Filed pursuant to Rule 424(b)(5)

Registration No. 333-229890

_____________________________________________________________________________________________

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 26, 2019)

_____________________________________________________________________________________________

4,000,000 Shares of

Common Stock

___________________________________

We are offering 4,000,000 shares of our common stock.

Our common stock is listed on the NYSE American under the symbol “LODE.” The last reported sale price of our common stock on the NYSE American on February 26, 2021 was $5.41 per share.

The Company has recently experienced extreme price volatility. From January 28, 2021 to February 28, 2021, sales the common stock have been effected at prices as low as $1.14 and as high as $9.85. The high of $9.85 occurred on February 17, 2021 when 204,234,300 shares were traded. Typical trading volume is approximately 500,000 shares per day. The Company has not experienced any material changes in its financial condition or results of operations that explain such price volatility or trading volume. Reports of increases in silver prices, as well as coordinated trading activities by investors (e.g., GameStop) may affect the trading prices of securities such as the Company’s common stock.

Investing in our common stock involves significant risk. Please read carefully the section entitled “Risk Factors” beginning on page S-6 of this prospectus supplement.

Neither the Securities and Exchange Commission (the “Commission”) nor any state securities commission has approved or disapproved of the common stock or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

We have retained Noble Capital Markets, Inc. (the “Placement Agent” or “Noble”) to act as our placement agent, and is the sole Placement Agent in this offering. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering. We have agreed to pay the Placement Agent fees set forth in the table below, which assumes that we sell all of the securities we are offering.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Total

|

|

Offering Price

|

|

$4.00

|

|

$16,000,000

|

|

Placement Agent Fees(1)

|

|

$0.24

|

|

$960,000

|

|

Proceeds to Us, Before Expenses

|

|

$3.76

|

|

$15,040,000

|

(1)We will pay the Placement Agent a cash fee equal to 6% of the aggregate gross proceeds. We have also agreed to reimburse the Placement Agent for certain of its expenses not to exceed $30,000.

Delivery of the shares of common stock is expected to be made on or about March 4, 2021.

Noble Capital Markets, Inc.

Sole Placement Agent

The date of this prospectus supplement is March 2, 2021.

TABLE OF CONTENTS

Prospectus Supplement

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

About This Prospectus Supplement

|

|

S-1

|

|

Where You Can Find More Information

|

|

S-2

|

|

Incorporation of Certain Documents by Reference

|

|

S-2

|

|

Cautionary Notice Regarding Forward-Looking Statements

|

|

S-3

|

|

Prospectus Supplement Summary

|

|

S-3

|

|

The Offering

|

|

S-6

|

|

Risk Factors

|

|

S-7

|

|

Use of Proceeds

|

|

S-10

|

|

Dilution

|

|

S-10

|

|

Capitalization

|

|

S-10

|

|

Plan of Distribution

|

|

S-11

|

|

Legal Matters

|

|

S-13

|

|

Experts

|

|

S-13

|

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of a registration statement that we have filed with the U.S. Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. By using a shelf registration statement, we may offer shares of our common stock under this prospectus supplement.

We provide information to you about this offering of shares of our common stock in two separate documents: (1) this prospectus supplement, which describes the specific details regarding this offering; and (2) the base prospectus, which provides general information, some of which may not apply to this offering. If information in this prospectus supplement is inconsistent with the base prospectus, you should rely on this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date, for example, a document incorporated by reference in this prospectus supplement, the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates.

You should rely only on the information contained in, or incorporated by reference into, this prospectus supplement and in any free writing prospectus that we may authorize for use in connection with this offering. We have not, and Noble Capital Markets, Inc. has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the Investor is not, making an offer to sell or soliciting an offer to buy our securities in any jurisdiction where an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this prospectus supplement, the documents incorporated by reference into this prospectus supplement, and in any free writing prospectus that we may authorize for use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement, the documents incorporated by reference into this prospectus supplement, and any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus supplement entitled “Where You Can Find More Information” and “Incorporation by Reference.”

