UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

|

[ ]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[X]

|

Definitive

Proxy Statement

|

|

[ ]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material Pursuant to Rule 14a-12.

|

DOCUMENT

SECURITY SYSTEMS, INC.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies.

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

|

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300

ROCHESTER, NEW YORK 14623

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

be held May 4, 2020

To

our Stockholders:

A

special meeting of stockholders Document Security Systems, Inc., a New York corporation (the “Company” or “DSS”

or “us” or “we” or “our”) will be held at The Woodlands Waterway Marriott Hotel & Convention

Center, 1601 Lake Robbins Drive, The Woodlands, Texas 77380, on May 4, 2020 at 9.00 a.m. local time for the following purpose:

|

|

(1)

|

To

approve an amendment to our certificate of incorporation to effect a reverse split of our common stock by a ratio of 1-for-30

(the “Reverse Split”); and

|

|

|

|

|

|

|

(2)

|

Transacting

such other business as may properly come before the meeting or any adjournment thereof.

|

The

close of business on April 3, 2020 has been fixed as the record date (the “Record Date”) for the determination of

stockholders entitled to notice of, and to vote at, the meeting or any adjournment thereof. Stockholders holding a majority of

our common stock outstanding as of the close of business on the Record Date must vote in favor of the Proposal to be approved

by stockholders.

Our

common stock may be delisted from the NYSE American LLC exchange (“NYSE American Exchange”) if our share price sells

for a low price for a substantial period of time. Approval of the Reverse Split enables our board of directors (the “Board”)

to judiciously select an appropriate Reverse Split ratio. Without approval of the Reverse Split Proposal, the Board of Directors

will not be able to prevent the common stock from potentially being delisted from NYSE American Exchange, which will likely have

very serious consequences for our company and our stockholders.

You

are cordially invited to attend the meeting in person. However, to assure your representation at the meeting, please mark, sign,

date and return the enclosed proxy as promptly as possible in the enclosed postage-prepaid envelope. If you attend the meeting

you may vote in person, even if you returned a proxy. These proxy materials will be mailed on or about April 9, 2020 to the stockholders

of record on the Record Date

By

Order of the Board of Directors of Document Security Systems, Inc.

|

/s/

Heng Fai Ambrose Chan

|

|

|

Heng

Fai Ambrose Chan

|

|

|

Chairman

of the Board

|

|

WHETHER

OR NOT YOU PLAN ON ATTENDING THE SPECIAL MEETING IN PERSON, PLEASE VOTE USING THE PROXY CARD AS PROMPTLY AS POSSIBLE TO ENSURE

THAT YOUR VOTE IS COUNTED.

DOCUMENT

SECURITY SYSTEMS, INC.

200

CANAL VIEW BOULEVARD, SUITE 300

ROCHESTER,

NEW YORK 14623

PROXY

STATEMENT

SPECIAL

MEETING OF STOCKHOLDERS

We

are furnishing this proxy statement to the holders of our common stock, par value $0.02 per share (the “Common Stock “),

in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Document Security

Systems, Inc. (the “Company”), for use at a special meeting of stockholders (the “Special Meeting”) to

be held at The Woodlands Waterway Marriott Hotel & Convention Center, 1601 Lake Robbins Drive, The Woodlands, Texas 77380

on May 4, 2020 at 9:00 a.m. local time, and any adjournment thereof, for the purpose of seeking approval of an amendment to our

certificate of incorporation to effect a reverse split of our Common Stock by a ratio of 1-for-30 (the “Reverse Split”).

Whether or not you expect to attend the special meeting in person, please vote by returning your executed proxy card in the enclosed

envelope and the shares represented thereby will be voted in accordance with your instructions.

The

purpose of the Reverse Split is to enable us to comply with the minimum continued listing standards of NYSE American Exchange

compliance. We urge our stockholders to review the information set forth in this proxy statement, particularly under the heading

“Approval of the Reverse Split”

SOLICITATION

OF PROXIES

Our

Board is sending you this proxy statement to in connection with its solicitation of proxies on behalf of the Board for use at

the Special Meeting to approve the Reverse Split. The Company will pay for the costs of solicitation. We will pay the reasonable

expenses of brokers, nominees and similar record holders in mailing consent materials to beneficial owners of our Common Stock.

