Comstock Mining Inc. (the “Company”) (NYSE American: LODE) today

announced selected unaudited financial results for the fiscal

quarter ended March 31, 2019.

First Quarter 2019 Selected Strategic

Highlights

- Executed the definitive agreement (the “Tonogold Agreement”)

for the sale of the Company’s Lucerne properties to Tonogold for

total consideration of approximately $23 million, consisting of

$11.5 million in cash, $3.5 million in stock and $8.0 million in

assumed liabilities, plus future royalties;

- Received $2 million in non-refundable deposits and reduced

debenture principal to $7.9 million;

- Received commitments for an additional $1 million in

non-refundable deposits in Q2 2019;

- Granted Tonogold an option, upon the Lucerne closing, to lease

American Flat processing facility for:• $1 million per annum, plus

$1 per ton until $15 million received by the Company;• $1

million per annum, plus $0.50 per ton for the next $10 million

received ($25 million total); and• $0.25 per ton for all tons

processed after the Company receives $25 million.

- Executed agreements to sell the Silver Springs non-mining

assets for $9.75 million;

- Commenced the realignment of the Company’s organizational

structure for optimizing future growth; and

- Advanced negotiations of multiple, clean technology ventures

for revenue growth.

First Quarter 2019 Selected Financial

Highlights

- Environmental and reclamation expenses achieved a record low of

$0.05 million in Q1 2019, an 8% reduction as compared to $0.06

million in Q1 2018, driven by higher 2018, site-water management

costs;

- General and administrative expenses were lower at $0.66 million

in Q1 2019, a 9% reduction as compared to $0.73 million in Q1 2018;

driven by lower net administrative costs;

- Net loss was $1.8 million, or ($0.02) loss per share for Q1

2019, as compared to net loss of $2.5 million, or ($0.05) loss per

share for Q1 2018, primarily from lower operating and

acquisition-related expenses;

- Net cash used in operations was $0.9 million in Q1 2019, as

compared to a net use of $1.1 million in Q1 2018, primarily

resulting from lower operating expenses and lower uses for working

capital;

- Net cash provided by investing activities was $1.6 million in

Q1 2019, substantially all from the $2.0 million in non-refundable

deposits from Tonogold, offset by $0.4 million used toward property

purchases;

- Net cash used in financing was $0.8 million in Q1 2019,

primarily reflecting $1.6 million in principal payments in long

term debt, offset by $0.8 million in cash proceeds from the

issuance of common stock;

- Cash and cash equivalents at March 31, 2019, were $0.3

million;

- Received additional $0.35 million in cash for non-refundable

deposits by May 3, 2019;

- Expect an additional $0.65 million in cash for non-refundable

deposits by May 24, 2019; and

- Common shares outstanding at March 31, 2019, were 80,790,273

shares.

Mr. Corrado De Gasperis, Executive Chairman and CEO stated, “Our

year over year costs are down, primarily from net reductions in our

environmental and administrative expenses. The Tonogold Agreement

ensures further reduced operating and interest expense reductions

of approximately $2 million per annum, effective June 1, 2019.”

Lucerne Resource Area

On January 24, 2019, the Company entered into the Tonogold

Agreement for the sale of its Lucerne properties (~1200 acres) to

Tonogold for $15 million which, upon closing, replaces the option

agreement announced in October of 2017.

On April 30, 2019, the Tonogold Agreement was amended (the

“Amendment”), allowing Tonogold the option to extend the closing

for three additional months, upon the payment of three additional

$1 million non-refundable deposits and other considerations. The

Amendment contemplates that Tonogold will pay the Company $11.5

million in cash and $3.5 million in an interest-bearing,

convertible note at closing. The Amendment also requires Tonogold

to reimburse the Company for the monthly interest expense on the

Company’s Senior Secured Debenture, and over $1 million in annual

operating expenses associated with the American Flat platform, both

beginning on June 1, 2019, regardless of when the Lucerne sale

closes.

Additionally, Tonogold is in advanced stage negotiations

with a third party over securing additional significant claims in

Storey and Lyon County, with the Company’s concurrence and support,

that enhances the scope and potential of the Lucerne project and is

conditioned upon: (a) closing the sale of the Lucerne properties;

(b) Tonogold assigning certain Lyon County patented and unpatented

mining claims to the Company for no additional consideration; (c)

the new Storey County claims to be acquired by Tonogold being

subject to the NSR Royalty Agreement with the Company and (d)

Tonogold assigning any royalty interests owned on the Company’s

existing Dayton property patented and unpatented claims package to

the Company.