We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We may also authorize one or more “free writing prospectuses” (i.e., written communications concerning the offering that are not part of this prospectus supplement) that may contain certain material information relating to this offering. Before you invest in the common stock offered under this prospectus supplement, you should carefully read both this prospectus supplement and the base prospectus together with additional information under the heading “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

References in this prospectus supplement to the terms “we,” “us,” “our” “Comstock” or “the Company” or other similar terms mean Comstock Mining Inc. and its consolidated subsidiaries, unless we state otherwise or the context indicates otherwise.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational reporting requirements of the Securities Exchange Act of 1934. We file reports, proxy statements and other information with the Commission. Our Commission filings are available over the Internet at the Commission’s website at http://www.sec.gov. You may read and copy any reports, statements and other information filed by us at the Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call 1-800-SEC-0330 for further information on the Public Reference Room.

We make available, free of charge, on our website at http://www.comstockmining.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports and statements as soon as reasonably practicable after they are filed with the Commission. The contents of our website are not part of this prospectus supplement, and the reference to our website does not constitute incorporation by reference into this prospectus supplement of the information contained at that site, other than documents we file with the Commission that are incorporated by reference into this prospectus supplement.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The Commission allows us to “incorporate by reference” into this prospectus supplement the information in documents we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus supplement, and information that we file later with the Commission will automatically update and supersede this information. Any statement contained in any document incorporated or deemed to be incorporated by reference in this prospectus supplement shall be deemed to be modified or superseded to the extent that a statement contained in or omitted from this prospectus supplement, or in any other subsequently filed document that also is or is deemed to be incorporated by reference, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

We incorporate by reference the documents listed below and any future documents that we file with the Commission under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement:

(b) Our quarterly reports on Form 10-Q for the fiscal quarter ended March 31, 2020, filed with the Commission on May 7, 2020 (the “First Quarter Form 10-Q”), fiscal quarter ended June 30, 2020, filed with the Commission on August 14, 2020 (the “Second Quarter Form 10-Q”), and fiscal quarter ended September 30, 2020, filed with the Commission on May November 16, 2020 (the “Third Quarter Form 10-Q”);

(c) Our current reports on Form 8-K, filed with the Commission on February 18, 2021, February 9, 2021, February 4, 2021, January 7, 2021, January 5, 2021, January 4, 2021, November 23, 2020, October 6, 2020, October 1, 2020, September 28, 2020, September 21, 2020, September 15, 2020, September 14, 2020, September 8, 2020, August 12, 2020, June 1, 2020, March 26, 2020, March 25, 2020 and March 20, 2020; and

We will not, however, incorporate by reference in this prospectus supplement any documents or portions thereof that are not deemed “filed” with the Commission, including any information furnished pursuant to Item 2.02 or Item 7.01 of our current reports on Form 8-K unless, and except to the extent, specified in such current reports.

We will provide you with a copy of any of these filings (other than an exhibit to these filings, unless the exhibit is specifically incorporated by reference into the filing requested) at no cost if you submit a request to us by writing or telephoning us at the following address and telephone number:

Comstock Mining Inc.

117 American Flat Road

Virginia City, Nevada 89440

Attention: Investor Relations

Telephone: (775) 847-0545

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

The information appearing under “Cautionary Notice Regarding Forward-Looking Statements” in the First Quarter Form 10-Q, Second Quarter Form 10-Q and Third Quarter Form 10-Q is hereby incorporated by reference.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained or incorporated by reference in this prospectus supplement. This summary may not contain all of the information that you should consider before investing in our common stock. We urge you to read this entire prospectus supplement, the base prospectus and the documents incorporated by reference carefully, including the section entitled “Risk Factors” and the financial statements and other information included or incorporated by reference in this prospectus supplement.

Overview

The Company is a Nevada-based, precious and strategic metal-based exploration, economic resource development, mineral production and metal processing business with a strategic focus on high-value, cash-generating, environmentally friendly, and economically enhancing mining and processing technologies and businesses. The Company has extensive, contiguous property in the historic Comstock and Silver City mining districts (collectively, the “Comstock District”) and is an emerging leader in sustainable, responsible mining and processing, and is currently commercializing environment-enhancing, metal-based technologies, products, and processes for precious and strategic metals recovery, including through investments in lithium-battery recycling and mercury remediation and gold recoveries as part of its efforts to focus on strategic, critical and precious-metal based growth opportunities.