REVOCABILITY

OF PROXY

Any

stockholder executing a proxy that is solicited has the power to revoke it prior to the voting of the proxy. Revocation may be

made by i) attending the Special Meeting and voting the shares of stock in person, ii) delivering to the Secretary of the Company

at the principal office of the Company prior to the Special Meeting a written notice of revocation or a later-dated, properly

executed proxy, iii) signing another proxy card with a later date and returning it before the polls close at the Special Meeting,

or iv) voting again via the internet or by toll free telephone by following the instructions on the proxy card.

GENERAL

INFORMATION ABOUT VOTING

Record

Date

Only

the holders of record of our Common Stock at the close of business on the record date, April 3, 2020 (the “Record Date”),

are entitled to notice of and to vote at the meeting. As of March 27, 2020, there were 62,086,099 shares of our Common Stock outstanding.

Stockholders are entitled to one vote for each share of Common Stock held on the record date.

Voting

When

a proxy is properly executed and returned (and not subsequently properly revoked), the shares it represents will be voted in accordance

with the directions indicated thereon, or, if no direction is indicated thereon, it will be voted:

|

|

(1)

|

FOR

approval of the Reverse Split (the “Proposal”); and

|

|

|

|

|

|

|

(2)

|

According

to their judgment on the transaction of such matters or other business as may properly come up for vote at the Special Meeting

or any adjournments or postponements thereof.

|

Votes

Required for Approval

The

approval of the amendment to our certificate of incorporation to effect the Reverse Split requires the affirmative vote of the

holders of a majority of the outstanding shares of our Common Stock entitled to be voted at the meeting. Abstentions are not treated

as votes cast, and therefore will have the same effect of a vote against this proposal. We understand that certain brokerage

firms have elected not to vote even on “routine” matters such as the Reverse Split without your voting instructions.

If your brokerage firm has made this decision and you do not provide voting instructions, your vote will not be cast and will

have the same effect of a vote against the Reverse Split. Accordingly, we urge you to provide instructions to your bank, brokerage

firm, or other nominee by voting your proxy.

Broker

Non-Votes

A

“broker non-vote” occurs when a broker, bank, or other holder of record holding shares for a beneficial owner does

not vote on a particular proposal because that holder (i) has not received instructions from the beneficial owner and (ii) does

not have discretionary voting power for that particular item.

If

you are a beneficial owner and you do not give instructions to your broker, bank, or other holder of record, such holder of record

will be entitled to vote the shares with respect to “routine” items but will not be permitted to vote the shares with

respect to “non-routine” items (those shares are treated as “broker non-votes”). If you are a beneficial

owner, your broker, bank, or other holder of record generally has discretion to vote your shares on the proposal to approve the

Reverse Split. However, we understand that certain brokerage firms have elected not to vote even on “routine” matters

such as the Reverse Split without your voting instructions. Accordingly, we urge you to provide instructions to your bank, brokerage

firm, or other nominee by voting your proxy to ensure that your shares will be voted in accordance with your wishes at the Special

Meeting.

***

You

can contact our corporate headquarters, at (585) 325-3610, or send a letter to: Investor Relations, Document Security Systems,

Inc., 200 Canal View Boulevard, Suite 300, Rochester, New York 14623, with any questions about proposals described in this Proxy

Statement or how to execute your vote.

VOTING

SECURITIES AND PRINCIPAL HOLDERS THEREOF

Voting

Securities

The

number of outstanding shares of our Common Stock as of March 27, 2020, is 62,086,099.

SECURITY

OWNERSHIP OF CERTAIN

BENEFICIAL

OWNERS AND MANAGEMENT

The

following table sets forth beneficial ownership of common stock as of March 27, 2020 by each person known by the Company to beneficially

own more than 5% of the Common Stock, each director and each executive officer, and by all of the Company’s directors and

executive officers as a group. Each person has sole voting and dispositive power over the shares listed opposite his or her name

except as indicated in the footnotes to the table and each person’s address is c/o Document Security Systems, Inc., 200

Canal View Boulevard, Suite 300, Rochester, New York 14623.