According to Tonogold’s public statements, Tonogold has secured

significant interest for funding the purchase of the Lucerne

properties and is finalizing negotiations with optimal terms and

allocations. Tonogold has also stated that it has executed a

term sheet for a $5 million debt financing with the option for

drawing an additional $25 million for development, production

start-up and working capital, subject to customary due diligence

and closing conditions. Tonogold also stated they have engaged Mine

Development Associates ("MDA") of Reno, Nevada to undertake and

complete a 43-101 compliant Preliminary Economic Assessment ("PEA")

on the Lucerne Deposit. The 43-101 compliant PEA is expected

to be completed by July 2019.

Mr. De Gasperis commented, “Tonogold has made consistent

progress toward acquiring the Lucerne mine and has worked

effectively to secure sufficient strategic investment capital for

closing this transaction and funding Lucerne development. We

have received $2.35 million in non-refundable deposits with an

additional $0.65 million due in the next 2 weeks. These payments

will bring our Debenture principal down to $7.2 million. These

results are truly outstanding and we look forward to closing

transaction in the next few months.”

Dayton Resource Area The Company plans to

advance the Dayton Project to full feasibility assessment, with a

production ready mine plan within two years of commencing that

work. This work has not yet commenced but with the completion of

the Lucerne transaction, the Company should have the capacity and

wherewithal for advancing the plan.

The Company also plans continuing its exploration activities

southerly into Spring Valley with incremental exploration programs

that include exploration and definition drilling of targets

identified by geophysical surveys, surface mapping, prior drilling

and deeper geological interpretations that will all lead to

publishing an updated, NI 43-101 compliant, mineral resource

estimate for the Dayton Project and the expanded exploration

opportunities in Spring Valley during 2019. The Company has also

commenced collaborating on community development planning

activities in Silver City associated with Dayton Mine planning and

expects to begin local permit activities in 2019, for the Dayton

Project following those planning activities.

Corporate Realignment

During the first quarter of 2019, the Company’s Board of

Directors determined that it would be in the best interests of the

Company and its stockholders to implement a strategy (the

“Strategic Focus”) focused on high-value, high cash-generating,

precious metal-based activities, including, but not limited to,

metals and mining and related supply chain asset acquisitions,

exploration, engineering, resource development, economic

feasibility assessment, mineral production, metal processing and

environmentally-friendly, conservation-based, economically

enhancing mining technology and processes. The Board

commenced realigning its assets in the first quarter of 2019.

The Board also determined to facilitate the formation of a new

entity to be named Comstock Capital Partners, LLC (“CCP”) or such

other name deemed appropriate by management of the Company that

qualifies as an opportunity zone fund in accordance with the Tax

Cuts and Jobs Act in order to minimize unnecessary dilution, access

capital efficiently, position the Company to maximize the potential

benefits of the existing Northern Nevada platform in the existing

and potential opportunity zone assets and foster metals and mining

based investments that are consistent with the Strategic Focus.

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/015ee819-d599-483f-869b-82ba5d656415

The Company and Comstock Processing LLC, a wholly owned

subsidiary of the Company, are pursuing strategic ventures for

mercury remediation, leach pad, tailings and waste dump

reprocessing and water remediation and purification.

Liquidity & Capital Resources During the

first quarter, the Company received $2.0 million in cash proceeds

from Tonogold and used $1.4 million to pay down Senior Secured

Debenture principal. The Company had total assets of

$28.2 million, total current assets of $10.1 million, current

liabilities of $3.9 million and net current assets of $6.2 million.

The Company’s current capital resources include cash and cash

equivalents and other net working capital resources, along with an

equity sales agreement (the "Sales Agreement") with Murray FO, LLC

("Murray"), with aggregate unused capacity of $5.0 million, for a

5% fee subject to certain volume and pricing restrictions pursuant

to the Company’s shelf registration statement on Form S-3, filed on

February 26, 2019. The 5% fee will be paid with 657,778 restricted

shares and 408,000 unrestricted shares.

