Current Report Filing (8-k)

June 28 2019 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 28, 2019

COMSTOCK MINING INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Nevada

(State or Other

Jurisdiction of Incorporation)

|

001-35200

(Commission File Number)

|

65-0955118

(I.R.S. Employer

Identification Number)

|

1200 American Flat Road, Virginia City, Nevada 89440

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code:

(775) 847-5272

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

On June 28, 2019, Comstock Mining Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Temple Tower Group LLC (the “Purchaser”) providing for the issuance and sale to the Purchaser of shares of the Company’s Series C Convertible Preferred Stock (the “Preferred Shares”) for gross proceeds to the Company of $1,083,000.

The articles of incorporation of the Company were supplemented to include the terms of the Preferred Shares pursuant to a Certificate of Designation of Preferences, Rights and Limitations (the “Certificate of Designation”), filed with the Secretary of State of the State of Nevada. The Certificate of Designation defines all rights of the holders of Preferred Shares. The Preferred Shares were issued pursuant to the Company’s registration statement on Form S-3, as supplemented by a prospectus supplement. The Preferred Shares are convertible into shares of the Company’s common stock. The number of shares of common stock issuable is determined by dividing the stated value of the Preferred Shares by the conversion price. The stated value of the Preferred Shares is $1,000 per share and $1,274,000 in the aggregate, including 191 Preferred Shares issued to the Purchaser as a due diligence fee. The conversion price is equal to 90% of the lowest reported volume-weighted average price for the Company’s common stock as reported at the close of trading on the NYSE AMERICAN LLC during the seven trading days ending on, and including, the date of the notice of conversion, subject to a minimum conversion price of $0.075 per share and a maximum conversion price of $0.75 per share.

The Preferred Shares have no voting rights other than votes affecting the Preferred Shares. the Holders of the Preferred Shares are entitled to receive a liquidating distribution of $1,000 per share, before the Company makes any distribution of assets to the holders of common stock or any other class or series of shares of junior stock.

Subject to restrictions in the Company’s debt documents, the Company may redeem the Preferred Shares at its option, in whole or in part, from time to time, at a redemption price equal to 115% of the stated value per share (subject to satisfaction of the “Equity Conditions” as defined in the Certificate of Designation).

The opinion of the Company’s counsel regarding the validity of the shares is also filed herewith as Exhibit 5.1. This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy the shares, nor shall there be an offer, solicitation or sale of the

shares in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

The foregoing description of the Purchase Agreement and Certificate of Designation does not purport to be complete and is qualified in its entirety by reference to the full text of each document. Copies of the Purchase Agreement and the Certificate of Designation are attached as exhibits to this Current Report on Form 8-K and are incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

The disclosure set forth in Items 1.01 of this Current Report on Form 8-K regarding the Certificate of Designation is incorporated by reference into this Item 5.03 in its entirety.

Item 9.01 Financial Statements and Exhibits.

d)

Exhibits

.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

COMSTOCK MINING INC.

|

|

Date: June 28, 2019

|

By:

|

/s/ Corrado De Gasperis

|

|

|

|

Name: Corrado De Gasperis

Title: Executive Chairman, President and Chief Executive Officer

|

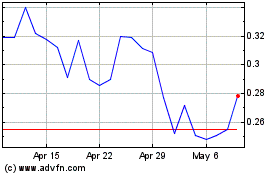

Comstock (AMEX:LODE)

Historical Stock Chart

From Mar 2024 to Apr 2024

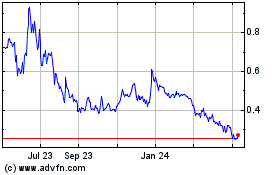

Comstock (AMEX:LODE)

Historical Stock Chart

From Apr 2023 to Apr 2024