File # 333-229295

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM S-1

POST-EFFECTIVE AMENDMENT NO. 4

Registration

Statement Under

THE

SECURITIES ACT OF 1933

Colorado

(State or other

jurisdiction of incorporation)

|

84-0916344

|

|

8229 Boone Blvd.

#802

Vienna, Virginia

22182

(703)

506-9460

|

|

(IRS Employer I.D.

Number)

|

|

(Address, including

zip code, and telephone number

including area of

principal executive offices)

|

|

Geert

Kersten

8229

Boone Blvd. #802

Vienna,

Virginia 22182

(703)

506-9460

|

|

(Name

and address, including zip code, and telephone

number, including area code, of agent for

service)

|

Copies of all communications, including all communications

sent

to the agent for service, should be sent to:

William T. Hart, Esq.

Hart & Hart

1624 Washington Street

Denver, Colorado 80203

(303) 839-0061

As soon as practicable after the effective date of this

Registration Statement

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE

PUBLIC:

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box:

[x]

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration

statement number of the earlier effective registration statement

for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier

effective registration statement for the same offering. [

]

If this Form is a post-effective amendment filed pursuant to Rule

462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier

effective registration statement for the same offering. [

]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, a

smaller reporting company, or an emerging growth company. See the

definitions of “large accelerated filer,”

“accelerated filer”, “smaller reporting

company” and “emerging growth company” in Rule

12b-2 of the Exchange Act.

|

Large

accelerated filer

|

[

]

|

Accelerated

filer

|

[

]

|

|

Non-accelerated

filer

|

[X]

|

Smaller

reporting company

|

[X]

|

|

Emerging growth

company [ ]

|

|

|

|

|

If an

emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. [

]

CALCULATION OF REGISTRATION FEE

Title of each

Class of

Securities to be

Registered

|

Securities to be

Registered

|

Maximum Offering

Price Per Share

|

Proposed Maximum

Aggregate Offering Price

|

Amount of

Registration Fee

|

|

Common stock

offered by selling shareholders

|

2,345,555

|

$12.52

|

$29,366,349

|

$3,204

|

The

registrant hereby amends this Registration statement on such

date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically

states that this Registration Statement

shall thereafter become effective in accordance with

Section 8(a) of the Securities Act of l933 or until

the Registration Statement shall become effective on

such date as the Commission, acting pursuant to said Section

8(a), may determine.

EXPLANATORY NOTE

By means of this Registration Statement a number

of our warrant holders are offering to sell shares of our common

stock which are issuable upon the exercise of our outstanding

warrants. The warrants were issued at various dates between

February 2017 and June 2018. The shares issuable upon the exercise

of the warrants were previously registered by means of a

registration statement, of which this prospectus is a part,

filed with the Securities and Exchange Commission (File #

333-229295). However this prospectus could not be used until it was

updated with the Company’s September 30, 2020 financial

statements, which are incorporated by reference, and the

Post-Effective Amendment to registration statement # 333-229295, of

which this prospectus is a part, is declared effective by the

Securities and Exchange Commission.

PROSPECTUS

CEL-SCI CORPORATION

Common Stock

By

means of this prospectus a number of our warrant holders are

offering to sell up to 2,345,555 shares of our common stock which

are issuable upon the exercise of our outstanding

warrants.

The warrants were issued at various dates between

February 2017 and June 2018. The shares issuable upon the exercise

of the warrants were previously registered by means of a

registration statement, of which this prospectus is a part, filed

with the Securities and Exchange Commission (File # 333-229295).

However this prospectus could not be used until it was updated with

the Company’s September 30, 2020 financial statements, which

are incorporated by reference, and the Post-Effective Amendment to

registration statement # 333-229295, of which this prospectus is a

part, is declared effective by the Securities and Exchange

Commission.

The

warrant holders are sometimes referred to in this prospectus as the

“selling shareholders”.

Although

we will receive proceeds, if any, if the warrants are exercised, we

will not receive any proceeds from the sale of the common stock by

the selling stockholders. We will pay for the expenses of this

offering which are estimated to be $30,000.

Our

common stock is traded on the NYSE American under the symbol CVM.

On January 5, 2021 the closing price for our common stock was

$12.52.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any

representation to the contrary is a criminal offense.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK.

FOR A DESCRIPTION OF CERTAIN IMPORTANT FACTORS THAT SHOULD BE

CONSIDERED BY PROSPECTIVE INVESTORS, SEE "RISK FACTORS" BEGINNING

ON PAGE 19 OF OUR 2020 ANNUAL REPORT ON FORM 10-K WHICH IS

INCORPORATED BY REFERENCE.

The date of this prospectus is January __, 2021

This summary highlights certain information about us, this offering

and information appearing elsewhere in this prospectus and in the

documents we incorporate by reference. This summary is not complete

and does not contain all of the information that you should

consider before investing in our securities. To fully understand

this offering and its consequences you should read this entire

prospectus carefully, including the documents incorporated by

reference, in this prospectus before making an investment

decision.

Our Company

We

are dedicated to research and development directed at improving the

treatment of cancer and other diseases by using the immune system,

the body’s natural defense system. We are currently focused

on the development of the following product candidates and

technologies:

1)

Multikine® (Leukocyte Interleukin,

Injection), or Multikine, an investigational immunotherapy under development for the potential

treatment of certain head and neck cancers;

2)

L.E.A.P.S.

(Ligand Epitope Antigen Presentation System) technology, or LEAPS,

with two investigational therapies, CEL-2000 and CEL-4000, product

candidates under development for the potential treatment of

rheumatoid arthritis, and LEAPS COV-19, a product candidate under

development to potentially treat the COVID-19

coronavirus.

We were formed as a Colorado corporation in 1983. Our principal

office is located at 8229 Boone Boulevard, Suite 802, Vienna,

Virginia 22182. Our telephone number is 703-506-9460 and our web

site is www.cel-sci.com.

Except for the information incorporated by

reference, the information

contained in, and that which can be accessed through, our website

is not incorporated into and does not form a part of this

prospectus.