The Company’s goal is to grow per-share value by commercializing environment-enhancing, precious and strategic-metal-based products and processes that generate a rate of predictable cash flow (throughput) and increase the long-term enterprise value of our northern Nevada based platform. The next three years are dedicated to delivering that value by achieving the performance objectives listed below:

Establish and grow the value of our mineral properties:

• Establish the Dayton Resource area’s maiden, stand-alone mineral resource estimate;

• Expand the Dayton-Spring Valley Complex through exploration drilling and geophysical modelling;

• Develop the expanded Dayton-SV Complex toward full economic feasibility, supporting a decision to mine;

• Entitle the Dayton-SV Complex with geotechnical, metallurgical, environmental studies and permitting; and

• Validate the Comstock NSR Royalty portfolio (Lucerne Mine, Occidental Lode, Comstock Lode, etc.).

Commercialize a global, ESG-compliant, profitable, mercury remediation system:

• Establish the technical efficacy of MCU’s Comstock Mercury System, and protect the intellectual property;

• Deploy and operate the first international mercury remediation project by deploying Mercury Clean Up LLC’s (“MCU”) second and third mercury remediation systems, into the Philippines;

• Identify, evaluate and prioritize a pipeline of potential mercury remediation projects; then deploy the third and fourth mercury remediation projects, producing extended, superior cash flow returns; and

• Assess and Capitalize on Value Enhancing Expansion Opportunities.

Monetize non-strategic assets and build a quality organization:

•Monetize our third-party, junior mining securities responsibly, for $12.5 million or more;

•Monetize our non-mining assets for $12.5 million, excluding the Gold Hill Hotel;

•Grow the value of our Opportunity Zone investments to over $30 million; and

•Deploy a systemic organization, capable of accelerating growth and handling complexity.

The strategic plan is designed to deliver per-share value over the next three years, while positioning the Company for continued growth beyond 2023.

The Company began acquiring properties in the Comstock District in 2003. Since then, the Company has consolidated a significant portion of the Comstock District, amassed the single largest known repository of historical and current geological data on the Comstock region, secured permits, built an infrastructure and completed two phases of test production. The Company continues evaluating and acquiring properties inside and outside the district, expanding its footprint and evaluating all our existing and prospective opportunities for further exploration, development and mining.

The Company and its subsidiaries now own or control approximately 9,056 acres of mining claims, parcels, and royalty interests in the broader Comstock District and surrounding area. The acreage includes approximately 2,365 acres of patented claims and surface parcels (private lands), and approximately 6,691 acres of unpatented mining claims (public lands), which the Bureau of Land Management (“BLM”) administers. The Company's headquarters is on American Flat Road, immediately north of the Lucerne resource area and just south of Virginia City, Nevada.

Because of the Comstock District’s historical significance, the geology is well known and has been extensively studied by the Company, our advisors and many independent researchers. We have expanded our understanding of the geology through vigorous surface mapping and drill hole logging. The volume of geologic data is immense, particularly in the Lucerne and Dayton resource areas. We have amassed a large library of historical data and detailed surface mapping of Comstock District properties and continue to obtain historical information from public and private sources. We integrate this data with information obtained from our recent mining operations, to target geological prospective exploration areas and plan exploratory drilling programs, including expanded surface and underground drilling.

Our Dayton resource area and the adjacent Spring Valley exploration targets are located in Lyon County, Nevada, approximately six miles south of Virginia City. Access to the properties is by State Routes 341 and 342, both paved roads.

Our sale of the membership interests in Comstock Mining LLC, the owner of the Lucerne mine and resource area, to Tonogold Resources Inc. closed on September 8, 2020. The Lucerne resource area is located in Storey County, Nevada, approximately three miles south of Virginia City and 30 miles southeast of Reno. The Lucerne resource area was host to the Company’s most-recent test mining operations from 2012 through 2015. Lucerne is the subject of ongoing assessment, exploration and development plans by Tonogold. The Company retained a 1.5% NSR royalty in the Lucerne properties.

The Company achieved initial production and first poured gold and silver on September 29, 2012. The Company ceased mining in 2015 and concluded processing in 2016. From 2012 through 2016, the Company mined and processed approximately 2.6 million tons of mineralized material, and produced 59,515 ounces of gold and 735,252 ounces of silver.

Since 2019, the Company's Board of Directors approved, and the Company's management has been pursuing, a transformational strategy focused on high-value, cash-generating precious and strategic metal-based activities (the "Strategic Focus"). The Company advanced the Strategic Focus by facilitating the formation of dedicated subsidiaries that optimize the alignment with the goal and the performance objectives. The realignment was completed in 2019, and the Company has begun investing in activities aligned with the performance objectives, including MCU, Pelen, and Comstock Royalty Holdings.