For

purposes of this table, beneficial ownership is determined in accordance with the Securities and Exchange Commission rules, and

includes investment power with respect to shares owned and shares issuable pursuant to warrants or options exercisable within

60 days of March 27, 2020.

The

percentages of shares beneficially owned are based on 62,086,099 shares of our common stock issued and outstanding as of March

27, 2020, and is calculated by dividing the number of shares that person beneficially owns by the sum of (a) the total number

of shares outstanding on March 27, 2020, plus (b) the number of shares such person has the right to acquire within 60 days of

March 27, 2020.

|

Name

of Beneficial Owner

|

|

Shares

|

|

|

Percentage

|

|

|

Officers

and Directors

|

|

|

|

|

|

|

|

|

|

Heng

Fai Ambrose Chan (1)

|

|

|

22,954,670

|

|

|

|

39.1

|

%

|

|

Frank

Heuszel

|

|

|

74,770

|

|

|

|

*

|

|

|

Sassuan

Lee

|

|

|

|

|

|

|

-

|

|

|

Jose

Escudero

|

|

|

|

|

|

|

-

|

|

|

John

Thatch

|

|

|

30,575

|

|

|

|

*

|

|

|

Lowell

Wai Wah

|

|

|

40,767

|

|

|

|

*

|

|

|

William

Wu

|

|

|

|

|

|

|

-

|

|

|

Jason

Grady

|

|

|

74,770

|

|

|

|

*

|

|

|

All

officers and directors as a group (8 persons)

|

|

|

23,175,552

|

|

|

|

39.4

|

%

|

|

|

|

|

|

|

|

|

|

%

|

|

(1)

|

Includes

(a) 1,786,531 shares of Common Stock held by Heng Fai Holdings Limited; (b) 500,000 shares of Common Stock held by BMI Capital

Partners International Limited; (c) 683,000 shares of Common Stock held by Hengfai Business Development Pte Ltd.; (d) 13,538,711

shares of Common Stock held individually by Heng Fai Ambrose Chan; and (e) 6,446,428 shares of Common Stock held by LiquidValue

Development Pte Ltd.

|

PROPOSAL—

APPROVAL OF THE REVERSE SPLIT

General

Our

Board has approved, subject to stockholder approval, an amendment to our certificate of incorporation to effect a Reverse Split

of our issued and outstanding Common Stock by a ratio of 1-for-30. The primary reason for the Reverse Split is to enable us to

comply with the minimum continued listing standards of the NYSE American Exchange. Our Common Stock may be delisted from NYSE

American Exchange if we do not receive stockholder approval to effect the Reverse Split.

The

form of the proposed amendment to the Company’s certificate of incorporation to effect a Reverse Split of our issued and

outstanding Common Stock (subject to any changes required by applicable law). If approved by our Stockholders, the Reverse Split

proposal would permit (but not require) our Board to effect a Reverse Split of our issued and outstanding Common Stock at any

time prior to May 31, 2020 by a ratio of 1-for-30. In determining the ratio, our Board considered, among other things, factors

such as:

|

|

●

|

the

listing requirements of the NYSE American Exchange;

|

|

|

|

|

|

|

●

|

the

historical trading price and trading volume of our Common Stock;

|

|

|

|

|

|

|

●

|

the

number of shares of our Common Stock outstanding;

|

|

|

|

|

|

|

●

|

the

prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Reverse Split on the trading

market for our Common Stock;

|

|

|

|

|

|

|

●

|

the

anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs; and

|

|

|

|

|

|

|

●

|

prevailing

general market and economic conditions.

|

Our

Board reserves the right to elect to abandon the Reverse Split, including any or all proposed reverse stock split ratios, if it

determines, in its sole discretion, that the Reverse Split is no longer in the best interests of the Company and its stockholders.

As

a result of the Result Split, every thirty shares of existing Common Stock will be combined into one share of Common Stock. Any

fractional shares will be rounded up to the next whole number. The amendment to our articles of incorporation to effect a reverse

stock split, if any, will include only the reverse stock split ratio determined by our Board to be in the best interests of our

stockholders and all of the other proposed amendments at different ratios will be abandoned.