Our

common stock is publicly traded on the NYSE American under the

symbol “CVM”. The high and low closing prices of our

common stock, as reported by the NYSE American, during the three

months ended December 31, 2020 were $16.62 and $11.05,

respectively.

As

of January 5, 2021, we had 39,767,401 outstanding shares of common

stock. This number

excludes 11,834,219 shares that may be issued upon

the exercise of outstanding warrants and options with a weighted

average exercise price of $6.29 per share.

In

February 2020 we issued 44,065 shares of our common stock to three

persons upon the exercise of warrants which had exercise prices

between $2.24 and $3.60 per share. However, the 44,065 shares were

not registered pursuant to Section 5 of the Securities Act of 1933

and no exemption from registration was available for the issuance

of these shares. If the persons that exercised these warrants

sought to rescind the exercise of the warrants, we would have to

pay these persons approximately $126,000.

Recent Developments

On

May 4, 2020 we announced that our pivotal Phase 3 head and neck

cancer study of Multikine (Leukocyte Interleukin, Inj.)

immunotherapy had reached the targeted threshold of 298 events

(deaths) required to conduct the data evaluation. In December 2020,

we announced that our Phase 3 study is in the final stage of review

which involves statistical analysis of all study data and data lock

has already been completed. We will continue to remain blinded to

the study results throughout this process. We will be advised of

the results when the analysis is completed and the study results

will be announced to the public at that time.

On

December 1, 2020, we announced that our LEAPS COV-19 peptides,

delivered as a therapeutic treatment following SARS-CoV-2 virus

challenge, achieved a 40% survival rate in transgenic mouse models

as compared to 0% survival in the two control groups in studies

conducted at the University of Georgia Center for Vaccines and

Immunology. The animals were therapeutically treated with

CEL-SCI’s LEAPS COV-19 peptides one day after infection with

a lethal dose of SARS-CoV-2. Of the LEAPS treated mice, forty

percent (40%) were alive, recovering and regained lost weight,

attaining > 90% of their starting weight, by the study’s

end. In contrast, mice in the two control groups lost 20% or more

of their body weight by day 8 and all of them died between day 5

and day 8 post challenge. The success of this therapy was

statistically significant at a 95% level. An additional study

conducted using LEAPS as a vaccine to prevent disease resulted in

similar findings to the above described study, but with a slightly

lower level of statistical significance. In this study, the

Human(h) ACE2 transgenic mice were dosed twice with the LEAPS

conjugate 28 and 14 days prior to being challenged with a lethal

dose of SARS-CoV-2 virus. Our next step is to leverage the findings

from these two animal studies into future studies that will

optimize treatment dosing and test additional LEAPS peptides as a

therapy.

Predictions

of success using the LEAPS peptides against COVID-19 coronavirus

are based on previous studies conducted in collaboration with the

National Institutes for Allergies and Infectious Diseases (NIAID)

with another respiratory virus, pandemic influenza (H1N1). In those

studies, LEAPS peptides elicited protection of mice from morbidity

and mortality after the introduction of infection by activating

appropriate T cell responses rather than an inflammatory response.

LEAPS is in the early stages for treating COVID-19 coronavirus and

there is no guarantee that we will be able to replicate the results

from our prior studies.

The Offering

By

means of this prospectus, a number of our warrant holders are

offering to sell up to 2,345,555 shares of our common stock which

are issuable upon the exercise of our outstanding

warrants.

The

purchase of the securities offered by this prospectus involves a

high degree of risk. Risk factors include our history of losses and

our need for additional capital.

INCORPORATION OF DOCUMENTS BY

REFERENCE

We

incorporate by reference the filed documents listed below, except

as superseded, supplemented or modified by this prospectus and any

future filings we will make with the SEC under Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act:

●

our Annual

Report on Form 10-K for the fiscal year ended September 30,

2020;

●

our

Current Reports on Form 8-K filed with the SEC on October 30, 2020,

December 8, 2020, December 9, 2020 and December 29,

2020.

●

the description of

our common stock contained in our Registration Statement on Form

8-A filed with the SEC on July 2, 1996 and all amendments and

reports updating that description; and

The documents incorporated by reference contain important

information concerning:

●

Risk

Factors relating to an investment in our securities;

●

our

Management and matters relating to Corporate

Governance;

●

our

Principal Shareholders; and

●

our

Financial Statements and our Management’s Discussion of our

Results of Operations and our Financial Conditions.

We

will provide, without charge, to each person to whom a copy of this

prospectus is delivered, including any beneficial owner, upon the

written or oral request of such person, a copy of any or all of the

documents incorporated by reference above, including exhibits.

Requests should be directed to:

CEL-SCI Corporation

8229 Boone Blvd., #802

Vienna, Virginia 22182

(703) 506-9460

The documents incorporated by reference may be

accessed at our website: www.cel-sci.com.

FORWARD-LOOKING STATEMENTS

This

prospectus and the documents that are incorporated by reference

into this prospectus contain or incorporate by reference

“forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. You can generally

identify these forward-looking statements by forward-looking words

such as “anticipates,” “believes,”

“expects,” “intends,” “future,”

“could,” “estimates,” “plans,”

“would,” “should,” “potential,”

“continues” and similar words or expressions (as well

as other words or expressions referencing future events, conditions

or circumstances). These forward-looking statements involve risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements, including, but not

limited to:

●

the

progress and timing of, and the amount of expenses associated with,

our research, development and commercialization activities for our

product candidates, including Multikine;

●

our

expectations regarding the timing, costs and outcome of any pending

or future litigation matters, lawsuits or arbitration

proceeding;

●

the

success of our clinical studies for our product

candidates;

●

our

ability to obtain U.S. and foreign regulatory approval for our

product candidates and the ability of our product candidates to

meet existing or future regulatory standards;

●

our

expectations regarding federal, state and foreign regulatory

requirements;

●

the

therapeutic benefits and effectiveness of our product

candidates;

●

the

safety profile and related adverse events of our product

candidates;

●

our

ability to manufacture sufficient amounts of Multikine or our other

product candidates for use in our clinical studies or, if approved,

for commercialization activities following such regulatory

approvals;

●

our

plans with respect to collaborations and licenses related to the

development, manufacture or sale of our product

candidates;

