UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: September 24, 2024

Commission File Number: 001-33414

Denison Mines Corp.

(Name of

registrant)

1100-40 University Avenue

Toronto Ontario

M5J 1T1 Canada

(Address of

principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form

40-F.

Form

20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(1): ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

DENISON MINES

CORP.

|

|

|

|

|

|

|

|

|

|

/s/ Amanda Willett

|

|

Date:

September 24, 2024

|

|

|

|

Amanda

Willett

|

|

|

|

|

|

Vice

President Legal and Corporate Secretary

|

FORM 6-K

EXHIBIT INDEX

Exhibit 99.1

|

|

Denison Mines

Corp.

1100 – 40

University Ave

Toronto, ON M5J

1T1

www.denisonmines.com

|

PRESS

RELEASE

Denison

Announces Option of Non-Core Exploration Projects to

Foremost

for up to $30

Million in Combined Consideration

Toronto, ON – September

24, 2024. Denison Mines Corp. (“Denison” or the “Company”) (TSX: DML; NYSE American: DNN) is pleased

to announce that is has executed an option agreement (the

“Option

Agreement”) with a Nasdaq

listed company to be renamed Foremost Clean Energy Ltd

(“Foremost”) (NASDAQ:FMST) (CSE:FAT), which grants Foremost an option to acquire up

to 70% of Denison’s interest in 10 uranium exploration

properties (collectively, the “Transaction”). Pursuant to the Transaction, Foremost

would acquire such total interests upon completion of a combination

of direct payments to Denison and funding of exploration

expenditures with an aggregate value of up to approximately $30

million.

David Cates, President & CEO of Denison,

commented, “Denison is

pleased to work with Foremost to enhance the potential for

discovery on an excellent portfolio of uranium exploration

properties that would otherwise receive little attention from

Denison with our current focus on development and mining stage

projects. We are impressed with Foremost’s leadership team

and technical capabilities and are excited to see high-potential

exploration work being carried out on these properties in the

coming years.

The Transaction is structured to incentivize exploration activity,

with Foremost required to invest a minimum of $8 million in

exploration expenditures to retain any interests in the properties

and $20 million in exploration expenditures to fully exercise the

option.”

Key Transaction Highlights:

●

Collaboration

with Foremost is expected to increase exploration activity on a

portfolio of non-core Denison properties with the potential to

increase the probability of discovery within Denison’s vast

Athabasca Basin exploration portfolio

●

Denison to

receive meaningful consideration in the form of an upfront payment

in Foremost common shares (representing ~19.95% ownership interest

in Foremost post transaction), cash or common share milestone

payments, and up to $20 million in project exploration

expenditures

●

Denison

retains direct interests in the optioned exploration properties and

will become Foremost’s largest shareholder, while also

securing certain strategic pre-emptive rights to participate in

future exploration success from the optioned

properties

Exploration Properties subject to the Option Agreement

The 10-project portfolio subject to the Option

Agreement (the “Exploration

Properties”) consists of

the following properties: Murphy Lake South, Hatchet Lake, Turkey

Lake, Torwalt Lake, Marten, Wolverine, Epp Lake, Blackwing, GR and

CLK. See Figure 1 for the location of the optioned

properties. Denison currently has 100% ownership in all of

the properties except for Hatchet Lake, which is subject to a joint

venture agreement with Eros Resources Corp., with Denison currently

holding a 70.15% ownership interest.

Collaboration between Denison and Foremost

Foremost

is expected to act as project operator during the term of the

Option Agreement; however, Denison expects to leverage its

significant team of technical experts based in its office in

Saskatoon, Saskatchewan to support Foremost as it transitions to

uranium exploration. Upon completion of Phase 1 of the Option

Agreement, Denison will be the largest shareholder of Foremost,

holding ~19.95% of the issued and outstanding shares of Foremost

and will retain a significant direct ownership interest in the

Exploration Properties. Additionally, David Cates, President and

CEO of Denison, is expected to join Foremost’s Board of

Directors.

Key Terms of the Transaction

Under the terms

of the Option Agreement, Foremost may acquire up to 70% of

Denison’s interest in the Exploration Properties. In the case

of Hatchet Lake, Foremost may earn up to a 51% interest in the

Hatchet Lake joint venture, representing slightly over 70% of

Denison’s current ownership interest.

