons generally are excluded from these information reporting and backup withholding rules. Backup withholding is not an additional tax. Any amounts withheld under the U.S. backup withholding tax rules will be allowed as a credit against a U.S. Holder's U.S. federal income tax liability, if any, or will be refunded, if such U.S. Holder furnishes required information to the IRS in a timely manner.

The discussion of reporting requirements set forth above is not intended to constitute a complete description of all reporting requirements that may apply to a U.S. Holder. A failure to satisfy certain reporting requirements may result in an extension of the time period during which the IRS can assess a tax, and under certain circumstances, such an extension may apply to assessments of amounts unrelated to any unsatisfied reporting requirement. Each U.S. Holder should consult its own tax advisor regarding the information reporting and backup withholding rules.

CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

The following is a summary, as of the date hereof, of the principal Canadian federal income tax considerations under the Income Tax Act (Canada) ("Tax Act") generally applicable to a holder who holds Common Shares of the Corporation. This summary only applies to a holder who is a beneficial owner of Common Shares and who, for the purposes of the Tax Act and at all relevant times deals at arm's length and is not affiliated with the Corporation, (a "Holder").

This summary is based upon: (i) the current provisions of the Tax Act and the regulations ("Regulations") in force as of the date hereof; (ii) all specific proposals (the "Tax Proposals") to amend the Tax Act or the Regulations that have been publicly announced by, or on behalf of, the Minister of Finance (Canada) prior to the date hereof; and (iii) counsel's understanding of the current published administrative policies and assessing practices of the Canada Revenue Agency made publicly available prior to the date hereof. This summary assumes that all such Tax Proposals will be enacted in the form currently proposed, but no assurance can be given that they will be enacted in the form proposed or at all. This summary does not otherwise take into account or anticipate any changes in law, administrative policy or assessing practice, whether by legislative, regulatory, administrative, governmental or judicial decision or action, nor does it take into account the tax laws of any province or territory of Canada or of any jurisdiction outside of Canada.

This summary is of a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice to any particular Holder. Accordingly, Holders are urged to consult their own tax advisors about the specific tax consequences to them of acquiring, holding and disposing of Common Shares in their particular circumstances.

Currency Conversion

Generally, for purposes of the Tax Act, all amounts relating to the acquisition, holding, or disposition of the Common Shares must be converted into Canadian dollars based on the exchange rates as determined in accordance with the Tax Act. The amounts subject to withholding tax and any capital gains or capital losses realized by a Holder may be affected by fluctuations in the Canadian-U.S. dollar exchange rate.

Residents of Canada

This section of the summary applies to a Holder who, for the purposes of the Tax Act and at all relevant times, is, or is deemed to be, resident in Canada and holds the Common Shares as capital property (a "Resident Holder"). This summary is not applicable to: (i) a Holder that is a "specified financial institution" within the meaning of the Tax Act; (ii) a Holder an interest in which is a "tax shelter investment" within the meaning of the Tax Act; (iii) a Holder that is a "financial institution" within the meaning of section 142.2 of the Tax Act; (iv) a Holder that reports its "Canadian tax results" within the meaning of the Tax Act in a currency other than Canadian currency; or (v) a Holder that enters into or will enter into, with respect to the Common Shares, a "derivative forward agreement" within the meaning of the Tax Act. Additional considerations, not discussed herein, may be applicable to a Resident Holder that is a corporation resident in Canada (for the purposes of the Tax Act) and is, or becomes, or does not deal at arm's length with a corporation resident in Canada that is, or that becomes, as part of a transaction or event or series of transactions or events that includes the acquisition of the Common Shares, controlled by a non-resident corporation, individual, trust or a group of any combination of non-resident individuals, trusts, and/or corporations who do not deal with each other at arm's length for purposes of the rules in section 212.3 of the Tax Act. Such Holders should consult their own tax advisors with respect to an investment in the Common Shares.

Common Shares will generally be considered to be capital property to a Resident Holder unless such securities are held in the course of carrying on a business of trading or dealing in securities or were acquired in one or more transactions considered to be an adventure or concern in the nature of trade. A Resident Holder whose Common Shares do not otherwise qualify as capital property may, in certain circumstances, be entitled to make an irrevocable election in accordance with subsection 39(4) of the Tax Act to have such Common Shares, and every other "Canadian security" (as defined in the Tax Act) owned by such Resident Holder in the taxation year in which the election is made and in all subsequent taxation years, deemed to be capital property. Resident Holders should consult their own tax advisors as to whether an election under subsection 39(4) of the Tax Act is available and advisable in their particular circumstances.

Dividends