●

business

disruption and related risks resulting from the recent pandemic of

the novel coronavirus 2019 (COVID-19);

●

our

expectations as to future financial performance, expense levels and

liquidity sources;

●

our

ability to compete with other companies that are or may be

developing or selling products that are competitive with our

product candidates;

●

anticipated

trends and challenges in our potential markets;

●

our

ability to attract, retain and motivate key personnel;

●

our

ability to continue as a going concern; and

All

forward-looking statements are expressly qualified in their

entirety by this cautionary statement. The forward-looking

statements contained in this prospectus and any document

incorporated reference in this prospectus, speak only as of their

respective dates. Except to the extent required by applicable laws

and regulations, we undertake no obligation to update these

forward-looking statements to reflect new information, events or

circumstances after the date of this prospectus or to reflect the

occurrence of unanticipated events. In light of these risks and

uncertainties, the forward-looking events and circumstances

described in this prospectus and the documents that are

incorporated by reference into this prospectus may not occur and

actual results could differ materially from those anticipated or

implied in such forward-looking statements. Accordingly, you are

cautioned not to place undue reliance on these forward-looking

statements.

Article

X of our bylaws provides that stockholder claims brought against

us, or our officers or directors, including any derivative claim or

claim purportedly filed on our behalf, must be brought in the U.S.

District Court for the district of Delaware.

Although it is our

intent that this provision applies to actions arising under the

Securities Act of 1933 and the Securities Exchange Act of 1934

there is uncertainty as to whether a court would enforce this

provision since Section 22 of the Securities Act creates concurrent

jurisdiction for federal and state courts over all suits brought to

enforce any duty or liability created by the Securities Act or the

rules and regulations under the Securities Act.

In

addition, since this provision in our bylaws applies to state law

claims there is uncertainty as to whether any court would enforce

this provision.

As

of September 30, 2020, we had a net tangible book value of $0.50

per share. An investor purchasing shares in this offering will

suffer dilution equal in amount to the difference between the price

paid for the shares and our net tangible book value at the time of

purchase.

DESCRIPTION OF COMMON STOCK

We

are authorized to issue 600,000,000 shares of common stock. Holders

of our common stock are each entitled to cast one vote for each

share held of record on all matters presented to the shareholders.

Cumulative voting is not allowed; hence, the holders of a majority

of our outstanding common shares can elect all

directors.

Holders

of our common stock are entitled to receive such dividends as may

be declared by our Board of Directors out of funds legally

available and, in the event of liquidation, to share pro rata in

any distribution of our assets after payment of liabilities. Our

Board of Directors is not obligated to declare a dividend. It is

not anticipated that dividends will be paid in the foreseeable

future.

Holders

of our common stock do not have preemptive rights to subscribe to

additional shares if issued. There are no conversion, redemption,

sinking fund or similar provisions regarding the common stock. All

outstanding shares of common stock are fully paid and

non-assessable.

Article

X of our bylaws provides that stockholder claims brought against

us, or our officers or directors, including any derivative claim or

claim purportedly filed on our behalf, must be brought in the U.S.

District Court for the district of Delaware.

Although it is our

intent that this provision applies to actions arising under the

Securities Act of 1933 and the Securities Exchange Act of 1934

there is uncertainty as to whether a court would enforce this

provision since Section 22 of the Securities Act creates concurrent

jurisdiction for federal and state courts over all suits brought to

enforce any duty or liability created by the Securities Act or the

rules and regulations under the Securities Act.

In

addition, since this provision in our bylaws applies to state law

claims there is uncertainty as to whether any court would enforce

this provision.

A number of our warrant holders are offering to

sell up to 2,345,555 shares of our common stock which are issuable

upon the exercise of our outstanding warrants. The warrants were

issued at various dates between February 2017 and June 2018.

The shares issuable upon the exercise of the warrants were

previously registered by means of a registration statement, of

which this prospectus is a part, filed with the Securities and

Exchange Commission (File # 333-229295). However this prospectus

could not be used until it was updated with the Company’s

September 30, 2020 financial statements, which are incorporated by

reference, and the Post-Effective Amendment to registration

statement # 333-229295, of which this prospectus is a part, is

declared effective by the Securities and Exchange

Commission.

The

warrant holders are sometimes referred to in this prospectus as the

“selling shareholders”.

We

will not receive any proceeds from the sale of the securities by

the selling shareholders. We will pay all costs of registering the

securities offered by the selling shareholders. These costs, based

upon the time related to preparing this section of the prospectus,

are estimated to be $2,000. The selling shareholders will pay all

sales commissions and other costs of the sale of their

shares.

The

selling shareholders are listed below.