The Option

Agreement contains three (3) phases, as summarized

below:

To earn an

initial 20% interest in the Exploration Properties (14.03% for

Hatchet Lake), on or before October 7, 2024 (the “Effective

Date”), Foremost must:

●

Issue

1,369,810 common shares to Denison;

●

Appoint a

Technical Advisor to Foremost at Denison’s election;

and

●

Enter into an

Investor Rights Agreement providing for, among other things: the

appointment by Denison of up to two (2) individuals to the board of

directors of Foremost; and a pre-emptive equity participation right

for Denison to maintain a 19.95% equity interest in

Foremost.

Phase 2

To earn an

additional 31% interest in the Exploration Properties (21.75% for

Hatchet Lake), on or before the date 36 months following the

Effective Date, Foremost must:

●

Pay Denison

$2,000,000 in cash or common shares or a combination thereof, at

the discretion of Foremost; and

●

Incur

$8,000,000 in exploration expenditures on the Exploration

Properties.

If

the conditions of Phase 2 are not satisfied, Foremost shall forfeit

the entirety of its interests in and rights to the Exploration

Properties.

To earn an

additional 19% interest in the Exploration Properties (15.22% for

Hatchet Lake), on or before the date 36 months following the

successful completion of Phase 2, Foremost must:

●

Pay Denison a

further $2,500,000 in cash or common shares or a combination

thereof, at the discretion of Foremost; and

●

Incur a

further $12,000,00 in exploration expenditures on the Exploration

Properties.

If

the conditions of Phase 3 are not satisfied, Foremost shall forfeit

a portion of its interests in and rights to the Exploration

Properties such that Denison’s interests in each of the

Exploration Properties will be increased to 51% and operatorship

shall revert to Denison.

Upon completion

of either Phase 2 or Phase 3 (as applicable) of the Option

Agreement, the parties will enter into a joint venture agreement in

respect of each of the Exploration Properties.

About Denison

Denison is a uranium mining, exploration and development company

with interests focused in the Athabasca Basin region of northern

Saskatchewan, Canada. The Company has an effective 95% interest in

its flagship Wheeler River Uranium Project, which is the largest

undeveloped uranium project in the infrastructure rich eastern

portion of the Athabasca Basin region of northern Saskatchewan. In

mid-2023, a feasibility study was completed for the Phoenix

deposit as an in-situ recovery (“ISR”) mining

operation, and an update to the previously prepared 2018

Pre-Feasibility Study was completed for Wheeler River's Gryphon

deposit as a conventional underground mining operation. Based on

the respective studies, both deposits have the potential to be

competitive with the lowest cost uranium mining operations in the

world. Permitting efforts for the planned Phoenix ISR operation

commenced in 2019 and have advanced significantly, with licensing

in progress and a draft Environmental Impact Study (“EIS")

submitted for regulatory and public review in October

2022.

Denison's interests in Saskatchewan also include a 22.5% ownership

interest in the McClean Lake Joint Venture (“MLJV”),

which includes unmined uranium deposits (planned for extraction via

the MLJV's SABRE mining method starting in 2025) and the McClean

Lake uranium mill (currently utilizing a portion of its licensed

capacity to process the ore from the Cigar Lake mine under a toll

milling agreement), plus a 25.17% interest in the MWJV’s

Midwest Main and Midwest A deposits, and a 69.44% interest in the

Tthe Heldeth Túé (”THT”) and Huskie deposits

on the Waterbury Lake Property. The Midwest Main, Midwest A, THT

and Huskie deposits are located within 20 kilometres of the McClean

Lake mill. Taken together, Denison has direct ownership interests

in properties covering ~384,000 hectares in the Athabasca Basin

region.

Additionally, through its 50% ownership of JCU (Canada) Exploration

Company, Limited (“JCU”), Denison holds additional

interests in various uranium project joint ventures in Canada,

including the Millennium project (JCU, 30.099%), the Kiggavik

project (JCU, 33.8118%), and Christie Lake (JCU,

34.4508%).

In 2024, Denison is celebrating its 70th year in uranium mining,

exploration, and development, which began in 1954 with

Denison’s first acquisition of mining claims in the Elliot

Lake region of northern Ontario.

For more information, please contact

|

David Cates

|

(416) 979-1991 ext.

362

|

|

President and Chief Executive

Officer

|

|

|

|

|

|

Geoff Smith

|

(416) 979-1991 ext.