The Company completed the realignment during 2019, such that the new corporate structure is now well aligned with the Strategic Focus. Comstock Mining Inc. remains as the parent company that wholly owns the realigned subsidiaries. Comstock Processing LLC owns the American Flat processing facility and additional land for potential expansion. Comstock Northern Exploration LLC owns or controls the remaining Storey County exploration targets, primarily located north of the Lucerne properties, including the Occidental Lode. Comstock Exploration and Development LLC owns or controls the Lyon County mining claims and exploration targets, including the Dayton Resource Area and the Spring Valley target. Comstock Industrial LLC owns the Silver Springs properties and water rights. Comstock Real Estate Inc. owns the Daney Ranch and the Gold Hill Hotel. Comstock Mining LLC controls the Lucerne properties, including those owned by Northern Comstock LLC, and is now owned 100% by Tonogold Resources Inc. The Company recorded a gain of $18.3 million associated with that sale.

Corporate Information

Our executive offices are located at 117 American Flat Road, Virginia City, Nevada 89440 and our telephone number is (775) 847-5272. Our mailing address is 117 American Flat Road, Virginia City, Nevada 89440. Our website address is www.comstockmining.com. Our website and the information contained on, or that can be accessed through, the website are not part of this prospectus supplement.

THE OFFERING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock to be offered by us……………………..

|

|

4,000,000 shares of common stock, $0.000666 par value, per share.

|

|

|

|

|

|

Price per Share.……………………………………........

|

|

$4.00

|

|

|

|

|

|

Use of Proceeds…………………………………………

|

|

We will use the net proceeds from this offering for strategic investments, including the funding for our investment in LINICO Corporation (“LINICO”), mercury remediation investments, mineral acquisitions and developments, working capital and other general corporate purposes. See “Use of Proceeds.”

|

|

|

|

|

|

Risk Factors…………………………………………….

|

|

You should carefully read and consider the information set forth in “Risk Factors” beginning on the next page of this prospectus supplement before investing in our common stock.

|

|

|

|

|

|

NYSE American LLC symbol………………………….

|

|

LODE

|

|

|

|

|

RISK FACTORS

Investing in our common stock involves significant risk. Prior to making a decision about investing in our common stock, you should carefully consider the specific risk factors included below, as well as the risk factors discussed under the heading “Risk Factors” in the 2019 Form 10-K and the risk factors discussed under the heading “Risk Factors” in the First Quarter Form 10-Q, Second Quarter Form 10-Q and Third Quarter Form 10-Q, both of which are incorporated by reference in this prospectus supplement and may be amended, supplemented or superseded from time to time by other reports we file with the Commission in the future. The risks and uncertainties we have described are not the only ones we may face. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also affect our operations. If any of these risks actually occurs, our business, results of operations and financial condition could suffer. In that case, the trading price of our common stock decline, and you could lose all or a part of your investment.

Risks Relating to the Company’s Common Stock and this Offering

The Company may issue additional common stock or other equity securities in the future that could dilute the ownership interest of existing shareholders.

The Company is currently authorized to issue 158,000,000 shares of common stock, of which 34,440,766 were issued and outstanding as of September 30, 2020, respectively, and 50,000,000 shares of preferred stock, of which no Preferred Shares are issued or outstanding as of September 30, 2020. To maintain its capital at desired levels or to fund future growth, the Board may decide from time to time to issue additional shares of common stock, or securities convertible into, exchangeable for or representing rights to acquire shares of common stock. The sale of these securities may significantly dilute stockholders’ ownership interest and the market price of the common stock. New investors in other equity securities issued by the Company in the future may also have rights, preferences and privileges senior to the Company’s current stockholders that may adversely impact its current stockholders.

You may experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

If the price per share of our common stock is offered at price that is substantially higher than the net tangible book value per share of our common stock, you will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. The net tangible book value of our common stock on September 30, 2020, was approximately $1.02 per share. Purchasing our common stock at a purchase price in excess of the net tangible book value per share, will result in you suffering an immediate and substantial dilution. See the section entitled “Dilution” in this prospectus for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering.

If we are unable to maintain the listing standards of the NYSE American LLC, our common stock may be delisted, which may have a material adverse effect on the liquidity and value of our common stock.