Background

and Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split

Our

Board is submitting the Reverse Split to our stockholders for approval with the primary intent to enable us to comply with the

minimum continued listing standards of the NYSE American Exchange, as well as to make our Common Stock more attractive to a broader

range of institutional and other investors. In addition to increasing the market price of our Common Stock, the Reverse Split

would also reduce certain of our costs, as discussed below. Accordingly, for these and other reasons discussed below, we believe

that effecting the Reverse Split is in the Company’s and our stockholders’ best interests.

We

believe that the Reverse Split enable us to comply with the minimum continued listing standards of the NYSE American Exchange.

The NYSE American Exchange reserves the right to delist the Company if our Common Stock sells for a low price for a substantial

period of time. Reducing the number of outstanding shares of our Common Stock should, absent other factors, increase the per share

market price of our Common Stock.

Additionally,

we believe that the Reverse Split will make our Common Stock more attractive to a broader range of institutional and other investors,

as we believe that the current market price of our Common Stock may affect its acceptability to certain institutional investors,

professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal

policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers

from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make

the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions

on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the

current average price per share of common stock can result in individual stockholders paying transaction costs representing a

higher percentage of their total share value than would be the case if the share price were substantially higher. We believe that

the Reverse Split will make our Common Stock a more attractive and cost effective investment for many investors, which will enhance

the liquidity of the holders of our Common Stock.

Reducing

the number of outstanding shares of our Common Stock through the Reverse Split is intended, absent other factors, to increase

the per share market price of our Common Stock. However, other factors, such as our financial results, market conditions and the

market perception of our business may adversely affect the market price of our Common Stock. As a result, there can be no assurance

that the Reverse Split, if completed, will result in the intended benefits described above, that the market price of our Common

Stock will increase following the Reverse Split or that the market price of our Common Stock will not decrease in the future.

Additionally, we cannot assure you that the market price per share of our Common Stock after a Reverse Split will increase in

proportion to the reduction in the number of shares of our Common Stock outstanding before the Reverse Split. Accordingly, the

total market capitalization of our Common Stock after the Reverse Stock Split may be lower than the total market capitalization

before the Reverse Split.

Procedure

for Implementing the Reverse Split

The

Reverse Split, if approved by our stockholders, would become effective upon the filing (the “Effective Time”) of a

certificate of amendment to our articles of incorporation with the Secretary of State of the State of New York. The exact timing

of the filing of the certificate of amendment that will affect the Reverse Split will be determined by our board of directors

based on its evaluation as to when such action will be the most advantageous to the Company and our stockholders. In addition,

our board of directors reserves the right, notwithstanding stockholder approval and without further action by the stockholders,

to elect not to proceed with the Reverse Split if, at any time prior to filing the amendment to the Company’s articles of

incorporation, our board of directors, in its sole discretion, determines that it is no longer in our best interest and the best

interests of our stockholders to proceed with the Reverse Split. If a certificate of amendment effecting the Reverse Split has

not been filed with the Secretary of State of the State of New York by the close of business on May 31, 2020, our board of directors

will abandon the Reverse Split.

Effect

of the Reverse Split on Holders of Outstanding Common Stock

As

a result of the Reverse Split, every thirty shares of existing Common Stock will be combined into one new share of Common Stock.

The table below shows, as of March 27, 2020, the number of outstanding shares of Common Stock that will result from the Reverse

Stock Split (without giving effect to the treatment of fractional shares):

|

Reverse

Stock Split Ratio

|

|

Approximate

Number of

Outstanding Shares

of Common Stock

Following

the

Reverse

Stock Split

|

|

|

1-for-30

|

|

|

2,069,537

|

|

The

Reverse Split will affect all holders of our Common Stock uniformly and will not affect any Stockholder’s percentage ownership

interest in the Company, except that as described below in “Fractional Shares,” record holders of Common Stock otherwise

entitled to a fractional share as a result of the Reverse Split will be rounded up to the next whole number. In addition, the

Reverse Split will not affect any Stockholder’s proportionate voting power (subject to the treatment of fractional shares).

