Credit Suisse High Yield Bond Fund Announces Results of Rights Offering

October 18 2010 - 8:15AM

Marketwired

Credit Suisse High Yield Bond Fund (NYSE Amex: DHY) (the "Fund")

announced today the results of its transferable rights offering

(the "Offer"). An aggregate of 18,725,102 common shares of the Fund

will be issued pursuant to subscriptions by rights holders through

the Offer. The Offer, which commenced on September 13, 2010 and

expired on October 15, 2010, was over-subscribed. The subscription

price was $2.72 per share and was determined based upon a formula

equal to 92.5% of the average of the last reported sales price of

the Fund's common shares on the NYSE Amex on the expiration date

and each of the four preceding trading days. Shares subscribed for

will be issued promptly after receipt of all shareholder payments

and the pro-rata allocation of shares in connection with the

Offer's over-subscription privilege.

Gross proceeds of the Offer are expected to be approximately $51

million. The Fund intends to invest the additional capital raised

from the Offer to take advantage of available existing and future

attractive investment opportunities and seek to enhance the Fund's

future risk-adjusted returns consistent with its investment

objectives.

The Fund is a non-diversified, closed-end management investment

company with a leveraged capital structure. The Fund's primary

investment objective is to seek high current income. The Fund also

seeks capital appreciation as a secondary objective to the extent

consistent with its objective of seeking high current income. Under

normal market conditions, the Fund invests at least 80% of its

total assets in fixed income securities of U.S. issuers rated below

investment grade quality (lower than Baa by Moody's Investors

Services, Inc. or lower than BBB by Standard & Poor's, a

subsidiary of The McGraw-Hill Companies, Inc.), or in unrated

income securities that Credit Suisse Asset Management, LLC, the

Fund's investment adviser, determines to be of comparable quality.

There can be no assurance that the Fund will achieve its investment

objectives.

Before investing in the Fund, investors should carefully

consider the investment objectives, risks and expenses of the Fund.

This information, including other information concerning the Fund

can be found on file with the U.S. Securities and Exchange

Commission. An investor should carefully read the prospectus before

investing.

This announcement is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state

where the offer or sale is not permitted.

Credit Suisse Asset Management, LLC, the Fund's investment

adviser, is part of the Asset Management business of Credit Suisse

Group AG, a leading global financial services organization

headquartered in Zurich.

Contact: The Altman Group, Inc. Warren Antler (212)

400-2605 Email Contact Credit Suisse High Yield Bond Fund

Eleven Madison Avenue New York, New York 10010

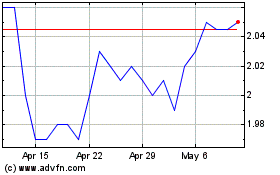

Credit Suisse High Yield (AMEX:DHY)

Historical Stock Chart

From Sep 2024 to Oct 2024

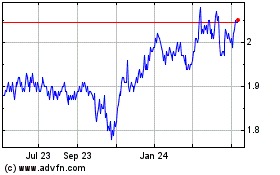

Credit Suisse High Yield (AMEX:DHY)

Historical Stock Chart

From Oct 2023 to Oct 2024