Our common stock is traded on the NYSE American LLC. To maintain our listing on the NYSE American LLC, we must meet certain financial and liquidity criteria. The market price of our common stock has been and may continue to be subject to significant fluctuation as a result of periodic variations in our revenues and results of operations. If we fail to meet any of the NYSE American LLC’s listing standards, we may be delisted. In the event of delisting, trading of our common stock would most likely be conducted in the over the counter market on an electronic bulletin board established for unlisted securities, which could have a material adverse effect on the market liquidity and value of our common stock.

Estimates of our mineral resources could be inaccurate, which could cause actual production and costs to differ from estimates and adversely impact the value of the common stock.

There are numerous uncertainties inherent in estimating measured, indicated and inferred mineral resources, including many factors beyond our control. The accuracy of estimates of mineral reserves and non-reserves is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation, which could prove to be unreliable. These estimates of mineral resources may not be accurate, and mineral resources may not be able to be mined or processed profitably. Moreover, depletion of mineral resources that are not replaced may adversely impact the Company's financial condition and prospects.

Fluctuation in gold prices, results of drilling, metallurgical testing, changes in operating costs, production, and the evaluation of mine plans subsequent to the date of any estimate could require revision of the estimates. The volume and grade of mineral resources mined and processed and recovery rates might not be the same as currently anticipated. Any material reductions in estimates of our mineral resources, or of our ability to extract these mineral resources, could have a material adverse effect on our results of operations and financial condition and the value of our common stock.

We will have broad discretion in how we use the proceeds, and we may use the proceeds in ways in which you and other stockholders may disagree.

We intend to use the net proceeds from this offering for drilling and development programs, working capital and other general corporate purposes. See the section entitled “Use of Proceeds.” Our management will have broad discretion in the application of the proceeds from this offering and could spend the proceeds in ways that do not necessarily improve our operating results or enhance the value of our common stock.

The market price of our common shares may be subject to fluctuations and volatility.

The market price of our common shares is subject to volatility, has fluctuated, and may continue to fluctuate significantly due to, among other things, changes in market sentiment regarding our operations, financial results or business prospects, the mining, metals, recycling or environmental remediation industries generally, coordinated trading activities, large derivative positions or the macroeconomic outlook. The price of our common stock has been, and may continue to be, highly volatile, including in response to our announced investments in LINICO. Certain events or changes in the market or our industries generally are beyond our control.

In addition to the other risk factors contained or incorporated by reference herein, factors that could impact our trading price include:

• our actual or anticipated operating and financial results, including how those results vary from the expectations of management, securities analysts and investors;

• changes in financial estimates or publication of research reports and recommendations by financial analysts or actions taken by rating agencies with respect to us or other industry participants;

• failure to declare dividends on our common stock from time to time;

• reports in the press or investment community generally or relating to our reputation or the financial services industry;

• developments in our business or operations or our industry sectors generally;

• any future offerings by us of our common stock;

• any coordinated trading activities or large derivative positions in our common stock, for example, a “short squeeze” (a short squeeze occurs when a number of investors take a short position in a stock and have to buy the

borrowed securities to close out the position at a time that other short sellers of the same security also want to close out their positions, resulting in surges stock prices, i.e., demand is greater than supply for the stock sold shorted);

• legislative or regulatory changes affecting our industry generally or our business and operations specifically;

• the operating and stock price performance of companies that investors consider to be comparable to us;

• announcements of strategic developments, acquisitions, restructurings, dispositions, financings and other material events by us or our competitors;

• expectations of (or actual) equity dilution, including the actual or expected dilution to various financial measures, including earnings per share, that may be caused by this offering;

• actions by our current shareholders, including future sales of common shares by existing shareholders, including our directors and executive officers;

• proposed or final regulatory changes or developments;

• anticipated or pending regulatory investigations, proceedings, or litigation that may involve or affect us; and

• other changes in U.S. or global financial markets, global economies and general market conditions, such as interest or foreign exchange rates, stock, commodity prices, credit or asset valuations or volatility.

We have made and may in the future pursue investments in other companies, which could harm our operating results.

We have made, and could make in the future, investments in other companies, including privately-held companies in a development stage, and most recently LINICO, a lithium-battery recycler. Many of these private equity investments are inherently risky because the companies’ businesses may never develop, and we may incur losses related to these investments. The price of our common stock has been, and may continue to be, highly volatile in response to various investments, including in response to our investment in LINICO. In addition, we may be required to write down the carrying value of these investments to reflect other-than-temporary declines in their value, which could have a material adverse effect on our financial position and results of operations.