|

Name of Selling Shareholder

|

Shares Owned

|

Warrant Series

|

Shares issuable upon exercise of warrants

|

Shares to be sold in this offering

|

Share ownership after offering

|

|

Charles Worthman

|

-

|

Series HH

|

200

|

200

|

-

|

|

Harald Wengust

|

-

|

Series MM

|

35,503

|

35,503

|

-

|

|

Christian Schleuning

|

-

|

Series MM

|

59,172

|

59,172

|

-

|

|

Dirk Oldenburg

|

-

|

Series MM

|

100,000

|

100,000

|

-

|

|

The Edward L. Cohen 2012 Descendants Trust

|

-

|

Series MM

|

118,343

|

118,343

|

-

|

|

Tom Ulie

|

-

|

Series MM

|

147,929

|

147,929

|

-

|

|

Geert Kersten

|

1,120,512

|

Series MM

|

297,929

|

297,929

|

1,120,512

|

|

Angela Brandenburg

|

-

|

Series MM

|

38,757

|

38,757

|

-

|

|

de Clara Trust

|

321,421

|

Series NN

|

109,170

|

109,170

|

321,421

|

|

Heinz Matthies

|

-

|

Series NN

|

32,751

|

32,751

|

-

|

|

The Edward L. Cohen 2012 Descendants Trust

|

-

|

Series NN

|

21,834

|

21,834

|

-

|

|

Tom Ulie

|

-

|

Series NN

|

43,668

|

43,668

|

-

|

|

Patricia Prichep

|

206,469

|

Series NN

|

10,917

|

10,917

|

206,469

|

|

Geert Kersten

|

-

|

Series NN

|

65,000

|

65,000

|

-

|

|

Angela Brandenburg

|

-

|

Series NN

|

65,502

|

65,502

|

-

|

|

Geert Kersten

|

-

|

Series RR

|

173,965

|

173,965

|

-

|

|

de Clara Trust

|

-

|

Series RR

|

54,585

|

54,585

|

-

|

|

The Edward L. Cohen 2012 Descendants Trust

|

-

|

Series RR

|

70,089

|

70,089

|

-

|

|

Tom Ulie

|

-

|

Series RR

|

95,799

|

95,799

|

-

|

|

Patricia Prichep

|

-

|

Series RR

|

5,459

|

5,459

|

-

|

|

Harald Wengust

|

-

|

Series RR

|

17,752

|

17,752

|

-

|

|

Dirk Oldenburg

|

-

|

Series SS

|

26,316

|

26,316

|

-

|

|

Andreas Moosmayer

|

-

|

Series SS

|

19,100

|

19,100

|

-

|

|

Claudia Kuen

|

-

|

Series SS

|

1,700

|

1,700

|

-

|

|

Lance S. Gad

|

-

|

Series SS

|

200,000

|

200,000

|

-

|

|

The Edward L. Cohen 2012 Descendants Trust

|

-

|

Series SS

|

26,316

|

26,316

|

-

|

|

Angela Brandenburg

|

-

|

Series SS

|

52,632

|

52,632

|

-

|

|

Dirk Oldenburg

|

-

|

Series TT

|

80,214

|

80,214

|

-

|

|

MAZ Partners LP

|

-

|

Series TT

|

40,107

|

40,107

|

-

|

|

The Edward L. Cohen 2012 Descendants Trust

|

-

|

Series TT

|

20,054

|

20,054

|

-

|

|

Angela Brandenburg

|

-

|

Series TT

|

40,107

|

40,107

|

-

|

|

Tom Ulie

|

-

|

Series TT

|

100,268

|

100,268

|

-

|

|

Duncree Holdings Inc.

|

-

|

Series TT

|

80,214

|

80,214

|

-

|

|

National Bank Financial Inc.

|

-

|

Series TT

|

600

|

600

|

-

|

|

de Clara Trust

|

-

|

Series UU

|

21,834

|

21,834

|

-

|

|

Patricia B.Prichep

|

-

|

Series UU

|

2,183

|

2,183

|

-

|

|

Geert Kersten

|

-

|

Series UU

|

69,586

|

69,586

|

-

|

|

|

|

|

|

|

|

|

|

|

|

2,345,555

|

|

|

The

controlling persons of the non-individual selling shareholders

are:

|

Name of Shareholder

|

Controlling Person

|

|

The Edward L. Cohen 2012 Descendants Trust

|

Debra Lerner Cohen and Jeffrey B. Stern

|

|

de Clara Trust

|

Ralf Brandenburg

|

|

MAZ

Partners LP

|

Walter

Schenker

|

|

Duncree Holdings Inc.

|

Timothy

Price

|

|

National Bank Financial Inc.

|

Charles

Marleau

|

The

terms of the warrants listed above are shown below:

|

Series

|

Exercise Price

|

Expiration Date

|

|

HH

|

$

3.125

|

2/16/2022

|

|

MM

|

$

1.86

|

6/22/2022

|

|

NN

|

$

2.52

|

7/24/2022

|

|

RR

|

$

1.65

|

10/30/2022

|

|

SS

|

$

2.09

|

12/18/2022

|

|

TT

|

$

2.24

|

2/5/2023

|

|

UU

|

$

2.80

|

6/30/2021

|

Geert

Kersten, our Chief Executive Officer, a trust in which Geert

Kersten holds a beneficial interest, and Patricia Prichep, our

Senior Vice President of Operations, are among the selling

shareholders. No other selling shareholder has, or had, any

material relationship with us or our officers or

directors.

A

holder of the Series HH warrants is affiliated with H.C. Wainright

& CO., a securities broker. To our knowledge, no other selling

shareholder is affiliated with a securities broker.

The

shares of common stock may be sold by the selling shareholders by

one or more of the following methods, without

limitation:

●

a

block trade in which a broker or dealer so engaged will attempt to

sell the securities as agent but may position and resell a portion

of the block as principal to facilitate the

transaction;

●

purchases

by a broker or dealer as principal and resale by such broker or

dealer for its account pursuant to this prospectus;

●

ordinary

brokerage transactions and transactions in which the broker

solicits purchasers; and

●

face-to-face

transactions between sellers and purchasers without a

broker/dealer.

In

completing sales, brokers or dealers engaged by the selling

shareholders may arrange for other brokers or dealers to

participate. Brokers or dealers may receive commissions or

discounts from the selling shareholders in amounts to be

negotiated. As to any particular broker-dealer, this compensation

might be in excess of customary commissions. Neither we nor the

selling shareholders can presently estimate the amount of such

compensation. Notwithstanding the above, no FINRA member will

charge commissions that exceed 8% of the total proceeds from the

sale.

The

selling shareholders and any broker/dealers who act in connection

with the sale of its securities may be deemed to be "underwriters"

within the meaning of §2(11) of the Securities Acts of 1933,

and any commissions received by them and any profit on any resale

of the securities as principal might be deemed to be underwriting

discounts and commissions under the Securities Act.

If

the selling shareholder enters into an agreement to sell its

securities to a broker-dealer as principal, and the broker-dealer

is acting as an underwriter, we will file a post-effective

amendment to the registration statement, of which this prospectus

is a part, identifying the broker-dealer, providing required

information concerning the plan of distribution, and otherwise

revising the disclosures in this prospectus as needed. We will also

file the agreement between the selling shareholder and the

broker-dealer as an exhibit to the post-effective amendment to the

registration statement.

The selling shareholders may also sell their shares pursuant to

Rule 144 under the Securities Act of 1933.

