Current Report Filing (8-k)

April 07 2020 - 4:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 7, 2020

COHEN & COMPANY INC.

(Exact name of registrant as specified in

its charter)

|

Maryland

|

|

1-32026

|

|

16-1685692

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

Cira Centre

2929 Arch Street, Suite 1703

Philadelphia,

Pennsylvania

|

|

19104

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (215) 701-9555

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

COHN

|

|

The NYSE American Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On April 7, 2020, the Board of Directors of Cohen & Company

Inc., a Maryland corporation (the “Company”), adopted the Cohen & Company Inc. 2020 Long-Term Incentive Plan

(the “Plan”). The ability to grant equity-based awards to members of the Company’s board of directors and employees

of the Company under the Plan permits the Company to recognize the contributions made to the Company by such persons and provides

them with an additional incentive to join or remain with the Company and to devote themselves to the Company’s success by

providing them with an opportunity to acquire or increase their proprietary interest in the Company.

The Plan is administered by the Compensation Committee (the

“Committee”) of the Company’s Board of Directors. Awards by the Committee that result in the issuance of the

Company’s common stock will be subject to approval of the Plan by the Company’s stockholders. The Company intends to

seek approval of the Plan by the stockholders at the Company’s 2020 annual meeting of stockholders. All directors and employees

of the Company or its affiliates are eligible to receive awards under the Plan, including the Company’s named executive officers,

Daniel G. Cohen, Lester R. Brafman and Joseph W. Pooler, Jr.

Awards under the Plan may be made to eligible persons in the

form of options (including stock appreciation rights), restricted stock, restricted stock units, dividend equivalent rights and

other forms of equity-based awards as contemplated in the Plan. With respect to option awards, the exercise price of the option

is required to be at least 100% of the fair market value of a share of the Company’s common stock on the grant date. The

aggregate maximum number of shares of the Company’s common stock that may be granted under the Plan is 600,000 shares, subject

to adjustment in the event there is a merger, consolidation, stock split, reclassification, recapitalization or similar transaction

with respect to the Company’s common stock. No award may be granted under the Plan after April 7, 2030.

Awards under the Plan may be subject to the attainment of objective

performance goals that are established by the Committee. Performance goals shall be based on one or more of the following business

criteria (which may be determined for these purposes either by reference to the Company as a whole or by reference to any one or

more of its subsidiaries, operating divisions or other operating units): stock price, revenues, pretax income, operating income,

cash flow, earnings per share, return on equity, return on invested capital or assets, cost reductions and savings, return on revenues,

productivity, level of managed assets and near or long-term earnings potential, or any variation or combination of the preceding

business criteria. In addition, the Committee may utilize as an additional performance measure the attainment by a participant

of one or more personal objectives and/or goals that the Committee deems appropriate, including, but not limited to, implementation

of Company policies, negotiation of significant corporate transactions, development of long-term business goals or strategic plans

for the Company, or the exercise of specific areas of managerial responsibility.

The foregoing description of the Plan does not purport to be

complete and is qualified in its entirety by reference to the full text of the Plan, which is attached hereto as Exhibit 10.1 and

is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

*

|

Filed electronically herewith.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

COHEN & COMPANY INC.

|

|

|

|

|

|

Date: April 7, 2020

|

By:

|

|

/s/ Joseph W. Pooler, Jr.

|

|

|

|

Name:

|

Joseph W. Pooler, Jr.

|

|

|

|

Title:

|

Executive Vice President, Chief Financial Officer and Treasurer

|

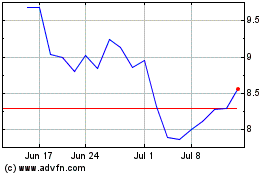

Cohen & (AMEX:COHN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cohen & (AMEX:COHN)

Historical Stock Chart

From Apr 2023 to Apr 2024