We primarily depend upon two manufacturers and if we encounter problems with these manufacturers there is no assurance that we could obtain products from other manufacturers without significant disruptions to our business.

The products to be sold by MCU and LINICO are currently manufactured by two manufacturers. If these manufacturers are unable to manufacture equipment on a timely and cost-efficient basis, operations will be disrupted and our net revenue and profitability will suffer. Moreover, if those manufacturers cannot consistently produce high-quality products that are free of defects, the strategic joint ventures may experience a high rate of product returns, which would also reduce our profitability and may harm our reputation and brand.

USE OF PROCEEDS

We estimate that the net proceeds we will receive from this offering will be $15,010,000.

We will use the net proceeds from this offering for strategic investments, including our investment in LINICO, mercury remediation investments, mineral acquisitions and developments, working capital and other general corporate purposes. See “Use of Proceeds.”

Pending the application of the net proceeds as described above, we may invest the net proceeds from this offering in short-term, investment grade, interest-bearing securities.

DILUTION

Investors in shares of our common stock offered in this offering will experience an immediate dilution in the net tangible book value of their common stock from the public offering price of the common stock. The net tangible book value of our common stock as of September 30, 2020, was approximately $35.2 million, or approximately $1.02 per share of common stock. Net tangible book value per share of our common stock is calculated by subtracting our total liabilities from our total tangible assets (which is equal to total assets less intangible assets) and dividing this amount by the number of shares of common stock outstanding as of such date.

Dilution per share represents the difference between the public offering price per share of our common stock and the adjusted net tangible book value per share of our common stock included in this offering after giving effect to this offering. Any sale of our common stock in this offering at a price per share greater than the net tangible book value per share will result in (after giving effect to such sale and deducting discounts, commissions estimated offering expenses payable by us) an increase in our as adjusted net tangible book value per share of common stock with respect to our existing stockholders and an immediate and substantial dilution in net tangible book value per share of common stock to new investors purchasing shares in this offering. The following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Offering price per share

|

|

|

|

|

|

$4.00

|

|

|

|

Net tangible book value per share as of September 30, 2020

|

|

$

|

1.02

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors

|

|

$

|

0.29

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net tangible book value per share after this offering

|

|

|

|

|

|

$1.31

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per share to new investors

|

|

|

|

|

|

$2.69

|

|

|

|

|

|

|

|

|

|

|

|

The number of shares of common stock to be outstanding after the offering is based on 34,440,766 shares of common stock outstanding as of September 30, 2020.

CAPITALIZATION

The following table shows our cash and cash equivalents, available-for-sale securities and capitalization as of September 30, 2020 on an actual basis and on an as adjusted basis to reflect the assumed sale of 4,000,000 shares of our common stock offered at a price per share of $4.00, after deducting the placement agent fees and estimated offering expenses.

This table should be read in conjunction with our financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in the 2019 Form 10-K, the First Quarter Form 10-Q, Second Quarter Form 10-Q and Third Quarter Form 10-Q and other reports filed by us with the SEC, which are incorporated by reference in this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2020

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

1,677,233

|

|

|

$

|

16,687,233

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt obligations (including current portion)

|

|

$

|

4,765,254

|

|

|

$

|

4,765,254

|

|

|

|

|

|

|

|

|

|

|

Common stock, $.000666 par value, 158,000,000 shares authorized, 34,440,766 shares issued and outstanding at September 30, 2020

|

|

|

22,937

|

|

|

|

25,601

|

|

|

Additional paid-in capital

|

|

|

252,715,337

|

|

|

|

267,725,337

|

|

|

Accumulated deficit

|

|

|

(217,548,201

|

)

|

|

|

(217,548,201

|

)

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

35,190,073

|

|

|

|

50,202,737

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

39,955,327

|

|

|

$

|

54,967,991

|

|

|

|

|

|

|

|

|

|

Dividend Policy

We have never declared or paid any dividends on our common stock. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. We currently intend to retain future earnings, if any, to finance operations and the expansion of our business. Any future determination to pay cash dividends will be at the discretion of the board of directors and will depend upon our financial condition, operating results, capital requirements and other factors the board of directors deems relevant. We are restricted from declaring or paying common stock dividends in cash under the terms of our preferred stock.