The

implementation of the Reverse Split will result in an increased number of available authorized shares of Common Stock. The resulting

increase in such availability in the authorized number of shares of Common Stock could have a number of effects on the Company’s

stockholders depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. The

increase in available authorized shares for issuance could have an anti-takeover effect, in that additional shares could be issued

(within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover of the

Company more difficult. For example, additional shares could be issued by the Company so as to dilute the stock ownership or voting

rights of persons seeking to obtain control of the Company, even if the persons seeking to obtain control of the Company offer

an above-market premium that is favored by a majority of the independent shareholders. Similarly, the issuance of additional shares

to certain persons allied with the Company’s management could have the effect of making it more difficult to remove the

Company’s current management by diluting the stock ownership or voting rights of persons seeking to cause such removal.

The Company does not have any other provisions in its articles of incorporation, Bylaws, employment agreements, credit agreements

or any other documents that have material anti-takeover consequences. Additionally, the Company has no plans or proposals to adopt

other provisions or enter into other arrangements that may have material anti-takeover consequences. The Board is not aware of

any attempt, or contemplated attempt, to acquire control of the Company, and this proposal is not being presented with the intent

that it be utilized as a type of anti- takeover device.

Additionally,

because holders of Common Stock have no preemptive rights to purchase or subscribe for any unissued stock of the Company, the

issuance of additional shares of authorized Common Stock that will become newly available as a result of the implementation of

the Reverse Split will reduce the current stockholders’ percentage ownership interest in the total outstanding shares of

Common Stock.

The

Company may issue the additional shares of authorized Common Stock that will become available as a result of the Reverse Split

without the additional approval of its stockholders.

The

Reverse Split may result in some Stockholders owning “odd lots” of less than 100 shares of Common Stock. Odd lot shares

may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher

than the costs of transactions in “round lots” of even multiples of 100 shares.

After

the Effective Time, our Common Stock will have new Committee on Uniform Securities Identification Procedures (CUSIP) numbers,

which is a number used to identify our equity securities, and stock certificates with the older CUSIP numbers will need to be

exchanged for stock certificates with the new CUSIP numbers by following the procedures described below. After the Reverse Split,

we will continue to be subject to the periodic reporting and other requirements of the Securities Exchange Act of 1934, as amended.

Our Common Stock will continue to be listed on the NYSE American Exchange under the symbol “DSS”.

Beneficial

Holders of Common Stock (i.e. Stockholders who hold in street name)

Upon

the implementation of the Reverse Split, we intend to treat shares held by stockholders through a bank, broker, custodian or other

nominee in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians or

other nominees will be instructed to effect the Reverse Split for their beneficial holders holding our Common Stock in street

name. However, these banks, brokers, custodians or other nominees may have different procedures than registered stockholders for

processing the Reverse Split. Stockholders who hold shares of our Common Stock with a bank, broker, custodian or other nominee

and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Registered

“Book-Entry” Holders of Common Stock (i.e. Stockholders that are registered on the transfer agent’s books and

records but do not hold stock certificates)

Certain

of our registered holders of Common Stock may hold some or all of their shares electronically in book-entry form with the transfer

agent. These Stockholders do not have stock certificates evidencing their ownership of the Common Stock. They are, however, provided

with a statement reflecting the number of shares registered in their accounts.

Stockholders

who hold shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic)

to receive whole shares of post-Reverse Split Common Stock, subject to adjustment for treatment of fractional shares.

Holders

of Certificated Shares of Common Stock

Until

surrendered, we will deem outstanding certificates representing shares of our Common Stock (the “Old Certificates”)

held by Stockholders to be cancelled and only to represent the number of whole shares of post-Reverse Split Common Stock to which

these Stockholders are entitled, subject to the treatment of fractional shares. Any Old Certificates submitted for exchange, whether

because of a sale, transfer or other disposition of stock, will automatically be exchanged for certificates representing the appropriate

number of whole shares of post-Reverse Stock Split Common Stock (the “New Certificates”). If an Old Certificate

has a restrictive legend on the back of the Old Certificate(s), the New Certificate will be issued with the same restrictive legends

that are on the back of the Old Certificate(s).

STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Fractional

Shares

We

do not currently intend to issue fractional shares in connection with the Reverse Split. Therefore, we will not issue certificates

representing fractional shares. In lieu of issuing fractions of shares, we will round up to the next whole number.

