Credit Suisse High Yield Bond Fund Approves and Announces Terms of Rights Offering

August 26 2010 - 2:21PM

Marketwired

The Board of Trustees of Credit Suisse High Yield Bond Fund (NYSE

Amex: DHY) (the "Fund"), a closed-end investment company managed by

Credit Suisse Asset Management, LLC ("Credit Suisse"), has approved

a transferable rights offering (the "Offer") for the Fund. The

Offer is intended to increase the assets of the Fund available for

investment, enabling the Fund to take advantage of attractive

investment opportunities consistent with its investment objectives

and strategies. The Offer will be made only by means of a

prospectus.

Under the terms of the Offer, the Fund will issue to record date

shareholders one transferable right for each common share of

beneficial interest held on the record date (September 13, 2010).

Each record date shareholder and each other holder of rights is

entitled to subscribe for one new common share for every three

rights held (1-for-3).

The subscription price will be determined on the expiration date

(October 15, 2010, unless extended) based on a formula equal to

92.5% of the average closing price of the Fund's common shares on

the New York Stock Exchange AMEX on the expiration date and the

four preceding trading days.

Pursuant to an over-subscription privilege, record date

shareholders who exercise all rights issued to them will be

entitled to subscribe for additional Fund shares that were not

subscribed for by other rightholders. In addition, in the event

that the subscription price is equal to or above the Fund's per

share net asset value on the expiration date, the Fund may issue

additional shares (up to an amount equal to 25% of the shares to be

issued assuming all rights are exercised) to satisfy

over-subscription requests.

A definitive announcement on the commencement of the Offer and

the record date will be made through a prospectus. The final terms

of the Offer may be different from those discussed above. The

information agent for the Offer is The Altman Group, Inc.

(212-400-2605).

The Fund is a non-diversified, closed-end management investment

company with a leveraged capital structure. The Fund's primary

investment objective is to seek high current income. The Fund will

also seek capital appreciation as a secondary objective to the

extent consistent with its objective of seeking high current

income. Under normal market conditions, the Fund invests at least

80% of its total assets in fixed income securities of U.S. issuers

rated below investment grade quality (lower than Baa by Moody's

Investors Services, Inc. or lower than BBB by Standard &

Poor's, a subsidiary of The McGraw-Hill Companies, Inc.), or in

unrated income securities that Credit Suisse, the Fund's investment

adviser, determines to be of comparable quality. There can be no

assurance that the Fund will achieve its investment objectives.

Shares of closed-end investment companies frequently trade at a

discount from their net asset values. The market price of the

Fund's shares is determined by a number of factors, several of

which are beyond the control of the Fund. Therefore, the Fund

cannot predict whether its shares will trade at, below, or above

their net asset value.

Before investing in the Fund, investors should carefully

consider the investment objectives, risks and expenses of the Fund.

This information, including other information concerning the Fund

can be found on file with the U.S. Securities and Exchange

Commission. An investor should carefully read the registration

statement before investing.

A registration statement relating to these securities has been

filed with the U.S. Securities and Exchange Commission but has not

yet become effective. The information in the registration statement

is not complete and may be changed. These securities may not be

sold nor may offers be accepted prior to the time the registration

statement becomes effective. This announcement is not an offer to

sell these securities and it is not soliciting an offer to buy

these securities in any state where the offer or sale is not

permitted.

* * * * * * * * *

Credit Suisse Asset Management, LLC, the Fund's investment

adviser, is part of the Asset Management business of Credit Suisse

Group AG, a leading global financial services organization

headquartered in Zurich.

Contact: The Altman Group, Inc. Warren Antler (212)

400-2605 Email Contact Credit Suisse High Yield Bond Fund

Eleven Madison Avenue New York, New York 10010

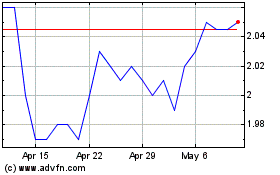

Credit Suisse High Yield (AMEX:DHY)

Historical Stock Chart

From Sep 2024 to Oct 2024

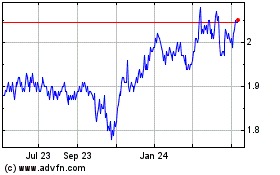

Credit Suisse High Yield (AMEX:DHY)

Historical Stock Chart

From Oct 2023 to Oct 2024