eMagin Corporation Announces Closing of $2 Million Registered Direct Offering

April 11 2019 - 5:04PM

Business Wire

eMagin Corporation, or the “Company” (NYSE

AMERICAN:EMAN), a leader in the development, design and

manufacture of Active Matrix OLED microdisplays for high resolution

imaging products, today announced the closing of its previously

announced $2.0 million registered direct offering of immediately

exercisable pre-funded warrants to purchase up to 4 million shares

of the Company’s common stock at a purchase price of $0.49 per

warrant and an exercise price of $0.01 per share. In a concurrent

private placement, the Company also issued to the investor in the

registered direct offering unregistered warrants to purchase up to

3 million shares of the Company’s common stock at an exercise price

of $0.78 per share. The unregistered warrants are exercisable six

months following issuance and will expire five and one-half years

from the issuance date.

The Company intends to use the net proceeds from the offering

for working capital and other general corporate purposes.

H.C. Wainwright & Co. acted as the exclusive placement agent

for both the registered direct offering and the private

placement.

The pre-funded warrants (but not the unregistered warrants or

the shares of common stock underlying the unregistered warrants)

were offered by the Company pursuant to a "shelf" registration

statement on Form S-3 (File No. 333-218838) that was originally

filed on June 20, 2017 and declared effective by the Securities and

Exchange Commission ("SEC") on July 11, 2017, and the base

prospectus contained therein. The offering of the pre-funded

warrants was made only by means of a prospectus supplement that

forms a part of the registration statement. A final prospectus

supplement and accompanying base prospectus relating to the

pre-funded warrants was filed with the SEC. Copies of the final

prospectus supplement and accompanying base prospectus may be

obtained on the SEC's website at http://www.sec.gov or by

contacting H.C. Wainwright & Co., LLC at 430 Park Avenue, 3rd

Floor, New York, NY 10022, by phone at 646-975-6996 or e-mail

at placements@hcwco.com.

The unregistered warrants described above were offered in a

private placement pursuant to an applicable exemption from the

registration requirements of the Securities Act of 1933, as amended

(the “Act”), and, along with the common stock issuable upon their

exercise, have not been registered under the Act, and may not be

offered or sold in the United States absent registration with the

SEC or an applicable exemption from such registration

requirements.

This press release shall not constitute an offer to sell, or the

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or jurisdiction in which such an offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About eMagin Corporation

A leader in OLED microdisplay technology, OLED microdisplay

manufacturing know-how and mobile display systems, eMagin

manufactures high-resolution OLED microdisplays and integrates them

with magnifying optics to deliver virtual images comparable to

large-screen computer and television displays in portable,

low-power, lightweight personal displays. eMagin’s microdisplays

provide near-eye imagery in a variety of products from military,

industrial, medical and consumer OEMs. More information about

eMagin is available at www.emagin.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995

that involve significant risks and uncertainties about eMagin,

including but not limited to statements with respect to eMagin’s

use of the net proceeds from the offering. eMagin may use words

such as “expect,” “anticipate,” “project,” “intend,” “plan,” “aim,”

“believe,” “seek,” “ estimate,” “can,” “focus,” “will,” and “may”

and similar expressions to identify such forward-looking

statements. Among the important factors that could cause actual

results to differ materially from those indicated by such

forward-looking statements are risks relating to, among other

things, whether or not eMagin will be able to raise capital, market

and other conditions, eMagin’s business and financial condition,

and the impact of general economic, industry or political

conditions in the United States or internationally. For additional

disclosure regarding these and other risks faced by eMagin, see

disclosures contained in eMagin’s public filings with the SEC,

including the “Risk Factors” in the company’s Annual Report on Form

10-K for the year ended December 31, 2018, and under the heading

“Risk Factors” of the prospectus supplements for this offering. You

should consider these factors in evaluating the forward-looking

statements included in this press release and not place undue

reliance on such statements. The forward-looking statements are

made as of the date hereof, and eMagin undertakes no obligation to

update such statements as a result of new information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190411005881/en/

eMagin CorporationJeffrey Lucas, President & Chief Financial

Officer845-838-7900jlucas@emagin.comAffinity Growth AdvisorsBetsy

Brod212-661-2231betsy.brod@affinitygrowth.com

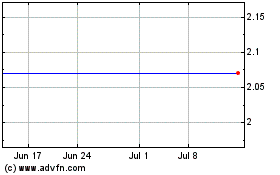

eMagin (AMEX:EMAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

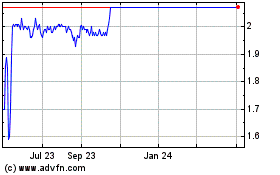

eMagin (AMEX:EMAN)

Historical Stock Chart

From Apr 2023 to Apr 2024