We

have advised the selling shareholders that they, and any securities

broker/dealers or others who sell the common stock on behalf of the

selling shareholders, may be deemed to be statutory underwriters

and will be subject to the prospectus delivery requirements under

the Securities Act of 1933. We have also advised the selling

shareholders that, in the event of a "distribution" of the

securities owned by the selling shareholders, the selling

shareholders, any "affiliated purchasers", and any broker/dealer or

other person who participates in the distribution may be subject to

Rule 102 of Regulation M under the Securities Exchange Act of 1934

("1934 Act") until their participation in that distribution is

completed. Rule 102 makes it unlawful for any person who is

participating in a distribution to bid for or purchase securities

of the same class as is the subject of the distribution. A

"distribution" is defined in Rule 102 as an offering of securities

"that is distinguished from ordinary trading transactions by the

magnitude of the offering and the presence of special selling

efforts and selling methods". We have also advised the selling

shareholders that Rule 101 of Regulation M under the 1934 Act

prohibits any "stabilizing bid" or "stabilizing purchase" for the

purpose of pegging, fixing or stabilizing the price of our common

stock in connection with this offering.

We

have filed with the Securities and Exchange Commission a

Registration Statement on Form S-1 (together with all amendments

and exhibits) under the Securities Act of 1933, as amended, with

respect to the securities offered by this prospectus. This

prospectus does not contain all of the information in the

Registration Statement, certain parts of which are omitted in

accordance with the rules and regulations of the Securities and

Exchange Commission. For further information, reference is made to

the Registration Statement which may be read and copied at the

Commission’s Public Reference Room.

We

are subject to the requirements of the Securities Exchange Act of

l934 and are required to file reports and other information with

the Securities and Exchange Commission. Copies of any such reports

and other information (which includes our financial statements)

filed by us can be read and copied at the Commission's Public

Reference Room.

The

public may obtain information on the operation of the Public

Reference Room by calling the Commission at 1-800-SEC-0330. The

Public Reference Room is located at 100 F. Street, N.E.,

Washington, D.C. 20549.

Our

Registration Statement and all reports and other information we

file with the Securities and Exchange Commission are available at

www.sec.gov, the website of the Securities and Exchange

Commission.

TABLE OF CONTENTS

No

dealer, salesperson or other person has been authorized to give any

information or to make any representation not contained in this

prospectus, and if given or made, such information or

representations must not be relied upon as having been authorized

by CEL-SCI Corporation. This prospectus does not constitute an

offer to sell, or a solicitation of an offer to buy, any of the

securities offered in any jurisdiction to any person to whom it is

unlawful to make an offer by means of this prospectus.

PART II

Information Not Required in Prospectus

Item 13. Other Expenses of Issuance and

Distribution.

The

following table shows the costs and expenses payable by the Company

in connection with this registration statement.

|

SEC

Filing Fee

|

$3,204

|

|

Legal

Fees and Expenses

|

12,500

|

|

Accounting

Fees and Expenses

|

15,000

|

|

TOTAL

|

$30,704

|

All

expenses other than the SEC filing fee are estimated.

Item 14. Indemnification of Officers and Directors

The

Colorado Business Corporation Act provides that the Company may

indemnify any and all of its officers, directors, employees or

agents or former officers, directors, employees or agents, against

expenses actually and necessarily incurred by them, in connection

with the defense of any legal proceeding or threatened legal

proceeding, except as to matters in which such persons shall be

determined to not have acted in good faith and in the

Company’s best interest.

Item 15. Recent Sales of Unregistered Securities.

|

|

Note Reference

|

|

|

|

|

On

February 5, 2018 the Company sold 2,501,145 shares of common stock

for $4,677,140 to 20 private investors. The purchasers of the

common stock also received warrants (Series TT) which entitle the

purchasers to acquire up to 1,875,860 shares of the Company’s

common stock. The Series TT warrants have an exercise price of

$2.24, are exercisable on August 6, 2018 and expire on February 5,

2023.

|

A, B

|

|

|

|

|

As of May 15, 2018 the Company was indebted to Ergomed, plc for

services provided by Ergomed in connection with the Company’s

Phase III clinical trials. On May 16, 2018 the Company issued

Ergomed 600,000 shares of its common stock in partial payment of

the amount the Company owed Ergomed.

|

A, B

|

|

|

|

|

On June 11, 2018 holders of notes in the principal amount of

$1,860,000 converted their notes into 937,804 shares of the

Company’s common stock. The Company issued 28,825 shares of

its common stock for $80,710 in accrued but unpaid interest on the

notes.

|

A, B

|

|

|

|

|

On June

11, 2018 holders of our notes in the principal amount of $1,860,000

converted their notes into 937,804 shares of our common stock. In

consideration for the early conversion of their notes, the note

holders received warrants (Series UU) which collectively allow the

holders to purchase up to 187,562 shares of our common stock at a

price of $2.80 per share at any time on or after December 11, 2018

and at any time on or before June 11, 2020.

|

A, B

|

|

|

|

|

On July 2, 2018, the Company sold 3,900,000 shares of its common

stock for aggregate gross proceeds of $5,070,000, or $1.30 per

share, in a registered direct offering. In a concurrent private

placement, the Company issued warrants (Series VV) to purchase

3,900,000 shares of CEL-SCI’s common stock. The warrants can

be exercised at a price of $1.75 per share, commencing six months

after the date of issuance and ending five and a half years after

the date of issuance. In addition, the Company issue

warrants to purchase up to 195,000 shares of CEL-SCI’s common

stock to the Placement Agent (Series WW). The Series WW warrants

are subject to a 180-day lock-up and may be exercised at any time

on or after January 2, 2019 and on or before June 28, 2023 at a

price of $1.625 per share.

|

A

|

|

|

|

|

On August 13, 2018, the Company sold 463,855 shares of its common

stock for aggregate gross proceeds of $385,000, or $0.83 per share,

in a private placement to four officers of the

Company.

|

A, B

|

|

|

|

|

As of August 29, 2018, the Company was indebted to Ergomed, plc for

services provided by Ergomed in connection with the Company’s

Phase III clinical trial. On August 30, 2018 the Company issued

Ergomed 1,000,000 shares of its common stock in payment of the

amounts it owed Ergomed.