These capital resources are in addition to certain planned

non-mining asset sales and proceeds of the transaction contemplated

by the Tonogold Agreement, including an additional $350,000

received from Tonogold through May 3, 2019, and an additional

$650,000 due by May 24, 2019. The Company expects the

Tonogold transaction to close on or before June 21, 2019,

otherwise, an additional $1 million non-refundable deposit becomes

due on that date. On February 25, 2019, the Company entered into

agreements to sell one non-mining asset, that is, the 98-acre

certified industrial site and related water rights, and to sell the

purchase agreements and option on the 160 acres of land, all

located in Silver Springs, NV, for a total of $9.75 million plus a

residual 3% future share of the profit. The transactions are

expected to be finalized in 2019, and the Company expects to record

gain of about $5 million. The shares outstanding on May 9, 2019,

and March 31, 2019, were 81,290,273 and 80,790,273,

respectively.

Outlook The Company’s annual operating expenses

are planned at $3.8 million, with approximately $1.2 million of

that amount currently being reimbursed under the existing Tonogold

Option Agreement. The Company anticipates over $1 million in

additional, annualized savings from the Tonogold Amendment,

effective June 1, 2019, regardless of when the transaction

closes. The transaction would also result in an early

extinguishment of its approximate $7.9 million outstanding Senior

Secured Debenture obligation, eliminating more than $1 million in

annualized interest expense. Theses interest savings will also be

effective June 1, 2019, regardless of when the transaction

closes.

The Company’s second half 2019 plans include advancing the

commercialization of certain mining and processing technologies

that the Company has been collaborating on, with partners such as

Itronics Inc., and Oro Industries Inc., and others, and includes

reclamation and enhanced recoveries that present nearer term

revenue opportunities and potentially enhance the economic

feasibilities of our existing properties. The Tonogold

Amendment supports these opportunities by reaffirming the Company’s

right to use the American Flat PP&E for any purpose that does

not materially interfere with Tonogold’s processing plans,

including but not limited to, testing, reprocessing, removing,

and/or selling previously stacked and leached material.

The Company expects to announce various ventures and alliances,

all designed for profitable revenue growth, during the second and

third quarters of 2019. The ventures and our strategic partners

will be showcased during our annual meeting, planned for early

September 2019, at the Gold Hill Hotel in Gold Hill, Nevada.

Conference Call

The Company will host a conference call today, May 9, 2019, at

8:00 a.m. Pacific Time/11:00 a.m. Eastern Time. The live call

will include a moderated Q&A, after the prepared comments by

the Company. The dial-in telephone numbers for the live audio

are as follows:

Toll Free: 1-888-241-0551

International Direct: 1-647-427-3415

Conference ID: 8058709

The audio will be available, usually within 24

hours of the call, on the Company website:

http://www.comstockmining.com/investors/investor-library

About Comstock Mining Inc.

Comstock Mining Inc. is a Nevada-based, gold and silver mining

company with extensive, contiguous property in the Comstock

District and is an emerging leader in sustainable, responsible

mining. The Company began acquiring properties in the Comstock

District in 2003. Since then, the Company has consolidated a

significant portion of the Comstock District, amassed the single

largest known repository of historical and current geological data

on the Comstock region, secured permits, built an infrastructure

and completed its first phase of production. The Company continues

evaluating and acquiring properties inside and outside the district

expanding its footprint and exploring all of our existing and

prospective opportunities for further exploration, development and

mining. The near-term goal of our business plan is to maximize

intrinsic stockholder value realized, per share, by continuing to

acquire mineralized and potentially mineralized properties,

exploring, developing and validating qualified resources and

reserves (proven and probable) that enable the commercial

development of our operations through extended, long-lived mine

plans and developments that are economically feasible and socially

responsible. Forward-Looking Statements

This press release and any related calls or discussions may

include forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements,

other than statements of historical facts, are forward-looking

statements. The words “believe,” “expect,” “anticipate,”

“estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,”

