CI Financial Announces Sale of its Minority Stake in Congress Wealth Management

April 27 2023 - 1:01PM

Business Wire

CI shareholders receive return of

approximately three times initial investment

CI Financial Corp. (“CI”) (TSX: CIX) announced today it has

reached an agreement to sell its minority stake in Congress Wealth

Management, LLC (“Congress”) to Audax Private Equity.

Congress, led by President Paul Lonergan, serves clients across

the U.S. from its Boston headquarters and offices in six other

cities. CI, which first invested in Congress in the third quarter

of 2020, holds its stake in the firm through CI Private Wealth, LLC

(“CIPW”), its integrated U.S. wealth management subsidiary.

“Congress is a great firm and our partnership with Paul and his

team has been fantastic,” said Kurt MacAlpine, CI Chief Executive

Officer.

“However, CI’s investment in Congress was made almost three

years ago, prior to the establishment of the CI Private Wealth

differentiated private partnership model. To fully benefit from its

features, only active contributors to the business can be CIPW

Partners. Unfortunately, the ownership structure at Congress

precludes it from fully integrating into CIPW. CI and Congress

believe that minority ownership is not the best structure to

maximize the client and employee experience, and that Audax will be

an excellent partner to support the next chapter of growth for

Congress.”

CI received a return of approximately three times its initial

investment in Congress and will use the proceeds from the

transaction to pay down debt.

“The investment from CI was extremely productive and we are

exiting on the best of terms,” said Mr. Lonergan. “In addition to

finding a solution that works for our ownership, we are also eager

to pursue additional M&A opportunities thanks to the backing

from Audax Group.”

“I want to thank Paul and the entire team at Congress for their

hard work and dedication over the last three years,” said Mr.

MacAlpine. “They are an incredibly talented team and I wish them

all the best.”

The transaction is expected to close in May 2023.

About CI Financial

CI Financial Corp. is a diversified global asset and wealth

management company operating primarily in Canada, the United States

and Australia. Founded in 1965, CI has developed world-class

portfolio management talent, extensive capabilities in all aspects

of wealth planning, and a comprehensive product suite. CI manages

and advises on approximately C$391.1 billion (US$289.4 billion) in

client assets (as at March 31, 2023).

CI operates in three segments:

- Asset Management, which includes CI Global Asset Management,

which operates in Canada, and GSFM Pty Ltd., which operates in

Australia.

- Canadian Wealth Management, which includes the operations of CI

Assante Wealth Management, Aligned Capital Partners, CI Private

Wealth (Canada), Northwood Family Office, CI Direct Investing and

CI Investment Services.

- U.S. Wealth Management, which includes CI Private Wealth

(U.S.), an integrated wealth management firm providing

comprehensive solutions to ultra-high-net-worth and high-net-worth

clients across the United States.

CI is headquartered in Toronto and listed on the Toronto Stock

Exchange (TSX: CIX). To learn more, visit CI’s website or LinkedIn

page.

This press release contains forward-looking statements

concerning anticipated future events, results, circumstances,

performance or expectations with respect to CI Financial Corp.

(“CI”) and its products and services, including its business

operations, strategy and financial performance and condition.

Forward-looking statements are typically identified by words such

as “believe”, “expect”, “foresee”, “forecast”, “anticipate”,

“intend”, “estimate”, “goal”, “plan” and “project” and similar

references to future periods, or conditional verbs such as “will”,

“may”, “should”, “could” or “would”. These statements are not

historical facts but instead represent management beliefs regarding

future events, many of which by their nature are inherently

uncertain and beyond management’s control. Although management

believes that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, such statements

involve risks and uncertainties. The foregoing list is not

exhaustive and the reader is cautioned to consider these and other

factors carefully and not to place undue reliance on

forward-looking statements. Other than as specifically required by

applicable law, CI undertakes no obligation to update or alter any

forward-looking statement after the date on which it is made,

whether to reflect new information, future events or otherwise.

CI Global Asset Management is a registered business name of CI

Investments Inc., a wholly owned subsidiary of CI Financial

Corp.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230427005833/en/

Investor Relations Jason Weyeneth, CFA Vice-President,

Investor Relations & Strategy 416-681-8779 jweyeneth@ci.com

Media Relations Canada Murray Oxby Vice-President, Corporate

Communications 416-681-3254 moxby@ci.com United States Jimmy Moock

Managing Partner, StreetCred 610-304-4570 jimmy@streetcredpr.com

ci@streetcredpr.com

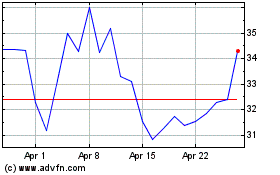

CompX (AMEX:CIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

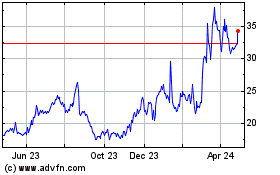

CompX (AMEX:CIX)

Historical Stock Chart

From Apr 2023 to Apr 2024