|

A, B

|

|

|

|

|

As of January 8, 2019, the Company had outstanding payables to

Ergomed, plc for services provided by Ergomed in connection with

the Company’s Phase III clinical trial. On January 9, 2019

the Company issued Ergomed 500,000 shares of its common stock in

payment of the amounts it owed Ergomed.

|

A, B

|

|

|

|

|

On May 7, 2019, the Company sold 30,612 shares of its common stock

for aggregate gross proceeds of $210,000, or $6.86 per share, in a

private placement to four officers and a director of the

Company.

|

A, B

|

|

|

|

|

On June 3, 2019, the Company sold 6,631 shares of its common stock

for aggregate gross proceeds of $25,000, or $3.77 per share, in a

private placement to the Chief Executive Officer of the

Company.

|

A, B

|

|

|

|

|

On August 15, 2019 the Company issued Ergomed 250,000 shares of its

common stock in payment for services.

|

A, B

|

|

|

|

|

On September 4, 2019, the Company sold 7,962 shares of its common

stock for aggregate gross proceeds of $57,000, or $7.16 per share,

in a private placement to three officers of the

Company.

|

A, B

|

|

|

|

|

On October 25, 2019, the Company sold 3,725 shares of its common

stock for aggregate gross proceeds of $25,000, or $6.71 per share,

in a private placement to the Chief Executive Officer of the

Company.

|

A, B

|

|

|

|

|

On January 10, 2020, the Company sold 6,631 shares of its common

stock for aggregate gross proceeds of $50,000, or $7.54 per share,

in a private placement to the Chief Executive Officer of the

Company.

|

A, B

|

|

|

|

|

On February 26, 2020, the Company sold 10,156 shares of its common

stock for aggregate gross proceeds of $110,000, or $10.83 per

share, in a private placement to three officers and three Directors

of the Company.

|

A, B

|

|

|

|

|

On April 6, 2020, the Company issued Ergomed 100,000 shares of its

common stock in payment for services.

|

A, B

|

|

|

|

|

On May 26, 2020, the Company lowered the exercise price and

extended the expiration date of the Series V warrants. For each

Series V warrant exercised on or before June 10, 2020 the former

holder of the Series V warrant received one Series XX warrant.

Every Series XX warrant will allow the holder to purchase one share

of the Company's common stock at a price of $18.00 per share at any

time on or before September 10, 2020. As of June 10, 2020, 461,953

Series V warrants had been exercised entitling the former holders

of the Series V warrants to 461,953 Series XX warrants. For each

Series V warrant exercised after June 10, 2020 but on or before

June 25, 2020 the former holder of the Series V warrant received

one Series YY warrant. Every two Series YY warrants will allow the

holder to purchase one share of the Company's common stock at a

price of $20.00 per share at any time on or before September 25,

2020. As of June 25, 2020, 203,678 Series V warrants had been

exercised entitling the former holders of the Series V warrants to

101,839 Series YY warrants.

|

A, B

|

|

|

|

|

On June 26, 2020, the Company issued Ergomed 50,000 shares of its

common stock in payment for services.

|

A, B

|

A. The

Company relied upon the exemption provided by Section 4(a)(2) of

the Securities Act of 1933 with respect to the issuance of these

shares. The persons who acquired these shares were sophisticated

investors and were provided full information regarding the Company.

There was no general solicitation in connection with the offer or

sale of these securities. The persons who acquired these shares

acquired them for their own accounts. The certificates representing

these shares bear a restricted legend providing that they cannot be

sold except pursuant to an effective registration statement or an

exemption from registration.

B. No

commission or other form of remuneration was given to any person in

connection with the sale or issuance of these

securities.

Item 16. Exhibits and Financial Statement Schedules

|

3(a)

|

Articles

of Incorporation

|

Incorporated by

reference to Exhibit 3(a) of CEL-SCI's combined Registration

Statement on Form S-1 and Post-Effective Amendment ("Registration

Statement"), Registration Nos. 2-85547-D and 33-7531.

|

|

|

|

|

|

3(b)

|

Amended

Articles

|

Incorporated by

reference to Exhibit 3(a) of CEL-SCI's Registration Statement on

Form S-1, Registration Nos. 2-85547-D and 33-7531.

|

|

|

|

|

|

3(c)

|

Amended

Articles (Name change only)

|

Incorporated by

reference to Exhibit 3(c) of CEL-SCI's Registration Statement on

Form S-1 Registration Statement (No. 33-34878).

|

|

|

|

|

|

3(d)

|

Bylaws

(as amended)

|

Incorporated by

reference to Exhibit 3(d) to Post-Effective Amendment No. 3 to this

Registration Statement

|

|

|

|

|

|

|

Shareholders

Rights Agreement, as Amended

|

Incorporated by

reference to Exhibit 4 filed with CEL-SCI’s 8-K report

dated October 30, 2020.

|

|

|

|

|

|

|

Incentive

Stock Option Plan

|

Incorporated by

reference to Exhibit 4 (b) filed on September 25, 2012 with

CEL-SCI’s registration statement on Form S¬8 (File

number 333-184092).

|

|

|

|

|

|

|

Non-Qualified

Stock Option Plan

|

Incorporated by

reference to Exhibit 4 (c) filed on August 19, 2014 with

CEL-SCI’s registration statement on Form S¬8 (File

number 333-198244).

|

|

|

|

|

|

|

Stock

Bonus Plan

|

Incorporated by

reference to Exhibit 4 (d) filed on September 25, 2012 with

CEL-SCI’s registration statement on Form S¬8 (File

number 333-184092).

|

|

|

|

|

|

|

Stock

Compensation Plan

|

Incorporated by

reference to Exhibit 4 (e) filed on September 25, 2012 with

CEL-SCI’s registration statement on Form S¬8 (File

number 333-184092).

|

|

|

|

|

|

|

2014

Incentive Stock Bonus Plan

|

Filed with Amendment No. 2 to

CEL-SCI’s annual report on Form 10-K for the year ended

September 30, 2014.

|

|

|

|

|

|

|

Legal

Opinion

|

|

|

|

|

|

|

|

First

Amendment to Development Supply and Distribution Agreement

with Orient Europharma.

|

Incorporated by

reference to Exhibit 10(m) filed with CEL-SCI’s 10-K

report for the year ended September 30, 2010.