Effect

of the Reverse Stock Split on Employee Plans, Options, Restricted Stock Awards and Units, Warrants, and Convertible or Exchangeable

Securities

Based

upon the Reverse Split ratio determined by the Board, proportionate adjustments are generally required to be made to the per share

exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible

or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of Common Stock. This would

result in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable

securities upon exercise, and approximately the same value of shares of Common Stock being delivered upon such exercise, exchange

or conversion, immediately following the Reverse Split as was the case immediately preceding the Reverse Split. The number of

shares deliverable upon settlement or vesting of restricted stock awards will be similarly adjusted, subject to our treatment

of fractional shares. The number of shares reserved for issuance pursuant to these securities will be proportionately based upon

the Reverse Split ratio determined by the Board, subject to our treatment of fractional shares.

Accounting

Matters

The

proposed amendment to the Company’s articles of incorporation will not affect the par value of our Common Stock per share,

which will remain $0.02 par value per share. As a result, as of the Effective Time, the stated capital attributable to Common

Stock and the additional paid-in capital account on our balance sheet will not change due to the Reverse Split. Reported per share

net income or loss will be higher because there will be fewer shares of Common Stock outstanding.

Certain

Federal Income Tax Consequences of the Reverse Stock Split

The

following summary describes certain material U.S. federal income tax consequences of the Reverse Split to holders of our Common

Stock:

Unless

otherwise specifically indicated herein, this summary addresses the tax consequences only to a beneficial owner of our Common

Stock that is a citizen or individual resident of the United States, a corporation organized in or under the laws of the United

States or any state thereof or the District of Columbia or otherwise subject to U.S. federal income taxation on a net income basis

in respect of our Common Stock (a “U.S. holder”). A trust may also be a U.S. holder if (1) a U.S. court is able to

exercise primary supervision over administration of such trust and one or more U.S. persons have the authority to control all

substantial decisions of the trust or (2) it has a valid election in place to be treated as a U.S. person. An estate whose income

is subject to U.S. federal income taxation regardless of its source may also be a U.S. holder. This summary does not address all

of the tax consequences that may be relevant to any particular investor, including tax considerations that arise from rules of

general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by investors.

This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal

income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment

trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, traders in securities that

elect to mark to market and dealers in securities or currencies, (ii) persons that hold our Common Stock as part of a position

in a “straddle” or as part of a “hedging,” “conversion” or other integrated investment transaction

for federal income tax purposes, or (iii) persons that do not hold our Common Stock as “capital assets” (generally,

property held for investment).

If

a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our

Common Stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the

partner and the activities of the partnership. Partnerships that hold our Common Stock, and partners in such partnerships, should

consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Split.

This

summary is based on the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative

rulings and judicial authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal

income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material

effect on the U.S. federal income tax consequences of the Reverse Split.

PLEASE

CONSULT YOUR OWN TAX ADVISOR REGARDING THE U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE

STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

U.S.

Holders

The

Reverse Split should be treated as a recapitalization for U.S. federal income tax purposes. Therefore, a stockholder generally

will not recognize gain or loss on the Reverse Split, except to the extent of cash, if any, received in lieu of a fractional share

interest in the post-Reverse Split shares. The aggregate tax basis of the post-split shares received will be equal to the aggregate

tax basis of the pre-split shares exchanged therefore (excluding any portion of the holder’s basis allocated to fractional

shares), and the holding period of the post-split shares received will include the holding period of the pre-split shares exchanged.

A holder of the pre-split shares who receives cash will generally recognize gain or loss equal to the difference between the portion

of the tax basis of the pre-split shares allocated to the fractional share interest and the cash received. Such gain or loss will

be a capital gain or loss and will be short term if the pre-split shares were held for one year or less and long term if held

more than one year. No gain or loss will be recognized by us as a result of the Reverse Split.

Board

Recommendation

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF AN AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION TO AUTHORIZE A REVERSE STOCK SPLIT OF OUR ISSUED AND OUTSTANDING COMMON STOCK.

STOCKHOLDER

PROPOSALS

There

are no proposals by any security holder which are or could have been included within this proxy statement.