358

|

|

Vice President Corporate

Development & Commercial

|

|

|

|

|

|

Follow Denison on X (formerly

Twitter)

|

@DenisonMinesCo

|

About Foremost

Foremost is currently named

Foremost Lithium Resource & Technology Ltd. (NASDAQ: FMST)

(CSE: FAT) (FSE: F0R0) (WKN: A3DCC8) and intends to change its name

to Foremost Clean Energy Ltd. in connection with the

Transaction. Assuming the effectiveness of

the Transaction, Foremost will be an emerging North American

uranium exploration company with interests in 10 prospective

properties spanning over 330,000 acres in the prolific,

uranium-rich Athabasca Basin. As global demand for decarbonization

accelerates, the need for nuclear power is crucial. Foremost

expects to be positioned to capitalize on the growing demand for

uranium through discovery in a top jurisdiction with the objective

to support the world’s energy transition goals. Alongside its

exploration partner Denison, Foremost will be committed to a

strategic and disciplined exploration strategy to identify

resources by testing drill–ready targets with identified

mineralization along strike of recent major

discoveries.

Foremost also maintains a secondary

portfolio of significant lithium projects at different stages of

development spanning over 50,000 acres across Manitoba and Quebec.

For further information please visit the company’s website

at www.foremostcleanenergy.com.

Cautionary Statement Regarding Forward-Looking

Statements

Certain information contained in this news release constitutes

‘forward-looking information’, within the meaning of

the applicable United States and Canadian legislation, concerning

the business, operations and financial performance and condition of

Denison. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as

‘potential’, ‘plans’,

‘expects’, ‘budget’,

‘scheduled’, ‘estimates’,

‘forecasts’, ‘intends’,

‘anticipates’, or ‘believes’, or the

negatives and/or variations of such words and phrases, or state

that certain actions, events or results ‘may’,

‘could’, ‘would’, ‘might’ or

‘will’ ‘be taken’, ‘occur’ or

‘be achieved’.

In particular, this news release contains forward-looking

information pertaining to Denison's current intentions and

objectives with respect to, and commitments set forth in, the

Option Agreement and ancillary agreements and the expected benefits

thereof; the assumption that the transactions set forth in the

Option Agreement will be completed as described; the

Company’s exploration, development and expansion plans and

objectives for the Exploration Properties and other Company

projects; and expectations regarding its joint venture ownership

interests and the continuity of its agreements with its partners

and third parties.

Forward looking statements are based on the opinions and estimates

of management as of the date such statements are made, and they are

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, performance

or achievements of Denison to be materially different from those

expressed or implied by such forward-looking statements. For

example, the parties to the Option Agreement may not complete the

option phases as described and/or the exploration objective for the

Exploration Properties may not be achieved. In addition, Denison

may decide or otherwise be required to discontinue testing,

evaluation and other work on the Company’s other properties

if it is unable to maintain or otherwise secure the necessary

resources (such as testing facilities, capital funding, joint

venture approvals, regulatory approvals, etc.). Denison believes

that the expectations reflected in this forward-looking information

are reasonable but no assurance can be given that these

expectations will prove to be accurate and results may differ

materially from those anticipated in this forward-looking

information. For a discussion in respect of risks and other factors

that could influence forward-looking events, please refer to the

factors discussed in Denison’s Annual Information Form dated

March 28, 2024 under the heading ‘Risk Factors’ or in

subsequent quarterly financial reports. These factors are not, and

should not be construed as being, exhaustive.

Accordingly, readers should not place undue reliance on

forward-looking statements. The forward-looking information

contained in this news release is expressly qualified by this

cautionary statement. Any forward-looking information and the

assumptions made with respect thereto speaks only as of the date of

this news release. Denison does not undertake any obligation to

publicly update or revise any forward-looking information after the

date of this news release to conform such information to actual

results or to changes in Denison's expectations except as otherwise

required by applicable legislation.

Figure 1: Detailed Map of Properties Subject to the Option

Agreement

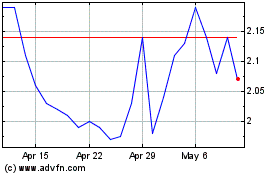

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Aug 2024 to Sep 2024

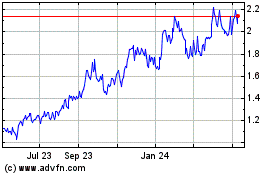

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Sep 2023 to Sep 2024