|

|

|

|

|

|

|

Exclusive

License and Distribution Agreement with Teva Pharmaceutical

Industries Ltd.

|

Incorporated by

reference to Exhibit 10(n) filed with CEL-SCI’s 10-K

report for the year ended September 30, 2010.

|

|

|

|

|

|

|

Lease

Agreement

|

Incorporated by

reference to Exhibit 10(o) filed with CEL-SCI’s 10-K

report for the year ended September 30, 2010.

|

|

|

|

|

|

10(p)

|

Licensing

Agreement with Byron Biopharma

|

Incorporated by

reference to Exhibit 10(i) of CEL-SCI’s report on Form

8-K dated March 27, 2009

|

|

|

|

|

|

10(z)

|

Development,

Supply and Distribution Agreement with Orient

Europharma

|

Incorporated by

reference to Exhibit 10(z) filed with CEL-SCI’s

report on Form 10-K for the year ended September 30,

2003.

|

|

|

|

|

|

|

Assignment

and Assumption Agreement with Teva Pharmaceutical Industries, Ltd.

and GCP Clinical Studies, Ltd.

|

Incorporated by

reference to Exhibit 10(rr) of CEL-SCI’s report on Form

10-K/A report for the year ended September 30, 2014 dated

April 17, 2015.

|

|

|

|

|

|

|

Service

Agreement with GCP Clinical Studies, Ltd., together with Amendment

1 thereto*

|

Incorporated by

reference to Exhibit 10(ss) of CEL-SCI’s first amendment to

its Form 10-K report for the year ended September 30, 2014

dated April 17, 2015.

|

|

|

|

|

|

|

Joinder

Agreement with PLIVA Hrvatska d.o.o.

|

Incorporated by

reference to Exhibit 10(tt) of CEL-SCI’s first amendment to

its Form 10-K report for the year ended September 30, 2014

dated April 17, 2015.

|

|

|

|

|

|

|

Master

Service Agreement with Ergomed Clinical Research,

Ltd., and Clinical Trial Orders thereunder

|

Incorporated by

reference to Exhibit 10(uu) of CEL-SCI’s first amendment to

its Form 10-K report for the year ended September 30, 2014

dated April 17, 2015.

|

|

|

|

|

|

|

Co-Development

and Revenue Sharing Agreement with Ergomed Clinical Research Ltd.,

dated April 19, 2013, as amended

|

Incorporated by

reference to Exhibit 10(vv) of CEL-SCI’s first amendment to

its Form 10-K report for the year ended September 30, 2014

dated April 17, 2015.

|

|

|

|

|

|

|

Co-Development

and Revenue Sharing Agreement II: Cervical

Intraepithelial Neoplasia in HIV/HPV co-infected women, with

Ergomed Clinical Research Ltd., dated October 10, 2013, as

amended

|

Incorporated by

reference to Exhibit 10(ww) of CEL-SCI’s first amendment to

its Form 10-K report for the year ended September 30, 2014

dated April 17, 2015.

|

|

|

|

|

|

|

Co-Development

and Revenue Sharing Agreement III: Anal warts and anal

intraepithelial neoplasia in HIV/HPV co-infected patients, with

Ergomed Clinical Research Ltd., dated October 24, 2013

|

Incorporated by

reference to Exhibit 10(xx) of CEL-SCI’s first amendment to

its Form 10-K report for the year ended September 30, 2014

dated April 17, 2015.

|

|

|

|

|

|

|

Master

Services Agreement with Aptiv Solutions, Inc.

|

Incorporated by

reference to Exhibit 10(yy) of CEL-SCI’s first amendment to

its Form 10-K report for the year ended September 30, 2014

dated April 17, 2015.

|

|

|

|

|

|

|

Project

Agreement Number 1 with Aptiv Solutions, Inc. together with

Amendments 1 and 2 thereto*

|

Incorporated by

reference to Exhibit 10(zz) of CEL-SCI’s first amendment to

its Form 10-K report for the year ended September 30, 2014

dated April 17, 2015.

|

|

|

|

|

|

|

Second

Amendment to Development Supply and Distribution Agreement with

Orient Europharma

|

Incorporated by

reference to Exhibit 10(aaa) of CEL-SCI’s first amendment to

its Form 10-K report for the year ended September 30, 2014

dated April 17, 2015.

|

|

|

|

|

|

|

Amendment

to Co-Development and Revenue Sharing Agreement with Ergomed

Clinical Research, Ltd., dated September 15, 2015

|

Incorporated by

reference to Exhibit 10(iii) filed with CEL-SCI’s 10-K report

for year ended September 30, 2015.

|

|

|

|

|

|

|

Employment

Agreement with Geert Kersten (2019-2023)

|

Incorporated by

reference to Exhibit 10(10.7) of CEL-SCI’s report on Form 8-K

dated August 31, 2019.

|

|

|

|

|

|

|

Employment

Agreement with Patricia Prichep (2019-2022)

|

Incorporated by

reference to Exhibit 10(10.8) of CEL-SCI’s report on Form 8-K

dated August 31, 2019.

|

|

|

|

|

|

|

Employment

Agreement with Eyal Taylor (2019-2022)

|

Incorporated by

reference to Exhibit 10(10.9) of CEL-SCI’s report on Form 8-K

dated August 31, 2019.

|

|

|

|

|

|

|

2019

Non-Qualified Stock Option Plan

|

Incorporated by

reference to Exhibit 10.7 of CEL-SCI’s report on Form 8-K

dated October 15, 2019.

|

|

|

|

|

|

|

2019

Stock Compensation Plan

|

Incorporated by

reference to Exhibit 10.8 of CEL-SCI’s report on Form 8-K

dated October 15, 2019.

|

|

|

|

|

|

|

Consent

of Hart & Hart, LLC

|

|

|

|

|

|

|

|

Consent

of BDO USA, LLP

|

|

*

Portions of this exhibit have been omitted pursuant to a request

for confidential treatment filed with the Commission under Rule

24b-2 of the Securities Exchange Act of 1934. The omitted

confidential material has been filed separately with the

Commission. The location of the omitted confidential information is

indicated in the exhibit with asterisks (*)