PLAN OF DISTRIBUTION

We have engaged Noble Capital Markets, Inc., (“Noble” or the “Placement Agent”) to act as our Placement Agent in connection with this offering of our securities pursuant to this prospectus supplement. Under the terms of the engagement agreement, the Placement Agent has agreed to be our Placement Agent, in connection with the issuance and sale by us of the securities in this takedown from our shelf registration statement, and the sole placement agent for this offering. The terms of this offering were subject to market conditions and negotiations between us, the Placement Agent and the investors. The engagement agreement does not give rise to any commitment by the Placement Agent to purchase any of our securities, and the Placement Agent will have no authority to bind us by virtue of the engagement agreement. Further, the Placement Agent does not guarantee that it will be able to raise new capital in any prospective offering.

The Placement Agent proposes to arrange for the sale of the securities we are offering pursuant to this prospectus supplement to one or more investors through a securities purchase agreement directly between the investors and us. We will only sell to investors who have entered into the securities purchase agreement.

We expect to deliver the securities being offered pursuant to this prospectus supplement on or about March 2, 2021, subject to satisfaction of certain customary closing conditions.

Fees and Expenses

We have agreed to pay the Placement Agent a total cash fee equal to 6.0% of the gross proceeds of this offering. We will also pay the Placement Agent $30,000 for its reimbursable expenses pursuant to the Placement Agent Agreement.

We estimate the total expenses payable by us for this offering will be approximately $990,000, which amount includes the Placement Agent fees and expenses.

Discounts and Commissions

The following table summarizes the public offering price, placement agent fees and proceeds before expenses to us:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

|

|

Public offering price

|

|

$4.00

|

|

|

$16,000,000

|

|

Placement Agent Fees

|

|

$0.24

|

|

|

$960,000

|

|

Proceeds, before expenses, to us

|

|

$3.76

|

|

|

$15,040,000

|

The expenses of the offering, not including the placement agent fees and commissions, payable by us are estimated to be $30,000. In no event will the total amount of compensation paid to other securities brokers and dealers upon completion of this offering exceed 6.0% of the maximum gross proceeds of the offering.

Quotation on the NYSE AMERICAN

Our common stock is listed on the NYSE American under the symbol “LODE.”

Indemnification

We have agreed to indemnify the Placement Agent against certain liabilities, including liabilities under the Securities Act and liabilities arising from breaches of representations and warranties contained in the placement agent agreement. We have also agreed to contribute to payments the Placement Agent may be required to make in respect of such liabilities.

Selling Restrictions

Other than in the United States, no action has been taken by us or the Placement Agent that would permit a public offering of the securities offered by this prospectus supplement in any jurisdiction where action for that purpose is required. The securities offered by this prospectus supplement may not be offered or sold, directly or indirectly, nor may this prospectus supplement or any other offering material or advertisements in connection with the offer and sale of any such securities be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus supplement comes are advised to inform themselves about and to observe any restrictions relating to the offering and the distribution of this prospectus supplement. This prospectus supplement does not constitute an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus supplement in any jurisdiction in which such an offer or a solicitation is unlawful.

Listing and Transfer Agent

Our common stock is listed on the NYSE American under the symbol “LODE.” We have submitted an application to the NYSE American to list the shares of common stock offered hereby. The transfer agent and registrar for our common stock is Equiniti, located at 3200 Cherry Creek Dr., South Suite 430, Denver, Colorado 80209. Its telephone number is (303) 282-4800.

LEGAL MATTERS

The validity of the issuance of the securities offered in this offering has been passed upon for us by McDonald Carano, LLP, Reno, Nevada.

EXPERTS

The consolidated financial statements, and the related financial statement schedule, incorporated in this prospectus supplement by reference from the 2019 Form 10-K have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their report, which is incorporated herein by reference. Such consolidated financial statements and financial statement schedule have been so incorporated in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

PROSPECTUS

4,000,000 Shares of Common Stock

________________________________

PROSPECTUS SUPPLEMENT

________________________________

March 2, 2021

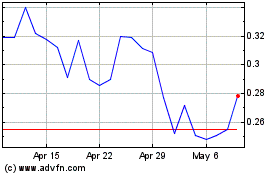

Comstock (AMEX:LODE)

Historical Stock Chart

From Mar 2024 to Apr 2024

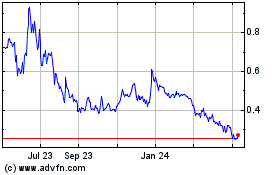

Comstock (AMEX:LODE)

Historical Stock Chart

From Apr 2023 to Apr 2024