UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC

20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE 14A

INFORMATION

Proxy Statement

Pursuant to Section 14(a) of the

Securities Exchange

Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant

[ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, For Use of the

Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[ ] Soliciting Material Pursuant

to Section 240.14a-12

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

|

Eaton Vance California Municipal Bond Fund

|

|

Eaton Vance Enhanced Equity Income Fund

|

|

Eaton Vance Municipal Bond Fund

|

|

Eaton Vance New York Municipal Bond Fund

|

|

(Name of Registrant as Specified in Its Charter)

|

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(Name of Person(s)

Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check

the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per

Exchange Act Rules 14a-6(i) (1) and 0-11.

(1) Title of each class of

securities to which transaction applies:

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(2) Aggregate number of securities

to which transaction applies:

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(3) Per unit price or other underlying value

of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it

was determined):

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(4) Proposed maximum aggregate

value of transaction:

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(5) Total fee paid:

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

[ ] Fee paid previously with

preliminary materials.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

[ ] Check box if any part of

the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(2) Form, Schedule or Registration

Statement no.:

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(3) Filing Party:

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(4) Date Filed:

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Investor Contact: (800) 262-1122

FOR IMMEDIATE RELEASE

Certain Eaton Vance Closed-End Funds Announce

Telephonic Annual Meeting Of Shareholders On July

15, 2021

BOSTON, MA, June 30, 2021 — The following notice relates

to the combined Annual Meeting of Shareholders of Eaton Vance California Municipal Bond Fund (NYSE American: EVM), Eaton Vance Municipal

Bond Fund (NYSE American: EIM), Eaton Vance New York Municipal Bond Fund (NYSE American: ENX) and Eaton Vance Enhanced Equity Income Fund

(NYSE: EOI):

Notice That Annual Meeting Of Shareholders

Will Be A Telephonic Meeting

Due to the public health impact of the coronavirus pandemic (COVID-19)

and to support the health and well-being of our shareholders, NOTICE IS HEREBY GIVEN that the combined Annual Meeting of Shareholders

of Eaton Vance California Municipal Bond Fund, Eaton Vance Municipal Bond Fund, Eaton Vance New York Municipal Bond Fund and Eaton Vance

Enhanced Equity Income Fund (each, a “Fund” and together, the “Funds”) to be held on Thursday, July 15, 2021 at

11:30 a.m. Eastern Time (the “Meeting”) will be held in a telephonic format. Shareholders will not be able to attend the Meeting

in person.

If, as of May 4, 2021, you were a record holder of Fund shares

(i.e., you held Fund shares in your own name directly with the Fund), you are entitled to notice of and to vote at the Meeting

or any postponement or adjournment thereof. If you wish to participate in the Meeting, you should email your full name and address to

AST Fund Solutions, LLC (“AST”) at attendameeting@astfinancial.com and include the Fund’s name in the subject line.

You will then be provided with the conference call dial-in information and instructions for voting during the Meeting. All requests to

participate in the Meeting must be received by AST no later than 3:00 p.m. Eastern Time on July 14, 2021.

If, as of May 4, 2021, you held Fund shares through an intermediary

(such as a broker-dealer) and wish to participate in and vote at the Meeting, you will need to obtain a legal proxy from your intermediary

reflecting the Fund’s name, the number of Fund shares held and your name and email address. You may forward an email from your intermediary

containing the legal proxy or attach an image of the legal proxy to an email and send it to AST at attendameeting@astfinancial.com with

“Legal Proxy” in the subject line. You will then be provided with the conference call dial-in information and instructions

for voting during the Meeting. All requests to participate in the Meeting must be received by AST no later than 3:00 p.m. Eastern Time

on July 14, 2021.

Please contact AST at attendameeting@astfinancial.com with any questions

regarding access to the Meeting, and an AST representative will contact you to answer your questions.

The Funds and the Boards of Trustees are closely monitoring the evolving

COVID-19 situation and, if circumstances warrant, the Funds will issue one or more additional press releases updating shareholders regarding

the Meeting. Whether or not you plan to participate in the Meeting, the Funds urge you to submit your vote in advance of the Meeting by

one of the methods described in the Funds’ proxy. The Funds’ proxy statement is available online at https://funds.eatonvance.com/closed-end-fund-and-term-trust-documents.php.

The proxy card included with the previously distributed proxy materials will not be updated to reflect the change to a telephonic meeting

and may continue to be used to vote your shares in connection with the Meeting.

By Order of the Board of Trustees,

/s/ Maureen A. Gemma

Maureen A. Gemma

Secretary

The Funds’ investment adviser is Eaton Vance Management (“Eaton

Vance”). Eaton Vance applies in-depth fundamental analysis to the active management of equity, income, alternative and multi-asset

strategies. Eaton Vance’s investment teams follow time-tested principles of investing that emphasize ongoing risk management, tax

management (where applicable) and the pursuit of consistent long-term returns. The firm’s investment capabilities encompass the

global capital markets. With a history dating back to 1924, Eaton Vance is headquartered in Boston and also maintains investment offices

in New York, London, Tokyo and Singapore. For more information, visit evmanagement.com. Eaton Vance is a part of Morgan Stanley Investment

Management, the asset management division of Morgan Stanley.

###

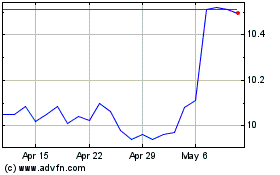

Eaton Vance Municipal (AMEX:EIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

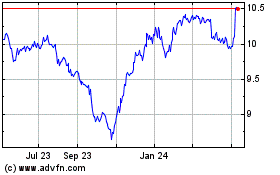

Eaton Vance Municipal (AMEX:EIM)

Historical Stock Chart

From Apr 2023 to Apr 2024