Item 17. Undertakings

The

undersigned registrant hereby undertakes:

(1)

To

file, during any period in which offers or sales are being made, a

post-effective amendment to this registration

statement:

(i)

To

include any prospectus required by Section l0 (a)(3) of the

Securities Act:

(ii)

To

reflect in the prospectus any facts or events which, individually

or together, represent a fundamental change in the information in

the registration statement. Notwithstanding the foregoing, any

increase or decrease in volume of securities offered (if the total

dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the

estimated maximum offering range may be reflected in the form of

prospectus filed with the Commission pursuant to Rule 424(b) if, in

the aggregate, the changes in volume and price represent no more

than a 20% change in the maximum aggregate offering price set forth

in the “Calculation of Registration Fee” table in the

effective registration statement; and

(iii)

To

include any material information with respect to the plan of

distribution not previously disclosed in the registration statement

or any material change to such information in the registration

statement.

(2)

That,

for the purpose of determining any liability under the Securities

Act of 1933, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

(3)

To

remove from registration by means of a post-effective amendment any

of the securities that remain unsold at the termination of the

offering.

Insofar

as indemnification for liabilities arising under the Securities Act

of l933 (the “Act”) may be permitted to directors,

officers and controlling persons of the Registrant pursuant to the

foregoing provisions or otherwise, the Registrant has been advised

that in the opinion of the Securities and Exchange Commission such

indemnification is against public policy as expressed in the Act

and is, therefore, unenforceable. In the event that a claim for

indemnification against such liabilities (other than the payment by

the Registrant of expenses incurred or paid by a director, officer

or controlling person of the Registrant in the successful defense

of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities

being registered, the Registrant will, unless in the opinion of its

counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question of

whether such indemnification by it is against public policy as

expressed in the Act and will be governed by the final adjudication

of such issue.

(4)

That,

for the purpose of determining liability under the Securities Act

of 1933 to any purchaser:

(i)

If

the registrant is relying on Rule 430B:

(A)

Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall

be deemed to be part of the registration statement as of the date

the filed prospectus was deemed part of and included in the

registration statement; and

(B)

Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5),

or (b)(7) as part of a registration statement in reliance on Rule

430B relating to an offering made pursuant to Rule 415(a)(1)(i),

(vii), or (x) for the purpose of providing the information required

by section 10(a) of the Securities Act of 1933 shall be deemed to

be part of and included in the registration statement as of the

earlier of the date such form of prospectus is first used after

effectiveness or the date of the first contract of sale of

securities in the offering described in the prospectus. As provided

in Rule 430B, for liability purposes of the issuer and any person

that is at that date an underwriter, such date shall be deemed to

be a new effective date of the registration statement relating to

the securities in the registration statement to which that

prospectus relates, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof.

Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement

or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a

time of contract of sale prior to such effective date, supersede or

modify any statement that was made in the registration statement or

prospectus that was part of the registration statement or made in

any such document immediately prior to such effective date;

or

(ii)

If

the registrant is subject to Rule 430C, each prospectus filed

pursuant to Rule 424(b) as part of a registration statement

relating to an offering, other than registration statements relying

on Rule 430B or other than prospectuses filed in reliance on Rule

430A, shall be deemed to be part of and included in the

registration statement as of the date it is first used after

effectiveness. Provided, however, that no statement made in a

registration statement or prospectus that is part of the

registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or

prospectus that is part of the registration statement will, as to a

purchaser with a time of contract of sale prior to such first use,

supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such date of

first use.

(6)

That,

for the purpose of determining liability of the registrant under

the Securities Act of 1933 to any purchaser in the initial

distribution of the securities:

The

undersigned registrant undertakes that in a primary offering of

securities of the undersigned registrant pursuant to this

registration statement, regardless of the underwriting method used

to sell the securities to the purchaser, if the securities are

offered or sold to such purchaser by means of any of the following

communications, the undersigned registrant will be a seller to the

purchaser and will be considered to offer or sell such securities

to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned registrant

relating to the offering required to be filed pursuant to Rule

424;

(ii)

Any free writing prospectus relating to the offering prepared by or

on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

(iii) The

portion of any other free writing prospectus relating to the

offering containing material information about the undersigned

registrant or its securities provided by or on behalf of the

undersigned registrant; and

(iv) Any

other communication that is an offer in the offering made by the

undersigned registrant to the purchaser.

SIGNATURES

Pursuant

to the requirements of the Securities Act of l933, the registrant

has duly caused this registration statement to be signed on its

behalf by the undersigned, thereunto duly authorized, in the

Vienna, Virginia on the 15th day of January 2021.

|

|

CEL-SCI CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

/s/ Geert

Kersten

|

|

|

|

|

Geert

Kersten

|

|

|

|

|

Chief

Executive and Principal Financial and Accounting

Officer

|

|

In

accordance with the requirements of the Securities Act of l933,

this registration statement has been signed by the following

persons in the capacities and on the dates indicated:

|

Signature

|

Title

|

Date

|

|

|

|

|

|

/s/ Geert Kersten

|

Chief

Executive and Principal Financial and Accounting

Officer

|

January 15, 2021

|

|

Geert

Kersten

|

|

|

|

|

|

|

|

/s/

Peter R. Young

|

Director

|

January 15, 2021

|

|

Peter

R. Young

|

|

|

|

|

|

|

|

/s/ Bruno

Baillavoine

|

Director

|

January 15, 2021

|

|

Bruno

Baillavoine

|

|

|

|

|

|

|

|

/s/ Robert

Watson

|

Director

|

January 15, 2021

|

|

Robert

Watson

|

|

|

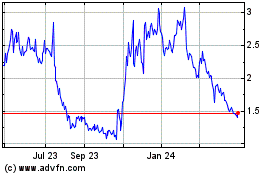

Cel Sci (AMEX:CVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

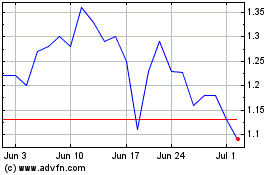

Cel Sci (AMEX:CVM)

Historical Stock Chart

From Apr 2023 to Apr 2024