Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

December 05 2019 - 4:19PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

Filed

by the Registrant ☐

Filed

by a Party other than the Registrant ☒

Check

the appropriate box:

|

|

☐

|

Preliminary

Proxy Statement

|

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy

Statement

|

|

|

☒

|

Definitive Additional

Materials

|

|

|

☐

|

Soliciting Material

Under Rule 14a-12

|

|

DOCUMENT

SECURITY SYSTEMS, INC.

|

|

(Name

of Registrant as Specified in Its Charter)

|

|

|

J.

MARVIN FEIGENBAUM

BARINDER ATHWAL

BRIAN MIRMAN

|

|

(Name

of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed

on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

☐

|

Fee

paid previously with preliminary materials:

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

|

(1)

|

Amount previously

paid:

|

|

|

(2)

|

Form, Schedule

or Registration Statement No.:

|

Persons

who are to respond to the collection of information contained in this form are not required to respond unless the form displays

a currently valid OMB control number.

Following review of the various stockholder

and beneficial owners lists, J. Marvin Feigenbaum, Barinder Athwal and Brian Mirman (collectively the “Concerned Shareholders”) have

reached the unfortunate conclusion that director slate put forward by the Concerned Shareholders is highly unlikely to prevail

in the contested director elections at the annual meeting of shareholders of Document Security Systems, Inc. (“DSS”)

scheduled for this coming Monday, December 9, 2019 (the “2019 Annual Meeting”).

The private placement on November 1,

2019 of six million (6,000,000) shares of the DSS’ common stock to Mr. Chan, the Company’s largest single shareholder

and Chairman, irremediably tipped the scales in favor of the Board’s slate for the vote at the 2019 Annual Meeting. As we

previously noted, in our opinion this private placement to Mr. Chan on the eve of the record date for the 2019 Annual Meeting served

no legitimate business purpose of DSS and had the unfortunate consequence of entrenching Mr. Chan as DSS’ largest shareholder

with approximately one-third (1/3) of DSS’ outstanding voting stock post-transaction. Under these circumstances, we did not

see any benefit to the DSS shareholders of our continuing efforts and investment of resources to promote our slate of directors.

Accordingly, the Concerned Shareholders

hereby notify that they are withdrawing their slate of Directors. The slate of directors we proposed are withdrawing their nominations.

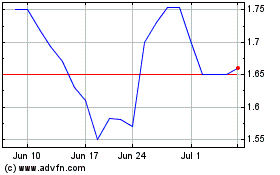

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024