“would,” “potential” and similar expressions identify

forward-looking statements, but are not the exclusive means of

doing so. Forward-looking statements include statements about

matters such as: future industry market conditions; future

explorations or acquisitions; future changes in our exploration

activities; future prices and sales of, and demand for, our

products; land entitlements and uses; production capacity and

operations; operating and overhead costs; future capital

expenditures and their impact on us; operational and management

changes (including changes in the board of directors); changes in

business strategies, planning and tactics; future employment and

contributions of personnel, including consultants; future land

sales investments, acquisitions, joint ventures, strategic

alliances, business combinations, operational, tax, financial and

restructuring initiatives; including the nature and timing and

accounting for restructuring charges, derivative liabilities and

the impact thereof; contingencies; environmental compliance and

changes in the regulatory environment; offerings, limitations on

sales or offering of equity or debt securities; including asset

sales and the redemption of the debenture and associated costs;

future working capital, costs, revenues, business opportunities,

debt levels, cash flows, margins, earnings and growth. These

statements are based on assumptions and assessments made by our

management in light of their experience and their perception of

historical and current trends, current conditions, possible future

developments and other factors they believe to be appropriate.

Forward-looking statements are not guarantees, representations or

warranties and are subject to risks and uncertainties, many of

which are unforeseeable and beyond our control and could cause

actual results, developments and business decisions to differ

materially from those contemplated by such forward-looking

statements. Some of those risks and uncertainties include the

risk factors set forth in this report and our Annual Report on Form

10-K for the fiscal year ended December 31, 2017, and the

following: adverse effects of climate changes or natural disasters;

global economic and capital market uncertainties; the speculative

nature of gold or mineral exploration, including risks of

diminishing quantities or grades of qualified resources;

operational or technical difficulties in connection with

exploration or mining activities; contests over our title to

properties; potential dilution to our stockholders from our stock

issuances, recapitalization and balance sheet restructuring

activities; potential inability to comply with applicable

government regulations or law; adoption of or changes in

legislation or regulations adversely affecting our businesses;

permitting constraints or delays; business opportunities that may

be presented to, or pursued by, us; acquisitions, joint ventures,

strategic alliances, business combinations, asset sales, and

investments that we may be party to in the future; changes in the

United States or other monetary or fiscal policies or regulations;

interruptions in our production capabilities due to capital

constraints; equipment failures; fluctuation of prices for gold or

certain other commodities (such as silver, zinc, cyanide, water,

diesel fuel and electricity); changes in generally accepted

accounting principles; adverse effects of terrorism and

geopolitical events; potential inability to implement our business

strategies; potential inability to grow revenues; potential

inability to attract and retain key personnel; interruptions in

delivery of critical supplies, equipment and raw materials due to

credit or other limitations imposed by vendors; assertion of

claims, lawsuits and proceedings against us; potential inability to

satisfy debt and lease obligations; potential inability to maintain

an effective system of internal controls over financial reporting;

potential inability or failure to timely file periodic reports with

the SEC; potential inability to list our securities on any

securities exchange or market; inability to maintain the listing of

our securities; and work stoppages or other labor difficulties.

Occurrence of such events or circumstances could have a material

adverse effect on our business, financial condition, results of

operations or cash flows or the market price of our securities. All

subsequent written and oral forward-looking statements by or

attributable to us or persons acting on our behalf are expressly

qualified in their entirety by these factors. Except as may be

required by securities or other law, we undertake no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise.

Neither this press release nor any related calls or discussions

constitutes an offer to sell or the solicitation of an offer to buy

the Debenture or any other securities of the Company. Contact

information: Comstock Mining, Inc. P.O. Box 1118 Virginia City, NV

89440 ComstockMining.com Corrado De Gasperis Executive Chairman

& CEO Tel (775) 847-4755 degasperis@comstockmining.com Zach

Spencer Director of External Relations Tel (775) 847-5272

ext.151questions@comstockmining.com

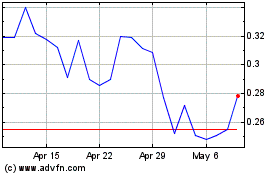

Comstock (AMEX:LODE)

Historical Stock Chart

From Mar 2024 to Apr 2024

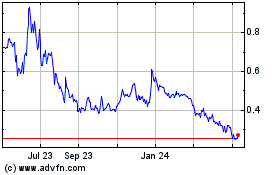

Comstock (AMEX:LODE)

Historical Stock Chart

From Apr 2023 to Apr 2024