****

Important

Notice Regarding the Availability of this Proxy Statement

We

have opted to provide our materials pursuant to the full set delivery option in connection with the Special Meeting. Under the

full set delivery option, a company delivers all proxy materials to its shareholders. The approximate date on which the proxy

statement and proxy card are intended to be first sent or given to the Company’s shareholders is April 9, 2020. This delivery

can be by mail or, if a shareholder has previously agreed, by e-mail. In addition to delivering

proxy materials to shareholders, the Company must also post all proxy materials on a publicly

accessible website and provide information to shareholders about how to access that website. Accordingly, you should have received

our proxy materials by mail or, if you previously agreed, by e-mail. These proxy materials include the Notice of Special Meeting

of Stockholders, proxy statement, and proxy card. These materials are available free of charge at www.proxyvote.com.

MISCELLANEOUS

The

Company will pay the cost of soliciting proxies for the Special Meeting. In addition to solicitation by mail, directors, officers

and regular employees of the Company and other authorized persons may solicit the return of proxies by telephone, telegram or

personal interview. The Company will request brokerage houses, custodians, nominees and fiduciaries to forward soliciting material

to their principals and will agree to reimburse them for their reasonable out-of-pocket expenses.

The

Company has engaged The Proxy Advisory Group, LLC, to assist in the solicitation of proxies and provide related advice and informational

support, for a services fee and the reimbursement of customary disbursements, which are not expected to exceed $15,000 in total.

AVAILABLE

INFORMATION

We

are currently subject to the information requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith

file periodic reports, Proxy Statements and other information with the SEC relating to our business, financial statements and

other matters. Copies of such reports, Proxy Statements and other information may be copied (at prescribed rates) at the public

reference room maintained by the Securities and Exchange Commission at 100 F Street NE, Washington DC 20549. For further information

concerning the SEC’s public reference room, you may call the SEC at 1-800-SEC-0330. Some of this information may also be

accessed on the World Wide Web through the SEC’s Internet address at http://www.sec.gov.

Requests

for documents relating to the Company should be directed to:

DOCUMENT

SECURITY SYSTEMS, INC.

200

Canal View Boulevard, Suite 300

Rochester,

New York 14623

Attention:

Frank D. Heuszel

*

* *

|

|

BY

ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

|

/s/

Frank D. Heuszel

|

|

|

Frank

D. Heuszel

|

|

|

Chief

Executive Officer

|

|

|

|

|

Rochester,

New York

|

|

|

March

27, 2020

|

|

Appendix

A

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

PROXY

FOR THE SPECIAL MEETING OF STOCKHOLDERS OF DOCUMENT SECURITY SYSTEMS, INC.

TO

BE HELD ON MAY 4, 2020

Frank

D. Heuszel, with full power of substitution, hereby is authorized to vote as specified below or, with respect to any matter not

set forth below, as he shall determine, all of the shares of common stock of Document Security Systems, Inc. that the undersigned

would be entitled to vote, if personally present, at the special meeting of stockholders and any adjournment thereof.

Unless

otherwise specified, this proxy will be voted FOR Approval of the Reverse Split. The board of directors recommends a vote

FOR Approval of the Reverse Split.

|

|

1.

|

APPROVAL

OF THE REVERSE SPLIT IN THE AMOUNT OF 1-FOR-30

|

|

[ ]

FOR

|

[ ]

AGAINST

|

[ ]

ABSTAIN

|

|

|

2.

|

Please

sign exactly as your name appears below. When shares are held by joint tenants, each should sign. When signing as attorney,

executor, administrator, trustee, guardian, corporate officer, or partner, please give full title as such.

|

|

Date:

__________, 2020

|

|

|

|

Signature

|

|

|

|

|

|

|

|

|

Signature

if held jointly

|

PLEASE

MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

Sign

exactly as name(s) appear(s) on stock certificate(s). If stock is held jointly, each holder must sign. If signing is by attorney,

executor, administrator, trustee or guardian, give full title as such. A corporation or partnership must sign by an authorized

officer or general partner, respectively.

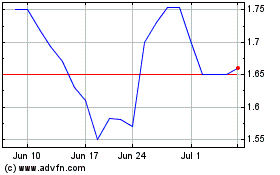

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024