Castellum, Inc. Provides Shareholders and Prospective Shareholders a Year-End Update

December 21 2022 - 6:55AM

Consistent with its requirements under Regulation FD,

Castellum, Inc. (NYSE-American: CTM) provides the following

information from CEO Mark Fuller for its shareholders, prospective

shareholders, and other stakeholders.

Dear Fellow Shareholders:

As we approach the end of 2022, I would like to

update you on recent developments at Castellum and provide a

roadmap for 2023.

Let me start by thanking you for your support of

CTM as a shareholder. The Board, management team, and I are all

excited by the progress Castellum has made in the 3 ½ years that we

have been running the company and are very mindful of the

collective fiduciary duty we owe to you as shareholders of our

company. We are proud to have taken a public company from zero

revenue to a $44.4 million run rate (as of last quarter) and from

operating losses to a recurring cash operating profit. We did that

by acquiring six businesses which help defend our country by

serving the Department of Defense (including Army, Navy, SOCOM, and

soon, with our recently announced new contract win, the Air Force)

as well as other parts of the United States government.

We focus on the digital battlefield in cyberspace:

cybersecurity, software engineering, data analytics, electronic

warfare, and information warfare, among other things. This digital

battlefield is active every day with cyberattacks from our

adversaries around the globe. We hire top talent to support our

mission of helping to protect Americans’ liberty and way of life.

Many of us in the company are veterans. I attended West Point and

then served for several years in Europe and Asia. Our COO, Glen

Ives, attended Annapolis and then flew Navy helicopters. Our board

has three prominent former general officers: Patricia Frost, Bernie

Champoux, and John Campbell. Each of them served with distinction.

We are proud of what we do and how we do it.

2023 looks like it will be another record year for

Castellum. We plan to close our recently announced $10 million

pending acquisition in the first quarter of the year, once we

complete our legal and financial due diligence and a 1-year audit

of the acquisition consistent with our accounting obligations under

PCAOB rules. We have ongoing conversations with other, larger

opportunities as well. We have multiple organic growth

opportunities available if Congress can move from continuing

resolution mode and pass a budget, which, as of this date, looks

possible this week. Our stated, aggressive, short-term goal is to

double our company’s size in 2023 and more than double our

recurring cash operating profit while keeping debt and share

issuance to a minimum so that our per share metrics (revenue per

share, recurring cash operating profit per share) increase. Our

ten-year goal is to build a $1 billion company which becomes a

leader in the digital battlefield space.

While our operations have had a very strong 2022,

and we believe will have an excellent 2023, our stock price has

not. As the second largest shareholder of our company, I am not

happy about this fact. Over the past 90 days, we have seen our

stock fall from over $4 per share (split adjusted) to under $1, a

more than 75% drop. Although we recovered above the $1 per share

level (back almost to $1.90), we recently dropped below that level

again. Especially surprising has been the decrease in price from

our underwritten public offering price of $2 per share. We had felt

that the $2 level, which was ratified by over 40 investors in our

$3 million offering and was not inconsistent with companies that we

consider comparable to Castellum, was setting a reasonable price

that would serve as the basis for trading on the NYSE-American. In

fact, since the offering, we have not yet traded at that level.

So, what are we doing to help the stock price?

First, we are continuing to focus on improving and growing our

operations. In the medium to long term, company performance drives

stock performance. Therefore, the best thing we can do is grow the

revenue and operating profit of the company and we focus on that

every day. Second, I and other member of the senior team, have made

open market purchases of CTM. We believe that current prices are

below not just our $2 offering price from October but other

measures of reasonable value for a company with our growth rate.

Third, I have engaged an Investor Relations firm and have had

numerous meetings with stockbrokers - and continue to schedule

additional meetings every week. These meetings are with

stockbrokers, retail investors, and others who purchase our stock

if they hear, understand, and like the Castellum story. The success

in this approach was evidenced by our stock recently moving as high

as $1.89 per share on good volume. Fourth, I am working on

finalizing an employee stock purchase plan for our Castellum

employees to be able to purchase CTM stock. Finally, we are

beginning a program to reach out to you and our other shareholders

to increase information flow and make sure that you have good

visibility into your company. The good news is that just a small

increase in buying for our stock could cause our stock price to

reverse its recent drop and move back higher. Given the significant

volume of trading since our offering on October 13, we believe that

anyone who wanted to sell has had their chance to sell.

Now it is time for us as shareholders to reassert

control of our destiny as a company. I welcome your support and

encourage you to follow my example by buying a bigger stake in CTM.

Working together we will have a bigger, stronger, more valuable

company.

Thank you for your support and warm regards for a

Happy Holiday Season,

Mark Fuller, President & CEO

About Castellum, Inc.:

Castellum, Inc. (NYSE-American: CTM) is a

defense-oriented technology company which is executing strategic

acquisitions in the cyber security, information technology and

software, information warfare, and electronic warfare and

engineering services space - http://castellumus.com/.

Forward-Looking

Statements: This release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended. All forward-looking statements are inherently

uncertain, based on current expectations and assumptions

concerning future events or future performance of the company.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which are only predictions and speak

only as of the date hereof. In evaluating such statements,

prospective investors should review carefully various risks and

uncertainties identified in this release and matters disclosed at

www.otcmarkets.com. These risks and uncertainties could cause the

company's actual results to differ materially from those indicated

in the forward-looking statements.

Contact: Mark Fuller, CEO

info@castellumus.com 301-961-4895

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6a5031f9-beea-43b7-a358-c6e89f1ff209

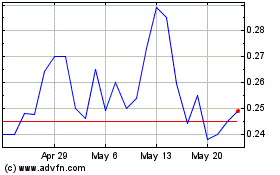

Castellum (AMEX:CTM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Castellum (AMEX:CTM)

Historical Stock Chart

From Apr 2023 to Apr 2024